Executive Summary

Digital partnerships represent far more than tactical solutions to immediate technical challenges. They function as strategic instruments that shape organizational identity, operational coherence, and long-term competitive positioning. Drawing from three decades of financial leadership across global enterprises, this analysis demonstrates how Chief Financial Officers must evolve from technology approvers to custodians of strategic coherence. The fundamental challenge lies in distinguishing between partnerships that merely solve today’s problems versus those that architect tomorrow’s capabilities. When enterprise tempo accelerates and quarterly pressures intensify, the temptation to select digital partners based on immediate needs becomes overwhelming. Yet such decisions, made without anchoring in strategic identity, mortgage organizational elegance for operational relief. True digital maturity emerges not from accumulating technologies but from choreographing them in service of purpose. Success requires establishing narrative clarity around strategic horizons, implementing governance frameworks that protect intellectual property and cultural alignment, developing multidimensional evaluation methodologies that measure impact across functional domains, and institutionalizing review rhythms that determine when partnerships should scale, restructure, or sunset. The CFO’s role transcends financial oversight to become curatorial stewardship, ensuring companies grow not merely in capability but in character, building systems that reveal corporate values while enabling sustainable transformation.

Strategic Alignment: Anchoring Partnerships in Long-Term Vision

The CFO as Custodian of Coherence

Enterprise tempo has accelerated dramatically. Where strategy once unfolded deliberately, today it responds to quarterly pressures and technology sprints. Digital partnerships emerge daily as solutions to immediate discomforts: infrastructure gaps, billing inefficiencies, and systems struggling under scale. Yet beneath pain points lies something fundamental: orchestrating the organizational future.

CFOs emerge not as technologists but as custodians of coherence. While product managers select platforms and engineers evaluate APIs, CFOs must ask: Does this partnership belong to the arc of who we are becoming? In environments saturated with SaaS vendors and data orchestration promises, selecting partners based solely on present needs without strategic anchoring mortgages organizational elegance for operational relief.

I witnessed this when a Series C company sought to modernize onboarding. A platform promising rapid integration was adopted within weeks. Initial results seemed promising. Yet within months, conflicts emerged: the partner’s data model contradicted internal architectures, and their roadmap veered toward SMB markets while we courted enterprise clients. Local solutions introduced global dissonance.

Establishing Strategic Narrative Clarity

Digital maturity is technology choreography in service of purpose. This requires foundational questions:

- Are we building a platform or a product?

- Do we optimize for depth in one vertical or optionality across many?

- Does long-term value lie in speed, brand, or operational resilience?

- What is our strategic horizon across three, five, and ten years?

