Executive Summary

There comes a moment when holding steady no longer suffices. A firm has seen better days. Sales slow. Costs creep. Events that once promised growth begin to feel brittle. The future awaits, but it calls not for more effort but for decisive clarity. Should you sell the business to a stronger steward? Pivot into a new direction that aligns with your strengths? Or fold it altogether, ending the struggle to preserve what is past its time? Throughout thirty years leading finance and operations across SaaS, digital marketing, gaming, logistics, and manufacturing, I have encountered firms facing existential choice. The past has taught me that decline does not always signal failure. Often it signals transition. And AI hastens those transitions further than we imagined.

The Case for Selling

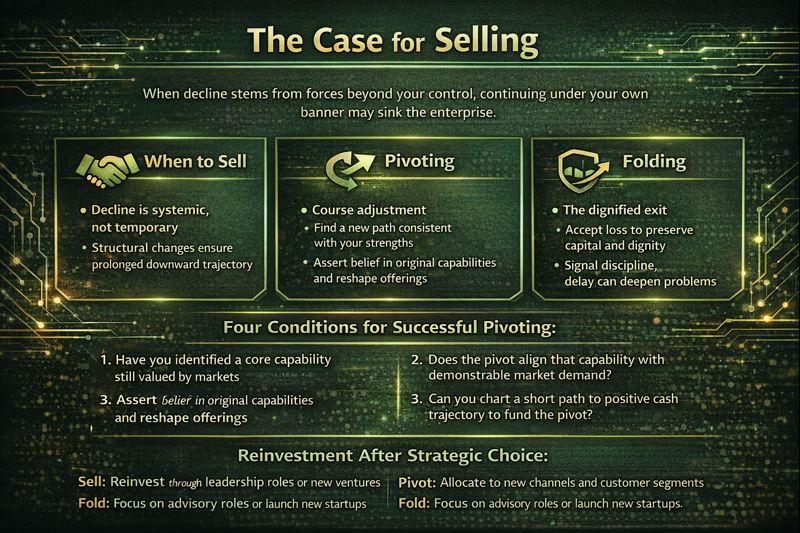

Selling is not an admission of defeat but an acknowledgement that stewardship has shifted. When decline stems from forces beyond your control, continuing under your own banner may sink the enterprise.

At organizations where I managed M&A due diligence, post-merger integration, and strategic acquisitions exceeding one hundred million dollars, I worked with firms at crossroads. New digital competitors proliferated. Regulatory costs rose. The firms could invest tens of millions in digitization or merge with larger players.

Rather than overcommit resources to defend declining positions, some chose strategic mergers. The firms’ legacies persisted under new management. Customers benefited. Talent found a wider stage. Industries from railways to steel markets show that consolidations can preserve value when competition leaves little room to expand.

When to Sell: Two Critical Recognitions

Choosing to sell must follow two recognitions:

First, decline is systemic, not temporary. Structural change including regulatory shifts, consumer behavior evolution, and technology disruption has a logic of its own. Think of the transition from sail to steam or from film to digital photography. When the underlying economics have changed, a sale protects value rather than bleeds it.

Second, stewardship ambition has shifted. If you can live with smaller returns under new stewardship, that is not failure but realism. If you cannot, then perhaps merger buys more time than exit, allowing reinvention under broader resources.

Pivoting: Course Adjustment

Pivot does not mean abandoning your work but finding a new path consistent with your strengths and domain understanding. Unlike selling, pivot asserts belief in original capabilities even as it attaches them to shifting demand.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we executed multiple strategic pivots. When initial service offerings faced commoditization pressure, we pivoted toward higher-margin consulting and proprietary technology platforms.

I have also witnessed fintech firms face declining usage on one product. But deeper analysis showed that customers valued financial guidance more than risk scoring. They retained core technology but changed messaging, built an advisory layer, and secured new partnerships. Revenue rebounded.

History records countless pivots. IBM pivoted from typewriters to computers and later to consulting. Netflix pivoted from mail to streaming. The mark of resilience is adaptability.

