Executive Summary

Every CFO knows the rhythm of the quarterly review: the pressure to reconcile variances, align forecasts, polish slides, and prepare a narrative that is credible yet optimistic. After three decades leading finance, strategy, and operations across verticals from SaaS and logistics to medical devices and professional services, I have come to view the quarterly planning cycle not just as a ritual but as a battleground of clarity versus complexity. We seek not perfection in numbers but conviction in direction. In most growth-stage companies, the quarterly review is still a manual, human-intensive exercise. Analysts scrub data, teams argue over assumptions, and the final materials emerge days before the board convenes. The result is often a summary of what happened, not a simulation of what might. But we now stand at the edge of a new era where AI agents become co-authors of strategy, embedded within the quarterly planning cycle not as tools but as collaborators. These agents will ingest systems data, generate forward-looking memos, highlight anomalies, and propose counterfactual paths the leadership team might otherwise miss. In several of the companies I currently advise, it has already begun.

Why the Current Planning Cycle is Broken

Despite advances in tools and dashboards, most strategic planning remains constrained by time, tools, and human bandwidth. Teams over-index on known metrics and under-explore unknown dynamics. Forecasts rely on trailing indicators. Variance analysis reveals symptoms, not systems.

At one digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we prepared five rounds of forecasts for a board meeting. Each iteration was more refined, but none challenged the assumption that net revenue retention would stay flat. An AI agent running multi-variable simulations identified a subtle uptick in churn among mid-tier clients that would undermine gross margin by three hundred basis points. That insight redirected go-to-market priorities before the quarter closed.

The lesson: speed is not the issue. Sightlines are.

Enter the AI Agent: Not a Tool, a Partner

The modern AI agent is not a dashboard but a context-aware reasoning engine integrating across ERP, CRM, HRIS, support logs, and product analytics.

Here is how it transforms the quarterly cycle:

- Pre-Read Generation: The agent assembles first drafts of quarterly business review materials including revenue bridges, margin analysis, churn signals, and scenario forecasts.

- Memo Synthesis: The agent writes strategic outlook memos based on current quarter data, flags performance deviations, and proposes questions for executive discussion.

- Anomaly Detection: It surfaces deviations not just from plan but from pattern, with confidence scores and linked potential causes.

- Counterfactual Exploration: The agent proposes alternative paths: what if marketing spend is reallocated? What if product launch is delayed? It does not predict but prepares.

At a SaaS organization where I rebuilt GAAP and IFRS financials, we used an AI-generated memo as kickoff for a board review. It opened: “Your ARR is growing, but your cash burn trajectory assumes flat hiring success.” That insight reshaped the discussion.

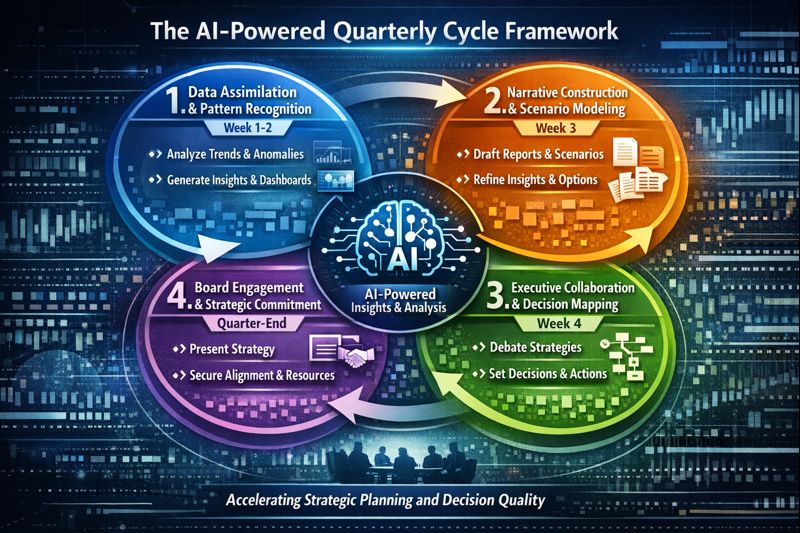

The AI-Powered Quarterly Cycle Framework

To truly leverage AI agents, the quarterly cycle must be redesigned. It should unfold across four coordinated stages:

- Data Assimilation and Pattern Recognition (Week 1-2): The AI agent ingests system data across all business units, identifying leading indicators, trend shifts, outliers, and underexplored variables. Human leadership validates data quality, provides business context, and highlights recent operational changes. Key deliverables include pattern reports, anomaly alerts, and trend dashboards.

