Executive Summary

In today’s digital enterprise, bits are as valuable as bricks and often far more vulnerable. Yet in many companies, cybersecurity is still treated as a technical silo, an IT function that operates parallel to finance, not in partnership with it. That is no longer tenable. Cybersecurity is not only a technical risk but a financial one. Breaches erase enterprise value, destroy trust, invite regulatory wrath, and threaten solvency. When cyber meets ledger, finance must have a seat at the security table. Throughout thirty years leading finance and operations across cybersecurity, SaaS, gaming, and logistics organizations, I have witnessed how cyber incidents translate directly into financial impact.

Cyber Risk Equals Financial Risk, Quantified

Cyber attacks are statistical certainties. According to IBM’s Cost of a Data Breach 2024 report, the average cost of a breach globally now exceeds $4.45 million, with U.S. enterprises facing upwards of $9.48 million. Those numbers are merely the direct costs. The indirect costs including customer churn, lost revenue, and brand erosion often exceed direct damages by a factor of three to five times.

McKinsey and WEF suggest that cyberattacks will cost the global economy $10.5 trillion annually by 2025.

Financial Consequences by Risk Category

In every scenario, the impact is measurable and material. Cybersecurity is a line item in enterprise value protection.

At organizations where I managed SOX compliance, internal controls, and financial reporting systems, we learned that cyber incidents directly threaten the integrity of financial data and reporting processes. This is not theoretical; it is operational reality.

The CFO as Chief Risk Synthesizer

Traditionally, cybersecurity sat under the CIO or CISO. But cyber risk affects audit, treasury, FP&A, investor relations, and legal compliance. The CFO is uniquely positioned to integrate these perspectives, balancing prevention, insurance, investment, and response into a coherent risk-return framework.

Consider the SEC rules effective late 2023: Material cybersecurity incidents must be disclosed within four business days. That is not an IT timeline but an earnings call timeline. When cyber events go public, the CFO faces the market.

Cybersecurity as a Capital Allocation Problem

Good security is expensive. Great security is strategic capital allocation.

The modern security stack including zero trust architecture, endpoint detection, and identity access management is a cost center until it is not. The question is where, when, and with what ROI to spend.

Finance can transform cybersecurity posture by:

- Prioritizing investments based on asset value at risk and breach cost modeling

- Stress-testing cyber scenarios using probabilistic simulations

- Integrating cyber risk into enterprise risk-adjusted return frameworks

- Modeling insurance versus self-insure trade-offs

Done right, cybersecurity becomes a portfolio optimization problem the finance function is equipped to solve.

The Hidden Cost of Cyber-Invisibility

When finance is not at the table, the cost is organizational blindness:

- Duplicate controls: Redundant spending between IT, legal, and operations

- Unmodeled exposures: Gaps between asset valuation and risk coverage

- Unquantified tail risks: No understanding of cyber black swan event impact on P&L or balance sheet

- Non-aligned incentives: Security teams optimizing for tech coverage, not economic protection

In the absence of financial oversight, security spending can become compliance theater: checklists and firewalls without strategic coherence.

