Executive Summary

Renewals are often treated as a postscript to the initial sale, but this misunderstands modern software businesses. Renewal is the true test of whether the original promise held value and where recurring revenue proves its name. The renewal process sits at the intersection of time, trust, and systems. Time, because renewals are rarely top of mind until too close to expiration. Trust, because the customer measures whether the relationship justified its cost. Systems, because without integration between contract data, customer health signals, and billing automation, you cannot forecast or scale renewals. Having spent three decades in finance, operations, and systems design, renewals are decision points requiring structured information, timing cues, and risk-adjusted action. At the heart is contract management. A contract is not a PDF but a living object, a bundle of obligations and triggers residing in a system where metadata can be parsed and risk modeled. The contract system must speak to CRM, CPQ tools, billing engines, and revenue recognition schedules. By systematizing when and how renewal begins, you shift from reactive to proactive. Expansion is the muscular system of recurring revenue. Customer Success Executives operate like forward observers, understanding not just how the product is used but why. Great CSEs ask not “Are you happy?” but “Where does your business need to go next?” Expansion is a rhythm, not an event, earned gradually through accumulated trust, evidence, and relevance.

Designing for Predictability and Precision

Renewals are often treated as a coda to the initial sale. But renewal is not the end of a contract but the true test of whether the original promise held value. Early in my career, I celebrated a record quarter with an ARR figure that looked flawless. Two quarters later, we discovered contracts that had expired quietly or auto-renewed into apathy. From that moment, I understood that renewals are not passive events. They are actively designed experiences demanding the same orchestration as new business.

What makes the renewal process deceptively complex is that it sits at the intersection of time, trust, and systems. Time, because renewals are rarely top of mind until too close to expiration. Trust, because the customer measures whether the relationship justified its cost. And systems, because without deep integration between contract data, customer health signals, and billing automation, you cannot forecast or scale renewals with discipline.

Having spent three decades in finance, operations, systems design, and strategic enablement, I view renewals through a lens shaped by engineering management and decision theory. Renewals are decision points requiring structured information, timing cues, and risk-adjusted action. The structure of your contract management system determines performance at these decision points. When done well, it becomes a renewal engine. When neglected, it becomes a leaky faucet draining forecasted revenue.

