Executive Summary

In the lexicon of startups and high-growth ventures, few metrics are scrutinized as intensely as burn rate. It is the pulse point of a company’s survival window, how much cash is being consumed each month and how long the runway lasts. Having led financial planning and analysis across organizations that raised over one hundred twenty million dollars in capital, from pre-revenue startups to growth-stage companies, I learned that burn rate tells only part of the story. It measures spend but not sense. The more strategic question is not just how fast you are burning but what you are learning with each dollar set ablaze. Enter the concept of learn rate, the velocity at which an organization converts capital into insight. In a world of constrained capital and mounting complexity, learn rate may be the more critical metric. It determines whether spending creates compounding understanding or just cumulative cost. The companies that win over the long run are not those that burn the least but those that learn the most per unit of burn.

Reframing the Tradeoff

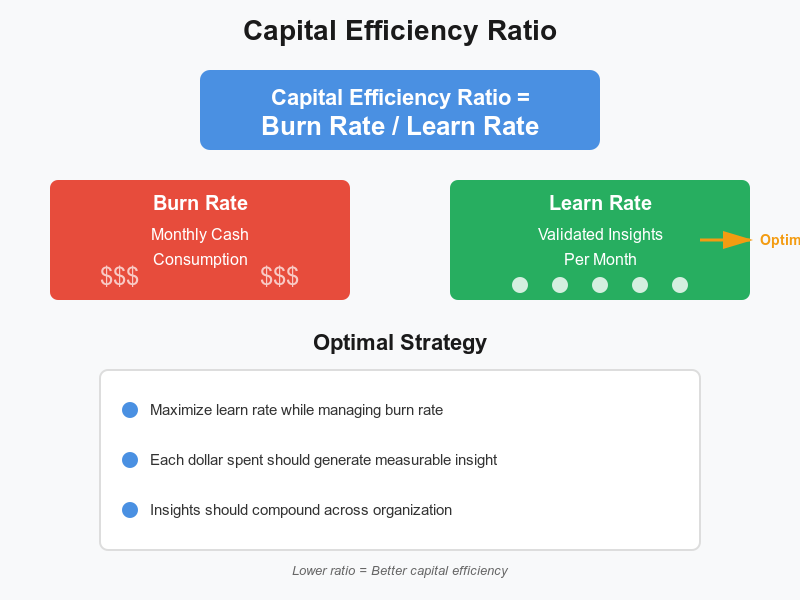

The traditional framing pits burn rate against survival: keep it low, and your runway lengthens. But this assumes time is the only constraint. In reality, opportunity cost is equally binding. A company that moves too slowly risks irrelevance. So the objective is not to minimize burn. It is to optimize burn against learning. Think of this as a capital efficiency lens: how many meaningful questions did you answer for each million dollars spent? Questions like who is our real customer, what messaging drives conversion, which channels are repeatable and scalable, and what features unlock retention.

If burn rate is the numerator, then learn rate is the denominator. And your efficiency ratio, the true measure of progress, is burn per validated insight. Having built financial models and created scenario analyses for organizations across multiple sectors, I learned that the most valuable forecasts are not those that predict revenue precisely but those that surface which assumptions matter most. The same principle applies to capital deployment. The goal is learning which levers drive value.

Defining Learn Rate

Learn rate is not about activity volume. It is about insight density. A company that ships twenty features but learns nothing about its users is less efficient than one that ships five features and uncovers a new pricing insight. Learn rate can be approximated through proxy metrics:

- Experiment throughput: number of structured tests including A/B tests, pilots, and minimum viable products per quarter

- Time to insight: average time from hypothesis to conclusive signal

- Decision-to-insight ratio: how often key decisions are backed by newly uncovered data

- Learning reuse rate: extent to which insights inform cross-functional teams, not just the origin team

This reframes velocity as a function of validated learning, not just output. In many cases, slowing down to run disciplined tests can actually accelerate long-term growth by reducing uncertainty. My certification in production and inventory management emphasizes this principle. Manufacturing velocity depends not on machine speed but on cycle time optimization, defect reduction, and flow efficiency. The same logic applies to organizational learning.

