Executive Summary

A well-managed company operates with an eye toward its eventual exit. Whether through acquisition, IPO, or merger, the CFO holds responsibility for ensuring the organization is always ready to transact. Transactions often come when least expected, so the time to prepare is long before. Exit readiness is a forward-looking framework. Exit-ready companies operate with rigor, with reliable numbers, scalable systems, and complete documentation. These qualities make companies more resilient and better governed. Exit readiness includes accurate financial statements, reliable forecasts, clear capital structure, identified tax exposures, accessible legal documents, and coherent strategic plans. The best-run companies treat exit readiness as normal operating discipline. In transactions ranging from thirty-five million to three hundred fifty million dollars, preparedness level makes visible difference. Buyers respond to clarity. Valuations hold when diligence confirms what was promised. Exit readiness is not about preparing for an ending but operating at a higher standard.

The Importance of Being Exit-Ready

A well-managed company operates not only with a view toward growing its business but also with an eye toward its eventual exit. The Chief Financial Officer holds responsibility for ensuring the organization is always ready to transact. Transactions often come when least expected. A strategic buyer may appear. A founder may decide to retire. A market opportunity may suddenly close. The time to prepare is not when opportunity presents itself but long before.

Exit readiness is a forward-looking framework. Exit-ready companies operate with more rigor. Their numbers are reliable. Their systems are scalable. Their documentation is complete. These qualities are not only valuable in a transaction. They make the company more resilient and better governed in ordinary times.

Exit Readiness Framework

This framework illustrates the three pillars of exit readiness: financial discipline ensuring reliable numbers and scalable systems, organizational framework covering governance through talent management, and sustained discipline maintaining readiness as a cultural norm. The arrows show progression from foundational financial rigor through organizational alignment to continuous operational excellence, demonstrating how exit readiness is not a final step but an ongoing commitment that strengthens the entire enterprise.

The CFO’s Central Role

The role of the CFO in cultivating readiness is central. The CFO oversees financial reporting. The CFO works across departments to ensure forecasting discipline. The CFO interacts with legal counsel and auditors to maintain clean records. Most importantly, the CFO is the link between the financial performance of the company and the strategic story that external parties will evaluate. The CFO must know not just what the numbers say but also what they mean and what they can become.

Exit readiness includes multiple dimensions:

- Financial statements must be accurate and timely

- Forecasts must be reliable and defensible

- Capital structure must be clear and orderly

- Tax exposures must be identified and mitigated

- Legal documents must be accessible and complete

- Strategic plan must be coherent and anchored in evidence

The challenge lies not in understanding these requirements but in maintaining them. Exit readiness is not an annual audit. It is not a pre-sale exercise. It is a continuous state of preparedness. The best-run companies treat it as part of normal operating discipline. They close books promptly every month. They update forecasts quarterly. They maintain a virtual data room that is refreshed periodically. They hold annual reviews with tax advisors and legal counsel. These practices are not burdensome. They are signs of a company that knows what it owns, what it owes, what it earns, and where it is headed.

In transactions I have been part of, ranging from thirty-five million to three hundred fifty million dollars, the level of preparedness has always made visible difference. Buyers respond to clarity. Valuations hold when diligence confirms what was promised. Delays and retrades happen less frequently. Teams remain focused and confident. These translate into better economics, smoother transitions, and lasting relationships.

The broader point is that exit readiness is not about preparing for an ending. It is about operating at a higher standard. It signals that the company is mature, transparent, and well managed. In that sense, it is not only the foundation for a successful exit but also a marker of operational excellence.

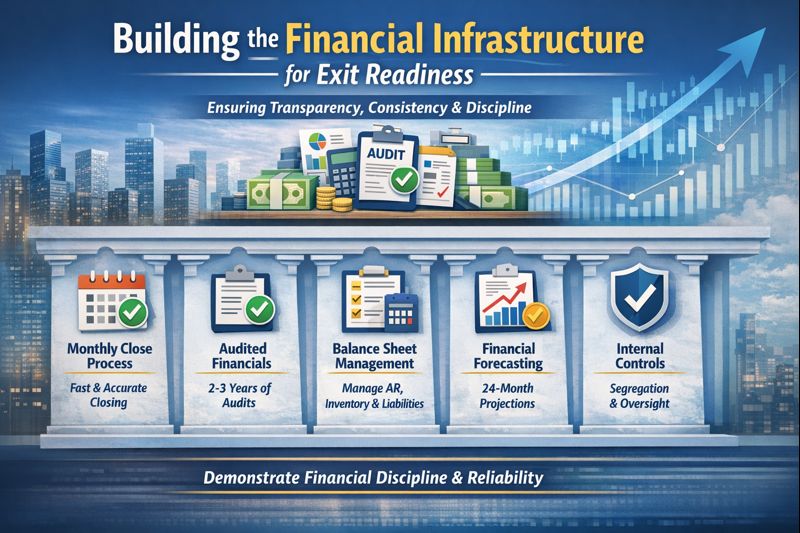

Building the Financial Infrastructure

The first pillar of exit readiness is financial discipline. A company with unreliable numbers will find it difficult to defend its valuation. Buyers examine revenue recognition practices, cost accounting methods, and working capital management. These tell a deeper story about how the business is run.

