Executive Summary

Dual-class share structures offer the seductive promise of founder control without the friction of shareholder interference. Designed ostensibly to protect visionary leadership from short-term market pressures, these structures are increasingly common in tech and growth-stage enterprises. Yet beneath their appeal lies a deeper governance paradox: the illusion that control equates to alignment. When founders retain disproportionate voting rights, standard checks and balances begin to erode. Independent board oversight becomes advisory rather than determinative. Investor engagement morphs into compliance rather than collaboration. The first casualty of this asymmetry is accountability. Without governance rigor that is self-imposed through independent audits, open communication, and real accountability frameworks, dual-class structures risk becoming licenses for entrenchment. For CFOs navigating these dynamics, the challenge is not to abolish dual-class shares but to architect structures where their benefits are earned through discipline, not assumed through entitlement.

The Structural Implications of Voting Asymmetry

Dual-class shares assign disproportionate voting rights to one class of shareholders, often founders or key executives, while relegating public or minority shareholders to economic participation with minimal influence. The logic is straightforward: insulate the core mission from transient sentiment. But the downstream consequences ripple far beyond proxy votes.

For CFOs and boards, the implications are structural. When founders retain ten-to-one or twenty-to-one voting rights, standard checks and balances erode. In conventional structures, poor performance invites scrutiny and strategic pivots. In dual-class environments, these levers weaken. CFOs may struggle to align capital allocation with fiduciary responsibility when strategic direction is insulated from feedback.

Throughout twenty-five years leading finance organizations across cybersecurity, SaaS, digital marketing, gaming, and nonprofit sectors, I have navigated the balance between supporting bold leadership and maintaining fiscal discipline. At one education nonprofit, securing forty million in Series B funding required demonstrating not just vision but governance credibility. Investors demanded transparency into decision-making processes, milestone accountability, and clear escalation protocols.

Founder-led firms with dual-class shares thrive when governance rigor is self-imposed. Without these safeguards, dual-class becomes a license for entrenchment. Investors increasingly price in governance discount. Index providers and ESG frameworks routinely flag or exclude companies with disproportionate voting rights, affecting capital access and reputational strength.

