Executive Summary

For many founders, the equity stake is sacred, symbolizing control, ambition, and identity. Yet as companies scale, ownership fragments and founders who once owned ninety percent may find themselves below twenty. CFOs positioned at the nexus of capital and governance must engage founders with a sharper truth: control is not merely a function of equity but a currency deployed strategically across negotiation, communication, and organizational design. This requires distinguishing between economic rights and control rights, which often diverge. A founder can own fifteen percent and still wield decisive control through dual-class shares or board composition. The CFO must model dilution scenarios robustly, showing not just percentages but control outcomes including board voting and liquidation preferences. This analytical rigor must be coupled with psychological insight, framing dilution not as erosion but as strategic reinvestment. When understood as currency, control can be traded or diluted if the exchange yields strategic return, and the CFO’s job is helping founders manage that currency with intention rather than instinct.

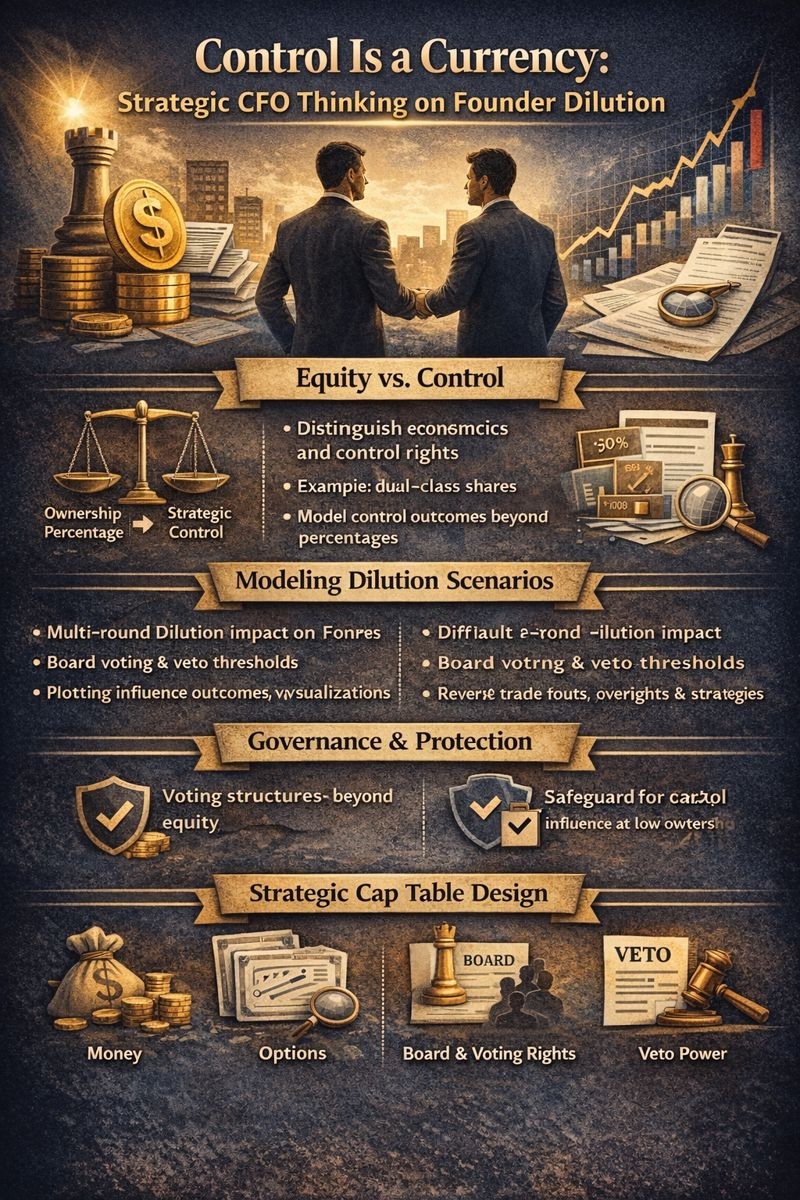

The Strategic Imperative: Reframing Founder Control

For many founders, the equity stake is sacred, symbolizing control, ambition, and identity. Yet as companies scale, founders who once owned ninety percent may find themselves below twenty. What remains is an illusion that control remains intact simply because a title does. Having managed cap table dynamics while raising over $120M in growth capital, I have witnessed how successful founders distinguish between ownership percentage and strategic control, understanding that influence derives not from shareholding alone but from intentional governance architecture.

