Executive Summary

Private equity firms are known for their ruthless efficiency: cutting costs, restructuring balance sheets, juicing margins, and plotting swift exits. But as capital has become commoditized and digital risk has grown, a new lever of operational value has emerged in code. Cybersecurity, long viewed as a compliance burden, is now an investment thesis in disguise. The firms that lead on digital resilience within their portfolio companies will not only protect enterprise value but discover a new dimension to build it. Throughout thirty years managing M&A transactions exceeding one hundred million dollars and post-merger integration, I have witnessed how cyber maturity directly impacts valuation and exit multiples.

The Urgency of Cyber Risk in PE Portfolios

Cyber risk has metastasized from nuisance to existential threat. Ransomware is rampant, state actors target private firms, and third-party vulnerabilities expose entire ecosystems. According to IBM’s 2024 Cost of a Data Breach report, the average incident in the United States costs over $9.4 million. PwC reports that less than forty percent of middle-market firms have implemented baseline cyber defenses.

Cybersecurity has become a board-level concern. Yet in PE it is too often overlooked during diligence, underfunded in early ownership, and left to overwhelmed portfolio company executives. That is risky and shortsighted.

Due Diligence in the Digital Age

Most private equity diligence processes focus on quality of earnings, legal exposure, tax structure, and growth trajectory. But increasingly, the intangible infrastructure including APIs, cloud misconfigurations, and legacy endpoints presents the most material risk.

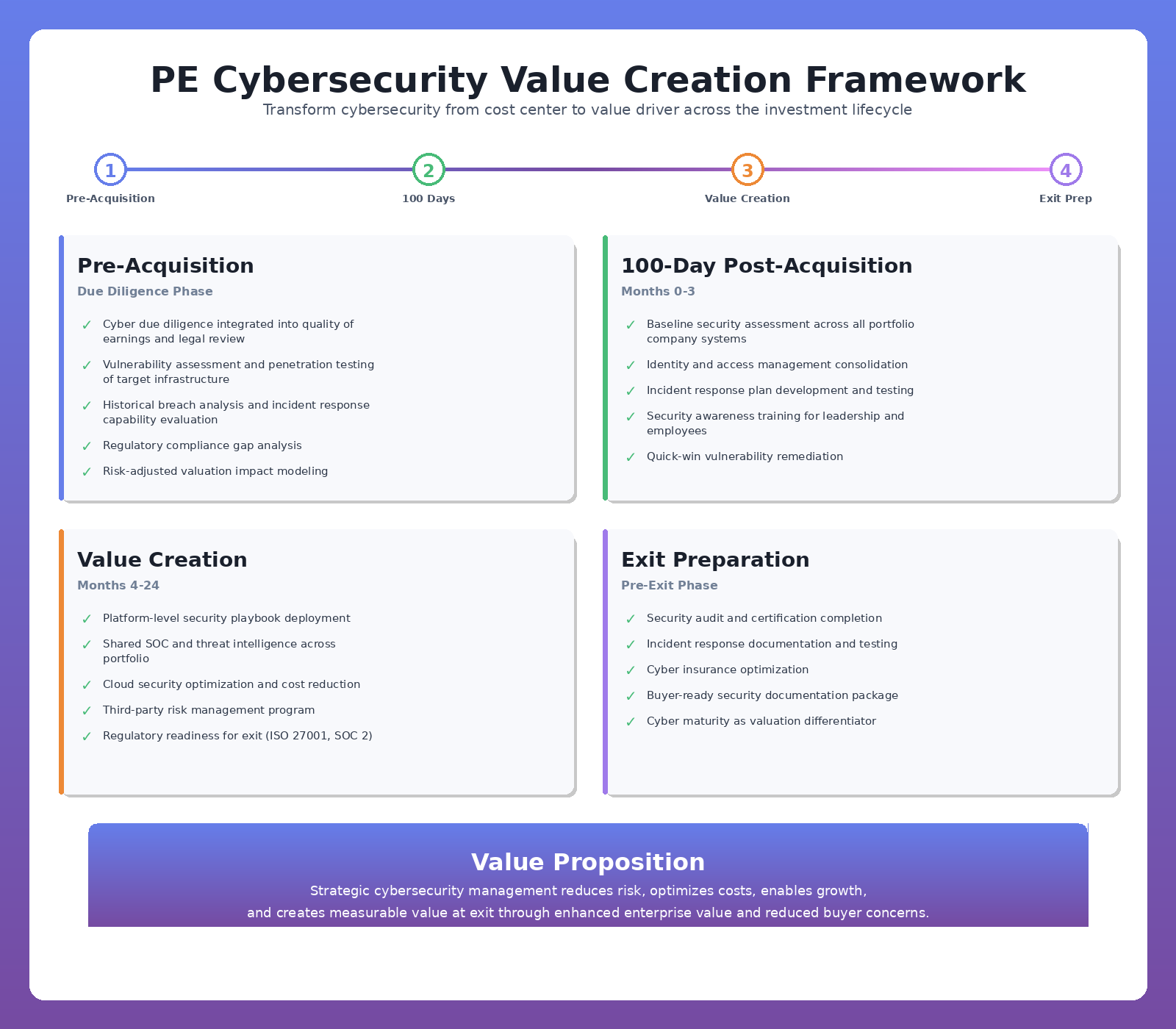

Savvier firms expand their diligence lens to include formal cyber assessments, penetration testing, and dark web exposure scans. This is about valuation accuracy. Consider the firm that acquires a target for 10x EBITDA only to learn six months later it harbored a latent vulnerability now exploited by ransomware. The result is a degraded asset and a liability that never made the pro forma.

