Executive Summary

In the world of venture capital, money is not just a resource. It is a directional signal. When capital comes into a company, it brings expectations about the market, the pace of growth, and the eventual path to liquidity. For the CEO of a venture-backed company, understanding these expectations is not optional. Every venture firm has a thesis, and that thesis shapes everything from hiring cadence to capital deployment. A wise CEO does not assume all capital is alike but works to understand the worldview behind it and adapts priorities accordingly. The CEO brings operational knowledge and customer insight. The investor brings market experience and return pressure. When these perspectives meet with mutual humility, the company steers with purpose. Alignment is not a one-time event. It must be refreshed constantly. The relationship between a CEO and their venture investors is foundational. Dollars are important but direction matters more.

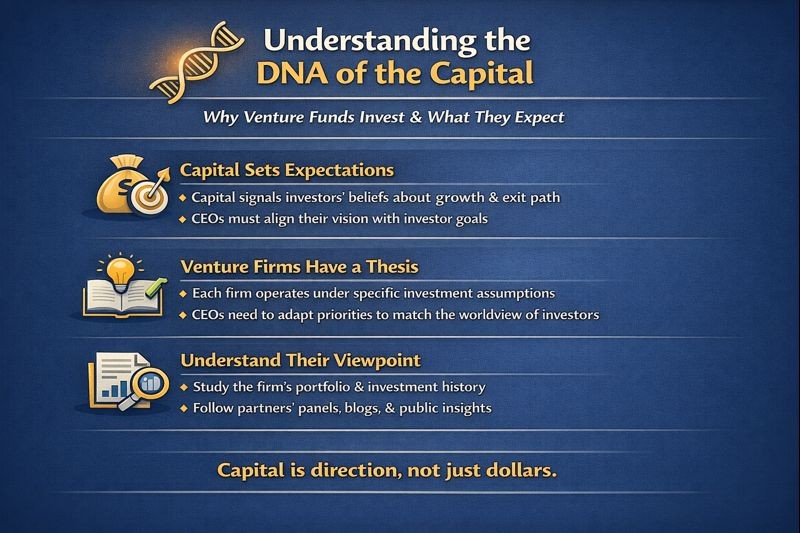

Understanding the DNA of the Capital

In the world of venture capital, money is not just a resource. It is a directional signal. When capital comes into a company, it brings with it expectations. These expectations are not always written in contracts. Often, they are embedded in what investors believe about the market, the pace of growth, and the eventual path to liquidity. For the CEO of a venture-backed company, understanding these expectations is essential. It is not enough to have a vision. That vision must align with the assumptions and priorities of the investor.

Every venture firm has a thesis. A wise CEO does not assume all capital is alike. Instead, the CEO works to understand the worldview of their investors and adapts the company’s priorities accordingly. This requires time and effort. It begins with research. The CEO should study the venture firm’s prior investments. Patterns often emerge. The firm’s partners may speak on panels, publish blogs, or contribute to thought leadership that reveals how they think. These materials are not marketing fluff. They are indicators of what the firm values.

Investor Thesis Profiles and Their Expectations

| Thesis Type | Growth Priority | Timeline Expectation | Liquidity Preference | Key Risk for CEO |

| Blitz-Scaling | Hypergrowth and market capture | Short, 3-5 years | IPO or large strategic acquisition | Misreading pace. CEO stabilizes while investor expects acceleration. |

| Unit Economics | Margin structure and profitability | Medium, 5-7 years | Profitable exit or IPO at scale | Burning capital on growth before fundamentals are proven. |

| Category Leadership | Dominance in a defined vertical | Medium to long, 5-8 years | Strategic acquisition by industry incumbent | Spreading too thin across verticals instead of owning one. |

| Rapid Acquisition | Customer volume and retention | Short to medium, 3-6 years | Revenue-based exit or roll-up | Ignoring retention metrics in pursuit of new logos. |

| Concentrated Long-Term | Deep value creation in fewer bets | Long, 7-10 years | IPO or secondary liquidity event | Moving too fast on expansion before the core product matures. |

This table maps five common investor thesis types against their growth priorities, timeline expectations, liquidity preferences, and the most consequential risk each creates for a CEO who does not read the room. Understanding where your capital sits on this spectrum is the first step toward alignment.

When Alignment Breaks Down

Problems arise when either side misreads the other. If a CEO assumes that an investor will support a slow and methodical product roadmap while the investor expects hypergrowth, conflict is inevitable. If an investor believes the company should pursue a merger and the CEO sees that as premature, tension builds. These gaps are not caused by bad actors. They are caused by a lack of proactive communication. Misalignment on burn rate, sales strategy, market expansion, or hiring cadence leads to boardroom tension and distracted execution. The cost is not just emotional. It is operational.

Rethinking the Board Meeting

Many CEOs treat board meetings as reporting sessions. The numbers are presented. The charts are shown. The quarter is reviewed. But in venture-backed companies, board meetings should function as alignment sessions. The numbers matter. The charts matter. But what matters more is the story. The questions that keep the discussion grounded in direction rather than distraction include:

- What bets is the company making, and why?

- What assumptions are being tested this quarter?

- What does the CEO need from the board to execute?

- Where does the current trajectory diverge from the investor’s thesis?

These questions invite dialogue rather than reporting. They create space for the shared conviction that turns capital into momentum.

Navigating Inflection Points

Many founders assume that the end goal of venture capital is a successful exit. While this is true, the definition of success varies. Some funds need to return capital within five to seven years. Others have longer horizons. Some want to see a path to IPO. Others are content with strategic acquisitions. A CEO who understands the specific timeline and liquidity preferences of their investors is better equipped to plan.

This matters most during inflection points. The answer to whether the company should raise big and push for market share or stabilize and build fundamentals depends entirely on the firm’s thesis. If the firm is geared toward early momentum, they may want the company to swing big. If the firm is more concentrated and long-term focused, they may support a slower build.

These are not academic issues. They affect hiring plans, marketing spend, customer segmentation, and capital strategy. If the CEO and investor are not aligned, the company feels like a car being pushed in two directions. No amount of talent or effort can overcome that friction.

The Currency of Credibility

Alignment is not a one-time event. It must be refreshed constantly. Markets change. Competitors adapt. New data emerges. The CEO must revisit the assumptions that underpin the business and ensure that investors are on the same page. This requires trust, and trust is built through candor. When things go well, the CEO should say why. When things go poorly, the CEO should say why. In both cases, the goal is to create a shared version of reality.

There is no substitute for intellectual honesty. Investors do not expect perfection. They expect clarity. A CEO who can explain a missed quarter with context and a plan earns more credibility than one who spins. This credibility is the currency of alignment. Without it, even the best boardroom strategy will falter. The CEO must represent the company’s interests while understanding the strategic goals of each board member, including financial returns, fund dynamics, and partner incentives. When the CEO sees the full picture, decisions make more sense and trade-offs become clearer.

Conclusion

The relationship between a CEO and their venture investors is not merely transactional. It is foundational. Dollars are important but direction matters more. A CEO who understands the thesis of their investors can lead with confidence and clarity. This requires curiosity, communication, and commitment. It requires seeing beyond the term sheet and into the mind of the capital. When this is done well, the company not only grows. It thrives with purpose.

If order is to be found in the chaos of scaling a startup, it will come not from certainty but from shared conviction. That conviction is what turns capital into momentum and strategy into success. The CEO and the investor must not just share a cap table. They must share a vision.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.