Executive Summary

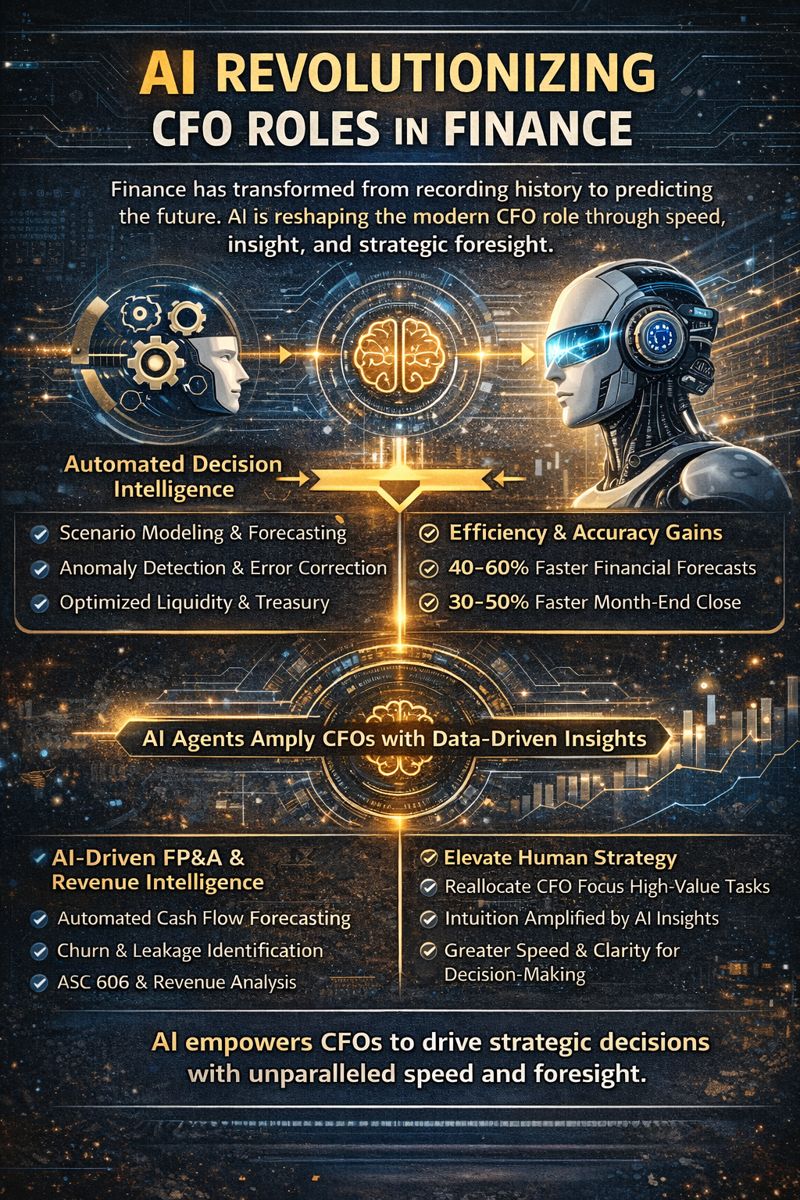

Three decades ago, finance was manual, reconciliation was art, and pattern recognition was not an algorithm but intuition shaped by exposure. Today, intelligent AI agents can identify, classify, and suggest corrections for problems that once took days and multiple people to resolve. This shift is not merely technological but philosophical. Finance is no longer about recording what happened but actively shaping what will happen. AI agents function as decision systems trained on historical data, business logic, policy documents, and dynamic market variables. They do not just automate, they interpret. For the modern CFO, the transformation requires rethinking the finance operating system itself. The challenge is not agent versus human but agent plus human, where intuition is amplified by intelligence. The future belongs to systems that learn, agents that reason, and leaders who design for speed and clarity.

Rewiring the Finance Operating System

Every finance function is fundamentally a decision-making engine powered by information, trust, and timing. Throughout twenty-five years working across SaaS, logistics, professional services, gaming, and manufacturing, the same problem repeats: finance lacks sufficient leverage because the data stack sits disconnected from the decision stack.

AI agents now enter this gap as decision systems trained on historical data, business logic, and dynamic market variables. They do not just automate, they interpret. At one professional services organization where I designed multi-entity global finance architecture, we deployed AI-powered systems that increased accuracy by twenty-eight percent while reducing month-end close from seventeen days to under six days.

AI agents function as context amplifiers living one layer above the ERP. They ingest not only structured journal entries but also unstructured data including emails, contracts, and pipeline notes. They simulate scenarios, generate alerts, and recommend actions with precision that would have been unthinkable even five years ago.

At a logistics organization managing one hundred twenty million in revenue, we implemented advanced analytics that identified recurring delay patterns in collections from key client verticals. That early insight enabled us to adjust working capital assumptions proactively. The system reduced logistics cost per unit by twenty-two percent through predictive optimization.

