Executive Summary

The down round often begins not with an announcement but with a quiet reckoning. For the CFO, this moment is as strategic as it is financial. The most damaging part is not the repricing but the narrative collapse that follows. Perception drives value, and a company seen to be weakening can find its brand, culture, and future capital access compromised. Yet if a CFO frames the down round with clarity and strategic positioning, they can re-establish control of the narrative. This begins by naming reality: soft-pedaling valuation resets only deepens mistrust. The survival strategy requires managing internal culture through radical transparency and celebrating operational wins. Terms matter more than headline valuation; poorly negotiated terms can install ratchets that cripple future rounds. The CFO must preserve optionality by mapping the recovery arc with clear operational metrics and future-proofing governance. Board dynamics shift dramatically, requiring proactive briefings and scenario modeling. External reputation rebuilding demands message discipline and intensified investor relations. The operating model must be reengineered for capital efficiency through unit economics scrutiny and zero-based budgeting. Tax implications and equity restructuring carry lasting consequences requiring thoughtful planning to preserve value while managing employee psychology around underwater options.

The Strategic Imperative: Reframing the Down Round Narrative

The down round often begins with a quiet reckoning. Metrics are behind. Markets are tighter. Having navigated capital raises totaling over $120M while managing through market volatility and investor relationship challenges, I have witnessed how the most damaging part is not the repricing itself but the narrative collapse that follows if left unmanaged.

If a CFO frames the down round with clarity and strategic positioning, they can re-establish control. This begins by naming reality. Soft-pedaling valuation resets only deepens mistrust. Founders and CFOs must present the valuation as recalibration, not retreat, connecting it to macro context and sharpened strategic focus. They must separate signal from noise. A down round is not a death sentence. Many high-performing companies have weathered them. What matters is whether the company uses the moment to upgrade discipline and recommit to fundamentals.

