Executive Summary

Turnarounds are seldom born in the boardroom and almost never in the PowerPoint slides of strategy consultants. They begin, quietly and unglamorously, on the balance sheet. Here lies the unvarnished truth of a company’s past decisions, both wise and wasteful, entombed in line items that few genuinely interrogate. In prosperous times, the income statement is king, seducing management with the siren song of growth, margin expansion, and scale economies. But when the tide turns, it is the balance sheet that determines survival. Like a seasoned diagnostician, it does not flatter. It simply records what is: assets marked at historical costs now bearing questionable future utility, liabilities that quietly compound, and equity that has become an exercise in creative optimism. The most dangerous turnarounds are not those where the income statement bleeds but where the P&L still whispers promise, even as the balance sheet groans under the weight of accumulating risk. Corporate resurrections do not begin with vision but with clarity. And clarity, like honesty, is often uncomfortable but also liberating.

The Balance Sheet as Diagnostic Instrument

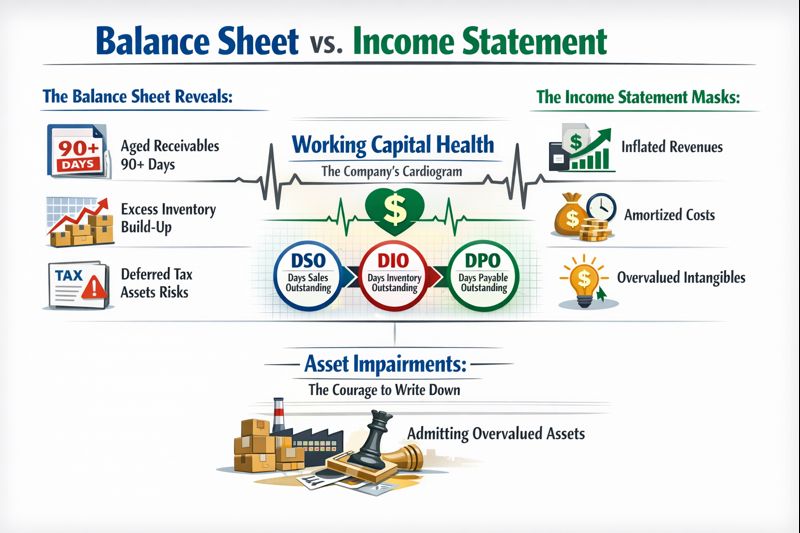

The Mirage of the Income Statement

Accounting is the language of business, but like any language, it has dialects. The income statement speaks optimistically, forward-facing and often flattering. Revenues recognize growth before cash is collected. Costs are amortized to soften impact. Intangible assets are rarely marked down unless catastrophe strikes. In a growth regime, this is tolerated. But in a turnaround, the P&L is not so much a guide as a distraction.

Throughout twenty-five years leading finance organizations across cybersecurity, SaaS, digital marketing, gaming, logistics, and manufacturing, I have witnessed executives in distress cling to the income statement like survivors to driftwood, citing adjusted EBITDA as proof of vitality. But it is on the balance sheet where reality asserts itself: accounts receivable aged beyond ninety days, inventory swelling faster than sales, and deferred tax assets that may never be realized.

At one logistics and wholesale organization managing one hundred twenty million in revenue, forensic examination of the balance sheet revealed inventories had grown thirty-five percent year-on-year while sales had risen only five percent. Worse, nearly sixty percent of this increase was in older SKUs with declining relevance. The overhang tied up capital, strained cash flow, and triggered additional warehousing costs. Meanwhile, receivables spiked, especially from a few large customers who were themselves entering financial stress. This was not yet a turnaround but a flashing red warning light demanding immediate action.

Working Capital: The Company’s Cardiogram

The surest pulse of operational health lies in working capital. It is not a strategy but a signal, a real-time indicator of either alignment or dysfunction. When receivables grow faster than sales, it may signal desperate discounting or deteriorating customer quality. When inventory rises while turnover slows, it speaks to demand misalignment, procurement inertia, or supply chain bloat.

At organizations where I led treasury operations, working capital management, and board reporting, implementing robust analytics around days sales outstanding, days inventory outstanding, and cash conversion cycles proved essential for early warning signals. At one professional services organization, we reduced month-end close from seventeen days to under six days while increasing accuracy by twenty-eight percent through automated reconciliation systems that highlighted working capital anomalies in real time.

