Executive Summary

Reporting into the boardroom is both a privilege and a test. The greatest CFOs do more than present numbers. They shape perspective, build trust, and serve as the board’s most indispensable partner. Behind closed doors, with powerful directors watching, the CFO’s role is not only to inform but to persuade, to anticipate, and to align. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that this is the crucible in which board-CFO relationships are forged, and in which financial stewardship meets strategic partnership. At its core, managing up is about credibility. Directors expect financial truth told frankly and consistently. Great CFOs earn credibility through precision, transparency, and rigor. They present not only audited results but the story behind the story. They highlight why trends matter, what drivers are moving margins, where risk lies in capital allocation. They do not merely reassure. They illuminate. They recognize that numbers without context are noise, and context without accountability is empty rhetoric. Boardrooms are built on confidence. CFOs provide it.

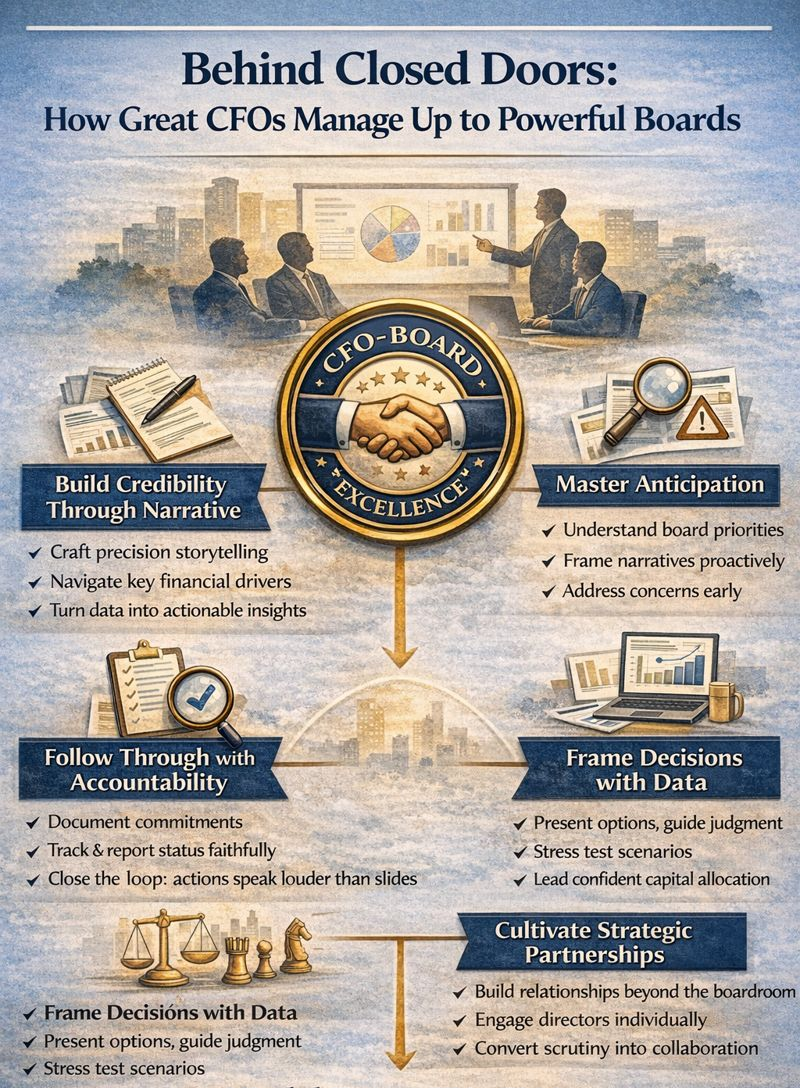

The Foundation: Building Credibility Through Narrative

This begins with clarity of narrative. Before walking into the boardroom, great CFOs know the key levers: revenue cadence, gross margin variance, working capital efficiency, free cash flow trajectory. They craft succinct narratives around each driver including what is going well, what is emerging, what is within their control, and what depends on broader factors. Their board deck is not a collection of schedules. It is an argument, informed, layered, and compelling. It is a thesis, not just a weekly update.

To build that narrative, CFOs invest in pre-read materials that enable insight. They surface key questions. They embed quarterly themes including efficiency, growth, digital investment, or regulatory exposure and analyze against both forecast and external benchmarks. These thematic deep-dives become conversation anchors in the boardroom. Directors reference them later. The CFO is no longer a presenter. They are a fellow in inquiry.

When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we established formal audit committee processes and structured board reporting calendars. Each quarterly board package began with a two-page executive summary that framed performance against strategic priorities, highlighted key variances with root cause analysis, and previewed upcoming decisions requiring board input. This narrative clarity transformed board meetings from review sessions into strategic working sessions.

