Executive Summary

When companies are acquired or sold, there are two primary methods for completing the transaction: asset purchase and stock purchase. Both transfer ownership, but they operate in fundamentally different ways and carry distinct implications for taxes, contracts, employees, and risk. In an asset purchase, the buyer selects which parts of the business to acquire, including equipment, inventory, and contracts, while choosing which liabilities to assume. The legal entity remains with the seller. In a stock purchase, the buyer acquires ownership shares of the entire company, assuming control of all assets and liabilities. Nothing changes about the company itself; it simply has new owners. The right structure depends on the kind of company being sold, the tax positions of both parties, and the speed at which the deal needs to close.

How Each Structure Works

In an asset purchase, the buyer selects which parts of the business to acquire. These typically include equipment, inventory, buildings, and contracts. The buyer can also choose which liabilities to assume, such as unpaid bills or outstanding legal claims. The seller keeps anything not included in the purchase agreement, and the legal company remains with the seller. This gives the buyer a degree of control over what enters and what stays out.

In a stock purchase, the buyer acquires the ownership shares of the company. This means the buyer assumes control of the entire company, including all its assets and liabilities. All contracts, licenses, and relationships remain with the company unless specific change-of-control clauses apply. Nothing about the company itself changes. It simply has new owners.

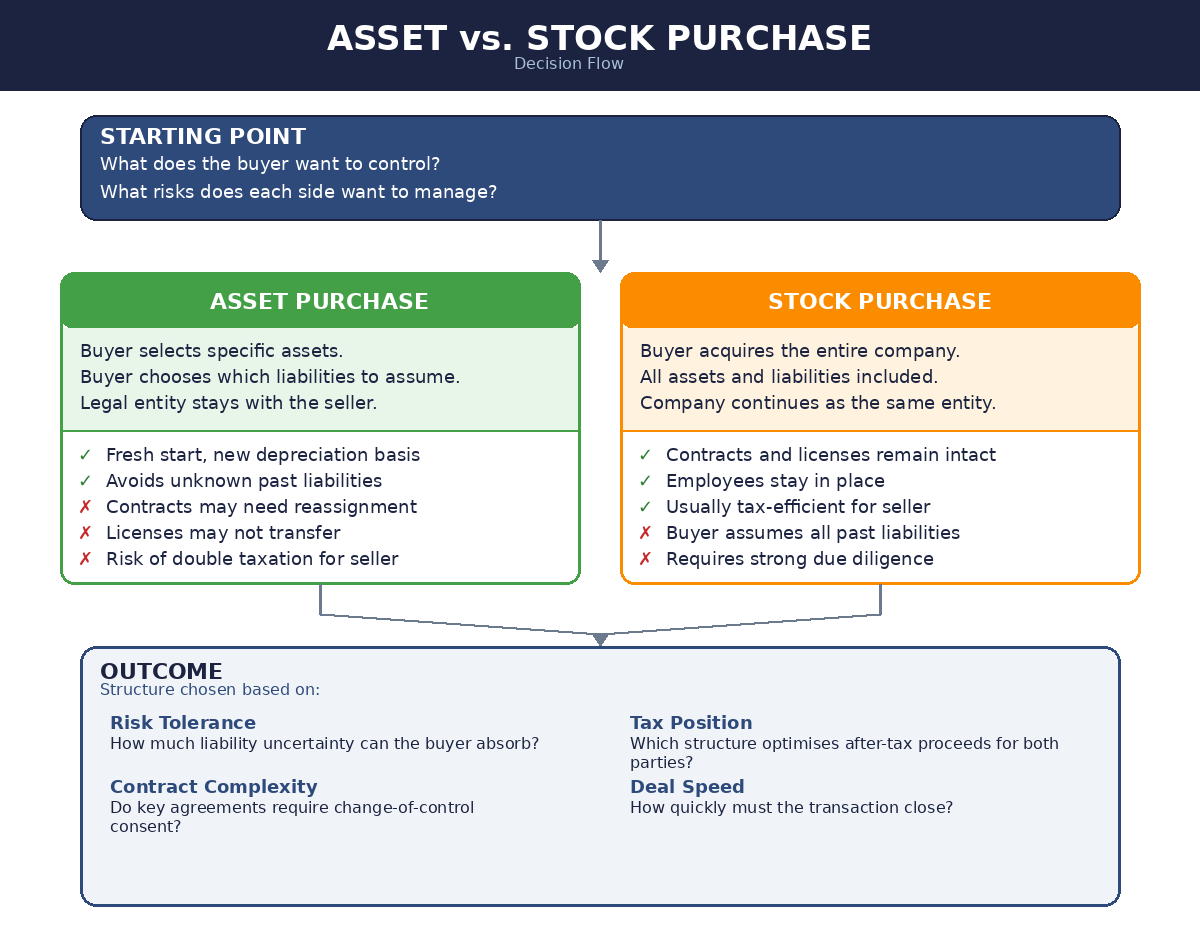

Asset Purchase vs. Stock Purchase: Decision and Outcome Flow

This diagram illustrates how the decision between asset and stock purchase flows from the buyer’s objectives and risk appetite. Each path carries distinct advantages and trade-offs across taxes, contracts, licenses, and employees. The structure chosen ultimately reflects the balance each side strikes between control, speed, and financial efficiency.

