Executive Summary

A board’s vision without operational alignment is aspiration without outcome. A management team’s execution without board perspective is momentum without meaning. The alignment between vision and value is not merely a communication issue. It is a structural necessity. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that when the boardroom’s intent fails to translate into day-to-day decisions, enterprises underperform not because of bad ideas but because of missed handoffs. Strategy becomes symbolic. Tactics become reactive. Accountability diffuses. What should be symphonic becomes fragmented. The board is charged with setting strategic direction, shaping fiduciary expectations, and holding leadership accountable for long-term enterprise value. But vision statements and investor narratives, unless translated into operational terms, remain rhetorical. The management team, in turn, is tasked with mobilizing people, processes, and capital to deliver. But without clear signal from the board on strategic priorities, they default to execution logic: meet the quarter, grow the line, protect the core. The distance grows. The board thinks long-term. The operators live short-cycle. And the gap between vision and value widens.

The Alignment Problem

This is not about intention. Most boards and executive teams share the same aspiration: to drive enduring growth. But misalignment is bred in the small choices including the KPI definitions, the agenda architecture, the language of risk, and the rhythm of reporting. Board members talk about long-term resilience. Operators talk about cost centers and delivery timelines. The gap is not ideological. It is operational.

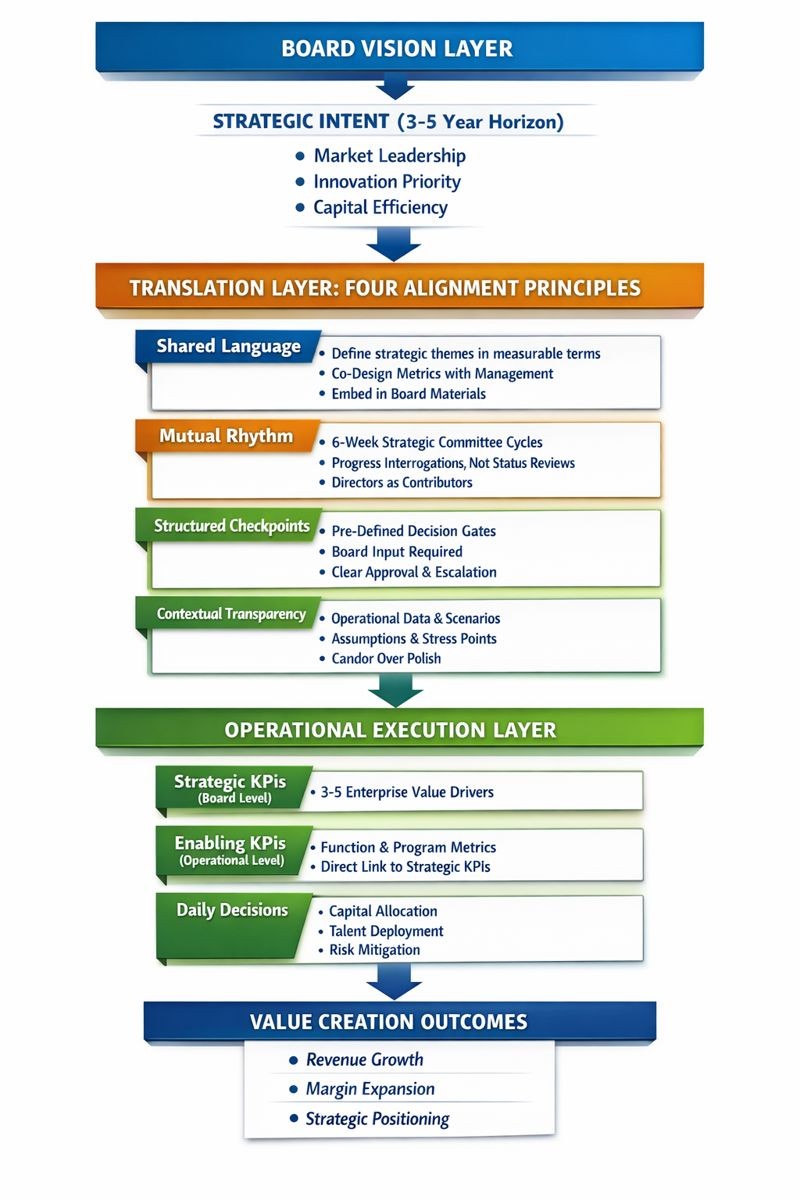

Bridging this divide requires more than better communication. It requires shared structure. Four principles govern the bridge: shared language, mutual rhythm, structured checkpoints, and contextual transparency. These principles must be embedded into the governance process, not tacked on as post-mortems. They transform the board from a directional body into an enabling partner. And they make the operational team not just executors but interpreters of vision.