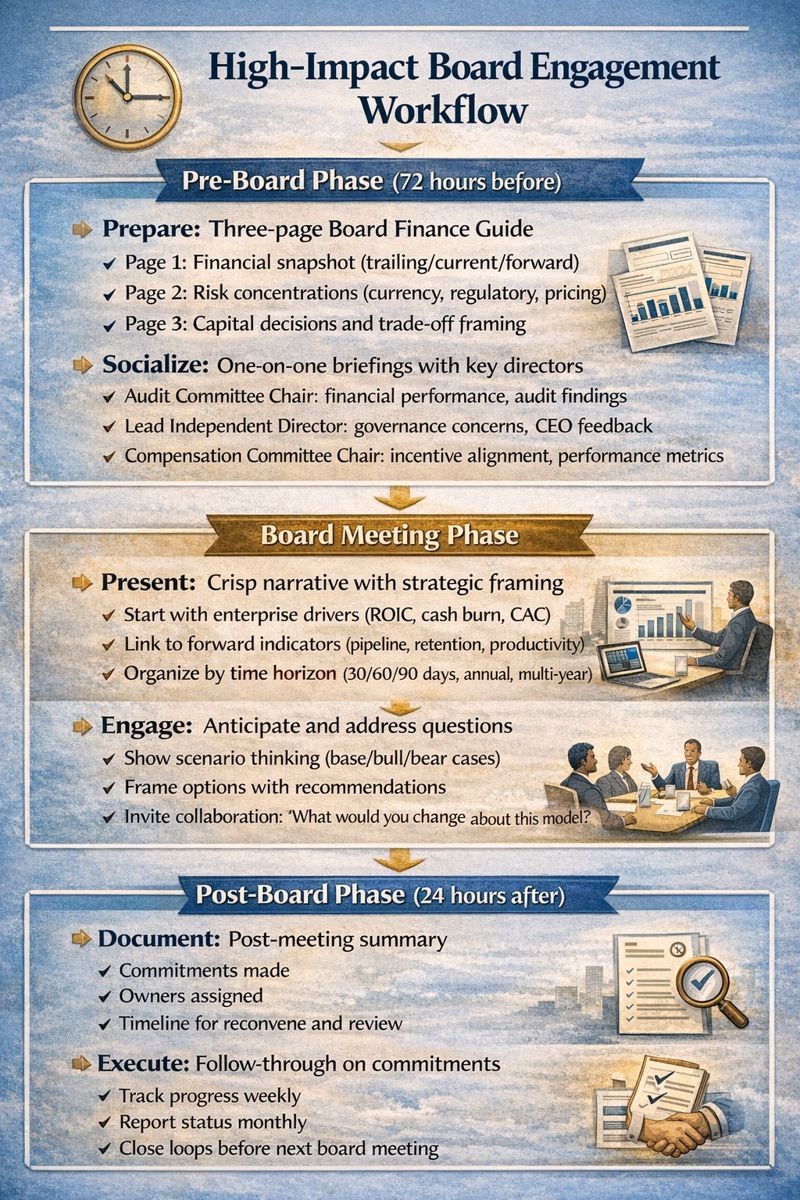

One elite CFO built a three-page Board Finance Guide ahead of every meeting. Page one showed the financial snapshot including trailing, current, and forward anchored in strategic themes. Page two mapped risk concentrations including currency, regulatory, and pricing power. Page three outlined upcoming capital decisions and framed trade-offs. This guide was emailed seventy-two hours in advance. It signaled readiness. It set expectations. And it turned board meetings into working sessions, not report reviews.

CFO Board Management Excellence Framework

This framework illustrates the complete cycle of effective CFO-board management. The pre-board phase focuses on preparation and relationship-building through targeted briefings with key directors. The board meeting phase emphasizes clarity and engagement with structured narratives and collaborative questioning. The post-board phase ensures accountability through documentation and execution tracking. Each phase builds trust and credibility that compounds over time, creating a continuous loop of improvement and deeper partnership.

Mastering Anticipation and Board Psychology

Behind closed doors, CFOs must master anticipation. They must understand the board’s composition, perspective, and focus. Is the board concerned today with long-term innovation or short-term liquidity? Is tax risk top of mind? Are activist investors likely to push back? A great CFO adjusts proactively, as they would in investor roadshows. They frame the narrative so the board sees and hears the data on their terms. They deploy tone with intention. They draw the board in before issues become surprises.

