Executive Summary

Most companies enter due diligence thinking of it as a test. A checklist. A gatekeeping ritual to get through so the deal can close and the real work can begin. But to a CFO with perspective, due diligence is not a hurdle. It is a mirror. It reflects how a company thinks, operates, and governs. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that for those who understand its power, due diligence becomes a stage. A quiet performance in which the company signals not just what it knows but how it leads. There is a reason investors ask the same questions. It is not laziness. It is psychology. Diligence is not just about confirming numbers. It is about confirming behavior. When investors ask for financials, they want to see more than revenue and cost. They want to see reconciliation. Forecast accuracy. Board-readiness. A company that treats the budget as a living tool, not a reporting artifact.

Due Diligence as Strategic Showcase

The companies that excel in due diligence are not the ones that simply have the answers. They are the ones that have a system. A rhythm. An operating cadence that shows maturity. The data room is organized. The documents are current. The answers arrive with context. No one is scrambling. The CFO is not playing traffic cop. They are guiding the narrative.

Diligence done well creates belief. Not just in the numbers but in the team. Investors think: if they can run this process cleanly under pressure, they can run a business under scale. The inverse is true too. Sloppy diligence signals risk. Legal documents are missing. Financials are contradictory. Policies are outdated. The story frays. The round slows. Confidence erodes.

But great diligence is not about perfection. It is about transparency. A CFO who owns gaps including this contract is delayed here is why or this variance occurred here is what we learned builds trust. Investors do not need a spotless record. They need a clear window. One that shows decision-making in real time, not post-hoc rationalizations.

This begins long before the raise. Strategic maturity is built over quarters, not days. The best CFOs treat every board meeting as rehearsal for diligence. Every forecast as a proof point. Every audit as a credibility signal. They do not wait for diligence to organize. They operate as if diligence could begin tomorrow. Because when it does, there is no time for reinvention.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we maintained investor-ready data rooms continuously rather than assembling them reactively. Our monthly financial packages included variance commentary, cohort analyses, and forward projections that became diligence materials without modification. When investors entered diligence, we provided access within 24 hours to organized folders covering financials, legal, HR policies, contracts, IP, and tax records. Investors noted that our process readiness shortened their diligence timeline by three weeks compared to typical processes and increased their confidence in our operational maturity.

Orchestrating the Process

There is a moment during every fundraise when the pitch deck fades and the diligence begins. The calls turn from vision to veracity. From growth curves to gap analysis. This is where companies reveal themselves. Not in the stories they tell but in how they respond when investors start to look underneath.

