Executive Summary

The Master Services Agreement is often dismissed as boilerplate but is in fact the legal chassis upon which long-term customer relationships are built. Having managed engagements from $300,000 pilots to programs exceeding $20 million, the MSA is not formality but infrastructure. An effective MSA serves as governance framework, risk allocation mechanism, and roadmap for operational clarity. It anticipates friction and provides language to resolve it before escalation. A scalable MSA creates rhythm through governance structures, steering committees, escalation paths, and communication protocols. Dispute resolution clauses are behavioral nudges minimizing commercial shock. Deliverables clarity distinguishes obligations from intentions, preventing scope ambiguity. The MSA must anticipate change and adapt as services scale. A static MSA becomes a silent liability. Operationalization requires version control, renewal discipline, and embedding MSA intelligence into systems. The MSA must be viewed as strategic protocol enabling speed without recklessness and growth without fragmentation.

Beyond Boilerplate: Strategic Infrastructure

The Master Services Agreement is often dismissed as boilerplate but is the legal chassis for long-term customer relationships. Having managed engagements from $300,000 pilots to multi-year programs exceeding $20 million, the MSA is infrastructure requiring maintenance and design for evolution.

An effective MSA serves as governance framework, risk allocation mechanism, and roadmap for operational clarity. It anticipates friction and provides language to resolve it before escalation. In multi-year relationships where services are modular and teams geographically dispersed, the MSA is the front line.

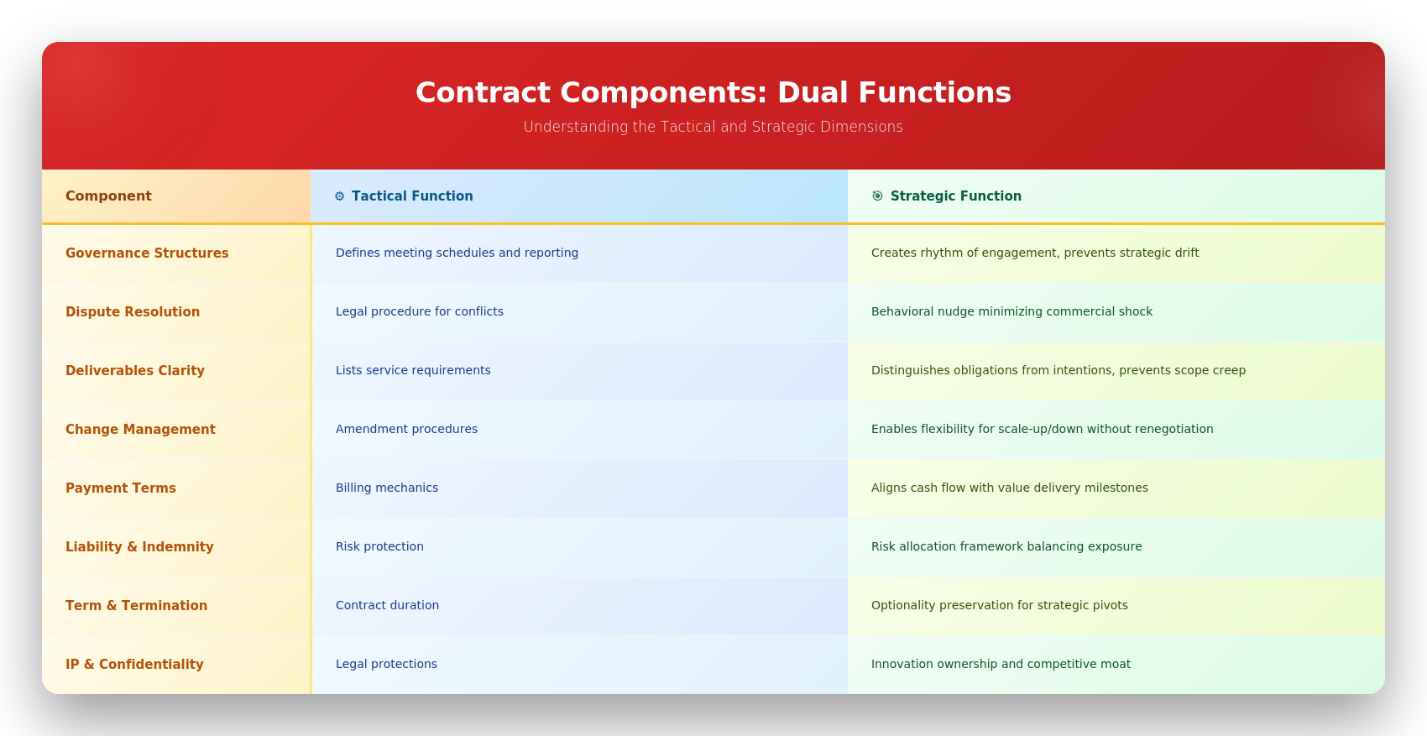

MSA Components: Strategic vs. Tactical Dimensions

Governance: Choreographing the Relationship

A scalable MSA creates rhythm through clearly defined governance structures. It choreographs the relationship. Governance clauses establish steering committees, escalation paths, performance review cadence, and communication protocols. These are vital in large-scale engagements where team turnover, scope creep, and strategic drift are inevitable. Without embedded governance, projects starting in alignment end in arbitration.

Dispute resolution clauses are behavioral nudges. The structure sends a signal about how the firm intends to manage conflict. A well-calibrated process minimizes commercial shock, providing a glidepath for escalation. In my experience, engagements where dispute procedures were rehearsed tended to resolve disagreements earlier and more rationally.