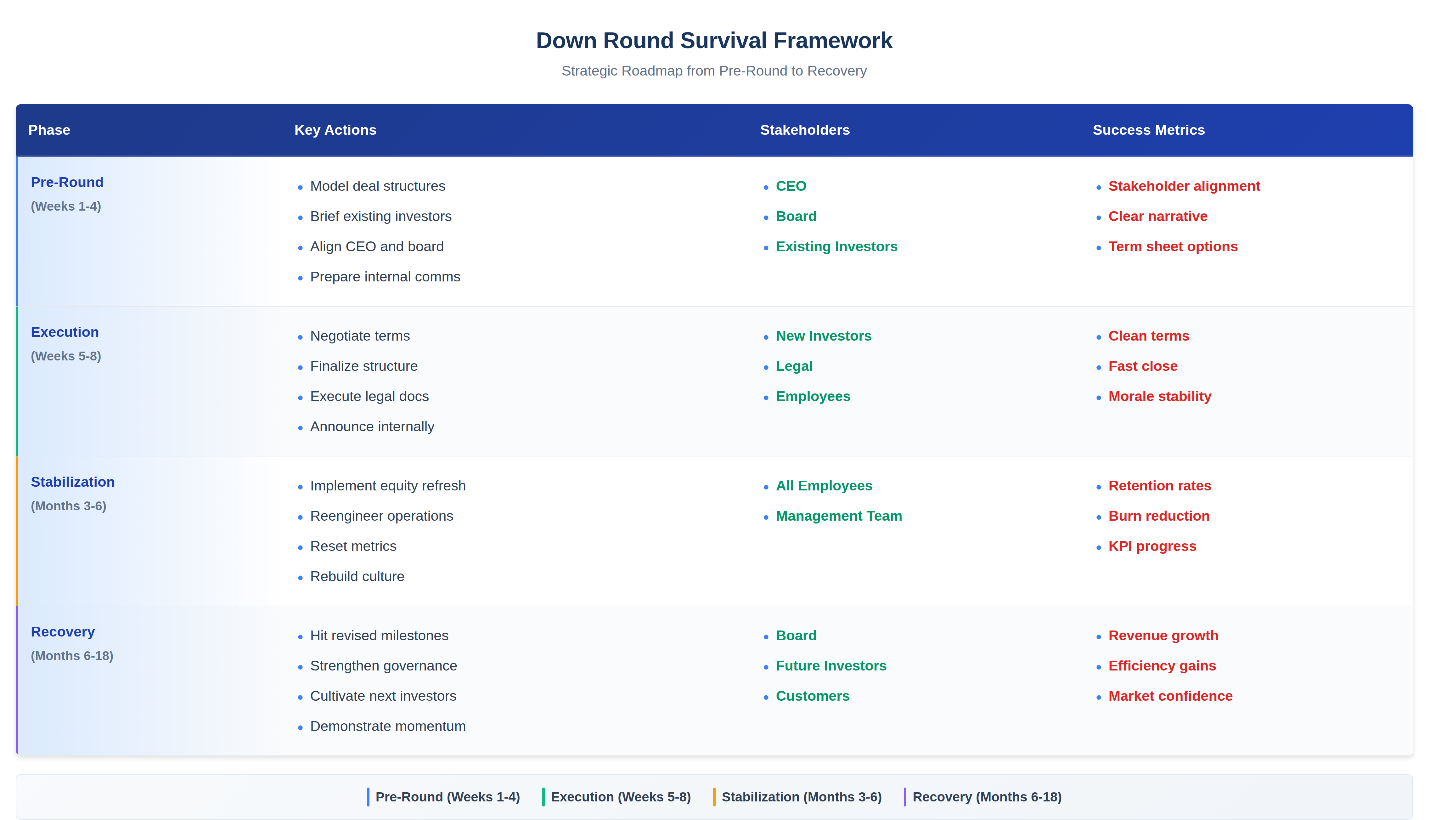

Down Round Survival Framework

Managing Culture and Negotiating Terms

Down rounds trigger emotional waves. Employees feel blindsided. Option holders feel betrayed. The CFO must lead through radical transparency. Teams need to understand why the round happened and what changes. CFOs must collaborate with HR to craft a narrative of resilience. Compensation structures must be revisited. Option repricing may be necessary. The CFO must balance fairness with dilution risk.

Celebrating wins becomes critical. When valuation drops, operational wins must be amplified: customer renewals, product launches, cash flow milestones, team accomplishments. When I reduced monthly burn from $800K to $200K while maintaining morale, the success factor was transparent communication about why constraints enabled sustainable growth.

Terms matter more than headline valuation. A poorly negotiated down round can install punitive preferences that cripple future rounds. The CFO must model multiple structures: clean down round, structured equity, convertible alternatives. Existing investors must be pre-briefed. Negotiating liquidation preferences is especially sensitive. The CFO must push for simplicity. Speed matters. A protracted down round erodes morale. The CFO must run a tight process with fast diligence and clear decision trees.

Preserving Optionality in Future Rounds

The worst outcome of a down round is to become boxed in. Structure-heavy terms, defensive investors, or morale collapse can make future raises harder. The CFO must design the down round as a bridge, not a wall. Begin by mapping the recovery arc. What metrics must improve to justify a flat or up round next time? These should be operational, not just financial:

- Revenue growth and quality (recurring versus one-time)

- Customer retention and net revenue retention rates

- Burn multiple (dollars burned per dollar of ARR added)

- Product adoption metrics and engagement scores

- Gross margin expansion and unit economics improvement

Next is communication cadence. Investors need a timeline. When will updates come? What milestones will be reported? Transparency builds trust. Option refreshes must be designed with vesting timelines that align to the recovery arc. This keeps employees focused on the long game. Governance must also be future-proofed. The board should be balanced. Strategic seats must be preserved. If the round includes new observers or directors, the CFO must ensure they align with the recovery vision.