Four Conditions for Successful Pivoting

When might you pivot? Four conditions suggest it may work:

- Have you identified a core capability still valued by markets?

- Does the pivot align that capability with demonstrable market demand?

- Can you chart a short path to positive cash trajectory to fund the pivot?

- Will AI accelerate your value proposition, time to market, or cost structure?

If those conditions line up, pivot yields not just survival but resonance.

Folding: The Dignified Exit

Folding is the hardest choice. It means stepping down and accepting that loss is part of reality. Folding is not cowardice but clarity, the decision to preserve dignity rather than prolong suffering.

At organizations where I led turnaround efforts and operational restructuring, I learned that sometimes the most strategic decision is a controlled shutdown rather than continued value destruction. When execution falters because conditions have changed irrevocably, folding preserves capital for tomorrow’s ideas.

Folding also signals discipline: we do not chase vanity metrics, we do not prolong the inevitable at stakeholder expense, and we preserve relationships and reputations for future opportunities.

The Dignity of Knowing When to Stop

When all paths forward require resources beyond what can be reasonably marshaled, when market conditions have fundamentally shifted against your business model, when team morale and customer confidence have eroded beyond recovery, folding becomes the strategic choice.

Reinvestment After Strategic Choice

Once you decide to sell, pivot, or fold, the next question is what you do with the energy, ideas, and talent you still command.

If you sell, reinvestment may mean joining the acquirer’s leadership or launching a new venture. At a gaming enterprise where I led global financial planning, post-acquisition integration often determined whether talent and culture survived the transition. Strategic sellers negotiate not just valuation but ongoing roles and influence.

When you pivot, reinvestment is built into the plan. You commit resources to new channels, products, or customer segments, treating reinvestment as a test of future cash flows.

If you fold, reinvestment occurs outside the business. You free up time and emotional energy for new purpose, whether advisory roles, new startups, or returning to core expertise in fresh contexts.

