Executive Summary

The most dangerous number in a boardroom today is not the burn rate or the customer acquisition cost but a blank field next to “AI ROI.” Companies are rushing to implement generative AI tools, deploy copilots, and fund internal agent projects, often driven by competitive pressure or vendor promises. Yet very few can answer, with any rigor, what return they are receiving on that investment. The situation reminds me of early BI and ERP deployments in the early 2000s, when every CIO had a roadmap but few could produce a scoreboard. Having spent decades operating at the intersection of finance, operations, and technology across verticals as varied as SaaS, freight, and gaming, I have seen hype cycles crest and crash. What sustains is not vision but value validation. As CFOs and executive teams steer their companies through this GenAI transition, we need a more grounded, CFO-style ROI framework, one that cuts through the noise and measures AI not as a science experiment but as an economic asset.

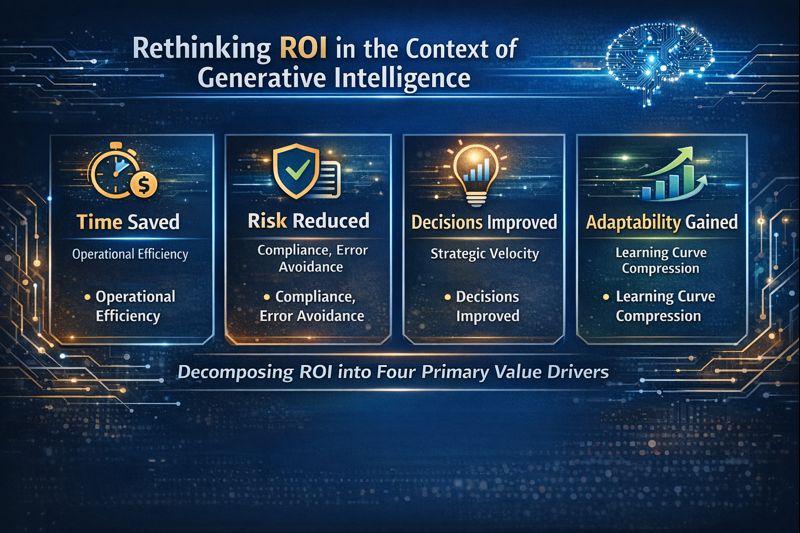

Rethinking ROI in the Context of Generative Intelligence

Traditional ROI formulas break down when applied to generative AI because most value is indirect: hours saved, faster time-to-insight, improved decision quality, or risk avoided. We need a more nuanced approach that decomposes ROI into four primary value drivers:

- Time Saved (Operational Efficiency)

- Risk Reduced (Compliance, Error Avoidance)

- Decisions Improved (Strategic Velocity)

- Adaptability Gained (Learning Curve Compression)

Each has a measurable, monetizable counterpart. Together, they form a composite ROI profile that assesses past impact and forecasts future leverage.

Time Saved: The Productivity Multiplier

This is the most immediate and quantifiable benefit. AI agents reduce time spent on rote tasks including summarizing documents, extracting data, building reports, or triaging support tickets.

The formula:

Time Saved Value = (Avg Hours Saved per Task × Frequency × Loaded Hourly Rate)

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, an AI summarization agent saved customer success managers six hours per week on documentation. Across twenty CSMs, that equated to 6,240 hours annually. With a blended cost of sixty dollars per hour, the realized time value exceeded $370,000.

But time saved is only valuable when it leads to better allocation. The real value was how that time was reinvested in more proactive customer engagement.

Boards should always ask:

- Is saved time being measured at the task level?

- Is that time being reinvested toward higher-value work or simply absorbed?

Risk Reduced: The Cost of Avoidance

AI agents can reduce risk in areas like compliance, security, contract review, and forecasting accuracy. These are typically invisible until something breaks but are monetizable through avoided cost.

The equation:

Risk Reduction Value = (Probability of Adverse Event × Estimated Loss × Risk Mitigation Impact %)

At one education nonprofit where I secured forty million in Series B funding, an AI agent scanned vendor contracts and flagged missing indemnification clauses. One missed clause could have exposed the firm to a $250,000 liability. The risk mitigation value was calculated as ten percent likelihood, $250K potential cost, and eighty percent agent catch rate, yielding a $20,000 risk-adjusted value.