Finally, external messaging must remain optimistic but credible. Press releases should highlight strategic investors, not valuation. Thought leadership should focus on product momentum, customer wins, and vision. The narrative shifts from growth-at-all-costs to disciplined scaling, from market expansion to market leadership, from potential to proof.

The CFO-CEO Partnership and Board Diplomacy

Before the organization hears “down round,” the CFO must sit with the CEO. This conversation is about leadership and trust. Founders often perceive down rounds as a referendum on credibility. The CFO must acknowledge this while guiding the CEO into strategic posture. The CFO must bring clear data: burn rates, revenue trajectory, investor sentiment, valuation scenarios. Next comes narrative strategy. The CEO must remain the company’s most compelling voice. The CFO must help shape a story the CEO can believe in. When I drove scale from $9M to $180M revenue, the CEO-CFO partnership proved most critical during inflection points where strategic narrative needed evolution.

The CFO must prepare the CEO for difficult conversations, role-playing investor calls and anticipating employee questions. Most importantly, the CFO must be loyal to the mission, not the mood. When the CEO wavers, the CFO steadies. The board requires similar diplomacy. The CFO must prepare comprehensive presentations with current metrics, cash runway, and forecast scenarios. Next is pre-alignment through individual briefings before full meetings. In the boardroom, the CFO must anchor conversation in first principles: What does the company need to survive and return to strength? The CFO must manage each director with tailored messaging and extract value beyond capital, engaging them as accelerators.

Reengineering the Operating Model for Capital Efficiency

The capital environment that necessitates a down round often demands a different operating model. The CFO must lead a rearchitecture. Start with unit economics. Every product line, customer segment, and channel must be scrutinized. The CFO must identify where capital is compounding and where it is burning. Budgeting shifts from top-down to zero-based. Every dollar must earn its place. Headcount plans must align to near-term returns.

Forecasting becomes tighter. Rolling forecasts replace annual plans. Cash burn is tracked weekly. The CFO becomes both operator and sentinel. Strategic planning must link directly to capital allocation. If a department wants more budget, it must show path to impact. This rigor, though difficult, becomes a source of pride. Teams feel the clarity. Decisions sharpen. Accountability rises. The key operational shifts include:

- Monthly cohort analysis replacing annual revenue targets

- Weekly cash burn reviews with department heads

- Quarterly zero-based budget resets for discretionary spend

- Customer payback period tracking by acquisition channel

- Gross margin monitoring at product and customer levels

Tax Implications and Equity Restructuring

A down round alters not just optics and ownership but also tax posture. For CFOs, this dimension is often underappreciated, but it can carry lasting consequences for employees, investors, and the business entity itself. Start with the basic impact on equity instruments. In a down round, the new lower price per share resets the company’s valuation baseline. For companies issuing options, especially Incentive Stock Options or Non-Qualified Stock Options, this creates an immediate challenge: how do you price new grants relative to prior ones, and what does that mean for employees who already hold equity?

The IRS requires that options be issued at or above fair market value. A down round, by resetting the FMV downward, renders many previous option grants underwater. While not taxable upon grant, underwater options are no longer incentivizing. Employees must pay a strike price higher than current value, a psychological and economic disincentive. CFOs often consider repricing or reissuing options. However, such actions must be carefully managed. For ISOs, repricing may be considered a new grant, resetting holding periods and potentially changing favorable ISO status to NSO treatment.

Additionally, 409A valuations must be revisited. The 409A, used to establish FMV for private company equity grants, typically lags the latest preferred price unless the company can demonstrate substantial progress. In the event of a down round, the CFO must work with valuation firms to update the 409A in a manner that reflects the new capital structure and external signal but also withstands IRS scrutiny. When I managed SOX compliance and internal controls across multiple organizations, the discipline of maintaining clean equity administration and proper 409A documentation proved essential during valuation transitions, avoiding costly tax surprises for employees and the company.

