Executive Summary

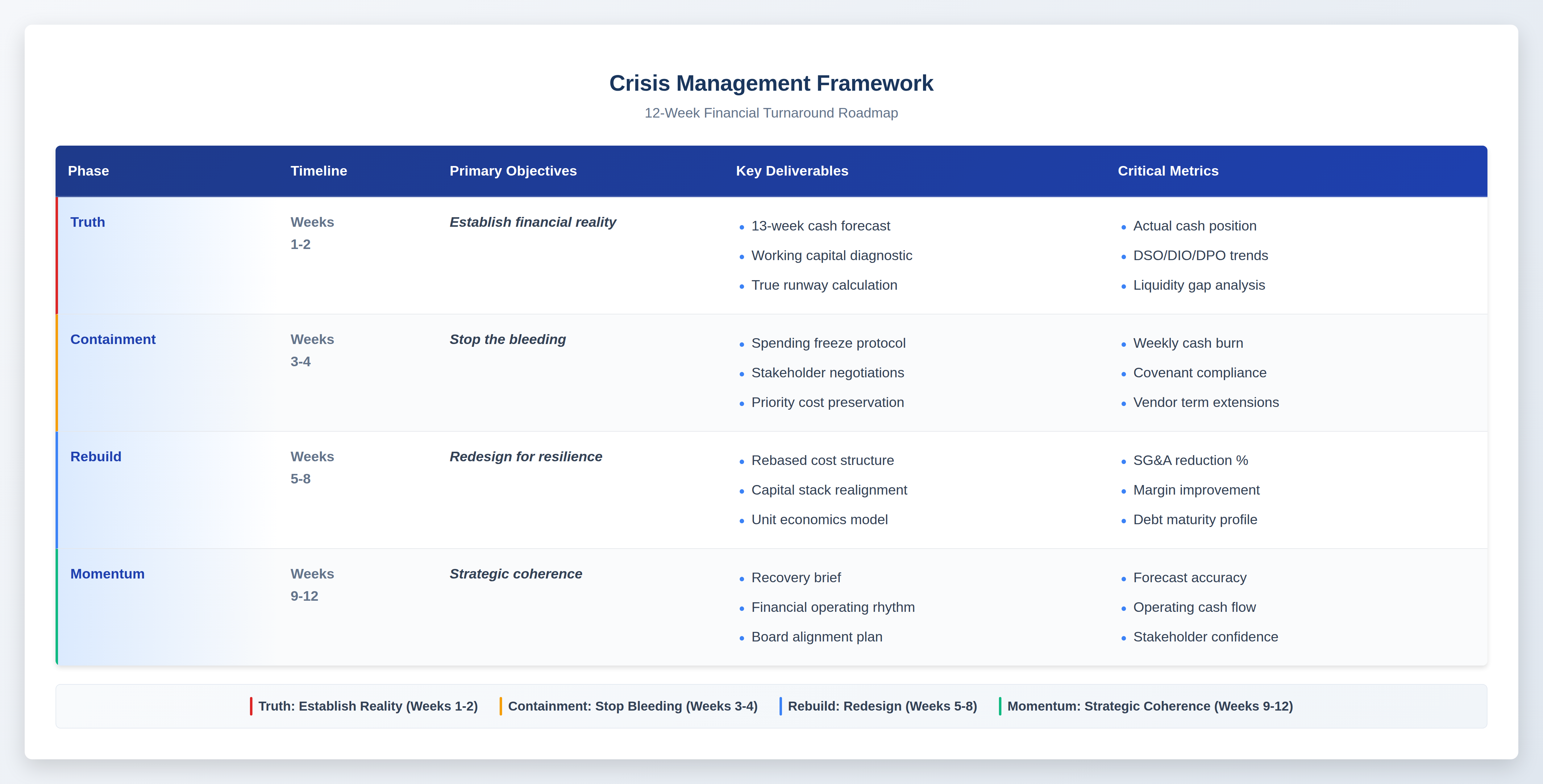

When the numbers stop making sense, the first instinct must be to make sense of them again quickly. Whether triggered by demand collapse, liquidity shortfall, margin compression, or debt covenant breach, the early days of a financial reset require a CFO to operate less like a strategist and more like a field general. Time compresses, noise multiplies, and decisions carry outsized consequences. These first 90 days are not merely about restoring order but regaining control. This is not the time for vision decks or long-range strategy retreats but for disciplined execution, ruthless prioritization, and transparency across all financial lines. Companies do not turn around with optimism; they turn around with arithmetic. The emergency action plan requires establishing financial truth through a 13-week rolling cash forecast and rapid working capital diagnostic, implementing stabilization and containment through spending freezes and stakeholder negotiations, rebuilding the cost base and capital structure through forensic P&L examination and capital stack realignment, and creating strategic coherence through recovery briefs and embedded financial operating rhythms. Beyond the 90-day mark, the goal shifts from staying alive to scaling wisely through unit economics focus, scalable systems infrastructure, and intelligent capital access strategy. The CFO becomes stabilizer, risk manager, capital allocator, and truth-teller in this compressed window, executing with discipline, transparency, and courage to create not just survival but the architecture of enduring advantage.

