Executive Summary

High growth is intoxicating. It creates a sense of inevitability where momentum becomes proof of model and acceleration a proxy for success. For boards of directors, especially in high-growth companies, the quarterly cadence often becomes a performance review conducted through a narrow window: revenue growth, customer acquisition, and cash runway. But these indicators, while attention-grabbing, rarely tell the whole story. They are the tip of the iceberg. The real indicators of health, scalability, and long-term value lie beneath the surface. What boards must evolve toward is not just observing velocity but understanding direction, quality, and sustainability. Revenue without retention is a treadmill. Growth can hide poor efficiency, and inefficiency compounds as you scale. The most effective boards act as strategic sensors, surfacing tensions between short-term wins and long-term value. They focus not only on the pace of the journey but on the reliability of the vehicle, insisting on metrics that matter because they tell the real story.

Beyond the Vanity Metrics

Revenue is often the first and last metric discussed in high-growth boardrooms. Yet revenue, in isolation, is dangerously incomplete. Without a clear picture of its origin, cost, and durability, it can mislead rather than illuminate.

Throughout twenty-five years leading finance organizations across cybersecurity, SaaS, digital marketing, gaming, and logistics, I have witnessed vanity metrics mask underlying inefficiencies and encourage bad decisions: hiring too fast, expanding too early, or entering new markets without operational muscle to sustain them.

At one professional services organization where I built enterprise KPI frameworks using business intelligence tools, we tracked bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention. The shift from vanity metrics to meaningful indicators transformed board conversations from applause to inquiry.

The Board Metrics Framework

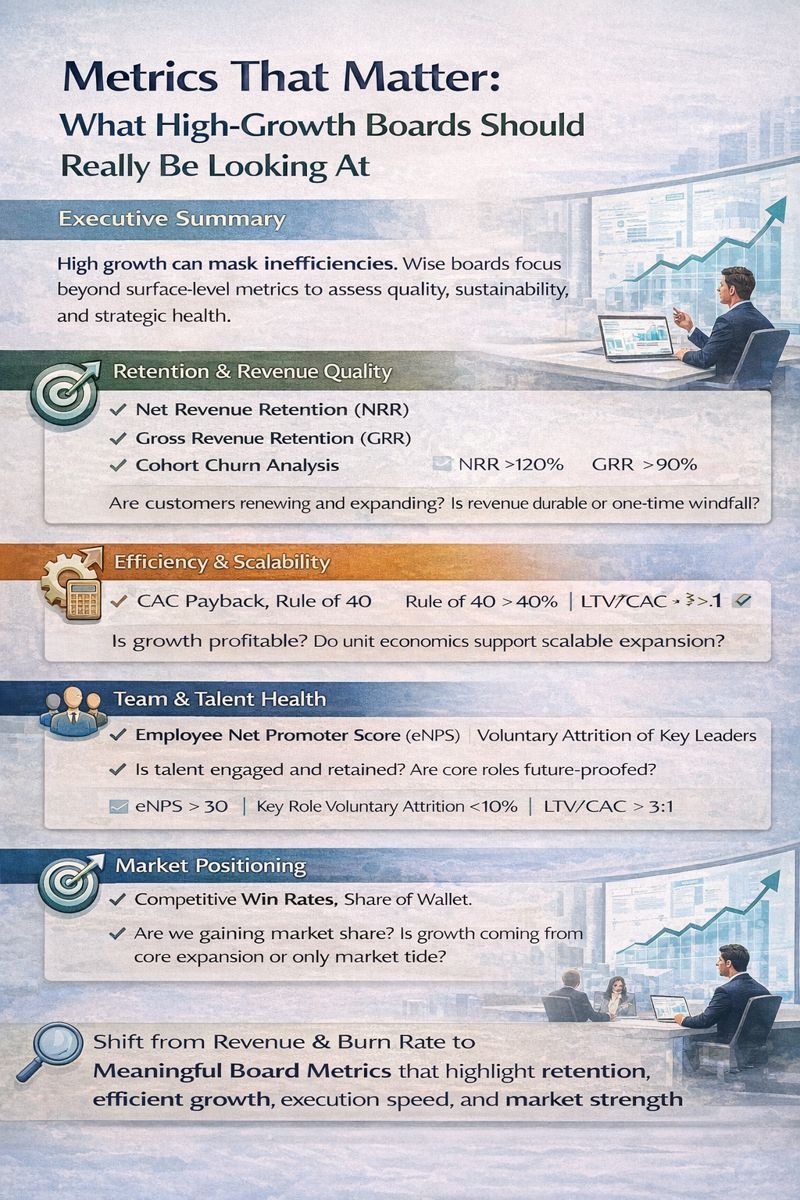

A meaningful metric for high-growth companies possesses three attributes:

- It reflects underlying business health, not just surface-level activity

- It predicts future outcomes rather than merely reporting past performance

- It is actionable, leading to insights that inform strategic or operational shifts