Cyber due diligence should be viewed as asset-level insurance. It reveals hidden liabilities, reduces overpayment, and calibrates post-acquisition investment needs.

Critical Cyber Due Diligence Components

- Infrastructure vulnerability assessment and penetration testing

- Identity and access management review across systems and third parties

- Cloud security configuration audit for misconfigurations and exposure

- Incident response capability evaluation and historical breach analysis

- Third-party vendor risk assessment and supply chain security review

- Regulatory compliance status for GDPR, CCPA, HIPAA, and industry-specific requirements

Post-Acquisition: From Policy to Platform

After acquisition, most PE firms implement a 100-day plan: new leadership, tighter controls, maybe an ERP rollout. Rarely does cybersecurity receive the same standardized treatment.

A platform-level cybersecurity playbook spanning identity governance, cloud controls, endpoint protection, and incident response can be deployed across the portfolio with economies of scale. This creates risk consistency across assets while enabling shared procurement savings, common KPIs, and centralized threat intelligence.

One untapped synergy is the opportunity to build collective cyber resilience. Portfolio companies can share a Security Operations Center (SOC) or pool data to train AI-driven threat detection systems. The general partner becomes not just a capital allocator but a force multiplier for cyber defense.

PE Cybersecurity Value Creation Framework

The following framework illustrates how PE firms can transform cybersecurity from cost center to value driver across the investment lifecycle:

Capital Efficiency and Cyber ROI

Private equity is an asset class obsessed with return on investment. Cybersecurity investments often fail to excite because they are framed as cost centers. But this misses the point.

Cyber initiatives, if intelligently deployed, preserve exit value, reduce regulatory exposure, and accelerate revenue recovery. According to Deloitte, companies that suffer a significant breach face market capitalization impact of up to fifteen percent over the subsequent year. For a portfolio under a five-year hold with 2x MOIC target, this is catastrophic.

Smart firms are modeling expected loss curves from cyber events and calculating capital-at-risk based on asset class, industry exposure, and threat surface, creating an actuarial framework for cyber investment that can be measured and managed.

The Regulatory Imperative

In late 2023, the U.S. Securities and Exchange Commission introduced rules mandating public companies to disclose material cybersecurity incidents within four business days. While private companies are not yet bound by the same rules, many portfolio companies prepare for IPOs or strategic sales that increasingly involve cyber scrutiny.

In Europe, the Digital Operational Resilience Act (DORA) and updated NIS2 Directive demand rigorous standards for companies operating critical services. A portfolio company in energy, healthcare, or logistics may find itself subject to these rules regardless of ownership structure.

PE firms should treat regulatory readiness as value creation. Firms that demonstrate cyber maturity at exit will benefit from smoother transactions, higher multiples, and fewer post-closing liabilities.

Building the Cyber Operating Platform

Cybersecurity professionals are expensive, scarce, and often reluctant to work for companies without a meaningful tech charter. PE firms can counter this by building in-house security operating teams, akin to operating partners in finance or supply chain.

These teams help portfolio companies mature cybersecurity practices through structured assessments, technology roadmaps, and policy templates. Some firms are experimenting with Cyber Operating Platforms including central repositories of tools, shared vendor contracts, benchmarks, and incident playbooks.

As AI proliferates, the attack surface expands. PE firms must build cyber awareness into every digital transformation initiative they fund.

Culture and the Exit Premium

The ultimate measure of cyber success is culture. A portfolio company that treats cybersecurity as a strategic function, embedding it into product development, customer trust, and business continuity, succeeds in competitive and regulated markets.

Cyber maturity creates exit premiums. Strategic buyers value targets with robust digital hygiene, particularly in fintech, healthcare, and logistics. A seller demonstrating audit trails, tested incident response plans, and third-party certifications including ISO 27001 and SOC 2 can command valuation advantages.

This is the final arbitrage: transforming cybersecurity from sunk cost to differentiated asset.

Conclusion

Private equity has always thrived on asymmetry: knowing what others do not, acting faster, managing better. Cybersecurity presents a new frontier for such asymmetry. It is still under-addressed, under-funded, and under-strategized in most buyouts. The firms that move first, embedding cyber into diligence, post-acquisition planning, and operational governance, will not just avoid costly breaches but build better businesses, command higher exits, and future-proof their portfolios. In an era where code is capital and trust is transactional, cybersecurity is operational alpha.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.