Executive Summary

It begins with a sheet of numbers. A spreadsheet filled with columns of income statements and balance sheets: earnings per share, free cash flow, return on invested capital. For many, these are lifeless figures resting quietly in a finance system. But for those who truly understand their power, they are the compass of transformation, the signal of where to walk next, when to pivot, and how to shape tomorrow. Consider a global retailer navigating digital disruption. Amid conversations about e-commerce platforms and customer acquisition, the real guiding lights are EBITDA margins, working capital ratios, customer lifetime value, and incremental return on marketing spend. Financial metrics are not passive reflections of what has happened. They are strategic levers, akin to gears in a transmission. When finance and strategy teams wield these metrics with discipline, they do more than react. They transform.

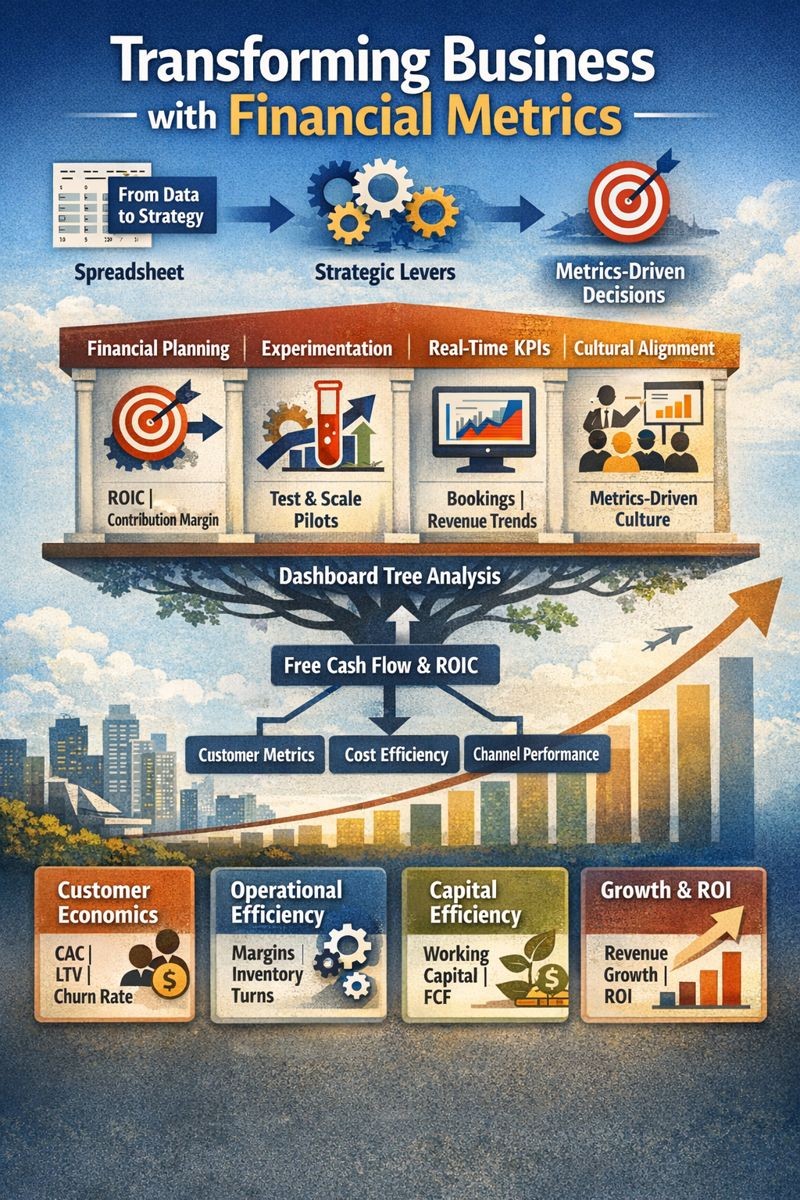

From Passive Reporting to Strategic Levers

Each metric is a node in a web of levers that, when pulled intentionally, redefine the business. Adjust the gear of pricing strategy, and you change revenue velocity. Tweak cost of goods sold, and margins move. Push on working capital efficiency, and cash flow expands, enabling new investments.

Yet this power is often overlooked. Strategy conversations devolve into visionary exercises without ever anchoring in financial reality. Likewise, finance teams retreat to their spreadsheets, delivering reports too late to influence strategic decision-making. The result is a chasm between ambition and arithmetic, between opportunity and financial design.

Throughout thirty years leading finance organizations across cybersecurity, SaaS, digital marketing, gaming, logistics, and manufacturing, I have witnessed how bridging that chasm begins with intentional alignment. Finance must embed itself at the heart of strategic thinking. Boards and executive teams must demand metrics-driven narrative. Instead of “we need to grow market share,” the conversation becomes: “show me how that translates into ROIC or EVA.”