Trust is not earned in the presentation slides. It is built in the CFO’s preparation, follow-up, and accountability. One best practice is setting up quarterly post-meeting summaries: here are the commitments we made to the board, here is who owns each one, here is when we will reconvene and review. And then deliver. This follow-through speaks louder than any earnings beat. It signals seriousness and reliability. The CFO becomes indispensable, not for their Excel skills but for their integrity.

The Five Pillars of CFO-Board Excellence

| Pillar | What It Means | How to Execute | Impact |

| Credibility | Financial truth told frankly and consistently | Precision in data, transparency in challenges, rigor in analysis | Board confidence in CFO judgment |

| Anticipation | Understanding board psychology and concerns | Adjust narrative proactively, deploy tone intentionally, socialize issues early | Surprises eliminated, trust built |

| Follow-Through | Accountability for commitments made | Document action items, assign owners, report progress | CFO becomes indispensable partner |

| Decisiveness | Clear recommendations amid uncertainty | Frame options with data, stress scenarios, guide judgment | Board decisions simplified, respect earned |

| Partnership | Collaborative engagement with directors | One-on-ones, informal settings, tailored follow-up | Allies created, not just audiences |

But tools alone do not deliver impact. Behavior does. The best CFOs calibrate tone. They speak in strategic language, not finance jargon. They are direct when earnings miss and factual when forecasts shift. They avoid emotional overselling. They resist defensiveness. They exhibit what one board chair called calm analytical gravity. That posture earns engagement. When the CFO speaks, the room listens because every word is designed to add value, not buy time.

Managing Tension and Hard Questions

Equally, great CFOs manage tension. They understand board accountability is both supportive and confrontational. They welcome hard questions, and they prepare for them. They do not avoid discomfort. They manage it. When faced with tough scrutiny, they answer with context and alternatives, not defensiveness. They say here is our baseline case, here is our downside scenario, here is what keeps me up at night. They show they are thinking like directors and provoking directors to think like stewards.

That comportment demands a posture of openness. CFOs invite feedback and do not equate challenge with criticism. They ask: what would you change about this model? What risk did we not include? How would you stress this assumption? This framing shifts the tone from scrutiny to collaboration. The board becomes part of the process, not just an adjudicator. The CFO builds allies, not just audiences.

What distinguishes the best CFOs is how they handle the board when performance stumbles. Everyone can communicate when numbers exceed plan. It is in the moments of stress including cost overruns, capital shortfalls, cash crunch when true discipline emerges. Great CFOs bring bad news early, frame context rigorously, and propose corrective actions with options. They show scenario thinking, not excuses. They elevate trust through transparency.

When I managed global finance for a $120 million logistics organization, we faced a mid-year earnings shock due to fuel pricing and labor disruption. Before the quarterly board meeting, I convened an emergency session with key directors. I presented the forecast delta, detailed the drivers, outlined three options to restore cash flow, and proposed a strategic pause on expansion spend. The board’s response was measured and constructive. The company acted decisively. Recovery followed. That confidence came not from minimizing the problem but from owning it early and pairing it with disciplined proposals. This is managing up at its finest.

Designing Decision-Ready Dashboards

Boards crave clarity. What they often receive are overly detailed financials or superficial summaries. Elite CFOs avoid both extremes. They design dashboards that compress complexity into coherence. These are not investor decks. They are decision guides. They begin with three questions: what do we need to understand? What do we need to watch? What do we need to decide? Each dashboard begins with a crisp view of enterprise drivers including operating leverage, return on invested capital, cash burn, and customer acquisition cost and links them to forward-looking indicators. Metrics are organized by time horizon. Forecasts are embedded with assumptions. Visuals lead. Verbiage is lean.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we designed board-specific views that synthesized these operational metrics into strategic insights. Rather than presenting raw dashboards, we created narrative-driven summaries that connected operational performance to board-level strategic themes. Each metric was accompanied by context: what it means, why it matters, what action it suggests.

The Art of Capital Allocation Framing

Boardrooms also demand decisiveness. If the CFO brings multiple options including do we accelerate investment here or lower dividends there, they must lead the debate confidently with data-backed recommendations. They do not dodge by underscoring unknowns. They draw on scenario framing to guide judgment. They say here is the range, here is our recommendation, here is what success looks like. This clarity earns respect and simplifies decision-making.

Financial discipline is not solely about margins. It is about framing capital allocation as purposeful. When CFOs manage up effectively, they position each capital ask within the board’s lens: return opportunity, downside exposure, optionality retained. They tie large expenditures to strategic themes including regional growth, digital transformation, or sustainability transition and quantify levers. They move beyond needed to grow toward funded to win.

One CFO positioned a $300 million digital platform investment not in cost but in cross-vertical data leverage, pricing personalization, and retention uplift. The board approved it not because it looked pretty but because the CFO modeled enterprise-wide implications. This framing turned a spend into a strategic multiplier.