Deliverables Clarity and Anticipating Change

The MSA must distinguish between obligations and intentions. Vague deliverables language leads to scope ambiguity, billing disputes, and missed expectations. Precise definitions of service levels, timelines, dependencies, and responsibilities must live within the MSA or be explicitly mapped to Statements of Work.

Moreover, the MSA must anticipate change. One contract version cannot serve all future engagements. As services scale, geographies expand, and laws evolve, the MSA must adapt. In engagements I managed where the MSA lapsed or remained outdated, complexities surfaced: pricing ambiguities, outdated tax terms, data residency conflicts. If the MSA expires, at minimum an amendment must be executed.

Building in Optionality and Coordination

The MSA serves as coordination hub. In complex engagements spanning multiple workstreams, locations, and technologies, the MSA should define interdependencies. What happens if one SOW impacts another? Who governs cross-stream dependencies? An MSA that maps these intersections prevents chaos and fosters trust.

Smart MSAs build in flexibility through modular service activation, volume-based rate adjustments, and milestone-linked payments. This allows engagement expansion or contraction without full renegotiation. In large contracts, we included appendices anticipating future workstreams, pricing frameworks for scale-ups, and protocols for onboarding new sites.

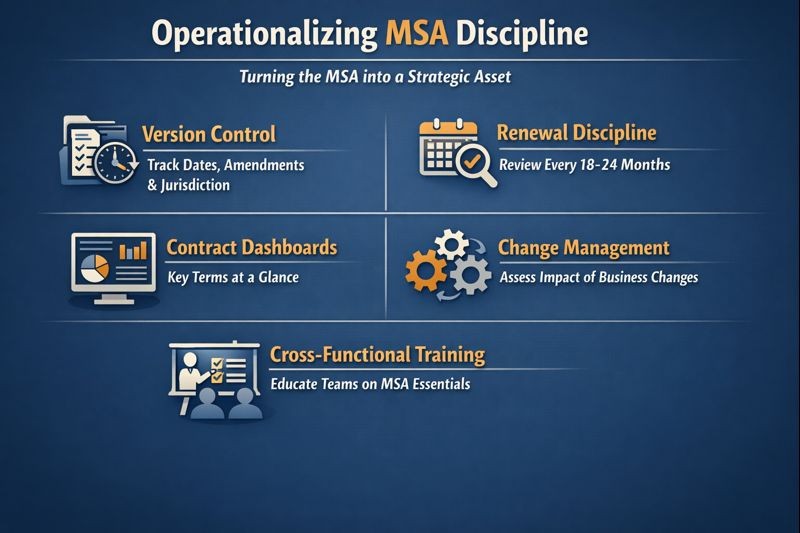

Operationalizing MSA Discipline

Turning the MSA into strategic asset requires operationalization. The most elegantly written contract is inert unless activated by business rhythm. This means embedding MSA intelligence into systems, governance cadences, and renewal workflows.

Version Control: Organizations must maintain repositories tracking effective periods, amendment history, and jurisdictional scope. This is risk control protocol. Operating under an expired agreement is dangerous. When issues arise, an outdated MSA offers no protection.

Renewal Discipline: MSAs must be reviewed every 18 to 24 months or sooner if triggered by regulatory change or service expansion. This cross-functional review should test the MSA against reality: Are roles still accurate? Are payment terms efficient? Is force majeure reflective of post-pandemic reality?

Contract Intelligence Dashboards: Key provisions including service levels, penalties, and notification windows should be abstracted into dashboards. In one shipping engagement, we embedded MSA terms into governance tools. Visibility improved both compliance and behavior.

Change Management: Business leaders underestimate how changes cascade through the MSA. Adding data centers? Check data sovereignty clauses. Expanding territories? Review tax terms. Operationalizing means treating the MSA as active document, part of every change initiative.

Cross-Functional Training: Delivery and finance teams live with consequences. We developed onboarding modules distilling key MSA terms into business language. This literacy turned contractual constraints into operational guardrails.

The Role of Contract Lifecycle Management Systems

The modern CLM system is a necessary enabler in this transformation. It should provide not just document storage but metadata tagging, clause comparison, expiration alerts, and integration with finance systems. In enterprise-scale contexts, the CLM becomes a financial control system. It links payment milestones to deliverables, flags renewal triggers, and validates compliance with audit protocols. In shipping engagements where pricing schedules spanned geographies and currencies, the CLM saved us from margin leakage more than once.

The Philosophical Shift: From Defense to Strategy

Lastly, there is a philosophical shift required. The MSA must be viewed not as a defensive document but as a strategic protocol. It is a playbook, not just a policy. When treated as such, it enables speed without recklessness, growth without fragmentation, and scale without entropy. It defines not just what we do but how we adjust when things change, because in business, things always change.

A final note: the MSA is not just for lawyers. It is for the business. Its language must be legible, its structure navigable, and its intent aligned with operational reality. Overly legalistic MSAs may shield against liability but often impede execution. In my approach, we treated the MSA as a shared document, crafted by legal, owned by finance, and executed by operations. This alignment elevated the MSA from compliance formality to strategic enabler.

Conclusion

The Master Services Agreement, long seen as a background instrument, deserves foreground attention. It is the spine of the commercial relationship. In my career spanning engagements across professional services and complex logistics, I have seen the difference between MSAs that simply exist and those that enable. The former are static. The latter are strategic. The difference lies not in the language but in the mindset. To treat the MSA as a strategic asset is to recognize that contracts are not barriers to commerce but bridges through which it scales. When governance structures are embedded, deliverables are clarified, optionality is built in, and operational discipline is maintained, the MSA transforms from legal formality into the foundation of scalable, resilient commercial relationships.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.