Executive Summary

Boards rely on their members to bring insight, challenge, and foresight, yet too often new directors are expected to contribute meaningfully before they truly understand the business, culture, or context. This default to learning on the job carries steep costs: missed signals, misaligned priorities, and underutilized potential. High-impact boards reject this approach, designing onboarding not as orientation but as activation, embedding directors quickly into both content and culture, perspective and performance. Effective onboarding must be structured around four core dimensions: enterprise fluency through operational deep dives that instill the ability to ask nuanced questions, stakeholder mapping that builds trust and surfaces alignment between internal and external expectations, judgment calibration through structured mentorship and scenario rehearsal, and network integration that transforms solo initiation into shared acculturation. The most common failure is timing: too much too fast overwhelms, too little too late creates drift. Best-in-class boards anchor onboarding around a 90-day cadence structured into pre-meeting immersion, first-meeting engagement, and post-meeting integration. When onboarding is designed as governance capital, its return on investment compounds: the board gets smarter faster, strategy gets sharper, management gets better guidance, and the enterprise earns deeper trust from investors, regulators, employees, and communities.

Boards rely on their members to bring insight, challenge, and foresight, but too often new directors are expected to contribute meaningfully before they have truly understood the business, culture, or context. As a result, many boards default to learning on the job, with steep costs: missed signals, misaligned priorities, and underutilized potential. High-impact boards reject this default. They design onboarding not as orientation but as activation, embedding directors quickly into both content and culture, perspective and performance. Having served on boards and worked closely with governance structures across cybersecurity, SaaS, education nonprofits, and public companies while managing relationships with institutional investors and board reporting requirements, I have witnessed how intentional onboarding design separates high-functioning governance from ceremonial oversight. The difference lies not in the quality of directors recruited but in how systematically they are integrated into the organization’s strategic fabric.

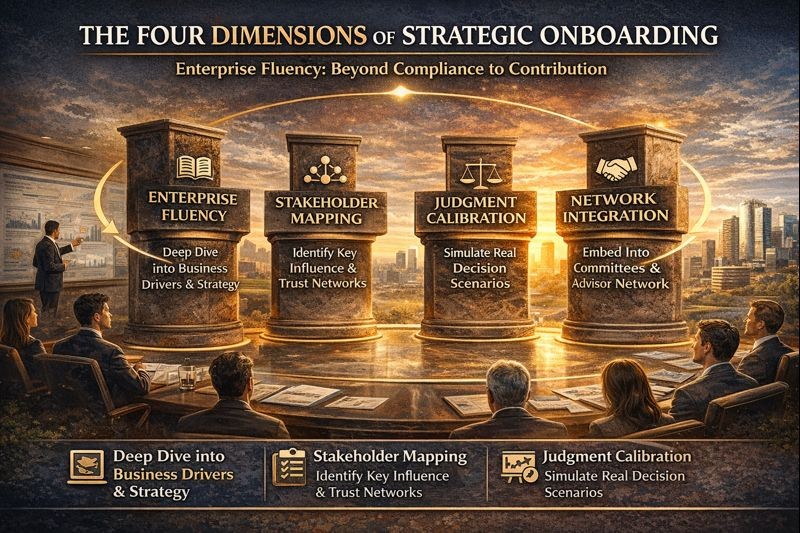

To shift from geographic introduction to genuine contribution, onboarding must be structured around four core dimensions: enterprise fluency, stakeholder mapping, judgment calibration, and network integration. Together, they form a coordinated program that accelerates performance while protecting governance rigor. The challenge for CFOs and governance leaders is to architect these dimensions with the same discipline applied to financial controls or operational processes, treating director onboarding as a strategic investment rather than an administrative formality.

The Four Dimensions of Strategic Onboarding

Enterprise Fluency: Beyond Compliance to Contribution

Enterprise fluency is the foundation. Directors must understand how the business makes money, where it plays, and how it wins. High-impact boards flip the typical sequence: operational deep dives precede formal briefings. New directors might spend a day with the CFO exploring profit and loss drivers, understanding revenue recognition complexities, margin dynamics, and cash flow patterns. They might spend a morning with operations touring a plant, observing manufacturing processes, quality controls, and supply chain integration points. They might spend an afternoon with R&D leaders understanding innovation rhythm, product development cycles, and technology roadmaps. These sessions include structured question and answer periods, scenario analysis examining what-if situations, and follow-up reading assignments that deepen comprehension. The goal is to instill the fluency necessary to ask nuanced questions that get to the heart of strategic and operational challenges.