CFOs must engage founders with a critical truth: control is not merely equity. It is a currency deployed strategically through negotiation and organizational design. CFOs must distinguish between economic rights and control rights, which often diverge significantly. A founder can own fifteen percent and still wield decisive control through:

- Dual-class share structures that provide super-voting rights

- Board composition that maintains founder-aligned directors

- Protective provisions requiring founder consent on major decisions

- Veto rights over strategic actions like M&A or financing

Conversely, majority ownership with a passive board may leave them cornered when hard decisions emerge around strategy, capital allocation, or exit timing.

Modeling Dilution with Strategic Clarity

Too many founders underplay dilution scenarios in early rounds. A CFO must introduce robust modeling showing not just ownership percentages but control outcomes including board voting thresholds, veto rights, and liquidation preferences. When I secured $36.5M while driving scale from $9M to $180M revenue, the critical discipline was modeling cumulative impact across three to five funding cycles, showing how each decision cascaded through future governance structures.

This analytical rigor must be coupled with psychological insight. For many founders, their equity is the scorecard of identity. When CFOs engage on dilution, they must not reduce the conversation to arithmetic. They must frame dilution as strategic reinvestment where every new shareholder becomes a partner bringing capital, expertise, or relationships. Control, when understood as currency, can be strategically traded or thoughtfully diluted if the exchange yields commensurate strategic return through access to markets, talent, or capabilities the founder cannot build alone.

Designing the Cap Table with Strategic Intent

The cap table is the architectural blueprint of governance. Strategic design starts with clarity on stakeholder roles. Who brings capital? Network? Sweat? Each should be priced differently. This clarity extends to board construction. The CFO must build a governance model: how will the board evolve post-Series B? What committee powers will be ceded? Timing matters. The CFO must manage not just who enters the cap table but when. Option pool refreshes must be strategically aligned to incentivize retention. The CFO should model down rounds, liquidity scenarios, and acquisition terms as decision-prep tools.

Dilution Timing and Tradeoffs

Not all dilution is equal. Timing shapes its cost. CFOs must guide founders in when and why to dilute. The core principle is momentum pricing. Capital should be raised at the peak of narrative credibility, when revenue growth, product traction, and investor sentiment converge. This means preparing well in advance. Strategic tradeoffs arise in raise sizing. CFOs must model dilution curves across cycles. Sometimes larger dilution now prevents multiple smaller dilutions later. Founders must be coached through secondary sales. Selling five percent now may allow the founder to play longer. CFOs must help quantify founder stress versus control retention. Finally, CFOs must help founders hold the line. CFOs must prepare founders with term sheet scenario trees showing what agreeing to clauses means at Series D or acquisition.

Protecting Control through Governance

Equity is visible. Control is embedded. CFOs help founders build protection beyond share percentages through voting structures, information rights, and consent thresholds. Dual-class shares grant founders strategic resilience. Board mechanics matter. A founder may have twenty-five percent equity but maintain control through board alliances. CFOs must build these by recruiting independent directors early. Information rights must preserve founder flexibility while satisfying LP requirements. Staged equity grants allow dilution only upon performance. Protective provisions such as veto rights can preserve influence but must be used sparingly. Ultimately, the best protection is performance. A founder who meets milestones earns de facto control even if equity falls.

Conclusion

Control is a currency that can be diluted, traded, and regained, but it must be managed with strategic clarity and personal conviction. The CFO who helps the founder navigate this journey becomes more than an operator; they become an architect of enduring influence. This requires moving beyond simple ownership percentages to understand the multidimensional nature of control through governance structures, board composition, protective provisions, and strategic timing of capital raises. By modeling dilution scenarios that show control outcomes rather than just equity percentages, framing dilution as strategic reinvestment rather than erosion, designing cap tables with stakeholder clarity and long-term governance intent, and coaching founders through the psychological journey of role evolution, the strategic CFO transforms founder dilution from a feared inevitability into a managed currency that, when deployed with intention, can amplify rather than diminish the founder’s ability to shape the company’s arc and realize their original vision.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.