Renewal Process Framework

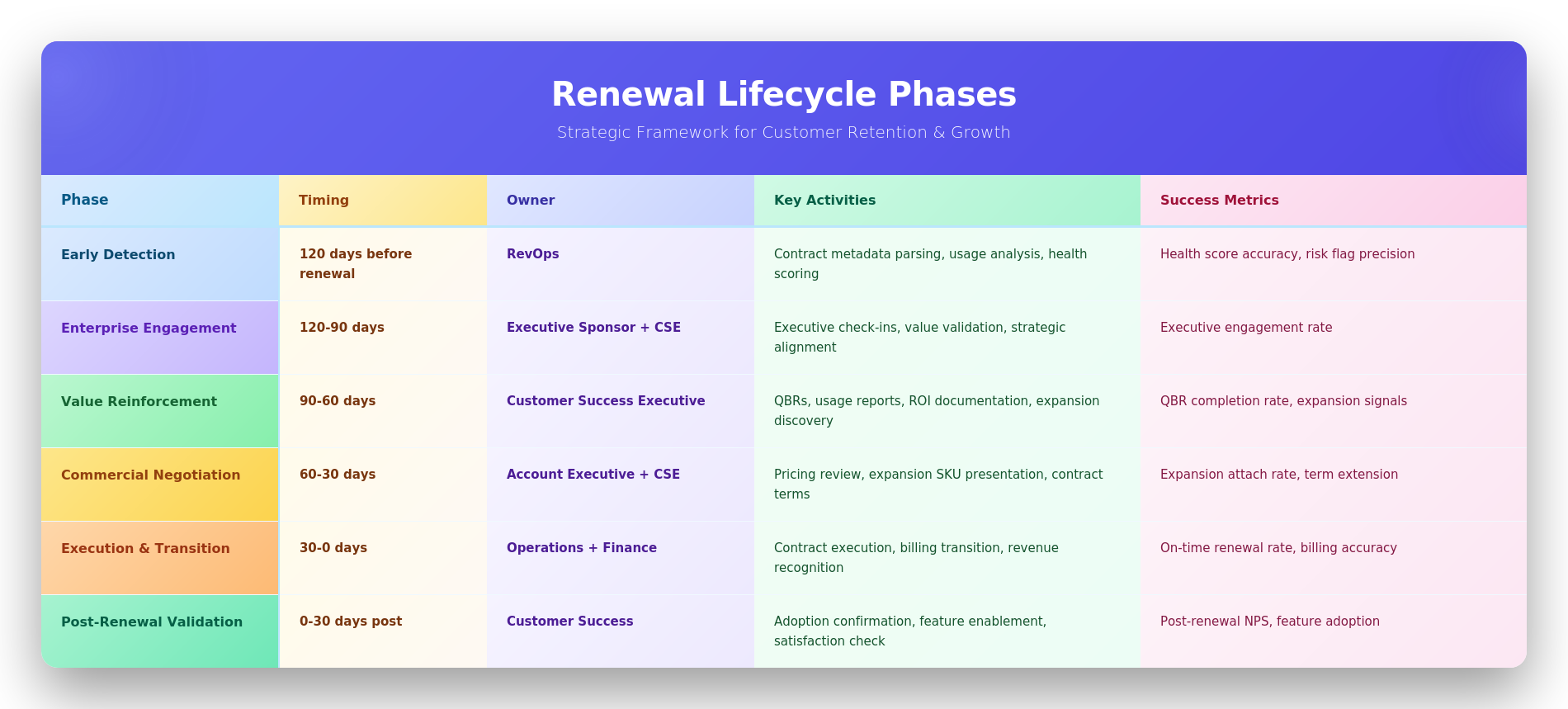

This framework illustrates the six phases of an effective renewal process, from early detection through post-renewal validation. Each phase has clear ownership, timing windows, key activities, and measurable success criteria, ensuring renewals are proactive rather than reactive.

Contract Management: The Foundation

At the heart of renewal is contract management. A contract is not a PDF stored on Box. It is a living object, a bundle of obligations, triggers, and rights residing in a system where metadata can be parsed, milestones calculated, and risk modeled. I have seen companies manage renewals by scouring email threads. That is not a process. That is an archeological dig. What you need is a repository treating contracts as structured entities, queryable and trackable by systems. The difference determines whether your renewal forecast is confident or speculative.

This aligns with my supply chain mindset. Just as inventory systems must trace parts, your contract system must reflect commitment state. If you do not know which contracts auto-renew, which require explicit acceptance, or which contain rate-escalation clauses, you cannot predict recurring base behavior. The contract system must speak to CRM, CPQ tools, billing engines, and revenue recognition schedules.

We built a contract metadata model triggering workflows at 120, 90, 60, and 30 days ahead of expiration. Each trigger launched different customer engagement, tailored to segment and expansion potential:

- 120 days: Large enterprise customers received executive sponsor engagement

- 90 days: Mid-market clients triggered CS-led value conversations

- 60 days: Commercial negotiation and expansion SKU presentation

- 30 days: Small business prompted self-service renewal links with incentives

These flows adapted based on customer usage, sentiment, and NPS scores. By systematizing when and how renewal began, we shifted from reactive to proactive.

Building a Risk-Adjusted Renewal Pipeline

Timing also transformed forecasting. Too often, companies roll forward ARR without distinguishing likely from unlikely renewals. That is inertia disguised as projection. What I advocate is a renewal pipeline, not unlike a sales pipeline, built with a different probability model. We score accounts not just on renewal proximity but on usage patterns, support ticket velocity, executive engagement, and prior payment behavior. These inputs generate a risk-adjusted forecast reflecting not just the date but probability of conversion.