The following framework outlines critical metrics across five dimensions that should form the backbone of every high-growth board review:

| Metric Category | Key Indicators | Why It Matters | Target Benchmark | Warning Signals |

| Retention & Revenue Quality | Net Revenue Retention (NRR), Gross Revenue Retention (GRR), Churn by Cohort | Reveals product-market fit and pricing power; high NRR enables growth without new acquisition | NRR >120%, GRR >90% | NRR declining quarter-over-quarter, widening gap between NRR and GRR |

| Efficiency & Scalability | CAC Payback Period, LTV/CAC Ratio, Rule of 40, Gross Margin Trends | Measures how well business converts inputs into durable outputs; indicates capital efficiency | CAC payback <12 months, LTV/CAC >3:1, Rule of 40 >40% | Extending payback periods, declining gross margins, Rule of 40 trending down |

| Team & Talent Health | Employee Net Promoter Score (eNPS), Voluntary Attrition in Key Roles, Span of Control | People scale companies; cultural drift and leadership gaps appear before financial deterioration | eNPS >30, key role attrition <10% annually | Declining eNPS, clustering of departures, expanding management layers |

| Execution Velocity | Roadmap Delivery Rate, Sales Cycle Length, OKR Achievement Rate | Reveals whether company does the right things effectively; indicates system scalability | >80% roadmap delivery, stable/declining sales cycle, >75% OKR achievement | Consistent slippage, lengthening sales cycles, <60% goal achievement |

| Market Positioning | Share of Wallet, Competitive Win Rate, Market Expansion Efficiency | Growth is relative to market, competition, and timing; differentiates rising tide from real wins | Increasing wallet share, >50% win rate in competitive deals | Declining win rates despite market growth, poor expansion ROI |

Retention and Revenue Quality

Growth without retention is a treadmill. At one SaaS organization operating across US and EU entities, customer cohort analysis revealed that recently acquired customers were churning at three times the historical rate. The issue was not pricing or service but sales targeting. Corrective shifts in lead qualification did more to restore profitability than any top-line growth initiative.

Net Revenue Retention represents perhaps the single most important metric for recurring revenue businesses. A company with one hundred thirty percent NRR can grow without acquiring a single new customer. It speaks to product depth and pricing power. Gross Revenue Retention reveals churn unclouded by upsell. Revenue should be judged not just by size but by shape: recurring, diversified, high-margin revenue deserves more weight than transactional or concentrated revenue.

Efficiency and Scalability

High growth can hide poor efficiency, but inefficiency compounds as you scale. At a logistics organization managing one hundred twenty million in revenue, we reduced logistics cost per unit by twenty-two percent through ruthless focus on efficiency metrics: freight optimization, warehouse management, and last-mile logistics performance.

CAC Payback Period shows how long it takes to recoup customer acquisition cost. Short payback periods mean growth is self-financing. At one digital marketing organization that scaled from nine million to one hundred eighty million in revenue, disciplined CAC payback enabled us to secure thirty-six million in growth capital on favorable terms. The Rule of 40 for SaaS provides combined growth rate and profit margin that should exceed forty percent. Gross margin trends reveal the engine room of business. A growing business with deteriorating margins may be scaling an unprofitable model.

Team and Talent Health

People scale companies, not slides or spreadsheets. Yet people metrics are often treated as HR concerns, not board-level issues. At one education nonprofit where I secured forty million in Series B funding, employee engagement metrics proved as predictive of organizational health as financial indicators. A declining Employee Net Promoter Score often precedes attrition and disengagement. Voluntary attrition in key roles represents a red flag suggesting internal friction. When the talent flywheel is broken, no amount of top-line growth can compensate.

Execution Velocity and Focus

Boards should focus less on pace and more on precision: Is the company doing the right things effectively? At a gaming enterprise where I led global financial planning and controllership, roadmap delivery rate became a critical indicator of technical debt and organizational capacity. Sales cycle length provides insight into market saturation or value proposition strength. OKR achievement rate reveals whether the company aligns intent with execution. A company that consistently misses internal deadlines is sending a message: we are outgrowing our systems.

Market Context and Competitive Positioning

Every metric must be interpreted in context. Growth is relative to market conditions, competitive moves, and timing. Share of Wallet reveals whether you are expanding within existing customers. Competitive Win Rate shows how often your company wins in head-to-head deals. A declining win rate, even in a growing market, suggests eroding differentiation. Market Expansion Efficiency examines whether new geographies generate return proportionate to cost. Boards should ask: Are we winning, or simply floating in a rising tide?

Conclusion

Boards are not operators but stewards of strategic integrity. The metrics they emphasize signal what matters. When boards obsess over revenue and neglect retention, they create pressure to grow at any cost. When they prioritize top-line goals over margin, they endorse fragility. The most effective boards act as strategic sensors, surfacing tensions between short-term wins and long-term value. They insist on metrics that matter not because they are trendy but because they tell the real story. In an era where capital is less patient, this kind of board engagement is not a luxury but a requirement for enduring success.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.