The Buyer’s Perspective

From the buyer’s point of view, asset purchases are often preferable when the goal is to avoid certain risks or problems the company may face. If a company has pending lawsuits, unpaid taxes, or complex contracts, a buyer may not want to assume those liabilities. By buying only selected assets, the buyer avoids those issues entirely. Asset purchases also allow the buyer to obtain a fresh start with new accounting. The buyer can begin depreciating assets from their new purchase value instead of carrying forward the old values, which can provide meaningful tax advantages.

However, asset purchases can be more complicated in execution. Each asset must be listed and transferred individually. Some contracts may require third-party consent to transfer. Licenses and permits may not carry over automatically and might require re-application, which can take time or even be denied in regulated industries such as healthcare, transportation, or financial services.

The Seller’s Perspective

From the seller’s perspective, a stock purchase is often simpler. The buyer takes over the entire company, meaning all contracts, permits, and employees remain in place. The seller walks away with fewer responsibilities. In many jurisdictions, a stock sale is also more tax-efficient for the seller. The seller typically pays only one level of tax on the gain. In an asset sale, the company may be required to pay tax on the gain from the sale, and the owners may pay tax again when they withdraw the proceeds. This is known as double taxation.

There are exceptions to this rule. If the selling company is structured as an S corporation or a partnership, the tax effects of an asset sale may be less severe because these entities are taxed only once at the owner level. In some cases, buyer and seller can agree to treat a stock sale as an asset sale for tax purposes through a special election under the tax code. This provides the buyer with the tax benefits of an asset deal while maintaining the simpler process of a stock deal.

Contracts, Licenses, and Employees

Some contracts contain clauses that prevent transfer without the consent of the other party. In an asset sale, these contracts need to be formally assigned to the buyer, which may require approval and can cause delays. In a stock sale, contracts typically remain in place because the company itself is unchanged. However, some contracts include change-of-control provisions that allow cancellation if ownership changes. These clauses can impact either type of deal and must be reviewed carefully before closing.

Licenses present a similar consideration. In industries where specific licenses are required to operate, an asset sale may not carry them over to the buyer, and new applications may be needed. In a stock sale, licenses generally remain with the company unless regulations specifically govern ownership changes.

Employees are handled differently under each structure as well. In an asset sale, the buyer typically issues new job offers to the seller’s employees, which can bring uncertainty around benefits and seniority. In a stock sale, employees remain with the same company unchanged. Labor laws in certain jurisdictions may require notice or consultation during transfers, and both sides need to plan accordingly.

Risk, Due Diligence, and Legal Protections

In a stock purchase, the buyer assumes all past liabilities of the company, including those that may not have been known at the time of purchase. To protect themselves, buyers typically request representations and warranties from the seller. They also ask that a portion of the purchase price be held in escrow for a defined period in case undisclosed problems surface. In an asset sale, the buyer does not assume past liabilities unless they agree to do so, which provides a stronger baseline of protection.

Special Cases and Cross-Border Considerations

Several scenarios call for specific structural thinking:

- Carve-outs: When a seller wants to divest only one division while retaining the rest of the company, an asset sale is typically required. Careful planning is needed to separate the division and ensure it can operate independently.

- Public companies and private equity buyers: These buyers often prefer asset deals to limit risk exposure. However, they may agree to a stock deal if due diligence is thorough and protections in the agreement are strong.

- Cross-border deals: Each jurisdiction carries its own tax laws, labor regulations, and rules around asset and license transfers. Currency rules, data privacy laws, and political factors add further layers of complexity. Local advisors in each jurisdiction are essential.

Conclusion

The best structure depends on the facts of the deal and the goals of each side. A straightforward business with few contracts and minimal risk may suit an asset sale. A company with numerous agreements, licenses, and a large workforce may be better suited to a stock sale. Tax position, deal speed, and risk tolerance all factor into the final decision. With clear communication, thorough due diligence, and guidance from qualified tax and legal advisors, both sides can arrive at a structure that works for everyone involved.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.