Executive Summary

When I first began crafting investor memos and quarterly earnings summaries in the early 1990s, precision and consistency were the cornerstones of trust. I learned to write every sentence with an awareness that the language, down to the clause, could move capital. We reviewed, redrafted, and calibrated every disclosure as though reputations depended on them because they did. Today, the mechanisms of Investor Relations have not changed in purpose, but the tools available to execute them have evolved radically. With the rise of Generative AI, companies now have the capacity to produce real-time, multi-stakeholder narratives drawn directly from internal systems and public signals. This technological leap brings both profound opportunity and real risk. The speed and fluidity of generative systems can strengthen the IR function, but only if CFOs, general counsel, and communications leads anchor that power in transparency, consistency, and control.

What AI Is Already Doing in Investor Relations

In the companies I advise, we have already begun using generative tools to craft first drafts of shareholder letters, quarterly updates, and investor FAQs. These systems pull from ERP data, CRM metrics, financial planning forecasts, and board decks to synthesize key themes and anticipate questions.

At one professional services organization where I led finance, accounting, revenue operations, and corporate analytics, we built enterprise KPI frameworks using business intelligence tools. When we introduced AI-assisted investor communications, the system could automatically generate quarterly updates that aligned with board-level metrics while maintaining consistent narrative across stakeholder groups.

At one education nonprofit where I secured forty million in Series B funding, the investor communication process required meticulous attention to narrative consistency across venture capital partners, limited partners, and board members. Each stakeholder group had different information priorities, yet the underlying message about organizational strategy and financial health needed to remain coherent. AI systems now enable this kind of stakeholder-specific customization at scale.

In one SaaS company, we trained a generative AI assistant to review our quarterly close package and draft a shareholder update within two hours of the books closing. The drafting time dropped by over sixty percent, and messaging consistency across channels became bulletproof.

Speed versus Clarity: The Real Competitive Advantage

Generative AI allows companies to communicate faster. But the real differentiator is consistency and clarity across formats. AI agents can scan for alignment across decks, memos, scripts, and internal guidance. When used responsibly, they catch discrepancies that otherwise slip through:

- Variations in forecast language between board presentations and investor memos

- Changes in metric definitions across different stakeholder communications

- Shifts in KPIs presented without documented rationale

At a logistics organization managing one hundred twenty million in revenue, AI-assisted narrative review systems flagged inconsistencies where investor FAQs described customer acquisition costs in a way that did not match the board deck. The model used to calculate blended customer acquisition costs had changed internally, but investor language had not caught up. A generative audit agent flagged the inconsistency before the investor call, saving the company from a potential credibility hit.

Custom-Tailored Messaging for Stakeholder Groups

One of the most compelling use cases for generative AI in investor relations is the personalization of narrative across stakeholder groups. With generative AI, companies can tailor narrative depth and framing to the audience:

- Institutional Investors: Emphasize lifetime value to customer acquisition cost trends, retention dynamics, and long-term margin expansion

- Retail-Facing Communications: Simplify explanations and spotlight community impact or product growth

- Strategic Acquirers: Surface comparative benchmarks, total addressable market expansion signals, and M&A rationale

- Board Members: Deep-dive into operational metrics, risk factors, and strategic trade-offs

This kind of adaptive narrative enhances engagement and reduces clarification cycles. But it must be governed. Boards and CFOs must decide what tone, language, and metrics are approved, what versions are public-facing, and how to prevent unauthorized narrative drift.

Earnings Calls and Risk Reduction

We have begun using generative AI to draft earnings call scripts that align with internal forecasts, board discussion themes, and past call transcripts. The AI not only suggests language but also anticipates potential analyst questions based on prior calls and peer transcripts.

At one digital marketing organization that scaled from nine million to one hundred eighty million in revenue, earnings preparation required synthesizing complex pipeline forecasting data with investor-grade financial models. AI systems helped maintain consistency between what we told the board and what we communicated to growth capital providers.

The next frontier will be real-time feedback systems during calls where AI listens to tone, sentiment, pacing, and alignment with prior disclosures to flag deviations.

The Illusion of Control: Critical Warnings

The danger with generative AI is the false sense of security it creates. Just because a model writes in grammatically perfect prose does not mean it understands regulatory thresholds or legal materiality. Review workflows must remain sacred:

- AI can draft

- Humans must approve

- General counsel must validate

- The finance function must own metric integrity

- IR must align across functions

The CFO remains the ultimate editor-in-chief. In one instance, an AI-generated earnings summary included a growth projection extrapolated from recent retention trends that had not been internally validated. Had it gone out, it would have constituted a forward-looking statement outside approved guidance. We caught it only because we did not over-trust the tool.