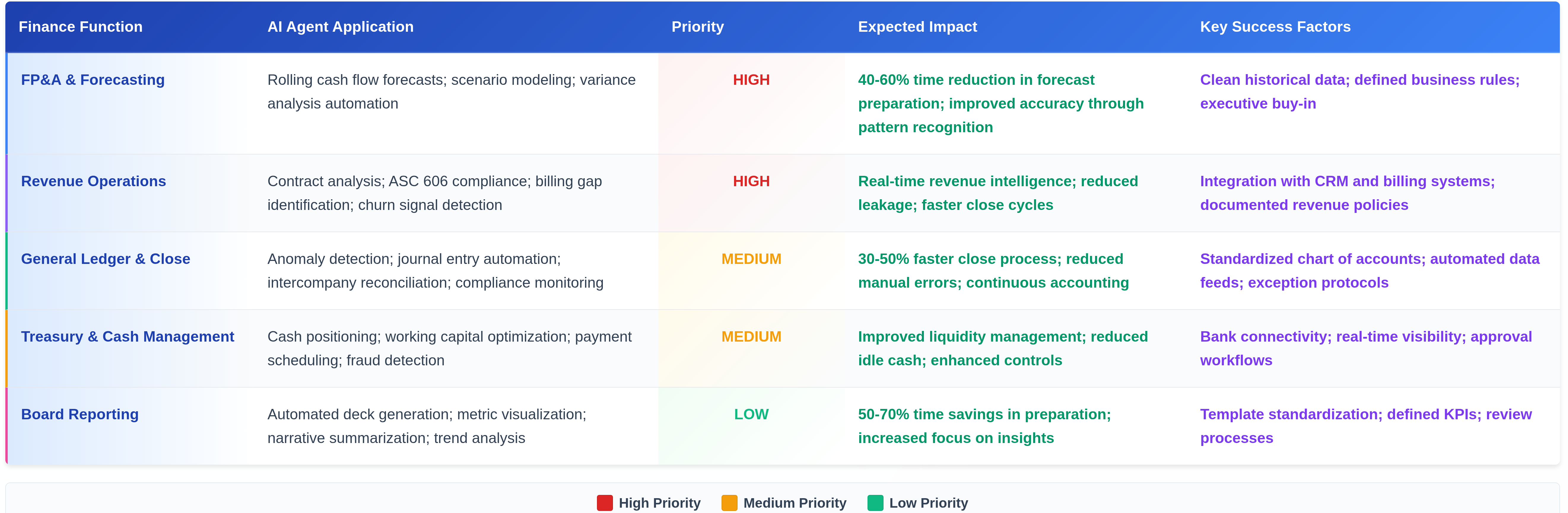

AI Implementation Framework for Finance Organizations

The following framework outlines a practical approach for integrating AI agents across core finance functions based on implementation experience across cybersecurity, SaaS, digital marketing, and nonprofit organizations:

At one SaaS organization operating across US and EU entities, we implemented AI agents for contract analysis and revenue recognition compliance. The system was trained on billing logic, contract clauses, and historical revenue recognition policies under ASC 606. Within weeks, the agent identified contract modifications triggering compliance risks within seconds. This agent was not just flagging issues but understanding context, explaining why particular contract clauses could accelerate or delay revenue recognition based on technical accounting standards.

From there, it becomes feasible to imagine AI agents helping shape pricing strategy, go-to-market alignment, and annual recurring revenue forecasting with more nuance than blunt linear growth assumptions. Revenue intelligence becomes an always-on function, not an end-of-quarter scramble.

Unbundling the Analyst, Rebundling the Brain

The office of the CFO traditionally mirrors the industrial model: many analysts, each with siloed tasks, coordinated by managers. With intelligent agents, we orchestrate fewer humans doing higher-order work supported by always-on machines. The analyst does not disappear but evolves.

At organizations where I built enterprise KPI frameworks using business intelligence tools, we tracked bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention. The shift from manual reporting to AI-augmented analytics enabled finance teams to reduce headcount focused on data preparation while increasing scope of coverage.

This reallocation of time is not trivial. AI agents give time back to the CFO to think, to lead, to design strategy. The modern finance professional I now recruit demonstrates a different profile: an orchestrator who knows how to task the AI agent, interpret its output, and contextualize it for the business.

Trust and Transparency in AI-Driven Finance

Every system gains power through trust. Boards will not trust an agent’s forecast unless they can understand its logic. As a CFO, trust begins with transparency. Every AI agent deployed must explain its assumptions, cite its sources, and surface its limitations.

At one education nonprofit where I secured forty million in Series B funding, we implemented an AI agent to track donor trends and cash flow seasonality. We required that every insight came with a transparency layer: what data powered it, what logic guided it, and what level of confidence it carried.

The same rigor applies at scale. Whether for mergers and acquisitions due diligence, board material preparation, or investor communications, AI agents must serve not as black boxes but as clarity engines. At a gaming enterprise where I oversaw one hundred million in acquisitions, AI-powered systems enabled us to validate financial controls, reconcile disparate accounting systems, and generate transparent reporting to stakeholders.

Designing the Finance Organization of the Future

If I had to build a finance function from scratch today for a growth-stage company, I would start with a data layer that allows interoperability. I would then deploy AI agents tailored to financial planning and analysis, revenue operations, compliance, and treasury. Each would handle inputs and generate outputs that flow into a unified command center where the CFO sees not only what is happening but what will likely happen next.

This organization would have fewer people doing repetitive reconciliation and more people synthesizing insights. The monthly close would move from backward-looking summaries to forward-facing simulation. But I would also retain the judgment structures. No matter how advanced the agent, it cannot yet feel the nuance of a founder’s conviction or the human value in keeping your word during a downturn. The future of finance is agent plus human, where intuition is amplified by intelligence.

Conclusion

The spreadsheet will not die, but it will no longer define the frontier of finance. That honor will go to systems that learn, agents that reason, and leaders who design for speed and clarity. Every finance executive should begin with a single audit: look at where your team spends time, classify that time into insight generation versus data preparation, then ask where an AI agent could help. Start a pilot with one process like forecasting or contract analysis. Foster a culture of experimentation where teams learn prompt design and data fluency. The future will reward those who understand that the best decisions are made with the best tools. Let us imagine a finance function that does not merely close books but opens possibilities.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.