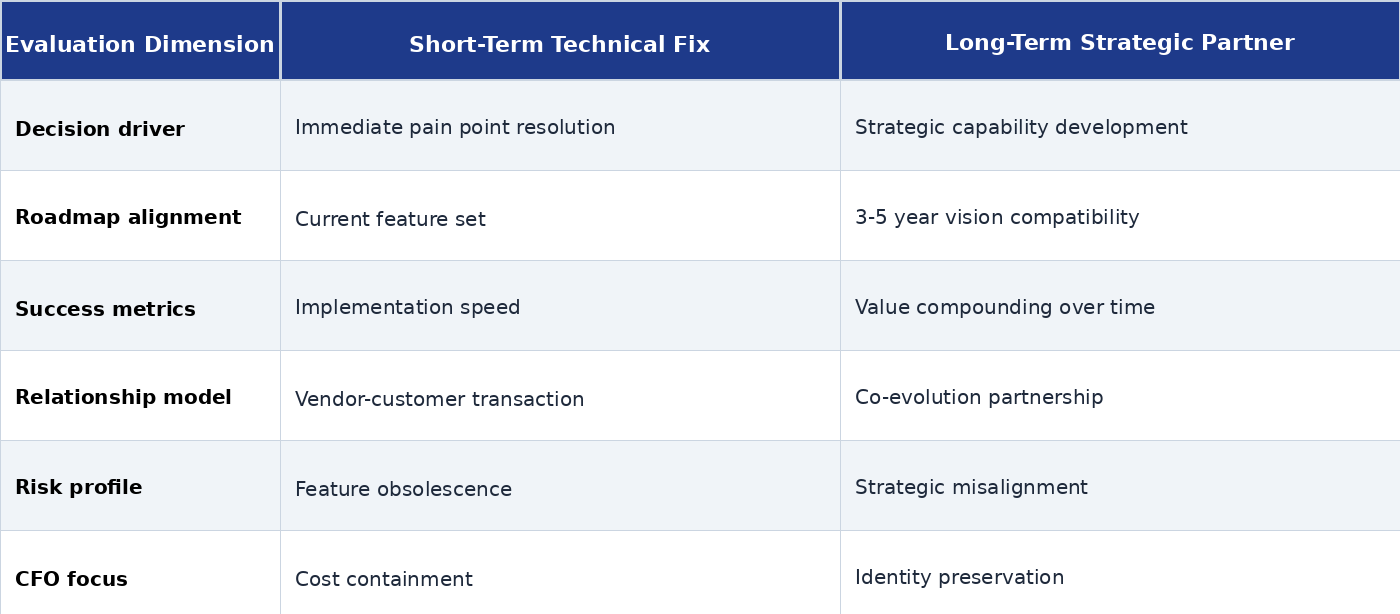

Strategic Partnership Alignment Framework

True strategic partners are not those who dazzle with features but whose worldviews echo your own. Their incentives align with your trajectory. The finest partnerships are those where neither side feels like vendor but each becomes vector in the other’s strategy.

This alignment must manifest through ongoing cadence: strategy summits, joint roadmap reviews, embedded metrics. CFOs insist upon these not as bureaucracy but as fidelity mechanisms. When tensions arise, CFOs act as translators asking: what does this divergence reveal? Strategy evolves continuously. The danger is not that partners change but that we stop noticing when they no longer fit.

Governance Architecture: Protecting Trust Through Design

Modern enterprises face temptation to treat partnerships as fast-moving transactions. Yet beneath API calls and automated workflows lies something more fragile: trust. Trust requires protection by design. CFOs bear responsibility ensuring this protection. Governance is not merely paperwork but poetry of restraint, giving form to energy and creating conditions where ambition can flourish without implosion.

Intellectual Property and Data Governance

The line between co-creation and ownership blurs in digital workstreams. CFOs must ensure IP is mapped in living processes:

- Escrow arrangements: Source code accessibility during dissolution

- Audit rights: Periodic review of jointly developed assets

- Joint innovation frameworks: Clear attribution for collaborative developments

- Rights reversion protocols: IP ownership upon contract termination

Customer behavior, user preferences, and transaction histories represent modern enterprise gold. In partnerships involving shared or processed data, governance must anticipate worst-case scenarios. Encryption protocols, retention standards, and breach notification hierarchies ensure structures do not collapse under their own ambition.

Cultural Alignment: The Art of Rhythm

Technical scaffolding addresses mechanical risk, but deepest failures often reside in culture. Partnerships implode not because systems fail but because people do not understand each other. An enterprise known for consensus pairs with partner driven by velocity. Initial excitement curdles into irritation.

Governance here becomes art of rhythm. Are meetings held with consistent cadence? Are decisions made with equivalent rigor? CFOs become translators of ethos, asking: can we live with how they deliver? Mitigating cultural dissonance requires relational infrastructure: shared communication channels, executive liaisons, immersion sessions. Not performative bonding but tactical alignment.

In one rewarding partnership, we built joint steering committee from inception to metabolize, digesting small frictions before they became systemic. Monthly meetings prevented misunderstanding, drift, and imbalance. When governance is lived rather than documented, it becomes confidence source. Teams move faster because rails are set. Disagreements de-escalate because processes exist. Innovation accelerates paradoxically because boundaries are clear.

Evaluation Methodology: Measuring Return Across Dimensions

In finance language, return typically manifests as clean ratio promising objectivity. But in digital maturity realm, particularly through complex partnership tapestries, return notion resists reduction. It becomes less metric and more mood, transformation in organizational grammar. Yet CFOs must measure it.