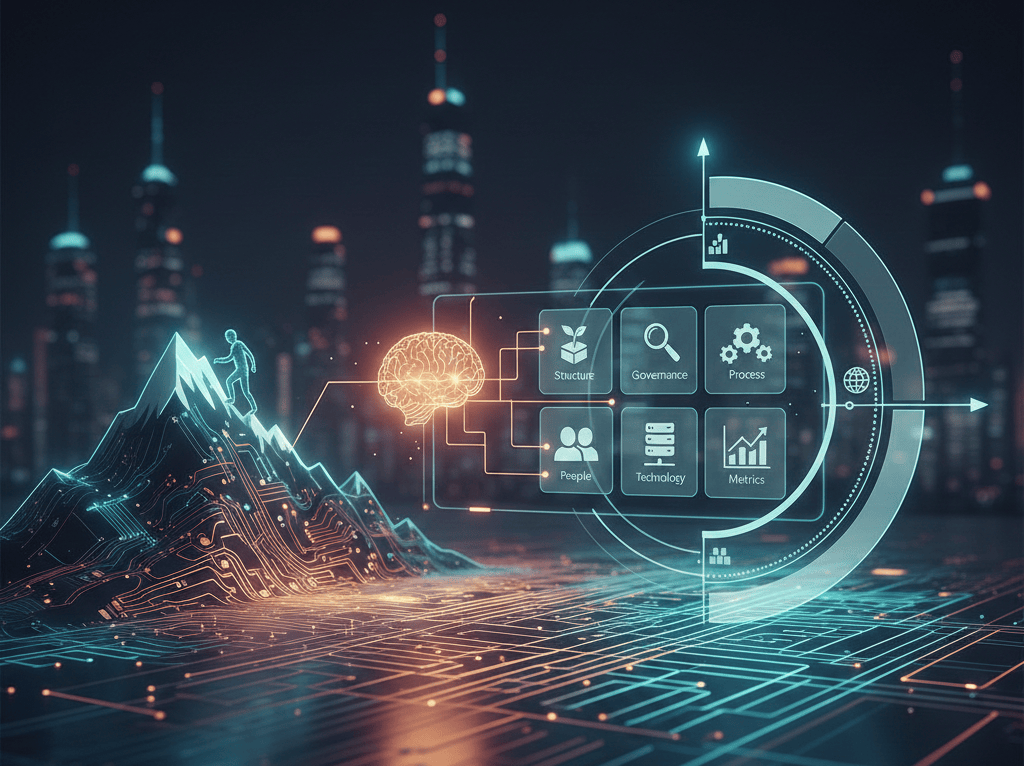

The Operating Model for Finance-Security Integration

To remedy this, we recommend a joint operating model where finance and security collaborate through structured governance:

| Integration Element | Finance-Security Action | Cadence |

| Cyber Risk Register | Maintained with finance input on asset and exposure value | Monthly |

| CapEx & OpEx Planning | Security budgets reviewed jointly with finance | Quarterly |

| Risk Dashboards | Cyber risk metrics embedded in finance reporting | Monthly |

| Incident Simulation | Tabletop exercises include treasury and IR participation | Semi-annually |

| Insurance Strategy | Joint modeling of coverage versus reserve thresholds | Annually |

This mirrors the finance-supply chain integration we saw post-COVID: strategic alignment on fragility, cost, and continuity.

At a gaming enterprise where I led global financial planning and controllership, we integrated cybersecurity metrics into quarterly board reporting, treating cyber risk as a core enterprise risk alongside market, credit, and operational risks.

Case in Point: The Market Memory

In September 2023, MGM Resorts suffered a major ransomware attack. Slots stopped spinning. Hotel doors failed to open. Earnings took a hit. MGM’s stock dropped eighteen percent, wiping out $3 billion in market cap. The breach was traced to a social engineering attack on a single helpdesk employee.

A simple access failure cascaded into an enterprise value event.

Could this have been prevented with finance at the table? Maybe not. But could it have been modeled, provisioned, insured, and disclosed more fluently? Almost certainly.

AI, Cyber Risk, and the Finance Imperative

AI introduces an entirely new cyber-attack surface including model theft, prompt injection, synthetic identity fraud, and data poisoning. As companies embed AI into financial modeling and customer experience, the intersection of AI risk and cyber risk demands CFO leadership.

Questions like “Can this AI output be trusted in forecasting?” or “Could someone exfiltrate financial data via chatbot?” are boardroom topics. Cyber risk will be continuous, autonomous, and probabilistic, making it inherently financial.

Conclusion

Finance must no longer be downstream of cybersecurity decisions. We must shape them, model them, and embed them into every financial projection and enterprise risk scenario. Cybersecurity is not just an IT problem, not just a compliance issue, and certainly not just an insurance line item. It is a capital protection function, a continuity engine, and a balance sheet defense mechanism. Finance deserves and requires a seat at the security table. Build the bridge now, before the breach.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.