As CFO, I used this model to inform revenue and cash forecasts, to size commission pools, and to prepare Board guidance. This rigor gave our CRO and CEO confidence. It reduced firefighting. It made the business run on rhythm.

Systems without people are hollow. And the people side is where many organizations falter. Who owns the renewal? The answer must be clear, consistent, and aligned with incentives. In our best implementations, renewal was a shared responsibility but not diluted.

Customer Success Executives led standard renewals, particularly where core value lay in adoption and retention. Account Executives were reactivated for expansion motions with pricing changes or upsell. The key was clarity. No renewal should go untouched because two functions assumed the other was handling it.

We built renewal playbooks providing guidance based on contract type, account size, and historical behavior:

- Accounts with 18-month terms and declining usage had escalation paths involving CS and legal

- Accounts with multi-year terms and active user growth were pre-qualified for expansion offers

- High-value accounts received executive sponsorship regardless of health score

- At-risk accounts triggered cross-functional war rooms with Product, CS, and Sales

By scripting these paths structurally, we gave teams confidence in their roles. We measured not just renewal rate but renewal quality. An auto-renewed contract leading to immediate cancellation is not a win. A renewed contract with upsell and extended term signals health. We baked this into incentive design, creating alignment between sales motion and customer lifecycle.

Renewal as a Design Problem

One valuable insight was treating renewal as a design problem. You must design processes, handoffs, systems, and data visibility. But more importantly, you must design the psychology. Customers renew not just because the product works but because they remember value. They feel seen. They understand what comes next. To reinforce that, we used every tool:

- Well-timed QBRs connecting product usage to business outcomes

- Executive check-ins validating strategic alignment

- Usage reports highlighting value delivered, not just features consumed

- Tailored expansion offers representing natural next steps

- Proactive support anticipating needs before they became problems

These touchpoints formed the scaffolding of retention. Over time, they helped renewals feel like a natural step, not a chore.

Each function viewed renewal differently. For the CFO, it was forecasting, deferred revenue modeling, and cost allocation. For the CRO, it was ownership, timing, and pipeline shape. For Customer Success, it was translating adoption into loyalty. Each view mattered. But without integration, shared vocabulary, shared data, and shared accountability, they remained fragmented.

From Renewals to Revenue Expansion

If renewal is the structural backbone of recurring revenue, expansion is its muscular system. It gives the enterprise strength and shape. But expansion does not happen by accident. It must be designed, enabled, and earned.

My philosophy of expansion was born from necessity. During a quarterly business review, renewal metrics looked solid. We had renewed 87 percent of the install base. But expansion revenue as a percentage of total renewals had fallen year-over-year. It was not churn we had to fear but stagnation. Customers were renewing out of inertia, not conviction. It became clear: we had engineered for retention but not yet for expansion.

Customer Success as Strategic Forward Observers

At the center of any expansion platform lies Customer Success. The best Customer Success Executives operate like forward observers. They sit close to customer operations. They understand not just how the product is used but why. They translate usage data into business outcomes. They create conditions for new value to emerge. Great CSEs act like embedded strategists. They ask not “Are you happy with the product?” but “Where does your business need to go next, and how can we help you get there?” That mindset transforms retention from operational task to strategic relationship.

But no CSE operates in isolation. Their influence scales when paired with executive sponsorship. Executive sponsors act as amplification nodes, bringing context, urgency, and access. When they engage quarterly with a key account, they validate the relationship and elevate the conversation. They also listen diagnostically. We trained our executive sponsors to view each call as information-gathering. What are the unstated goals? What changes are coming? What new budgets are forming? Information gathered fed back into account planning. The loop closed through design.

Triggered Engagement and Behavioral Signals

We built living account plans combining CRM data, usage telemetry, support ticket history, and renewal timelines. They acted as dynamic canvases, updated quarterly, showing relationship health and trajectory. These plans were accessible across Sales, Customer Success, Marketing, and Product. They formed the shared map guiding expansion planning.