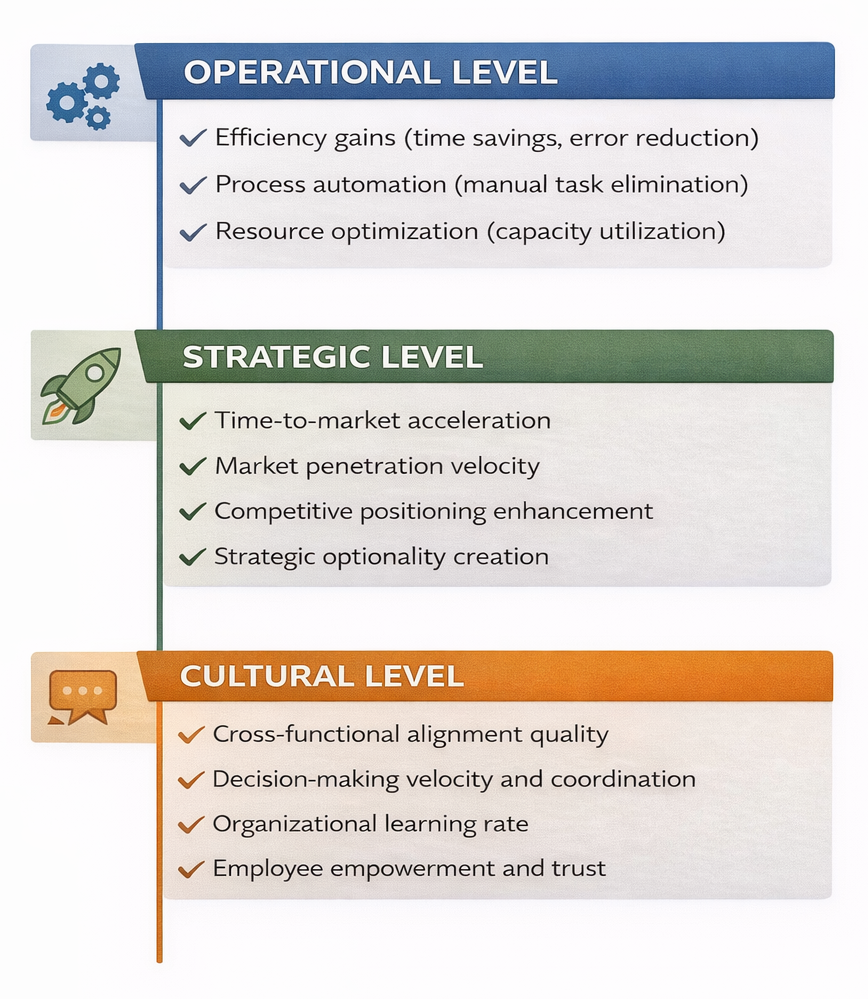

Digital maturity expresses itself in diagonals: marketing teams pivot campaigns based on real-time telemetry, operations reduce latency interpreting upstream data, engineering and sales speak common language as insights become anticipatory. I recall advising a late-stage startup where digital analytics partner integrated into marketing, customer success, and HR. The platform did not directly sell or service, yet organizational rhythm changed. Campaigns that took weeks launched in days. Churn reduced without product changes. Hiring decisions began showing prescient alignment with culture fit. When executives asked for ROI, I responded: what is cost of not knowing yourself?

Establishing Multidimensional ROI Framework

CFO role expands from analyst to interpreter. Frameworks exist: total cost of ownership, payback periods, productivity multipliers. These are beginning, not end. Deeper evaluation occurs at junction of financial signal and behavioral shift.

Layered ROI Evaluation Model

First, establish baseline in fluency. How long does it take teams to act on signals? How many decisions remain siloed? What is velocity between insight and execution? CFOs see these as leading indicators of enterprise intelligence.

Next, monitor vectors. Does digital partnership accelerate integration across functions? When digital maturity is genuine, it collapses latency, not just temporal but cultural. Organizations transform from department clusters into continuums of insight and action.

Account for optionality. Many partnerships do not produce immediate returns but create previously inaccessible futures. They turn unknowns into addressables. CFOs must articulate this as structured foresight. Storytelling becomes essential, narrating ROI through vignettes: sales cycles that shortened 40 percent because customer intelligence flowed seamlessly, onboarding that became frictionless due to predictive tagging.