Convertible instruments also carry tax implications. If the company had previously issued convertible notes or SAFEs with valuation caps or discounts, a down round may cause these instruments to convert on more favorable terms to investors. While not necessarily a taxable event, this can lead to complicated equity allocations and reporting. For preferred shareholders, particularly those with liquidation preferences, a down round may activate ratchets or anti-dilution protections. While typically non-taxable at conversion, these clauses can distort equity distributions at exit and create cap table complexity that impacts M&A negotiations.

Communication around these consequences is paramount. Employees should receive briefings, tax guidance, and scenario models. The CFO should preempt panic by showing how the company is managing alignment and downside protection. Done correctly, tax strategy during a down round becomes part of the recovery, reinforcing the message that the company not only understands the situation but has planned thoughtfully to protect stakeholders.

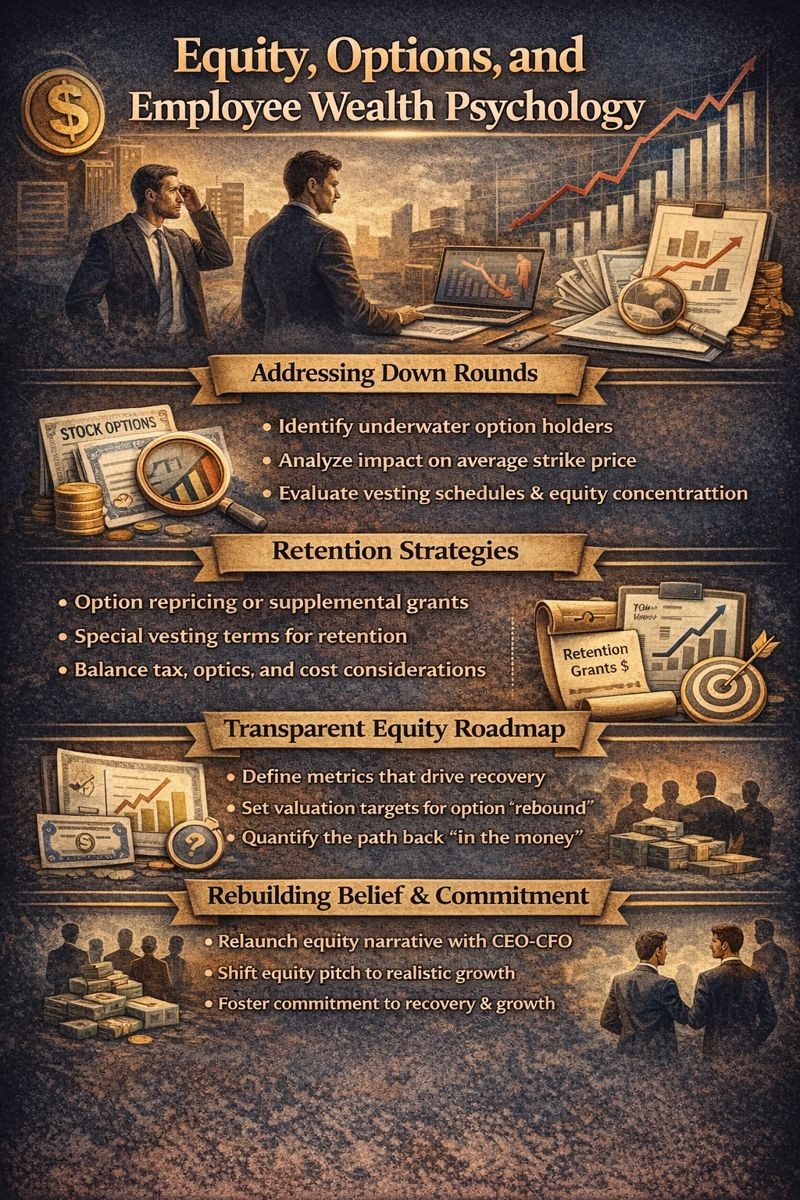

Equity, Options, and Employee Wealth Psychology

A down round does not just dilute. It disrupts belief. For employees, equity is not just a reward mechanism; it is a psychological contract. When valuations fall and options lose value, people do not simply see lower numbers. They question the deal they signed up for. They wonder if their contribution still has a path to meaningful return. CFOs must confront this reality with empathy and strategy. The objective is not to erase the impact but to reframe equity as part of a revised journey.