The CFO should focus on six essentials:

- Monthly Close Process: Books should close within five to seven business days. Each close should include review of key accounts, reconciliation of major balance sheet items, and variance analysis. These ensure numbers are correct and understood.

- Audited or Reviewed Financials: Many buyers require at least two or three years of audited financials. The cost is modest compared to the value they provide. They reduce uncertainty, accelerate diligence, and support premium valuation.

- Balance Sheet Management: Working capital accounts must be managed carefully. Accounts receivable should be aged regularly. Inventory must be tracked and valued accurately. Accrued liabilities should be documented. These practices prevent surprises.

- Forecasting Discipline: An exit-ready company maintains a three-statement model projecting revenue, expenses, and cash flows over at least twenty-four months. Assumptions must be documented and tested against historical trends. Forecasts should be updated quarterly.

- Key Performance Indicators: KPIs should be tracked and linked to financial outcomes. When KPIs are monitored closely, they help tell a story that is both compelling and verifiable.

- Internal Controls: The principles of segregation of duties, authorization controls, and audit trails should be in place. These reduce the risk of errors and fraud.

Financial readiness is about demonstrating that numbers are the product of a well-managed operation. Buyers do not expect perfection. But they do expect transparency, consistency, and discipline.

Preparing the Organizational Framework

Beyond financials, the CFO must ensure that the broader organizational framework is aligned with exit readiness. This includes governance, legal documentation, tax planning, and talent management.

Governance begins with the board. Meeting minutes should be complete. Shareholder agreements must be up to date. The capitalization table must be accurate and reflect all outstanding instruments. Discrepancies can delay a deal or create disputes post-closing.

Legal documentation must be accessible and well organized. Key contracts should be summarized and cataloged, including customer agreements, vendor contracts, lease agreements, employment agreements, and intellectual property assignments. The company should know which agreements require change-of-control consent. Intellectual property must be owned by the company and assigned by all contributors.

Tax readiness is equally important. The CFO should conduct periodic reviews with tax advisors to assess exposure and opportunities. This includes reviewing prior year filings, identifying net operating losses, and ensuring transfer pricing policies are documented. In cross-border operations, compliance with local rules must be verified.

The people side cannot be overlooked. Buyers assess not just financial metrics but also the strength and stability of the management team. The CFO should maintain a current organizational chart, identify key employees, and implement retention plans where appropriate. Compensation should be benchmarked to market.

The company should maintain a virtual data room that includes all critical documents. This data room should be refreshed periodically and reviewed by legal counsel. When a transaction opportunity arises, the company can respond quickly and confidently.

Sustaining Readiness as a Cultural Norm

Exit readiness is not a static state but a dynamic discipline. It must be sustained through changes in leadership, growth phases, and shifting market conditions.

One way to sustain readiness is through regular internal reviews. These can include quarterly updates to the financial model, annual reviews of legal and tax structures, and semi-annual audits of the data room. These reviews should be built into the company’s calendar and led by the CFO.

Another practice is to simulate a transaction process. This includes preparing a management presentation, responding to sample diligence questions, and conducting mock interviews. These exercises identify gaps and prepare the team for the intensity of a real process.

Communication with the board is also essential. The CFO should provide periodic updates on exit readiness, including financial health, forecast accuracy, legal status, and strategic positioning. When the board is informed, it can respond more effectively to opportunities.

Finally, the CFO must cultivate a mindset of stewardship. Exit readiness is not about dressing up the business. It is about building a business that can withstand scrutiny and deliver long-term value. This mindset influences hiring decisions, vendor selection, system implementation, and customer relationships.

Conclusion

The benefits of this approach are not limited to a potential exit. Companies that operate with exit discipline attract better investors. They secure better financing terms. They retain better employees. They grow with more confidence. When a transaction opportunity does arise, they are not scrambling. They are prepared. They can negotiate from a position of strength.

In conclusion, the CFO is not merely a financial officer. The CFO is a strategic steward. Exit readiness is one of the clearest expressions of this stewardship. It reflects not just the quality of the numbers but the quality of the company. It is not a final step. It is an ongoing commitment. And it is one of the most powerful ways a CFO can create and protect shareholder value.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.