Measure emotional resonance. Do employees trust tools? Do they feel empowered or surveilled? Adoption is not login frequency but belonging. Maturity is not simply digitization but dignity. ROI is trail, pattern of impacts read across silos and quarters. Partnerships delivering true maturity alter organizational understanding of what it means to work well.

Partnership Lifecycle Management: Scaling, Restructuring, and Sunsetting

Every business relationship begins with potential’s warm glow. But early compatibility often gives way to coexistence’s harder work. CFO responsibility is noticing erosion early and naming it. Digital partnerships must be reviewed not for charm but contribution. The challenge lies in signal subtlety. Rarely do partners fail spectacularly. More often, they underperform gently. Dashboards go unused. Integrations become routine rather than revelatory. What once accelerated now merely accompanies.

Decision Framework

Scaling Signals:

- Rising adoption across departments without mandate

- Spontaneous employee evangelism and peer-to-peer advocacy

- Growing use cases extending organically from original implementation

- Deepening value with each iteration and usage milestone

Scaling should feel like unfolding, happening because value deepens. In one mid-market firm, data visualization partner began as marketing tool but soon product managers tested features, finance spotted anomalies, customer success refined onboarding. What began tactical became symphonic, demonstrating true strategic partnership value.

Restructuring Indicators:

- Core promise remains valid but execution falters or needs adjustment

- Partner roadmap has shifted materially from original alignment

- Internal needs have evolved beyond original scope

- External market events have recast strategic priorities

Restructuring requires CFOs to become quiet diplomats. I witnessed salvage operations: cybersecurity partners whose dashboards overwhelmed users were retrained with embedded learning journeys, machine learning vendors misaligned with go-to-market shifted from direct analytics to behind-the-scenes enrichment.

Sunsetting Criteria:

- Over-customization creating brittle dependencies

- Proliferating workarounds indicating poor fit

- Decreasing leadership engagement

- Growing trajectory mismatch

To sunset is not declaring failure but recognizing that in digital spine evolution, not all vertebrae are permanent. CFOs must narrate, protecting dignity on both sides. How we end partnerships becomes brand component, signaling: we choose with intention and unchoose with respect.

Support this through institutionalized reviews: annual partnership summits, joint scorecards measuring uplift not just uptime, pulse surveys asking if tools matter, quarterly cross-functional examinations. At process heart lies single question: is this partnership still mirror to our ambition? If yes, scale. If almost, restructure. If no, part. Digital maturity is not just what we integrate but what we outgrow elegantly.

Conclusion

Digital maturity is not finish line but living architecture, continually refined, often invisible, and always in dialogue with identity. For those who have carried growth weight in ledgers and enterprise soul in strategic convictions, this architecture is less about tools and more about tempo, the rhythm of how companies learn, adapt, and stay true while becoming more capable. At this rhythm’s center lie partnerships, not as transactions but as mirrors, and it falls to CFOs more than anyone to determine whether what is reflected back aligns with deeper organizational story. When selecting digital partners, most vital question is not whether technology fits task but whether collaborator fits arc, whether their roadmap extends purpose and worldview sympathizes with evolution. From there comes governance, not control exercise but trust framework, protecting intellectual property, ensuring data fidelity, and maintaining cultural resonance as affirmations that what we build together is worth protecting. Then measurement challenge emerges, understanding ROI in context requiring listening for diagonals, the subtle ways collaboration becomes faster, decision-making sharper, and organizations more self-aware, with CFOs shedding strict financialism armor to don interpretation robes. Finally comes partnership arc itself, determining when to scale, when to restructure, when to gracefully release, with CFOs acting not as judges but conductors reading tempo, sensing dissonance, knowing digital maturity requires as much discernment ending relationships as beginning them. In all this, we are reminded that digital strategy is not technology deployed but character revealed, and to those stewarding finance and future intersection, the lesson is clear: partnerships must be chosen with imagination, governed with integrity, evaluated with empathy, and evolved with grace, so we not merely build systems but build companies that know who they are even as they grow into something more.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.