To ensure expansion was not haphazard, we implemented triggered engagement. We identified signals suggesting expansion readiness:

- Surges in usage beyond purchased capacity

- Addition of new business units to the platform

- Repeat logins from new geographies

- Feature requests indicating adjacent use cases

- Executive stakeholder turnover creating refresh opportunities

When a signal fired, a workflow triggered: CSE and AE aligned on messaging, expansion SKU was prepped, pricing governance logic reviewed. This choreography ensured the offer was timely, relevant, and credible. When expansion offers aligned with customer inflection points, conversion rates more than doubled.

NPS as a Triage and Expansion Tool

While behavioral signals were invaluable, we also leaned on sentiment. Net Promoter Score played a crucial role but not in the way many treat it. NPS is often dismissed as vanity metric. But used properly, it becomes a triage tool. We embedded NPS responses into RevOps dashboards:

- Detractors triggered recovery workflows with executive escalation

- Passives triggered engagement checks and value revalidation

- Promoters were tagged for advocacy and pre-expansion consultation

We correlated NPS scores with account expansion over four quarters. The pattern held: promoters expanded 3.2 times more often than passives. So we invested in promoter cultivation for revenue strategy.

We ran cluster analyses to segment customers by behavior and sentiment. This revealed four segments:

- High-use promoters: Early access to new modules and premium support

- Low-use promoters: Training nudges and adoption campaigns

- Silent adopters: Engagement campaigns and community building

- At-risk detractors: Executive attention and recovery plans

Each segment received tailored engagement strategy. These tactics, drawn from analytics and empathy, turned broad retention effort into precision-guided expansion platform.