- Narrative Construction and Scenario Modeling (Week 3): The agent produces memos, deck outlines, variance commentary, and scenario trees as first drafts. Leadership interprets findings, refines narratives, challenges assumptions, and adds strategic context. This stage delivers draft quarterly business review materials, scenario models, and risk assessments.

- Executive Collaboration and Decision Mapping (Week 4): The agent surfaces key questions, models trade-offs, and simulates decision impacts. Leadership aligns on priorities, debates strategic choices, commits to decisions, and assigns ownership. Outputs include decision logs, strategic commitments, and action items.

- Board Engagement and Strategic Commitment (Quarter-End): The agent provides insight logs, confidence-rated forecasts, and documented decision rationale. Leadership presents strategy, engages board questions, and secures alignment and resources. The final board packet, approved strategy, and resource allocation emerge from this stage.

At organizations where I led FP&A, forecasting, and board reporting across cybersecurity, SaaS, and gaming sectors, implementing structured planning cycles with clear stage gates proved essential for maintaining strategic discipline. The AI-powered framework extends this discipline while accelerating insight generation and decision quality.

Trust Requires Explainability, Not Just Output

For boards and executive teams to trust AI agents, every output must come with explainability metadata. When a model proposes delaying a product rollout, it must explain which assumptions it used, what evidence it weighted, and what alternatives it rejected.

At one education nonprofit where I secured forty million in Series B funding, transparency in financial projections and strategic assumptions proved essential for maintaining investor confidence. The same principle applies to AI-generated materials. Without transparency, AI becomes another black box in a room that demands daylight.

Reclaiming Human Time for Higher Judgment

The true value of AI in planning is not replacing the analyst but elevating the executive. By outsourcing mechanical work of report preparation and chart creation, leadership teams gain clarity.

Time is reclaimed not for rest but for judgment. The CFO can focus on capital strategy. The CEO can focus on market signal. The CRO can interrogate funnel dynamics.

At one professional services organization where I reduced month-end close from seventeen days to under six days through automation, the pattern was clear: technology should handle data preparation, freeing finance teams for strategic analysis.

From Forecasting to Foresight: The Future of Planning

In the coming quarters, more companies will build or buy agent orchestration platforms. These systems will not just support quarterly planning but run it.

Imagine a CFO logging in Monday morning to see real-time deviation alerts for top KPIs, a draft quarterly business review memo, suggested board talking points, a variance heatmap, and recommended capital reallocations.

This is not AI-driven as a label but AI-embedded strategy: always-on, always-updating, always-informed.

Calls to Action for Founders and CFOs

- Pilot First, Institutionalize Later: Start with one quarterly business review. Deploy an AI agent to draft a first-pass packet. Measure time saved, insight surfaced, and decisions influenced.

- Create Governance Layers: Define which materials must be human-reviewed. Establish thresholds for agent-recommended decisions. Design escalation paths.

- Educate the Board: Bring your board along. Show them how AI is used. Invite them to interrogate the logic. Trust grows through transparency.

- Design for Foresight, Not Just Forecasts: Shift the quarterly cycle from reporting to preparing. Focus on scenario readiness, not just metric accuracy.

- Invest in a Strategic AI Stack: Build or integrate an orchestration layer that enables multi-agent reasoning across functions.

Conclusion

We are entering a world where machines suggest and humans decide. Where planning cycles are no longer driven by deadlines but by live signals. Where strategy is not revised quarterly but updated continuously. The AI agent will not replace your team. It will challenge it, support it, and occasionally surprise it.

But the best leaders, CFOs, CEOs, and board chairs, will welcome that challenge. Because insight does not emerge from process but from perspective. And in the next strategic planning cycle, that perspective will come from both sides of the table: the human and the agent.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.