When I led FP&A, controllership, and board reporting for organizations ranging from $9M to $180M in revenue, the most effective board members understood not just financial statements but operational drivers behind them. They could ask about utilization rates in professional services, understanding how billable hours translated to revenue and profit. They could probe customer acquisition costs in SaaS models, connecting marketing spend to customer lifetime value and churn dynamics. They could question inventory turnover in logistics operations, seeing the working capital implications and operational efficiency indicators. This depth came from investing time understanding the business model at a granular level, not just reviewing board packets. Beyond surface familiarity, enterprise fluency programs emphasize context: What are the three strategic priorities this year, and how do they connect to long-term value creation? Where are latent exposures in the business model, competitive position, or regulatory environment? How do financial controls support or inhibit execution speed and strategic flexibility? Who are internal disruptors challenging conventional approaches, and who are external threats reshaping the competitive landscape?

Stakeholder Mapping: Building Trust Through Structured Engagement

Boards operate at a nexus of relationships. New directors must understand who holds influence and why. Best practice provides a curated stakeholder map: interviews with the CEO, CFO, lead independent director, committee chairs, major institutional investors, and key external advisors. These sessions are structured as listening labs, where the newcomer hears what matters most, what concerns prevail, what stories guide decision-making. This mapping builds trust, informs strategy, primes questions, and surfaces alignment or dissonance between internal and external expectations.

Judgment Calibration: From Observation to Strategic Voice

Governance is judgment work, not compliance. High-impact boards fast-track judgment calibration through structured mentorship and scenario rehearsal. Each new director is paired with a seasoned peer who guides them through pre-meeting huddles, introduces models for strategic trade-offs, and debriefs early participation. In parallel, boards host scenario rehearsals where real or hypothetical strategic issues are run through the board model. The new director observes how disclosure unfolds, how dissent is introduced, how rigorous debate shapes decisions. When I managed $100M in acquisitions for a gaming enterprise, the board members who added most value were those calibrated early on risk tolerance, strategic priorities, and decision-making rhythms.

Network Integration: From Solo Initiation to System Embedding

A board is a system, not a lineup. Onboarding programs should coordinate introductions to committee peers, functional teams, and external advisors. There should be structural exposure to analytics teams, risk owners, and ESG specialists. These relationships are activated through formal pairing, joint briefings, and invitation to board dinners or offsite cohort groups. Boards should consider a second-mentee model, where the new board member shadows across committees and builds cross-chamber rapport early.

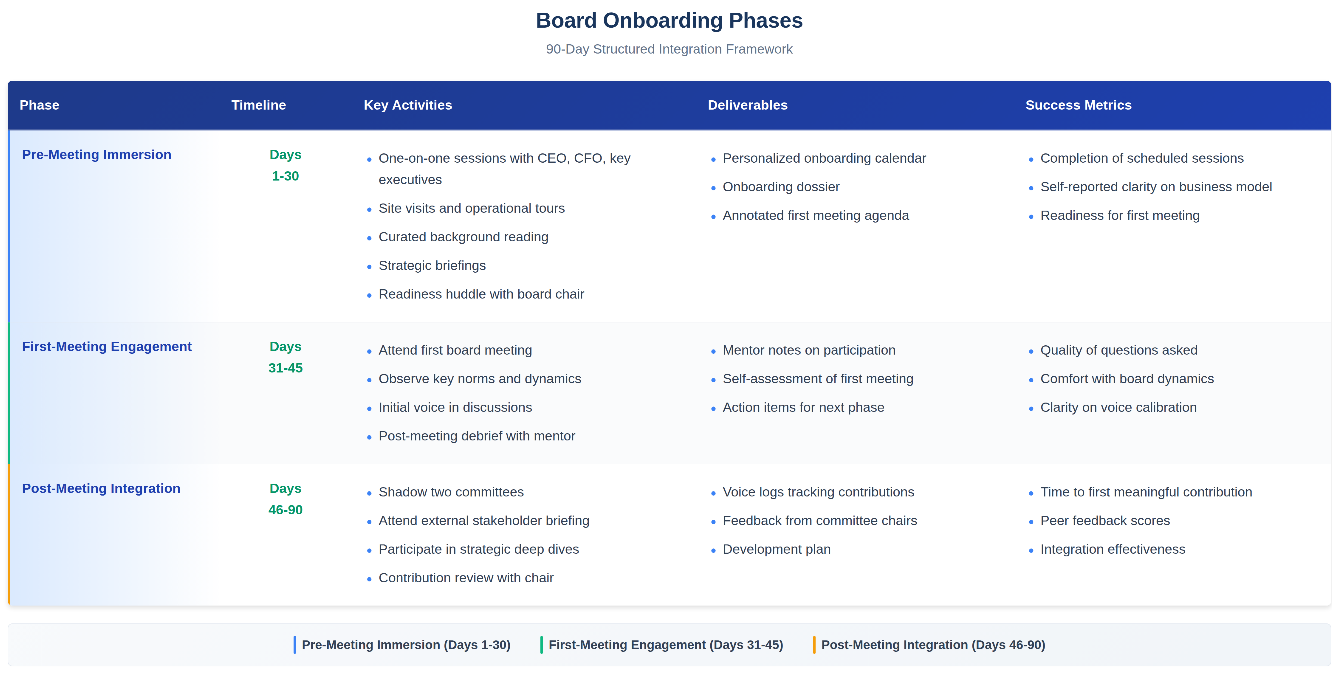

Operationalizing Excellence: The 90-Day Framework

Effective onboarding is not accidental. It must be engineered with precision, cadence, and accountability. The most common onboarding failure is timing. Too much too fast overwhelms. Too little too late creates drift. High-impact boards anchor onboarding around a 90-day cadence structured into three phases:

90-Day Onboarding Framework

Phase 1: Pre-Meeting Immersion (Days 1-30) includes a personalized calendar with one-on-one executive sessions, site visits, curated background reading including prior earnings calls and board memos, and strategic briefings. A detailed onboarding dossier is prepared with current initiatives, key board debates from the past twelve months, and stakeholder sentiment data. This stage culminates with a readiness huddle reviewing the forthcoming meeting agenda.

Phase 2: First-Meeting Engagement (Days 31-45) sets the tone. New directors receive annotated agendas, peer insights, and mentor briefings. They observe key norms: when to speak, how to frame dissent, what constitutes material insight. Post-meeting, the director debriefs with their mentor and committee chair, reviewing what went well and where their voice can sharpen.

Phase 3: Post-Meeting Integration (Days 46-90) accelerates engagement. The new director participates in two structured shadow sessions, attending one committee other than their own and one external stakeholder briefing. By day ninety, the cycle closes with a contribution review focused on feedback, development areas, and early wins.

Tools and Safeguards for Acceleration

Structure alone is insufficient. Several proven tools accelerate onboarding:

The Onboarding Dashboard is a confidential tracker maintained by the general counsel or board secretary. It includes scheduled sessions, briefing status, mentor notes, and a three-phase progress indicator: orientation, calibration, and activation. When I implemented enterprise KPI frameworks using business intelligence tools for tracking bookings and utilization, the same discipline applied: what gets measured gets managed.

The Director Briefing Book is a strategic digest including enterprise model explanation, committee mandates, organizational charts annotated with influence insights, and a timeline of past board actions. Voice Logs are thematic records of where new directors speak up, helping mentors provide calibration feedback.

Common Pitfalls and Design Safeguards

Best-in-class boards design safeguards against common pitfalls:

- Content Overload: Segment onboarding into thematic waves across ten weeks

- Cultural Ambiguity: Include a cultural lexicon explaining board norms and power dynamics

- Access Asymmetry: Ensure equal engagement across CEO, CFO, CHRO, and general counsel

- Unclear Feedback Channels: Include midpoint and endpoint feedback touchpoints

Embedding Onboarding in Board Performance

Onboarding must be integrated into the board’s performance cycle. Best-in-class boards include onboarding feedback loops in annual self-assessments: How effective was our onboarding in preparing new directors? Did new directors integrate at pace? What gaps were revealed? These responses inform future onboarding design and reinforce that onboarding is part of board performance.

Leading boards conduct onboarding retrospectives. After twelve months, the new director participates in a structured debrief with the chair and lead independent director discussing what enabled performance, what inhibited contribution, and what cultural signals stood out.

Measurement matters. Boards track outcomes including:

- Time to first meaningful contribution

- Self-reported clarity scores on board expectations and enterprise strategy

- Peer feedback on integration and effectiveness

- Quality and frequency of questions in first six months

- Committee contribution ratings

These metrics improve the process. High-performing boards use data to refine cadence, select better mentors, and rebalance content, reducing the lag between director appointment and enterprise impact.

Cultural Reinforcement and Strategic Renewal

Onboarding shapes culture. It signals what the board values, how it learns, and what it expects. Boards that view onboarding as a leadership differentiator ensure culture is made visible early. This means explaining not just rules but norms: what previous chairs prized, how past crises were navigated, where fault lines exist. Culture is not left to inference. It is taught.

Some boards use onboarding to reset culture. When a board is in transition, new director onboarding establishes new norms. Chairs convene onboarding summits where new and current directors co-create cultural covenants: how we debate, how we speak truth, how we support management. Boards also use onboarding to model renewal. A new director’s voice is not peripheral; it is a signal of learning.

This modeling matters. Investors, regulators, and stakeholders watch whether boards refresh with substance or symbolism. If a new director contributes materially in the first ninety days, stakeholders see that governance is alive, not ceremonial. In managing global finance architecture and board reporting across multi-entity structures, the governance bodies that commanded greatest investor confidence were those where new members demonstrated rapid fluency and substantive contribution.

Conclusion

High-impact boards know that governance is built in moments: appointments, decisions, transitions. Onboarding is where those moments coalesce. It is where new directors become contributors, where experience meets expectation, where board renewal becomes real. When onboarding is designed as governance capital, its return on investment compounds. The board gets smarter faster. Strategy gets sharper. Management gets better guidance. And the enterprise earns deeper trust from investors, regulators, employees, and communities. No more learning on the job. It is time to start governing on day one.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.