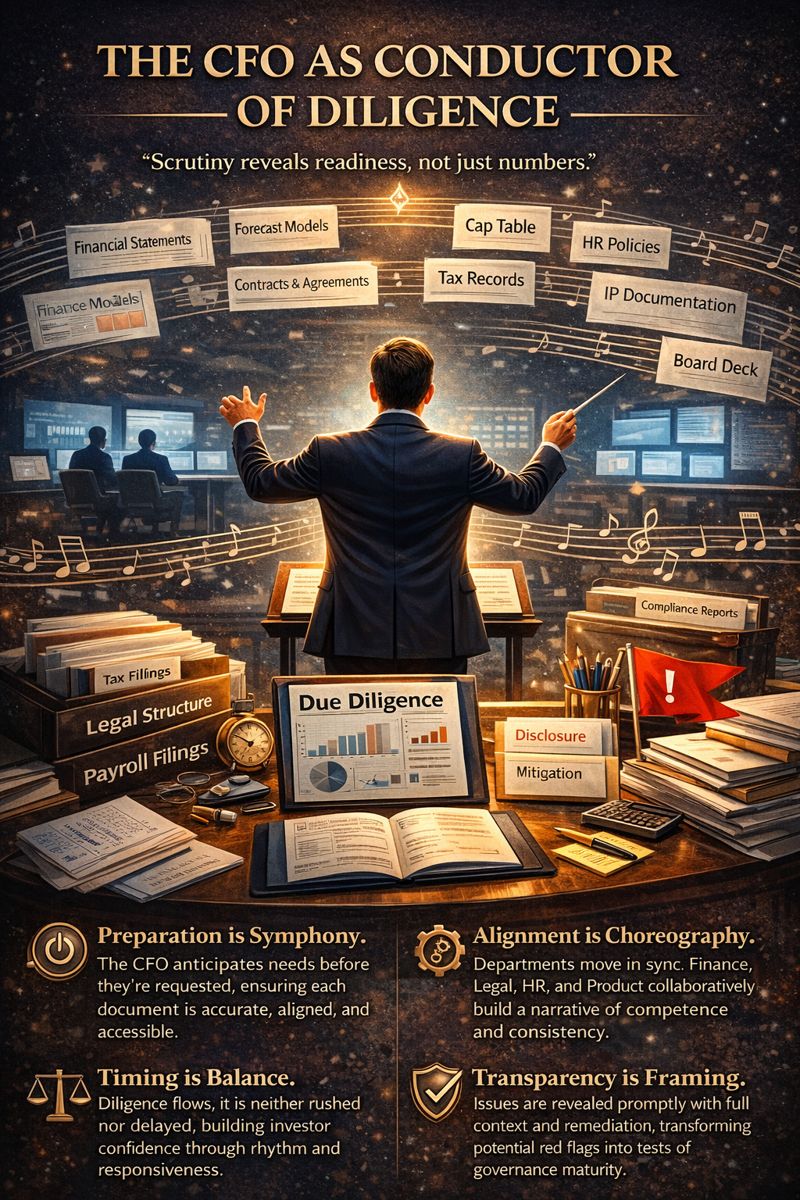

The CFO as Conductor

The CFO becomes the conductor. The data room is the stage. Each document, each file, each response a note in a larger composition. Done poorly, it is discord including duplicate contracts, mismatched metrics, and updates that feel retrofitted. Done well, it is a symphony of alignment, precision, and command. The difference is not polish. It is preparation.

Orchestration begins with a map. The CFO must know what is needed before it is requested: financials, legal structure, cap table, contracts, HR policies, tax records, IP documentation, forecast models, and customer contracts. Each has a place. Each has an owner. The CFO assigns, tracks, and quality-checks not as a taskmaster but as an editor.

Staging the Data Room

Then comes the staging. The data room is not a folder dump. It is a narrative space. Files should be logically named. Chronologically organized. Labeled with purpose. A good data room invites exploration. A great one eliminates confusion. The CFO designs for clarity. Not because investors demand it but because it signals respect.

Responses are just as critical. Every investor follow-up is a chance to demonstrate maturity. Slow answers hint at scrambling. Defensive answers suggest chaos. Evasive ones raise alarms. But timely, direct, contextual responses build a relationship. They show that the company is not just ready to raise money. It is ready to be accountable.

Managing Alignment and Pacing

This work cannot be outsourced. Advisors help. Lawyers review. But the tone and tempo come from within. The CFO must quarterback the process, ensuring every department is in sync. Legal cannot cite policies Finance has not modeled. HR cannot promise things Product has not seen. Alignment is not luck. It is intentional choreography.

The CFO must also manage pacing. Diligence is not a sprint. Nor is it a drift. It must flow. Too fast and investors feel rushed. Too slow and they lose interest. The CFO reads the room. They release materials in phases. They follow questions with insight. They anticipate next moves.

Framing the Uncomfortable

Great diligence orchestration also includes the uncomfortable. Every company has messes. A disputed contract. An expired filing. A personnel issue. The CFO does not hide them. They frame them. Here is what happened. Here is what we have done. Here is the exposure. Here is the mitigation. That framing turns red flags into character tests.

When I managed global finance for a $120 million logistics organization preparing for potential acquisition, diligence revealed historical payroll tax filing delays in one state jurisdiction. Rather than minimize the issue, we immediately disclosed it with complete documentation showing the delay was administrative not substantive, all back taxes and penalties were paid, processes were revised to prevent recurrence, and external tax counsel validated compliance going forward. Buyers appreciated the transparency and proactive remediation, converting a potential deal-breaker into a demonstration of governance maturity.

Documentation as Narrative

Documentation is more than proof. It is narrative. A hiring plan is a bet. A budget is a philosophy. A board deck is a window into culture. The CFO who curates documents to tell a coherent, truthful, forward-looking story gives investors more than compliance. They give confidence.

This maturity is cultural. It shows in how teams respond to requests. In how contracts are stored. In whether HR policies are documented. Whether compliance is proactive. Whether intellectual property is defended. Diligence becomes a lens not just on finance but on the company’s whole nervous system.

My certifications as a CPA, CMA, and CIA provide technical foundation for due diligence preparation and execution. But what separates companies that showcase strategic maturity from those that merely survive scrutiny is not document completeness alone. It is the discipline to maintain investor readiness continuously, the orchestration to align cross-functional responses seamlessly, the transparency to frame weaknesses as character tests, and the narrative skill to transform compliance into confidence.

Conclusion

In the end, orchestration is about readiness. Not just to raise. But to grow. To govern. To scale. A due diligence process that runs cleanly tells investors what a CFO believes: that operational maturity is not a stage. It is a choice. Made early. Practiced daily. Demonstrated under pressure. That is how diligence leaves an impression. Not of perfection. But of leadership.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.