The Strategic Imperative: Operating as Field General

When the numbers stop making sense, the first instinct must be to make sense of them again quickly. Whether triggered by a demand collapse, a liquidity shortfall, margin compression, or a debt covenant breach, the early days of a financial reset require a CFO to operate less like a strategist and more like a field general. Time compresses, noise multiplies, and decisions carry outsized consequences. Having managed financial operations, treasury, controllership, and board reporting across organizations during periods of market volatility, capital constraints, and operational restructuring while implementing SOX compliance frameworks and managing through crisis conditions, I have witnessed how these first 90 days are not merely about restoring order but regaining control.

This is not the time for vision decks or long-range strategy retreats. It is the time for disciplined execution, ruthless prioritization, and transparency across all financial lines. Companies do not turn around with optimism; they turn around with arithmetic. What follows is a CFO’s practical guide to executing a financial reset in the first three months, a period that, if mishandled, can define the fate of the enterprise.

90-Day Financial Reset Framework

Weeks 1-2: Establishing Financial Truth

The first order of business is establishing what is real. Most companies in distress suffer from a distorted understanding of their true financial position. The CFO must become an internal auditor, cash economist, and operating detective all at once.

Build the 13-Week Cash Flow Forecast: The 13-week rolling cash forecast becomes the centerpiece of all decisions, updated weekly with cross-functional coordination. The model must differentiate between committed inflows and probabilistic collections, distinguishing between contractual outflows and discretionary spend. Key features include granular breakdown of cash inflows by customer and aging bracket, outflow prioritization based on strategic criticality, liquidity gap analysis under base, conservative, and stress scenarios, and overlay of short-term borrowing facilities. In one turnaround case, a company believed it had six weeks of runway. A cash forecast built from bank data revealed it had only three.

Conduct a Rapid Working Capital Diagnostic: Working capital inefficiencies are silent killers. A proper diagnostic dissects receivables examining DSO trends and customer concentration risks, inventory analyzing turns by SKU and obsolescence, and payables reviewing supplier terms and discount capture. In one industrial firm, tightening credit terms and accelerating collections from top ten customers improved cash inflow by $8 million in a quarter. When I managed global finance architecture while improving month-end close from 17 days to under 6 days, daily cash monitoring created early-warning capabilities that prevented liquidity crises.

Weeks 3-4: Stabilization and Containment

The CFO’s role shifts from discovering truth to enforcing control. Speed trumps perfection. Survival is the only KPI that matters.

Freeze and Redirect Spending: Non-essential spending must be paused including hiring, marketing pilots, and long-term IT projects. The CFO must personally sign off on new vendor contracts and capex. More important than what is cut is what is preserved: payroll for revenue-generating staff, IT infrastructure required to bill and collect, critical suppliers with bottleneck risk, and legal and compliance functions.

Stakeholder Negotiation: Creditors, vendors, and landlords prefer early transparency over late surprises. The CFO should initiate direct conversations with senior lenders requesting covenant relief, vendors seeking term extensions, and landlords renegotiating leases. This proactive outreach reduces short-term cash burden and buys time for strategic realignment.

Weeks 5-8: Cost Base and Capital Structure Rebuild

The CFO must transition from defensive control to forward-looking design. The goal is not simply to stop hemorrhaging but to design a model that will not relapse into fragility.

Rebase the Cost Structure: Every line of the P&L should be scrutinized on a per-unit, per-channel, per-region basis. Key levers include FTE review to eliminate organizational bloat, technology spend rationalization of underused SaaS licenses, and procurement redesign consolidating vendors and renegotiating contracts. A manufacturing company cut its SG&A by 18 percent without affecting sales capacity by redesigning its channel support model.

Capital Stack Realignment: Distressed capital structures are often residue of old ambition. The CFO should perform a full capital stack audit assessing maturity ladders versus cash flow profiles, modeling scenarios for convertibles, and exploring exchanges or bridge financing. Transparency with the board is vital. At times, dilution is preferable to insolvency.

Weeks 9-12: Strategic Coherence

The final third begins the transition from stabilization to momentum.

Publish a Strategic Recovery Brief: This factual document outlines what went wrong, what was done, and what the company will now prioritize. It resets the communication narrative and becomes a checkpoint for progress.

Embed Financial Operating Rhythm: Finance must run as a real-time system through monthly rolling forecasts with variance tracking, weekly operating dashboards tied to revenue and cash, and monthly finance operations meetings. The CFO must institutionalize financial fluency across business functions.