Four Principles for Bridging Vision and Value

Principle 1: Shared Language

Words matter. When a board says it wants to be the most innovative company in its space, what does innovation mean? Is it product velocity, R&D spend, market share of new revenue, or patent filings? When the board talks about resilience, is it cost structure variability, supply chain redundancy, or customer diversification? Great boards do not allow strategic themes to remain abstract. They define them. They embed them into board materials. They align on how performance is tracked.

One industrial board translated its vision for market leadership into three defined terms: cost-to-serve advantage, innovation monetization index, and segment capture rate. These metrics were co-designed with management. Each operational dashboard presented to the board referenced these three drivers. The board stopped debating semantics and started driving outcomes. The shared language created shared accountability.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we established shared definitions across board and operational reporting. Rather than maintaining separate board metrics and operational metrics, we created a tiered architecture where operational indicators rolled up to strategic KPIs the board reviewed, ensuring consistent language and line of sight from daily decisions to strategic outcomes.

Principle 2: Mutual Rhythm

Boards typically meet quarterly. Operators manage in real time. This temporal gap creates risk. If strategy reviews occur only in the spring and budget approvals only in the fall, alignment decays in between. Great boards and management teams build a rhythm that enables sustained strategic focus. They establish a cadence of review that mirrors operational cycles.

A global software firm instituted a six-week rhythm between board strategic committees and operational program leads. These sessions were not status reviews. They were progress interrogations. Each focused on a strategic theme including platform expansion, partner monetization, or AI enablement. Directors joined as contributors, not evaluators. This rhythm created continuity. It eliminated surprises. It reinforced trust. And it helped ensure the strategy remained dynamic, not episodic.

Principle 3: Structured Checkpoints

Boards often receive comprehensive reports but lack access to decision points in real time. By the time data reaches the board, key strategic decisions may have already been made. This passivity undermines oversight. To fix this, leading boards co-design structured checkpoints, gates in the operational plan where board input is not just welcomed but required.

A consumer goods company embedded four strategic gates into its annual cycle: brand portfolio allocation, supply chain restructuring, market exit considerations, and digital acceleration budgeting. Each gate triggered a board engagement with pre-read materials, scenario modeling, and clear decisions to be made. This checkpoint design allowed the board to act as a steward of strategic integrity, not a rubber stamp. It made oversight real. And it allowed executives to operate with clarity about when and where board input would be material.

Principle 4: Contextual Transparency

Boards do not require every data point. But they require the right data framed in operational reality. Too often, board decks are curated to impress, not inform. They emphasize graphics over substance and optimism over risk. This dilutes insight. CFOs and COOs must frame data in context: what are the baseline assumptions, where are the stress points, how does the operational forecast compare to scenario targets?

Boards, for their part, must request transparency, not reassurance. They must reward candor, not polish. A mining board facing geopolitical risk in a key region requested monthly operating updates not as full reports but as three-page volatility snapshots. These included crew activity, regulatory exposure, cash burn estimates, and alternate logistics options. The tone shifted. The board asked better questions. The operators offered deeper context. Transparency, once normalized, created trust.

Vision-to-Value Alignment Framework

This framework illustrates the complete architecture for translating board vision into operational value. The board vision layer establishes strategic intent. The translation layer applies four alignment principles to bridge vision and execution. The operational execution layer cascades from strategic to enabling KPIs down to daily decisions. Each layer is connected through systematic processes, ensuring that board perspective directly influences operational choices that create value.

