Executive Summary

In the modern business landscape, compliance is no longer a back-office function but a first-order commercial variable. Regulatory frameworks such as GDPR, CCPA, and other regional regulations have made clear: compliance must be designed, not appended. The evolution of data privacy laws has forced redefinition of the contract lifecycle. Commercial contracts must now be hybrid documents: legally rigorous, operationally executable, and technically compliant. The challenge is acute for companies operating across jurisdictions. Embedding compliance begins with clarity of roles: who is the data controller, who is the processor. Contracts must define these explicitly and allocate responsibilities for breach notification, consent management, and data deletion protocols. Data processing agreements must reflect operational realities: what data is collected, how it flows, where it is stored. A fundamental insight emerges: compliance is not a clause but a capability. When embedded early, it reduces deal friction and builds trust. When bolted on later, it delays execution and erodes margin.

The Strategic Imperative: Compliance as Commercial Design

Compliance has graduated from afterthought to first-order commercial variable. Having managed deal desks and worked with compliance and DevOps teams while structuring commercial contracts across jurisdictions, I have witnessed how compliance must be embedded in the agreement foundation.

The evolution of data privacy laws has forced contract lifecycle redefinition. Commercial contracts must now be hybrid documents: legally rigorous, operationally executable, and technically compliant. The challenge is acute across jurisdictions where European GDPR rights differ from Californian CCPA rights. Add Brazil’s LGPD, India’s DPDP, or evolving cross-border restrictions, and complexity compounds. Yet complexity necessitates design.