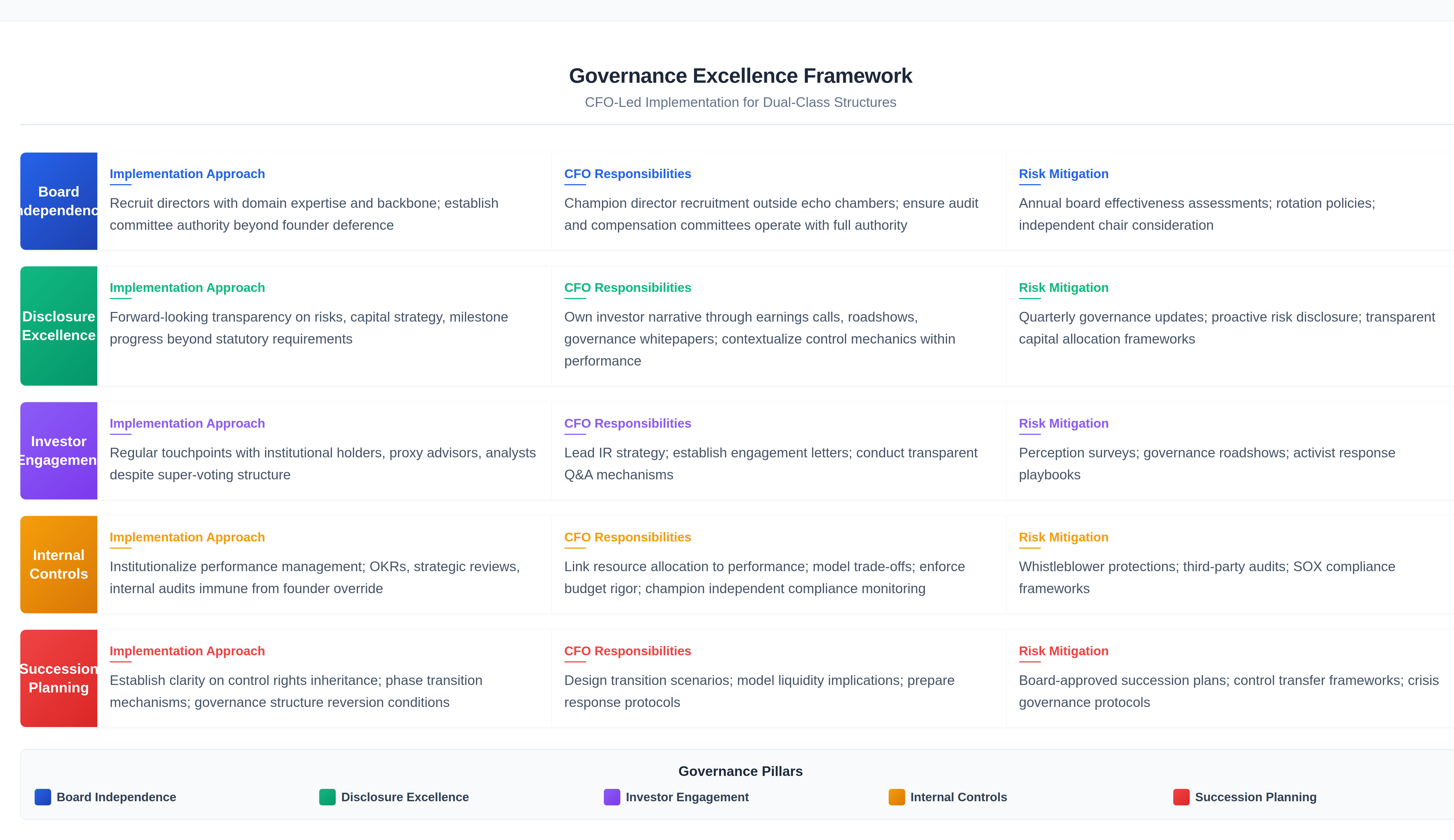

Governance Framework for Dual-Class Companies

If dual-class structures are to function effectively, governance must be reengineered to withstand the gravitational pull of centralized control. This requires the CFO, along with legal counsel and the board, to design systems that reinforce transparency, discipline, and legitimacy even when voting rights are uneven.

At one professional services organization where I designed multi-entity global finance architecture spanning US, India, and Nepal, implementing robust internal controls proved essential. Establishing independent audit protocols, automated compliance monitoring, and transparent reporting systems created accountability mechanisms that functioned regardless of voting structure. These systems reduced month-end close from seventeen days to under six days while increasing accuracy by twenty-eight percent.

The CFO maintains governance discipline through rigorous frameworks. Equity design also matters. Stock-based compensation should align with long-term value creation. If super-voting rights persist while employee options stagnate, cultural drift accelerates. At organizations where I implemented comprehensive KPI frameworks linking compensation to performance metrics including ARR, customer retention, and margin health, alignment improved measurably.

Capital Markets and Succession Realities

Beyond internal dynamics, dual-class share structures exert systemic influence on capital markets. Index exclusion represents the most direct consequence. Several major indices now bar or flag companies with dual-class shares, reducing passive investor exposure and shrinking the demand pool. For CFOs planning IPOs, this becomes a valuation and liquidity constraint.

The long-term viability of dual-class companies hinges on succession. What happens when the controlling founder exits, retires, or loses legitimacy? If the governance structure lacks a transition mechanism, the company faces existential dilemma. Succession planning must begin early. The board and CFO must establish who inherits control rights, how transitions are phased, and under what conditions governance structures may revert.

Private markets are not immune. Dual-class logic has permeated venture and growth equity deals. CFOs must recognize that governance health is now a diligence factor. Sophisticated limited partners and late-stage funds increasingly demand alignment metrics.

Conclusion

Governance is not the antithesis of control but its legitimizer. In a world where capital moves fast and scrutiny runs deep, legitimacy represents the most valuable form of power a CFO can help protect. The test of dual-class governance emerges not during expansion but during adversity. Market contraction, activist pressure, or leadership transitions expose the fragility of unchecked control. If governance is engineered with foresight, companies not only survive these shocks but gain reputational capital that translates into sustainable competitive advantage.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.