Risk avoidance is often underestimated but in regulated industries frequently becomes the dominant driver of AI ROI.

Boards should insist on reporting that tracks:

- Incidents flagged versus avoided

- Agent accuracy in risk triage

- Escalation rate and override frequency

Decisions Improved: Strategic Velocity

This is the most abstract but arguably most valuable benefit. AI augments human decision-making by simulating scenarios, surfacing insights, and generating alternatives. The impact is not in efficiency but in better judgment, made faster.

We can proxy this with:

Decision Value = (Impact of Decision × Confidence Gain from AI × Time Gained)

At a logistics organization managing one hundred twenty million in revenue, an AI agent ran daily simulations of fuel costs, route efficiencies, and labor availability. The AI shaved four days off each monthly planning cycle and increased route profitability by two percent.

Those gains stem not from saved hours but from accelerated clarity. When AI makes the decision space more legible, executive bandwidth shifts from data wrangling to action.

For boards, the key questions are:

- Are forecasts or scenarios now more accurate or faster?

- How often are AI suggestions accepted versus overridden?

- Can we measure increased velocity in planning cycles?

Adaptability Gained: Future-Proofing Through Learning

GenAI systems improve with use. As users correct outputs, agents adapt prompts, and systems capture feedback, the organization learns quietly and continuously. This adaptability reduces onboarding time, retraining cycles, and response latency to market shifts.

Quantifying adaptability involves measuring time-to-retrain, reduction in onboarding curve for new hires using copilots, and model performance improvement per iteration.

At a global professional services firm, an AI onboarding agent reduced time-to-productivity for new hires from twelve weeks to eight. That is four weeks of reclaimed output per employee, compounded across cohorts.

Adaptability ROI is harder to capture in a single formula but essential for long-term planning. Companies with high adaptability require less capital to react.

Boards should ask:

- How fast do our AI systems adapt to change?

- Is the system learning from user inputs and feedback?

- Do we measure improvement in agent output over time?

The Composite AI ROI Framework

The following framework provides a comprehensive approach to measuring GenAI ROI across all four value drivers:

| Value Driver | Key Metrics | Measurement Formula | Typical Impact Range | Reporting Frequency |

| Time Saved | Hours saved per task, frequency of task, loaded hourly rate | (Avg Hours Saved × Frequency × Hourly Rate) | $200K – $500K annually for mid-size teams | Monthly |

| Risk Reduced | Incidents flagged, incidents avoided, agent accuracy rate | (Probability × Loss × Mitigation %) | $50K – $300K in avoided costs | Quarterly |

| Decisions Improved | Forecast accuracy gain, planning cycle reduction, suggestion acceptance rate | (Decision Impact × Confidence Gain × Time Gained) | 10-20% velocity improvement | Quarterly |

| Adaptability Gained | Time-to-retrain, onboarding curve reduction, model improvement rate | Performance delta per iteration | 15-30% efficiency gain over 12 months | Semi-annually |

Building a Composite AI ROI Dashboard

CFOs should present AI ROI using a composite scorecard:

| Metric | Value | Measurement Period | Trend |

| Time Saved | $425,000 | Annualized | ↑ 12% QoQ |

| Risk Avoided | $185,000 | Trailing 12 months | → Stable |

| Decision Acceleration | +12% planning velocity | Quarterly | ↑ 3% QoQ |

| Adaptability Index | +18% model accuracy | Since last retrain | ↑ 5% |

The goal is not to reduce AI impact to a single number but to show where and how value accrues and to inform future investment.

Implementation Guidelines for CFOs

To implement this ROI framework effectively, establish baseline metrics before AI deployment, define standardized measurement protocols for hours saved and risks avoided, create feedback loops for continuous data collection, set review cadences monthly for time saved and quarterly for risk and decisions, and communicate composite ROI to boards rather than cherry-picking individual metrics.

Conclusion

GenAI projects should be evaluated with discipline but also with context. Not every project will deliver immediate ROI. Some will teach. Others will fail fast. That is the nature of intelligent systems; they require iterative trust, not blind scale. But as fiduciaries of capital and strategy, boards and CFOs must demand evidence. If AI is being deployed across FP&A, sales, legal, and customer service, we must treat it not as a magic wand but as a portfolio of experiments, each with its own return profile. Because in the end, AI does not generate value. People, teams, and systems, when augmented intelligently and evaluated rigorously, do.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.