Asset Impairments: The Courage to Write Down

The true test of executive maturity is not in the quarterly earnings call but in the courage to admit missteps. Writing down asset values is often viewed as an admission of failure. In fact, it is a mark of stewardship. Whether it be plant and equipment now underutilized or goodwill from an overpriced acquisition, these items clog the balance sheet and obscure capital allocation clarity.

At a gaming enterprise where I led global controllership and oversaw one hundred million in acquisitions, post-merger integration demanded rigorous asset evaluation frameworks. Impairment charges reset expectations internally and externally, telling the market that management is no longer in denial. They liberate capital from illusion, allowing for more productive reinvestment or redeployment. For every dollar of overvalued asset, there is a shadow distortion in ROA, ROE, and even capital budgeting decisions.

Balance Sheet Diagnostic Framework

The following framework provides a systematic approach to balance sheet analysis in turnaround situations:

| Analysis Area | Key Metrics | Warning Signals | Immediate Actions |

| Liquidity Position | Current ratio, quick ratio, cash to current liabilities | Ratio below 1.0, declining trend over 3 quarters, restricted cash increasing | Build 13-week cash forecast, negotiate extended vendor terms, accelerate collections |

| Working Capital Health | DSO, DIO, cash conversion cycle, working capital as % of revenue | DSO increasing 20%+ YoY, inventory turns declining, negative cash conversion | Implement aggressive collections, rationalize slow-moving inventory, renegotiate payment terms |

| Asset Quality | Goodwill as % of assets, PP&E utilization rates, asset turnover | Goodwill exceeds 30% of assets, declining utilization, impairment indicators | Conduct impairment analysis, evaluate non-core asset sales, reassess acquisition strategy |

| Debt Sustainability | Debt/EBITDA, interest coverage, maturity profile, covenant headroom | Leverage above 4x, coverage below 2x, near-term maturities, covenant proximity | Engage lenders proactively, model debt-for-equity scenarios, explore refinancing options |

| Equity Erosion | Book value trends, retained earnings, shareholder equity ratio | Negative retained earnings, declining book value, equity below 20% of assets | Consider capital raise, explore strategic alternatives, communicate transparently with board |

Liquidity as Survival Mechanism

Cash Flow is Not a Lagging Indicator

Companies do not die of losses. They die of illiquidity. At one education nonprofit where I secured forty million in Series B funding and eight million in credit facilities, maintaining liquidity visibility proved essential. The thirteen-week cash flow forecast became indispensable, focusing on near-term obligations: who is due when, what cash is coming in, and which levers can be pulled within days. It is cash budgeting in its purest form: zero-based, assumption-light, and painfully honest.

In a turnaround, the aim is no longer profitability over time but survival over weeks. Cash burn often accelerates before revenues fall. Customers delay payments. Vendors tighten terms. Credit lines become harder to draw. The first instinct of any CFO in distress should be to abandon the income statement and turn to the cash flow statement.

The Doctrine of Liquidity Triage

In liquidity crises, obligations are triaged not by legal ranking alone but by strategic criticality:

- Essential operations: Payroll, critical suppliers, utilities

- Customer-facing commitments: Fulfillment obligations, service delivery

- Secured creditors: Asset-backed lenders, equipment lessors

- Unsecured creditors: General vendors, professional services

- Discretionary spend: Marketing, travel, non-essential projects

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we implemented rigorous cash management protocols during a growth capital raise. Every dollar was deployed like a scarce resource. Travel budgets were slashed not for optics but for necessity. Headcount rationalization was not ideological but mathematical.

Zero-Based Budgeting as Fiscal Doctrine

Zero-based budgeting re-emerges in turnarounds not as a theoretical exercise but as a fiscal doctrine. It demands that every cost be justified not by history but by current need. Legacy line items including subscription services, deferred compensation plans, and innovation labs are reexamined with severity.

At organizations where I implemented comprehensive KPI frameworks linking resource allocation to performance metrics including ARR, customer retention, and margin health, zero-based approaches forced uncomfortable questions: Why does a company of shrinking revenues maintain three redundant CRM platforms? Why is marketing spend still indexed to last year’s topline when consumer behavior has shifted entirely?

Stakeholder Communication: Transparency Buys Time

Liquidity crises are not just financial but social. Vendors, landlords, lenders, and employees form a web of implicit contracts built on trust. Companies that manage cash effectively in turnarounds communicate more, not less. Vendors are told the truth, often resulting in extended terms. Employees are brought into confidence, creating room for temporary sacrifice. Creditors are informed early, allowing renegotiation before default.

Trust becomes a form of working capital. And transparency, paradoxically, becomes a currency.