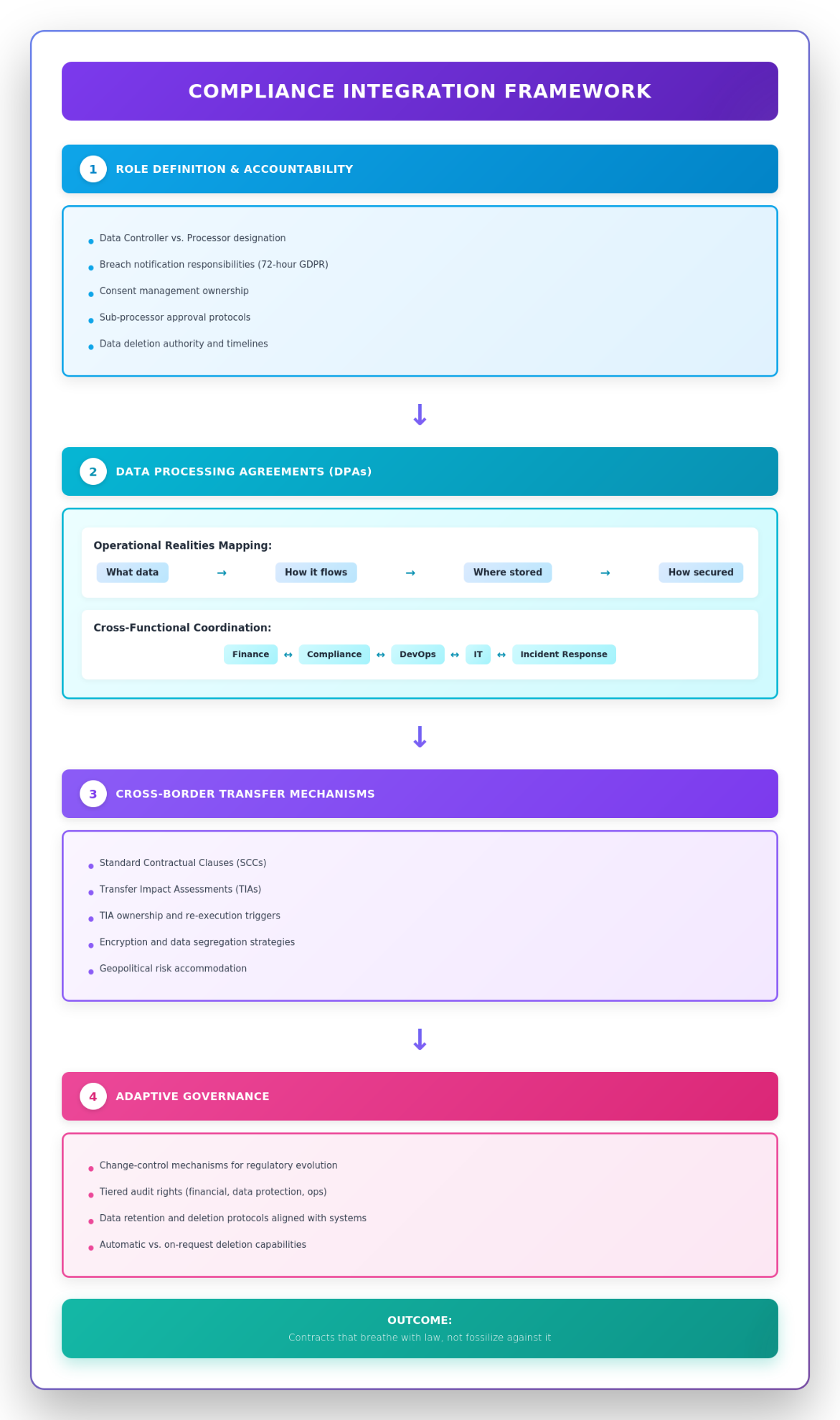

Compliance Integration Framework

This framework illustrates the four essential layers of compliance integration in commercial contracts. Starting with role definition and accountability, it progresses through data processing agreement requirements, cross-border transfer mechanisms, and adaptive governance structures. Each layer builds upon the previous one, creating a comprehensive compliance architecture that transforms regulatory requirements from afterthoughts into foundational contract design elements. The arrows show the logical progression from defining who is responsible through to creating flexible governance that adapts to regulatory changes.

Role Definition: The Foundation of Compliance

Embedding compliance begins with role clarity. Who is the data controller? Who is the processor? These distinctions may appear academic until enforcement hits. A misclassification can result in liability exposure and regulatory penalties. Contracts must define roles explicitly and allocate responsibilities for breach notification, consent management, sub-processor approvals, and data deletion. In my experience running deal desks, any ambiguity on data roles triggered elongated review loops, delaying deals. Codifying these definitions early reduces friction later.

Data Processing Agreements: Beyond Templates

Data processing agreements are now essential counterparts to Master Service Agreements. DPAs must reflect operational realities: what data is collected, how it flows, where it is stored, how it is secured. Finance must develop fluency in privacy lexicon. Understanding the operational implications of a 72-hour breach notification clause requires coordination with DevOps, IT, and incident response teams. Lack of cross-functional rehearsal leads to contradictory timelines embedded in different contract parts.

Cross-Border Transfers: Geopolitical Risk as Design Input

Cross-border data transfer is particularly subtle. With Privacy Shield invalidation and emergence of Standard Contractual Clauses and Transfer Impact Assessments, international agreements must accommodate geopolitical risk. Contracts should not merely cite legal instruments but lay out operational pathways. Who completes the TIA? What triggers re-execution? Which encryption strategies are deployed? Finance, compliance, and DevOps must converge.

Commercial flexibility must not be sacrificed. Contracts should contain change-control mechanisms allowing for regulatory evolution. Well-designed agreements permit modification of data handling procedures in response to new laws without full contract renegotiation. These adaptive clauses ensure contracts breathe with law rather than fossilize against it.

Operational Execution: Audit Rights and Data Lifecycle

Audit rights are critical. While customers may demand unrestricted audit rights, vendors must negotiate reasonableness: advance notice, scope limits, confidentiality protections. In my deal desk experience, I built tiered audit structures distinguishing between financial audits, data protection audits, and operational assessments.

Data retention and deletion clauses carry immense liability risk. Contracts must outline not just how data is stored but when and how it is deleted. These requirements must mirror system capability. An elegant clause promising deletion within 30 days is moot if the platform cannot execute it. Finance leaders must translate regulatory expectations into operational language that systems teams can deliver.

Scaling Compliance: From Contract to Capability

Scaling compliance across a portfolio without bureaucratic inertia requires design systems: playbooks, clause libraries, governance cadences. Every company must create a compliance clause architecture, a curated repository of approved contractual language indexed by jurisdiction, risk profile, and data sensitivity. Such clause libraries reduce redlines and empower commercial teams to negotiate confidently.

Playbook-driven contracting defines deal archetypes with pre-approved compliance positions, allowing teams to progress autonomously within understood compliance perimeters. Integration of compliance in contract lifecycle management systems embeds compliance metadata: where personal data is processed, what data types are handled, what jurisdictions are implicated. This visibility turns compliance from reactive chore into proactive asset.

Data Protection Impact Assessments inform contract design when conducted early. They map the data lifecycle and surface risks that must be mitigated. Pre-deal DPIAs create alignment where technical, legal, and commercial elements synchronize before signature.

Leadership Imperative: Reframing Compliance

Leadership must shift the compliance narrative from blocker to competitive advantage. Embedded compliance de-risks revenue streams, protects customer trust, and reduces downstream liability. For CFOs, this means quantifying compliance as part of deal ROI, measuring delay percentages caused by unresolved compliance issues and marginal gains from clause standardization.

Conclusion

The integration of compliance into commercial agreements is not dilution but elevation, the maturation of contracting into a strategic vector. From GDPR to CCPA and beyond, regulatory complexity will only increase. But complexity, when managed with design and discipline, becomes a competitive edge. Contracts are not the end of compliance but where it begins. Compliance is not a clause; it is a capability. When embedded early, it reduces friction and builds trust. The role of finance is ensuring compliance is not just a requirement but a differentiator.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.