Start with analysis. How many option holders are now underwater? What is the average strike price versus new FMV? What is the vesting schedule of unexercised options? How concentrated is the equity among early joiners versus recent hires? These insights shape the refresh strategy. Repricing options is one tool, but not the only one. In some cases, CFOs may offer supplemental grants. In others, they may create retention grants with special vesting terms. Each method has trade-offs in tax treatment, optics, and cost.

Communication is central. Option holders need to understand not just the new strike prices but also the value path. What metrics will drive equity recovery? What valuation does the company need to reach for options to be back in the money? Providing a transparent equity roadmap fosters trust. Founders face a different, often deeper reckoning. Their personal wealth, public identity, and emotional commitment are all tied to company value. In a down round, founder equity may be diluted heavily, especially if participating preferred shares or aggressive investor terms come into play.

Here, the CFO plays a dual role: modeler and advisor. They must quantify the new wealth reality with brutal clarity, what ownership remains, what exit values yield meaningful return, and what dilution scenarios lie ahead. But they must also reframe wealth as trajectory, not moment. The CFO may also propose mechanisms to restore founder alignment. This might include performance-based equity, revised vesting, or secondary sale opportunities to reduce concentration risk.

A hidden casualty in down rounds is equity narrative. New hires may view the equity plan as compromised. To counteract this, the CFO and CEO must relaunch the story. They must show that new option grants are made at more realistic entry points with clearer paths to value creation. Equity becomes not just compensation but a commitment to the rebuild. The measure of a strong equity program post-down round is not the number of new grants. It is the number of employees who still believe that staying is better than leaving. And that belief is earned through design, communication, and consistent modeling.

Turning Crisis into Strategic Advantage

Few companies emerge stronger from a down round. But those that do often outperform over time. The CFO must lead this transformation. First is storytelling. The company must own its journey from exuberance to discipline, from hype to execution. Second is talent. A reset often shakes out misalignment but also attracts operators who thrive in focus. The CFO must support hiring for this new phase.

Third is investor quality. Down rounds often flush out weak capital. Those who stay or join now are more aligned. The CFO must deepen these relationships. Fourth is speed. Scarcity breeds agility. The company that emerges post-down round often ships faster, learns faster, and grows healthier. Finally, the CFO must reframe ambition. The mission has not changed. The vehicle has. And with discipline, the destination is closer than it appears.

Conclusion

Surviving a down round with reputation, culture, and optionality intact requires the CFO to orchestrate a multidimensional strategy that spans narrative control, culture management, negotiation precision, governance diplomacy, operational reengineering, tax planning, and equity psychology. The down round is not a verdict on company potential but a test of leadership resilience and strategic clarity. CFOs who frame the valuation reset as recalibration rather than retreat, who maintain radical transparency with employees while celebrating operational wins, who negotiate clean terms that preserve future optionality, and who manage board dynamics as strategic partnership rather than oversight theater position their companies not just to survive but to emerge stronger. The key is recognizing that perception drives value as much as metrics do, and the CFO’s ability to control narrative, model scenarios, and maintain stakeholder alignment determines whether the down round becomes a bridge to renewed growth or a trap of compounding constraints. Great companies are not defined by never facing adversity but by how they metabolize it, and the CFO who leads with clarity, empathy, and unwavering focus on the recovery arc transforms the down round from crisis into catalyst, proving that accountability, discipline, and mission alignment can compound faster than valuation multiples when the fundamentals are sound and the team remains committed to the journey.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.