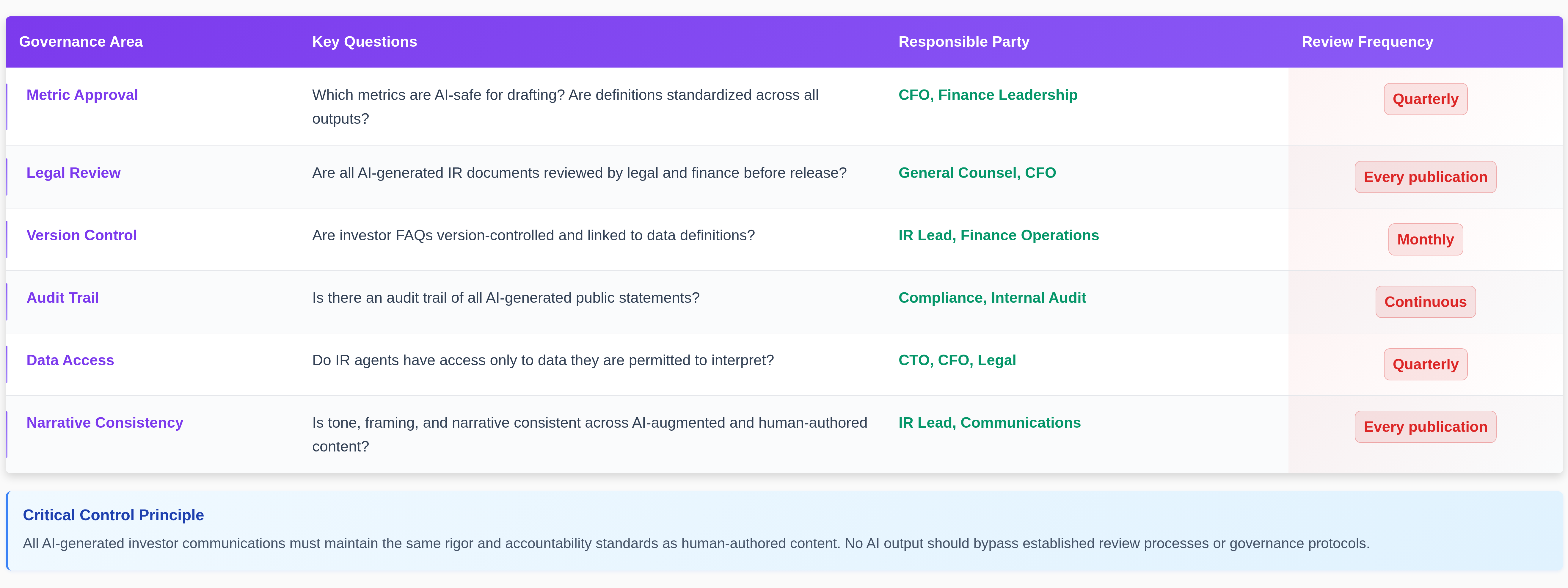

IR Governance Framework for AI Implementation

The following governance checklist ensures responsible AI integration in investor relations:

CFOs must treat FAQs as versioned, auditable documents. Any AI-generated responses must pull from approved logic trees or structured narrative libraries. Responses should be tagged by source: was this derived from the S-1, from the board deck, from internal models?

Auditability in communication is the next compliance frontier. Investors have long memories. AI must too.

From Templated Disclosure to Strategic Storytelling

The goal is not to replace your IR team but to elevate them. Give them tools to respond faster, monitor narrative drift, prepare FAQs at scale, and simulate investor behavior. The best IR teams I have worked with now spend less time writing and more time listening. They monitor market reactions, competitor disclosures, and sentiment shifts and use that insight to refine strategy.

At a gaming enterprise where I led global financial planning, controllership, and internal controls for a multi-studio operation, investor communications required balancing creative business narratives with rigorous financial discipline. The same principles apply when implementing AI systems: the technology should amplify strategic storytelling capability, not replace human judgment.

Conclusion

Generative AI is not about disclosure speed but narrative coherence. It helps companies tell their story with rhythm, discipline, and scale. But it demands clear boundaries, ownership, and accountability. As CFOs, we are not just number custodians but narrative engineers. The future of investor relations will be won not by those who talk the most but by those who speak clearly, consistently, and credibly across every format, every quarter, every stakeholder. Generative AI offers leverage, but judgment is still ours to own.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.