Executive Summary

The transition from key performance indicators to objectives and key results represents a fundamental shift from measuring what is easily quantified to pursuing what matters strategically. Drawing from three decades at the intersection of finance, strategy, and systems thinking, this analysis demonstrates how OKRs transform founder-led companies under private equity ownership by connecting daily execution to strategic ambition without draining entrepreneurial agility. Traditional KPI-driven cultures entrench focus on lagging indicators serving as scorecards of past performance rather than compass needles pointing toward future direction. OKRs add the essential “why” by binding outcomes to purpose, with objectives defining destinations while key results quantify progress. Successful implementation requires education distinguishing output from outcome, recalibrating incentive structures to introduce intentional alignment, establishing cadences treating uncertainty as signal rather than noise, and building transparency explaining why objectives matter. The framework matures when embedded into operational cores, when teams craft objectives supporting company directional arc, and when review processes function as Bayesian updates revising beliefs about what works. This evolution transforms accountability from residing in founder memory to becoming institutional capability, democratizing leadership while preserving entrepreneurial speed, creating conditions where private equity sponsors gain execution visibility without micromanagement, and building companies that shape performance rather than merely measure it.

The Fundamental Shift: From Scorecards to Compass Needles

In thirty years working at the intersection of finance, strategy, and systems thinking, I have witnessed how goals steer organizations through growth and transformation. In founder-led companies, key performance indicators often served as scorecards indicating past performance but seldom as compass needles signaling future direction. Private equity ownership demands accountability frameworks connecting daily execution to strategic ambition without draining entrepreneurial agility.

When performance discussion limits itself to KPIs, it entrenches focus on what is easily measured rather than what matters strategically. Founders gravitate toward revenue growth, daily active users, or bookings. These serve as signposts but do not convey direction. OKRs add the “why” by binding outcomes to purpose. As John Doerr illustrates in Measure What Matters, objectives define destinations while key results quantify distance. I have witnessed teams transform when they move from asking “did we hit sales?” to “how did we expand into new segments this quarter?”

Transitioning to OKRs begins with education. I have hosted workshops where leadership teams unpacked differences between output and outcome. Participants drafted objectives reflecting directional intent, such as improving product engagement rather than merely shipping versions. Key results were milestones engineered to reveal progress at uncertainty’s boundaries. When founders lead these sessions, adoption becomes immediate.

A critical challenge arises when KPIs remain embedded in incentive structures. I have recalibrated incentive structures so baseline compensation remains KPI-linked while bonuses depend on achieving OKRs. This dual-track approach preserved system stability, introduced intentional alignment, prevented resistance, and ensured purpose became architecture.

Implementing OKRs changes business rhythm. KPIs follow monthly or quarterly cycles. OKRs require planning, review, and reflection cadences. I introduced bi-weekly check-ins focused on progress, learning, and iteration, treating OKRs as experiments where surprises became signal rather than noise.

Cultivating performance culture through OKRs demands clear communication. In quarterly all-hands meetings, I shared origin stories of each objective: why it matters, who owns it, and how it links to customer value. Over time, organizations tracked not just numbers but narratives about why objectives existed and how they shaped work.

By implementation midpoint, teams realize OKRs feel less like governance and more like liberation. A product head told me that writing OKRs forced them to explain why behind features. Sponsors began seeing that companies had moved beyond chasing metrics to defining outcomes.

Some metrics resisted transformation. Foundational KPIs like cash runway, gross margin, and average revenue per user remained critical. I embedded KPIs under strategic objectives. Rather than “achieve $10 million ARR,” a key result might read “increase ARR to $10 million with net dollar retention above 110 percent.” This layering ensured metrics nested into larger intentions.