Board Alignment: The CFO should institute bi-weekly financial updates presenting liquidity metrics, risk registers, forecast-to-actual dashboards, and contingency plans. Transparency earns trust, but discipline maintains it.

From Survival to Scalability

Beyond the 90-day mark, the goal shifts from staying alive to scaling wisely. The CFO plays a central role in this pivot, not just as scorekeeper but as co-architect of the next phase of growth. Three areas deserve early investment:

Unit Economics and Product Rationalization: Growth must now be governed by margin and velocity. Which customers return profitably? Which products turn inventory faster? Growth that dilutes cash flow or gross margin is no longer viable. A disciplined CFO will embed contribution margin thinking into pricing, sales compensation plans, and marketing ROI metrics. The finance function moves from gatekeeping to enabling decisions that compound value.

Scalable Systems Infrastructure: As growth resumes, the CFO must ensure the back-end scales with the front. This includes ERP stabilization or consolidation, upgraded billing and collections systems, and data pipelines that support cohort and LTV/CAC analysis. Infrastructure investment is often neglected post-crisis. But scaling on manual processes leads to later breakdowns. When I implemented NetSuite and OpenAir PSA systems while automating revenue recognition and project accounting, the 28 percent increase in accuracy was less important than the operational scalability it enabled, allowing the organization to double in size without doubling finance headcount.

Capital Access Strategy: Finally, as the firm regains footing, it must reevaluate its capital philosophy. This includes revisiting credit ratings and debt terms, exploring strategic partnerships or minority investments, and designing equity incentive programs that reward sustained margin expansion, not just topline growth. The capital that funds the next chapter must be patient, aligned, and strategically intelligent. The CFO, having guided the firm through turbulence, is best positioned to shape this future.

Executive Communication: Memo to CEO and Board

The following represents the type of communication required to initiate the reset with clarity and credibility:

To: Chief Executive Officer and Members of the Board

From: Chief Financial Officer

Subject: Initiation of Financial Reset – 90-Day Emergency Action Plan

Date: [Current Date]

Colleagues,

In light of recent developments in operating performance, liquidity constraints, and forward-looking covenant pressures, I am formally initiating a structured financial reset of the business. This memo outlines the objectives, scope, and immediate implications of the proposed 90-day plan. Our aim is not only to stabilize the enterprise but to restore credibility with stakeholders and establish the foundation for long-term financial resilience.

Current Position: While headline revenue trends have been resilient in pockets, we are seeing sustained pressure on gross margin, elongation in receivables, inventory accumulation, and tightening vendor terms. Operating leverage is no longer absorbing these pressures. Absent intervention, we project negative free cash flow within two quarters. Liquidity coverage has narrowed to less than three months of fixed obligations under base-case assumptions. The divergence between accounting earnings and economic reality is now material. We must act swiftly.

Plan Objectives: The 90-day Financial Reset is organized around four imperatives. First, restore cash visibility through a 13-week cash flow model implemented and owned by Treasury, reviewed weekly at the executive level. Second, enforce financial discipline by freezing all non-essential spend, reviewing headcount alignment, and reassessing all ongoing project commitments. Third, engage stakeholders early by renegotiating vendor terms, lease obligations, and credit covenants where necessary through proactive, transparent, data-driven communications. Fourth, restructure for resilience by reassessing our cost structure, capital stack, and forecast assumptions with a rebaselined budget replacing the current operating plan.

Governance and Reporting: A cross-functional Financial Reset Committee will be stood up with representation from Treasury, FP&A, Legal, HR, and Business Operations. I will lead this directly with a standing agenda covering weekly cash flow reporting, progress against cost and capital restructuring milestones, and risk assessment and escalation items. I will report progress bi-weekly to the Board and will furnish a mid-point and final readout at Day 45 and Day 90, respectively.

We are not in crisis. But we are out of margin for delay or drift. This plan reflects neither panic nor pessimism. It is a disciplined assertion of control, one that will give us the information, options, and credibility to chart our path forward.

Conclusion

The first 90 days of a financial reset do not define the company’s ultimate strategy. But they define its ability to have a future strategy at all. In this compressed window, the CFO becomes the stabilizer, the risk manager, the capital allocator, and the truth-teller. It is a role of extraordinary weight and strategic leverage. When executed with discipline, transparency, and courage, it becomes the turning point from which everything else flows, not just survival but the architecture of enduring advantage. The emergency action plan transforms crisis into clarity through systematic truth-telling, ruthless containment, structural redesign, and strategic momentum-building, proving that companies turn around not with optimism but with arithmetic, not with vision decks but with weekly cash forecasts, and not with aspirational plans but with disciplined execution that compounds credibility one milestone at a time.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.