Execution Mechanisms for Sustained Alignment

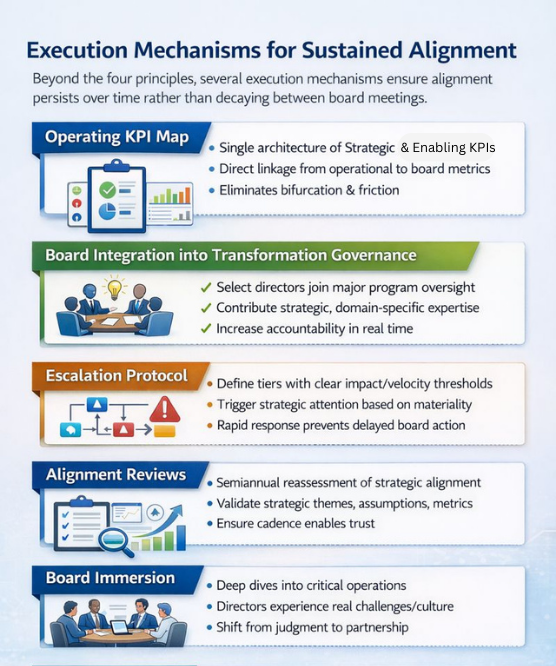

Beyond the four principles, several execution mechanisms ensure alignment persists over time rather than decaying between board meetings.

Operating KPI Map

Too many organizations run two sets of metrics, one for the board and one for the business. This bifurcation creates friction. To fix this, high-performing companies build a single KPI architecture that serves both domains. They define tiered indicators:

- Strategic KPIs: Three to five indicators that track enterprise-level value creation

- Enabling KPIs: Metrics tied to functions or programs

- Direct linkage: Each enabling metric must link to one or more board-level KPIs

When I managed global finance for a $120 million logistics organization, we rebuilt our reporting architecture to create line of sight from operational metrics like route efficiency, warehouse utilization, and delivery cycle time to board-level strategic KPIs including cost-to-serve, customer retention, and return on invested capital. This integration eliminated the bifurcation between what operators managed daily and what the board reviewed quarterly.

Board Integration into Transformation Governance

Major programs including digital overhaul, supply chain redesign, or global expansion carry board interest but often exclude directors until quarterly reviews. Smart enterprises embed directors selectively into transformation oversight. A technology company launching a data platform invited two board members, one with enterprise architecture background and the other with growth capital experience, to quarterly reviews. They participated not as supervisors but as strategic sparring partners. Their questions sharpened hypotheses. Their presence increased accountability.

Escalation Protocol

Boards must know when operational issues require strategic attention. But escalation cannot be subjective. High-functioning boards and management teams define thresholds:

- Impact threshold: Financial, reputational, or strategic materiality

- Velocity threshold: Rate of change requiring accelerated decision

- Strategic exposure: Alignment with core strategic priorities

A healthcare firm designed a five-tier escalation model. Tier one involved routine variance and internal mitigation. Tier five involved full board review and external disclosure. When a geopolitical shock disrupted a primary supplier region, the escalation protocol kicked in. The board was informed within 24 hours, reviewed contingencies within 72, and approved revised capital commitments within the week.

Alignment Reviews

Boards and management must not assume alignment is permanent. It must be reviewed. High-performance boards run alignment reviews semiannually. These reviews answer four questions:

- Is our strategic intent still valid?

- Are our operating assumptions still accurate?

- Are our metrics still predictive?

- Is our cadence of communication enabling trust?

One global agribusiness firm conducted such a review mid-cycle. They discovered their innovation metrics were lagging indicators. The board and management co-designed a forward-looking index based on stage-gate throughput, IP filing velocity, and early-stage attrition. This new metric gave the board early signal and gave management confidence that strategy and oversight were again aligned.

Board Immersion

One of the most effective alignment rituals is the board immersion. Not a factory tour. Not a cocktail hour. A working immersion into a critical business area including customer journey, pricing logic, or digital workflow. Directors join operators for deep dives. They ask how decisions are made, what tensions exist, what workarounds have emerged. These sessions create mutual empathy. They shift board posture from judgment to partnership.

Conclusion

At the close of every strategic cycle, great boards ask not did we win but were we aligned. Because alignment, not aspiration, determines whether vision becomes value. It determines whether strategy is durable. It determines whether capital compounds. It determines whether the enterprise endures. Boards that embed alignment into process, not as a philosophy but as a system, become accelerants. They reduce confusion. They shorten time to decision. They increase signal-to-noise ratio. And they help operators do what they were hired to do: deliver. In the end, vision is only as powerful as its translation. Strategy is only as real as its execution. And value is only as enduring as its alignment. That is the work. That is the bridge. That is the standard.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.