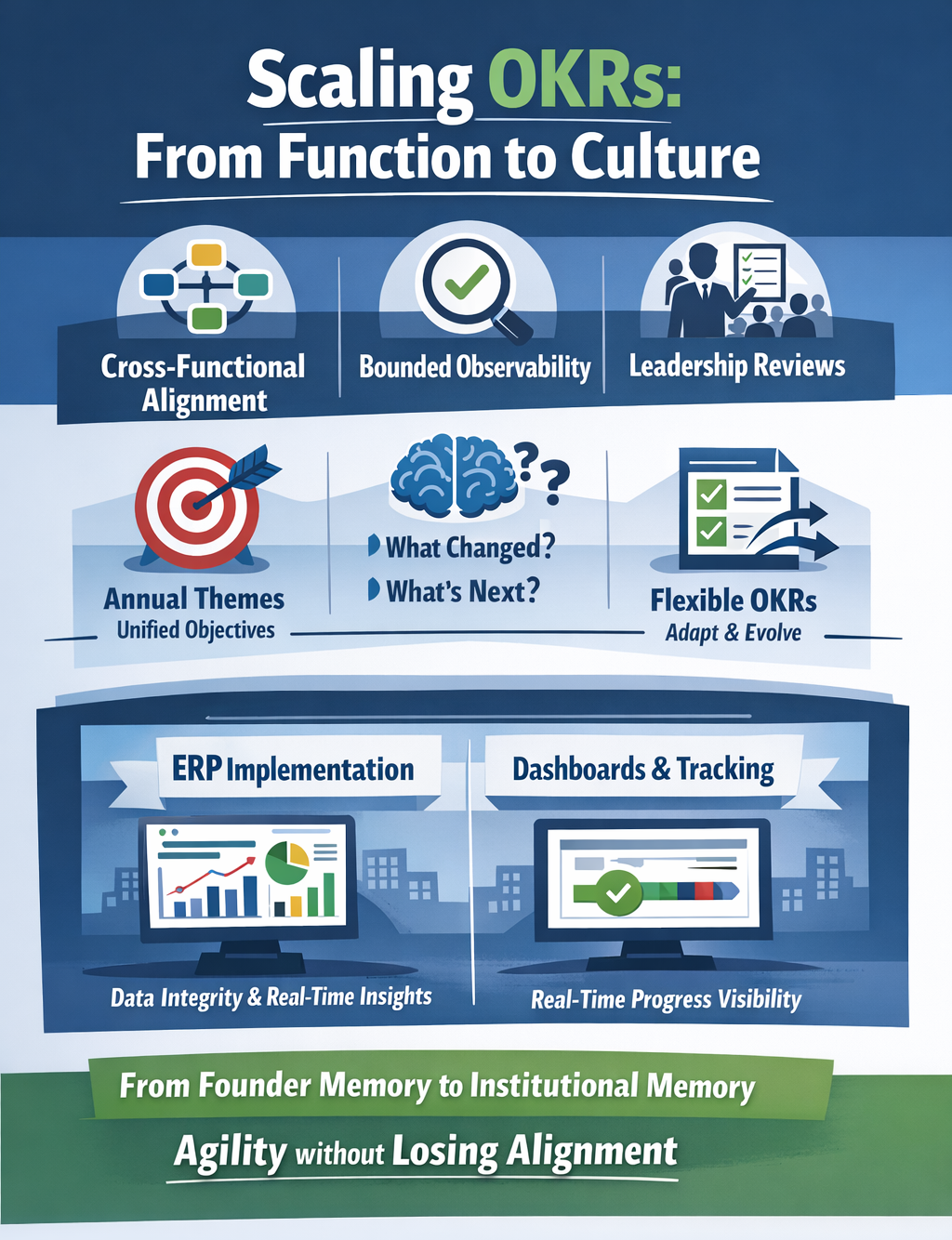

Scaling OKRs: From Function to Culture

Once organizations adopt OKRs, temptation arises to treat them as projects. But OKRs are directional compasses, not plug-and-play solutions. They are dynamic agreements between intent and execution. The key is elevating founder traits like speed and experimentation with context. OKRs work best when integrated into operational cores.

To scale OKRs across functions, I start with three principles: cross-functional alignment where each department defines objectives supporting not just their silo but company directional arc, bounded observability where teams craft time-bounded observable key results that can be measured and validated, and leadership modeling through weekly or biweekly review rhythms that invite reflection and update direction. This framework avoids the trap where OKRs get written and forgotten. Instead, they evolve as strategy must evolve.

During one ERP implementation, we embedded OKRs into finance team change management planning. The objective was not “complete ERP migration” but “establish data integrity and real-time visibility into unit economics.” Key results mapped to reconciliation accuracy, time-to-close improvement, and dashboard adoption across business units. This objective reframed painful process into strategic capability. The finance team became architects of better decisions rather than system administrators. Forecasting became more confident. Margin levers became transparent. The team, once buried in process, now led board narratives.

OKRs allow thematic alignment. I coach teams to define annual themes transcending functional walls. One founder proposed “Customer-First Velocity” as unifying objective. Every team crafted quarterly OKRs supporting that arc. The theme synchronized organization without stifling creativity.

The most critical capability is review process. I advocate for reviews functioning like Bayesian updates where you revise beliefs about what works. We developed “learning reviews” asking three questions: what changed since last check-in, what did we learn about assumptions, and what will we change going forward. This turned OKRs into living systems where missing key results was expected and adaptation was key.

This adaptability proves crucial in high-variance environments. When market opportunities emerged mid-quarter, we allowed teams to add new OKRs on rolling bases. This flexibility preserved founder instinct while maintaining strategic intent records.

Integration with dashboards is often overlooked. We linked dashboards to OKR platforms, enabling real-time progress visibility. When product OKRs targeted reducing onboarding time, dashboards showed median time from signup to first action.

Culturally, OKRs transfer accountability from founder memory into institutional memory, democratizing leadership. In KPI cultures, missed targets feel like failures. In OKR cultures, missed key results spark retrospectives where teams stay curious and reframe.

As organizations mature under private equity ownership, OKR value becomes clearer. Sponsors gain execution visibility without micromanagement. OKRs reveal where conviction lives and where uncertainty hides. Teams consistently delivering on OKRs are chosen to lead strategic initiatives. This alignment between investor visibility and team autonomy is rare. OKRs make companies more coachable while allowing founders to preserve speed without sacrificing clarity.

Conclusion

Moving from KPIs to OKRs is not about replacing metrics but elevating intent, building companies that do not simply measure performance but shape it, learning not just what worked but why, and using goals not as scorecards but as signals. Private equity demands outcomes, but great companies deliver more: learning, resilience, and culture. Those outcomes, as I have seen across a career in finance and transformation, always begin with clarity of purpose.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.