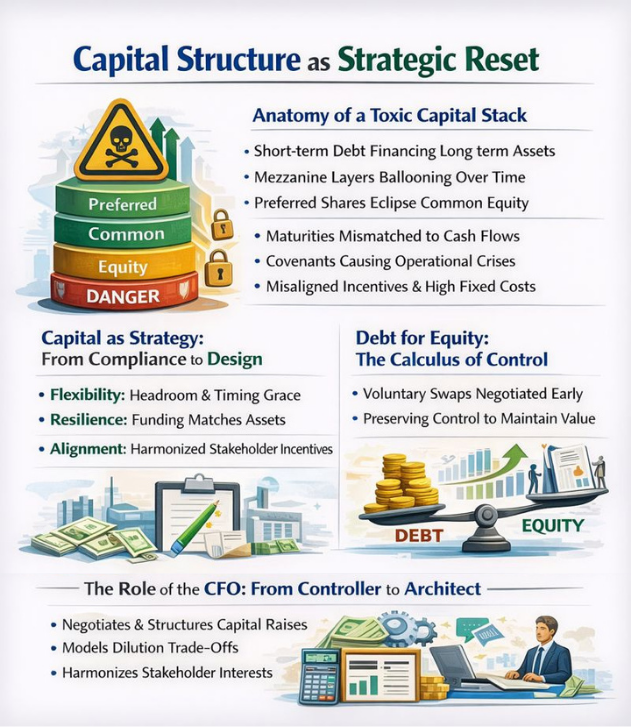

Capital Structure as Strategic Reset

Anatomy of a Toxic Capital Stack

A failing company rarely stumbles for lack of ambition. More often, it is choked by a capital stack layered in haste and optimism: short-term debt financing long-term assets, mezzanine layers that balloon over time, and preferred shares with rights that eclipse common equity.

A toxic stack is not just about high leverage but about misaligned leverage:

- Maturities mismatched to cash flows

- Covenants that turn operational hiccups into crises

- Shareholder classes with divergent incentives

- Fixed debt service that compresses operational flexibility

These distortions affect decision-making. CFOs juggle quarterly survival while CEOs cannot commit to multiyear bets. The organization internalizes this constraint. Innovation is stifled not by lack of ideas but by lack of financial oxygen.

Capital as Strategy: From Compliance to Design

Reconstructing a company’s capital structure is not financial engineering but strategic reset. The goals are clear:

- Flexibility: Debt structures that permit covenant headroom and timing grace

- Resilience: Funding matched to asset life and cash flow generation

- Alignment: Instruments that harmonize the incentives of stakeholders

At a manufacturing organization where I managed compliance audits and established GAAP-compliant financial reporting, rewriting the capital stack required design mindset: what funding mix best supports the reimagined business model? Should equity be diluted now to preserve solvency, or should management pursue hybrid instruments to defer valuation reset?

Debt for Equity: The Calculus of Control

One of the hardest truths in turnaround finance is that control and dilution are trade-offs, not enemies. When debt overwhelms operating cash flow, conversion into equity often becomes inevitable. The reluctance is cultural. Founders and management see dilution as defeat. But in financial terms, not diluting can be far more damaging.

The key is timing and transparency. Voluntary debt-for-equity swaps negotiated early and from a position of openness tend to retain more enterprise value than court-imposed cramdowns. They also avoid reputational damage and preserve the ability to raise fresh capital from new investors.

The Role of the CFO: From Controller to Architect

In this phase of the turnaround, the CFO’s role expands dramatically. No longer just managing liquidity or reporting metrics, the finance leader becomes the architect of corporate destiny. He or she negotiates with lenders, structures capital raises, models dilution trade-offs, and interprets the capital stack as a design challenge.

At organizations where I led FP&A, forecasting, and board reporting across cybersecurity, SaaS, and professional services sectors, the CFO must speak in two languages: one to the markets, signaling discipline and intent; the other internally, communicating trade-offs and educating peers. This is where financial stewardship meets strategic vision.