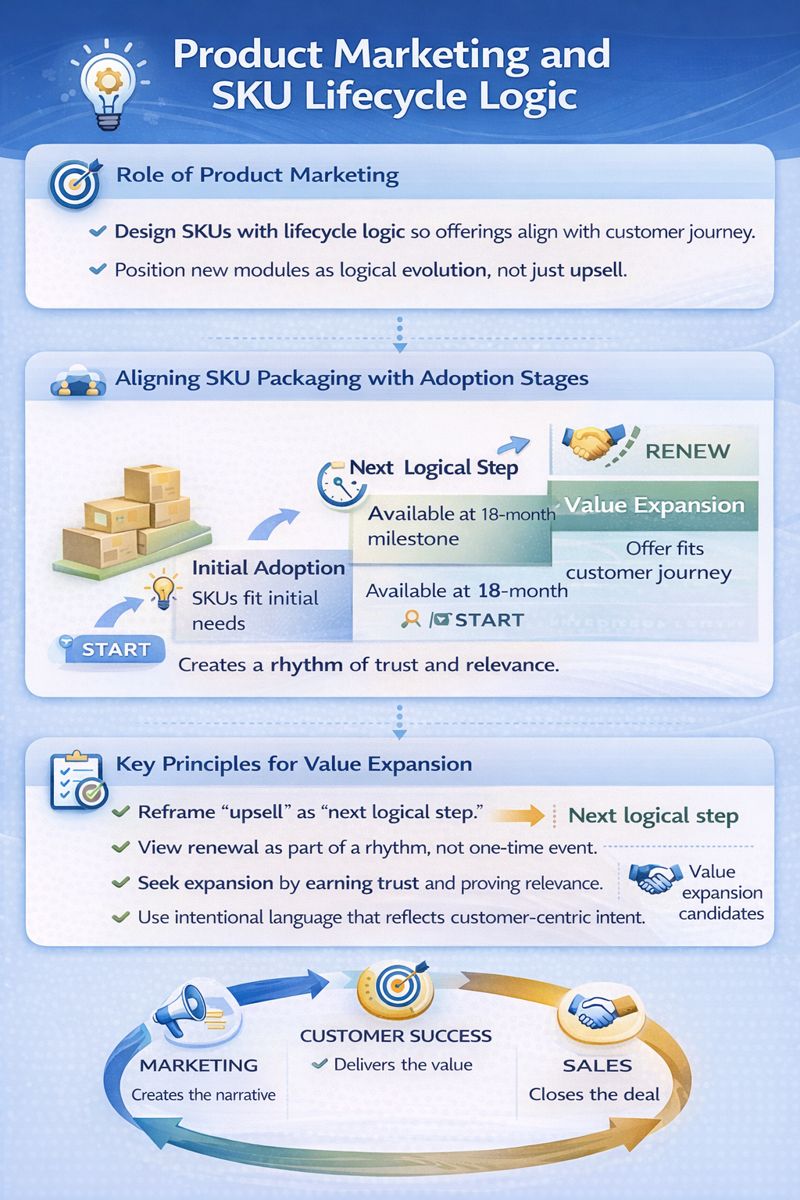

Product Marketing and SKU Lifecycle Logic

The role of product marketing cannot be overstated. Expansion readiness depends on relevance. If SKUs are not designed with lifecycle logic, you force teams to make up value propositions on the fly. We worked with product marketing to align SKU packaging with adoption stages. For example, a new analytics module was positioned not as upsell but as evolution, available at the 18-month usage milestone. These offers were easier to sell because they made sense within the customer’s journey. Product marketing created the narrative. Customer Success delivered it. Sales closed it.

One important lesson was that expansion is a rhythm, not an event. You cannot show up at renewal and hope for growth. You must earn it gradually through accumulated trust, evidence, and relevance. That is why we reframed our internal language. Instead of “upsell,” we called it “next logical step.” Instead of “target accounts,” we spoke of “value expansion candidates.” Language mattered. It reflected intent, and intent shaped behavior.

Predictive Modeling and Resource Allocation

We used simulations to project expansion outcomes. With my background in data science and simulation modeling, I built predictive frameworks using R and Python to simulate customer paths. Based on account age, usage metrics, and NPS data, we could estimate likelihood of expansion, contraction, or renewal-only outcomes. These models did not dictate action but guided prioritization. If a customer had 70 percent probability of expansion and was 90 days from renewal, we accelerated engagement. If a customer had only 30 percent probability and low usage, we focused on retention risk. This allowed strategic resource allocation.

At scale, expansion must be operationally simple. We built expansion playbooks into CPQ logic. When a rep opened a renewal opportunity, the system auto-suggested potential add-ons based on similar customer profiles. We integrated billing logic to smooth the transition between old and new contracts. Finance was involved early, validating revenue recognition impact and ensuring expansion deals did not create irregular rev rec profiles. Legal templates were version-controlled, reducing friction. Everyone played a part. The system told a story everyone could read and contribute to.

Conclusion: The Heartbeat of a SaaS Company

This alignment paid dividends. We increased net revenue retention by over 15 percentage points within 18 months. But more importantly, we created confidence. The CRO knew which accounts could grow. The CFO could project ARR with precision. And the CEO could speak to investors about not just customer count but customer depth. In a world obsessed with durable growth, that depth mattered.

Renewals and expansions reveal more than customer behavior. They reveal internal coherence. A company with a broken renewal process often has deeper operational dysfunctions. A company that struggles with expansion likely lacks shared understanding of customer value. Fixing these things is not just hiring more reps or buying better tools. It is about system design. About integrating people, process, and platforms into a rhythm that respects both the customer’s journey and the company’s ambition.

And so we return to where we began. Renewals are not the end. They are the checkpoint where you validate your product, your promise, and your partnership. Expansion is not a bonus. It is the reward for discipline, insight, and care. Together, they form the heartbeat of a SaaS company. And like any heartbeat, they must be regular, strong, and audible across the entire organization. When designed properly, the renewal and expansion engine becomes not just a revenue mechanism but a manifestation of organizational maturity, a system that turns customer relationships into durable competitive advantage.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.