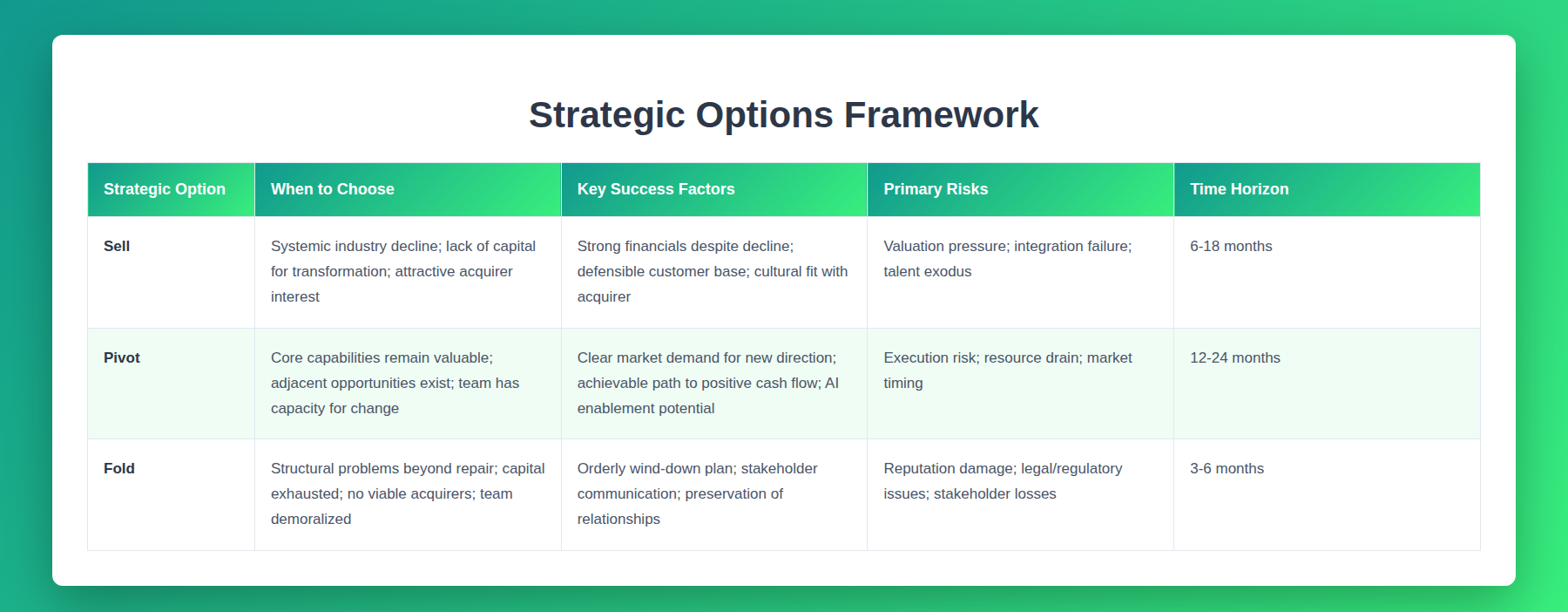

Decision Framework: Sell, Pivot, or Fold

The following framework provides a structured approach to evaluating strategic options during business decline:

Case Study: Regulated Payments Provider in the AI Era

I advised a regulated payments firm serving small to mid-sized clients. Regulation changed. Capital requirements rose. Client sophistication increased. They faced a choice: sell to a regulated bank, pivot to consulting, or fold the service desk.

Their capabilities remained strong in compliance and process. They had deep client relationships but legacy systems that could not meet upcoming standards. AI could automate compliance workflows with less human oversight, but acceleration would require capital and culture change.

They structured three scenarios: sell mode for modest valuation but infrastructure access, pivot mode to partner with a bank and build an AI platform, or fold mode to shut down gracefully.

Pivot aligned best with their capabilities and the trajectory of regulation. They raised a bridge round, secured an AI development partner, and hired a CTO with relevant experience. Eighteen months later they drove double-digit revenue growth under AI-aided compliance architecture.

This case echoes classical industrial shifts, where innovation repurposes talent and structure. AI became the lever, not crutch.

Case Study: The Honorable Exit in Manufacturing

At a logistics and manufacturing organization managing one hundred twenty million in revenue, we faced decisions about underperforming product lines that could not compete with low-cost imports. One division held a loyal customer base but faced unsustainable commoditization pressure.

The leadership team modeled scenarios: selling would maintain jobs at scale with earn-out, pivoting would require significant capital and entry into unknown markets, folding meant immediate job loss and community impact.

They chose to sell the division to a larger manufacturer. The acquiring company preserved the brand and retained most staff. The sellers redirected capital to higher-margin divisions.

History shows such decisions repeatedly: once-successful divisions often sell at the threshold of structural change. Honoring talent and legacy while refusing to pretend survival is feasible becomes a strategic act.

The AI Imperative in Strategic Clarity

When AI is on the horizon, strategic decisions gain extra nuance. AI reshapes cost curves and accelerates data-driven decisions. It makes pivoting faster and shuts down sacrificial ventures sooner. Yet it also entices with illusions.

Strategic clarity in the AI era requires speed:

- Sell when AI threatens your moat and the economics of defense are prohibitive

- Pivot when AI enables a leap tied to domain strengths and customer relationships

- Fold when the resource cost of building AI infrastructure exceeds the value of trying

At a professional services organization where I reduced month-end close from seventeen days to under six days, AI-powered automation could transform operations. But the capital and cultural investment required meant smaller firms often chose to partner or sell rather than build indigenous AI capabilities.

As IBM once pivoted from hardware to consulting, firms must shift to take advantage of AI. But those shifts demand honest decisions.

Conclusion

The decision to sell, pivot, or fold is not merely financial but existential. It reveals organizational character, leadership courage, and strategic discipline. Selling preserves value through transition. Pivoting channels capabilities toward new opportunities. Folding honors reality and preserves dignity. Each path carries risks and rewards. Each requires honest assessment of market conditions, organizational capabilities, and stakeholder interests. The firms that navigate decline with clarity, whether through strategic sale, bold pivot, or dignified exit, emerge with relationships intact, reputations preserved, and pathways open for future opportunities. Capital may create options, but character determines outcomes.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.