The Operating Model Reborn

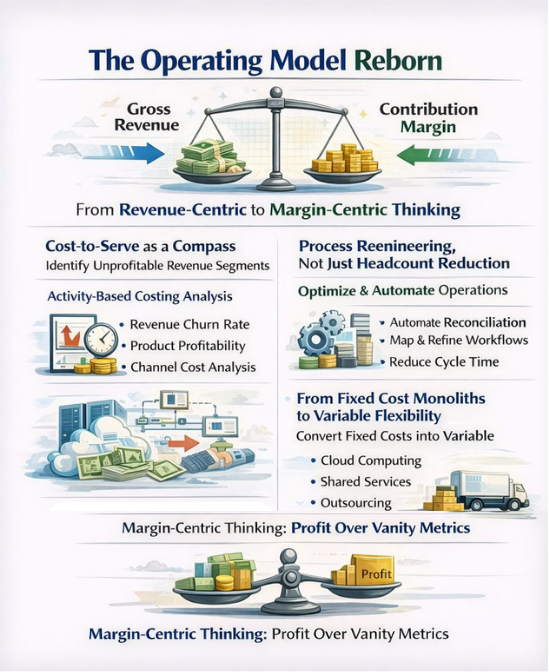

From Revenue-Centric to Margin-Centric Thinking

A common pathology in pre-distressed firms is revenue obsession. Sales become sacrosanct. Costs are tolerated as investments, and margin erosion is excused as a temporary condition of scale. But revenue is not value. Profit is. And in turnaround conditions, gross revenue becomes a vanity metric.

The model must pivot to contribution margin, the true unit economics that determine if each additional sale creates or destroys cash. At one SaaS organization operating across US and EU entities, we rebuilt GAAP and IFRS financials with obsessive focus on unit-level profitability. Customer cohort analysis revealed that recently acquired customers were churning at three times the historical rate. The issue was not pricing or service but sales targeting and qualification criteria.

Cost-to-Serve as a Compass

Modern cost structures are rarely monolithic. They are layered, interdependent, and often opaque. In turnarounds, clarity comes not from blanket cuts but from forensic cost allocation. By mapping cost to activity, firms discover uncomfortable truths:

- Forty percent of revenue may come from accounts that destroy value

- Legacy products may carry negative margins once overhead is applied

- A single sales channel may require three times support cost relative to others

In such findings lie the blueprint for rationalization. The goal is not mere cost-cutting but cost reshaping: exiting unprofitable segments, redesigning products, automating touchpoints, and tightening the customer footprint.

Process Reengineering, Not Just Headcount Reduction

Personnel cuts often feature prominently in turnaround headlines. But while layoffs create immediate savings, they rarely fix systemic inefficiencies. True operating leverage lies in process reengineering. This requires asking first-principles questions: Can cycle time be halved through automation? Are multiple systems reconciling the same data? Does procurement have visibility into true landed cost?

At organizations where I implemented NetSuite and OpenAir PSA, automated revenue recognition and project accounting, the profit came not from attrition but from alignment. Process improvements increased accuracy while reducing manual effort, freeing finance teams to focus on strategic analysis rather than data preparation.

From Fixed Cost Monoliths to Variable Flexibility

Many companies, especially those built in the pre-cloud era, carry high fixed cost DNA. Real estate, captive IT infrastructure, full-time staffing are costs that scale up but rarely down. The turnaround imperative is to modularize the cost base. This does not mean outsourcing everything but designing the model so that cost moves with demand.

Cloud computing, shared services, contract manufacturing, third-party logistics all offer variable substitutes to fixed functions. The aim is not to erode quality but to preserve financial responsiveness. A firm that turns thirty percent of its cost base variable is no longer just lean but agile.

Aligning Incentives to the New Model

A rebuilt operating model must be matched by a rebuilt incentive structure. Employees who once chased growth at any cost must now be rewarded for discipline, margin, and repeatability. This may involve:

- Linking bonuses to contribution margin, not revenue

- Tying variable compensation to operational KPIs including churn, NPS, and gross margin

- Structuring equity grants around milestone EBITDA, not just valuation

At organizations where I drove company scale from nine million to one hundred eighty million in revenue while securing thirty-six million in growth capital, culture reset required aligning compensation structures with strategic priorities. In turnarounds, culture is not reset by memos but reshaped by what is rewarded. One logistics company replaced volume-driven sales bonuses with profit-per-shipment targets. Initially resisted, the program led to route rationalization, customer repricing, and twelve percent EBIT improvement in six months.

Conclusion

The final truth of a turnaround is this: profitability is not a reward but a product of architecture. It reflects not the brilliance of a new strategy or the luck of a market cycle but the cumulative impact of thousands of aligned decisions on cost, price, customer, process, and incentive. A firm reborn from crisis does not merely resume where it left off. It becomes something new: more conscious, more deliberate, and more grounded in unit economics. The balance sheet offers reckoning. It does not predict the future, but it demands the truth about the past. And in turnaround situations, this is not merely accounting housekeeping but existential necessity. Once a company accepts what it is, it can finally begin the journey to what it might become. Because in the end, a company does not turn around by growing back but by growing better.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.