Mergers and acquisitions represent an advanced test. Boards do not forgive bad deals. The CFO’s role is to construct valuation integrity, risk buffers, synergy realism, and cultural fit frameworks. Elite CFOs anticipate board questions in diligence, rehearse integration math, and frame downside safeguards. They bring external benchmarking. They show exit options. They own the deal not as a sponsor but as a fiduciary. They treat the board as a co-investor. The result is confidence. And when needed, restraint.

Building Relationships Beyond the Boardroom

But relationship is as critical as message. The best CFOs forge connection with board members in informal settings: one-on-ones at off-sites, dinners with non-executive chairs, joined finance committee workshops. They invest in understanding each director’s priorities. They tailor follow-up emails to share deeper insight. They do not confuse professional distance for emotional distance. They know that behind each powerful director is a perspective that, when understood, can become a partner in execution.

Elite CFOs establish board-side relationships with key players: the audit chair, the lead independent director, the compensation committee chair. These relationships are not ceremonial. They are operational. Before budget cycles, capital reallocation decisions, or major shifts in policy, the CFO briefs these directors in one-on-one calls. They ask for reaction, not permission. They incorporate feedback. This advance engagement converts board time from reaction to confirmation. It creates shared ownership of insight. And it flattens friction in the full session.

Preparation as Performance

Still, all engagement depends on discipline. Great CFOs schedule boardroom rehearsals. They expect tough questions. They run mock drills. They co-host dry runs with the CEO and audit committee chair. They test assumptions. They refine explanations. This preparation is methodical. When they sit before the board, it shows. They are calm, purposeful, strategic.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, the board presentation evolved from historical reporting to forward-looking strategic dialogue. The time saved in close allowed deeper analysis of trends, scenario modeling, and strategic option development. Board meetings shifted from what happened last quarter to what should we do next quarter and beyond. This transformation required preparation not just of materials but of mindset, shifting the CFO role from reporter to strategic advisor.

Succession, Transition, and Continuity

Succession and transition moments are another test. When a new CEO arrives, the CFO’s role becomes stabilizer and translator. They must earn trust quickly, and they must also anchor the new leader to fiscal reality. Great CFOs help the CEO understand board preferences, historic sensitivities, and financial commitments. They onboard the CEO not with dogma but with data. They ensure consistency in messaging, and they quietly guard continuity of insight. They preserve the bridge between board and management, ensuring strategy does not disconnect from feasibility.

CFOs also manage through transitions of their own. The strongest leaders do not leave without a playbook. They document reporting rhythms. They mentor successors. They preserve board relationships through the handoff. They ensure the board does not feel the loss of institutional memory. Because managing up includes managing departure. And doing so with professionalism signals the highest level of executive maturity.

Continuous Learning and Thought Leadership

Finally, elite CFOs maintain the board’s trust across cycles by showing they are always learning. They bring fresh insights from the investor community, capital markets, and rating agencies. They flag shifts in credit sentiment, ESG metrics, or digital finance standards before others do. They do not wait to be asked. They lead the board to issues that matter.

In one industrial company, the CFO hosted biannual Finance Horizon Briefings for the board, thirty-minute sessions on macro risk, cyber insurance, climate-linked bonds, or AI in financial planning. These sessions were optional. They were always full. Because the board saw the CFO not just as a controller but as a thought partner. This continuous education positioned the CFO as a strategic asset, not just a functional leader.

My certifications as a CPA, CMA, and CIA provide the technical foundation for board reporting. But what separates effective CFO-board relationships from transactional ones is not credentials alone. It is the discipline to prepare meticulously, the courage to surface bad news early, the judgment to frame decisions clearly, and the humility to build relationships authentically. It is understanding that boardroom dynamics are as much about psychology and timing as they are about spreadsheets and slides.

Conclusion

In every case, the most effective CFOs manage up not by asserting power but by elevating performance. They make the board better. They enable judgment. They de-risk decisions. And they do it not by overstepping but by showing up prepared, aligned, and clear. They leave no loose ends. They follow through without delay. They model the very discipline they expect the board to demand. Behind closed doors, boardroom confidence is the result of hundreds of unseen decisions. It is the product of how the CFO prepares, how they listen, how they respond, and how they lead without dominating. In those moments, the numbers matter, but the narrative wins. The detail is essential, but the judgment is decisive. And the CFO’s role becomes more than finance. It becomes institutional stewardship. The great CFOs know this. They do not chase headlines. They do not seek applause. They manage up quietly, competently, and completely. And in doing so, they help boards become sharper, faster, and better. Not with fanfare. But with results.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.