The Burn-Learn Mismatch

A dangerous scenario is when burn outpaces learning. This occurs when teams scale before customer clarity, marketing ramps before messaging is tested, product teams build for roadmap optics rather than user feedback, and hiring increases while onboarding and enablement lag. In these cases, capital is being deployed but the organization’s knowledge frontier is not advancing. That is how startups raise one hundred million dollars and still do not know what truly drives net revenue retention or customer acquisition cost efficiency.

A burn-learn mismatch is a signal of execution risk, not just financial risk. It means the organization is compounding complexity without compounding clarity. During my time advising organizations from Series A through growth stages, I witnessed companies that spent heavily on sales and marketing before validating product-market fit, then struggled when unit economics deteriorated. The burn was high but the learning was shallow.

Pacing Investment to Learning Velocity

How should companies pace investment? By anchoring funding decisions to learning velocity, not just ambition. First, implement phase-gated resourcing by tying budget unlocks to learn-rate milestones. If a product team has not validated market need, do not fund scale development. Treat resources like venture capital within the organization, released only after credible traction.

Second, create learning dashboards that move beyond financial metrics to track validated hypotheses, test velocity, and learnings per department. If teams are not surfacing meaningful insights, they may be busy but not productive. Third, establish monthly learning reviews that create forums not just for key performance indicators but for key learnings. What did we learn this month that changed our understanding? What bets were invalidated? What assumptions now seem false?

Fourth, cultivate learning equity by elevating learning as an internal currency. Reward teams that reduce uncertainty, not just those that deliver output. A failed experiment with clear conclusions may be more valuable than a successful launch with no insight. Finally, enable cross-functional amplification by encouraging sharing of learnings across silos. Insights from sales should inform product. Operations discoveries should influence go-to-market. This converts learnings into organizational compounding.

Having designed enterprise key performance indicator frameworks using business intelligence tools including MicroStrategy and Domo, I learned that what you measure shapes behavior. When we tracked only revenue and pipeline metrics, teams optimized for those outcomes. When we added learning velocity metrics, including experiment completion rates and insight documentation, teams began treating learning as a strategic objective rather than an operational byproduct.

Why Boards Should Monitor Learn Rate

Boards often focus on capital allocation efficiency. But they rarely ask: how much smarter is the company this quarter than last? Learn rate provides a leading indicator of strategic agility. Boards can ask for learning dashboards during reviews, evaluate burn not just on duration but learning return on investment, encourage structured experimentation as a strategic asset, and pressure-test hiring plans against clarity of need. In doing so, they shift governance from hindsight to foresight.

Having managed board reporting for organizations across multiple stages and sectors, I learned that the most effective boards ask not just what we accomplished but what we learned. They understand that in uncertain environments, the ability to learn faster than competitors is as important as the ability to execute faster. When I secured forty million dollars in Series B financing and an eight million dollar credit line for a nonprofit organization, investor confidence came not just from our financial performance but from our demonstrated ability to learn and adapt based on evidence.

Capital Efficiency Framework

Conclusion

Not all burn is bad. But purposeless burn, spend without sense, is unsustainable. In high-growth environments where capital is both catalyst and constraint, the most valuable currency is not time or money. It is learning. Burn rate may determine how long you can stay in the game. Learn rate determines whether you will win it.

The smartest companies are not just burning. They are learning. The smartest boards are not just watching spend. They are watching sense-making. In the end, it is not about how fast you go. It is about how much further you see with every step. My certifications spanning accounting, management accounting, internal audit, production and inventory management, and project management provide the multidisciplinary framework for understanding that efficiency is not just about cost minimization. It is about value maximization per unit of resource deployed.

Based on thirty years of financial leadership across diverse sectors and situations, from startups to established enterprises, I can attest that the organizations that sustain competitive advantage are those that treat learning as a strategic capability, not an operational accident. They structure experiments deliberately. They measure insight generation rigorously. They share knowledge systematically. They pace investment based on validated learning rather than untested assumptions. Burn wisely. Learn relentlessly. That is how you convert capital into competitive advantage.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.