Executive Summary

Every dollar has a cost. Not just the explicit cost of capital but the opportunity cost of deployment. Every dollar spent on one project is a dollar not spent elsewhere. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that this constraint is not a limit. It is a lens. It clarifies. It sharpens. And in the hands of a disciplined CFO, it becomes a strategic advantage.

The Job Assignment Framework

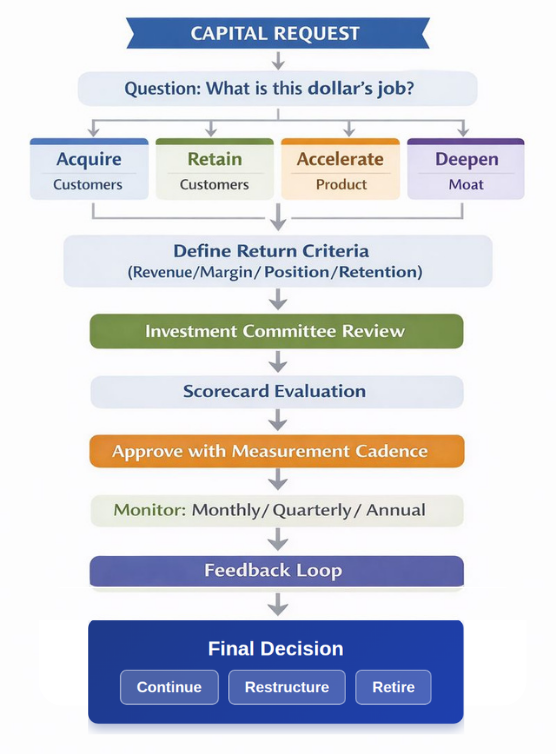

Strategic investment discipline is not about spending less. It is about spending with intent. CFOs who embrace this mindset begin every capital allocation with a question: what is the job of this dollar? Not the category. Not the department. The job. Is it to acquire customers? To reduce churn? To accelerate product velocity? To deepen moat? Vague goals yield vague results. Specific jobs yield measurable outcomes.

Strategic Investment Discipline Framework

To answer this question well, CFOs need structure including investment committees, capital scorecards, and business-case rigor. These are not bureaucratic layers. They are filters. They force tradeoffs into the open. They prevent pet projects from hiding under legacy budget lines.

The discipline extends to how outcomes are measured. CFOs must define return criteria up front. Each investment must have a yardstick. And that yardstick must be reviewed in rhythm. Not to punish. But to learn.

When I managed global finance for a $120 million logistics organization, we implemented quarterly capital portfolio reviews scoring every initiative above $50,000 against defined return criteria. One technology investment projected 15 percent efficiency gains but after six months showed only 4 percent improvement. Rather than continue funding, we restructured implementation, achieved 12 percent gains in the next quarter, and reallocated the remaining budget to a route optimization project delivering 22 percent returns. This disciplined feedback loop improved overall capital efficiency by 18 percent year-over-year.

This rigor builds alignment. When teams know capital is finite, they prioritize. They model. They debate assumptions. CFOs who push this culture teach teams to think like owners. This discipline is vital in growth phases when capital flows easily. The CFO must resist pressure to fund everything. Instead, they ask: what drives the flywheel?

My certifications as a CPA, CMA, and CIA provide technical foundation for capital allocation frameworks. But what separates effective investment discipline from budgeting theater is ensuring every dollar has a defined job, measurable outcomes, and regular performance feedback that drives continuous capital reallocation toward highest-return opportunities.

Conclusion

In high-functioning companies, no dollar is loose. Every dollar has a job. And the CFO makes sure it gets done.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.