The Metrics-Driven Transformation Framework

Effective integration happens through disciplined approach:

- Strategic Planning Anchored in Financial Targets: Planning must start with financial targets. Every new channel, product, or market entry is treated like a micro-investment, evaluated by return on marketing spend and contribution margin.

- Metrics-Guided Experimentation: Test-and-scale financial frameworks identify pilots, define thresholds, and trigger expansion only once metrics exceed targets.

- Real-Time Strategic Indicators: At organizations where I built enterprise KPI frameworks, we tracked bookings, utilization, annual recurring revenue, pipeline health, and retention as living operational guides.

- Cultural Integration: Some meetings must begin with financial outcomes. Metrics-backed retrospectives replace anecdotal debriefs. When teams tell stories with numbers, strategy becomes accountable narrative.

Key Metric Categories for Transformation

The following metrics portfolio provides comprehensive visibility:

- Customer Unit Economics: CAC, LTV, LTV-to-CAC ratio, payback period, churn rate, Net Revenue Retention

- Operational Efficiency: Gross margin by product line, contribution margin by segment, days sales outstanding, inventory turnover

- Capital Efficiency: ROIC, EVA, free cash flow, working capital ratio, cash conversion cycle

- Growth Quality: Revenue growth rate, margin expansion, digital penetration, average revenue per user

- Strategic Alignment: Incremental return on marketing spend, channel performance, market expansion contribution margin

Subscription Models: A Case Study in Metrics-Driven Scale

A striking example emerges in subscription models. Customer acquisition costs are high, sometimes loss-leading. But when CAC is paired with robust lifetime value and payback horizon metrics, CFOs and CMOs can align on sustainable scale.

At one SaaS organization operating across US and EU entities where I rebuilt GAAP and IFRS financials, we established LTV-to-CAC ratio as a north star. Customer cohort analysis revealed that recently acquired customers were churning at three times the historical rate. The issue was not pricing but sales targeting. Corrective shifts in lead qualification restored profitability.

Working Capital as Strategic Asset

Working capital provides another rich canvas. Inventory, receivables, payables all bind cash. CFOs who track days sales outstanding and inventory turns turn their supply chains into cash generators.

At a logistics organization managing one hundred twenty million in revenue, implementing advanced supply chain analytics reduced logistics cost per unit by twenty-two percent. Capital shifted from being trapped in warehouses to funding new customer initiatives.

At one professional services organization where I reduced month-end close from seventeen days to under six days, we unlocked finance as an operational driver. The time saved allowed finance teams to engage in forward-looking analysis rather than backward-looking reconciliation.

The Dashboard Tree: From Top-Level to Root Cause

One emerging practice is the metrics dashboard tree. Start with a top-level financial scorecard such as free cash flow and ROIC. Then branch down to drivers: customer unit economics, cost efficiencies, capital intensity. Below that, campaign-level ROI and channel performance. This structure allows leaders to trace signals back to root causes.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we implemented hierarchical dashboards that enabled executives to drill from enterprise-level performance down to individual campaign economics.

Finance as Product Management

Another powerful principle is treatment of financial metrics like product features. Strategy teams measure cost per acquisition or contribution margin per customer segment and treat underperformance as a bug to fix.

This approach injects speed and problem-solving into what can otherwise feel static. At a gaming enterprise where I led global financial planning and controllership, we treated financial performance as iterative optimization.

Overcoming Resistance Through Partnership

Forging metrics-led transformation is not without resistance. Finance teams may feel stretched. Business units may see finance as gatekeepers. The remedy lies in upskilling and partnership.

CFOs can deploy self-service analytics tools, train marketers in unit economics, and embed analysts in product teams. At organizations where I led FP&A and board reporting, embedded finance cells served both as accelerators and guardians of financial integrity.

The Pricing and Segmentation Interplay

When customer-facing teams launch new offers, they often focus on conversion metrics. But if the financial landscape is tracked via customer margin analysis, retention impact, and payback periods, those same offers become strategic investments.

At one education nonprofit where I secured forty million in Series B funding, pricing strategy for program offerings required balancing mission impact with financial sustainability. We tracked program margin by cohort and long-term financial viability, enabling us to expand high-impact programs while restructuring those that could not achieve unit economics targets.

Metrics Life Cycle: Constant Adaptation

Business conditions shift. Metrics that once drove strategy may now mislead. Leading teams review not just performance against metrics but the metrics themselves: are they still valid? Do they incentivize the right behavior? It is a metric life cycle, not just measurement.

Conclusion

Transformation without financial clarity is like a river without a channel: powerful but aimless. Financial metrics give it form, concentrate energy, and make strategy operational. They show where we are, where we have been, and where we might go. Through disciplined use of financial metrics, transformation becomes not a buzzword but a practice. The best transformations reduce complexity to clarity. Revenue, margin, ROIC, CAC, payback. These are not just numbers. They are the language of impact. And when a company learns to move in that language, it becomes unstoppable.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.