Executive Summary

The capital markets do not reward imagination. They reward coherence. And yet, every successful capital raise, every expansion round, every acquisition pitch is anchored not in spreadsheets but in stories. Stories that persuade. Stories that resonate. Stories that make risk feel like opportunity. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that for a CFO, shaping that story is not about spin. It is about truth, rendered with precision, structured with intent, and delivered with conviction. There is a myth that the CEO tells the story and the CFO validates it. In practice, the opposite is often true. Investors believe what the CFO embodies. Because the CFO speaks the language of constraint. When a CFO aligns with the story, it earns gravity. When they hesitate, the entire narrative wobbles. But credibility is not manufactured. It is built. Slowly, and then all at once.

Building Credibility Through Internal Alignment

Credible narratives begin with internal truth. Before speaking to investors, the CFO must ensure alignment across product, sales, operations, and finance. Not agreement, but clarity. Everyone must understand what the numbers actually say today, not what they might say under ideal conditions.

Investors do not expect perfection. They expect clarity.

When I secured forty million dollars in Series B funding and an eight million dollar credit facility at a nonprofit organization, we avoided hockey-stick projections. Instead, we presented consistent program expansion, declining cost per beneficiary, and improving impact metrics. We explicitly acknowledged dependency on foundation funding cycles and outlined a diversification strategy.

That transparency converted skepticism into commitment because investors saw that we understood our constraints as clearly as our opportunities.

The most persuasive CFO narratives acknowledge friction. They name bottlenecks. They explain sensitivity. A CFO who says, “Here is what happens if churn increases by one percent,” signals realism. Realism earns belief.

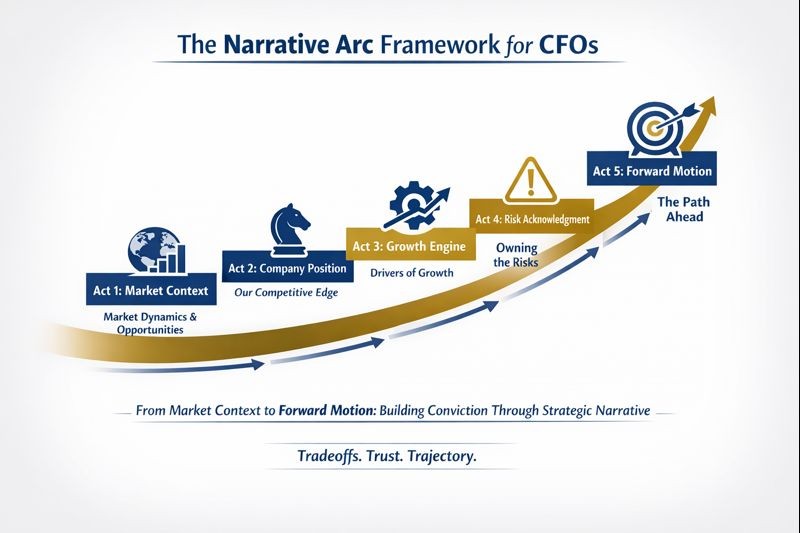

The Narrative Arc Framework

Data alone does not persuade. It must be assembled into arc. Strong CFO narratives follow a consistent structure, whether consciously or not.

Act 1: Market Context – Here is the market. What dynamics shape opportunity? What has changed? Numbers alone cannot answer these. They must be grounded in the landscape. Revenue means little without market size. Margin means less without competitive structure.

Act 2: Company Position – Here is our position. Where do we play within the market? What is our unique positioning? How have we earned the right to compete?

Act 3: Growth Engine – Here is our engine. What drives growth? Is it product adoption? Sales efficiency? Distribution leverage? Product velocity? Each company has its axis. That axis must be named and proven.

Act 4: Risk Acknowledgment – Here is our risk. This is the most neglected part of financial narratives. Volatility, framed correctly, builds trust. A CFO must name the uncertainties including customer concentration, regulatory exposure, dependency on channel partners, and product delays. Not to apologize but to own.

Act 5: Forward Motion – Here is our motion forward. The CFO must not only explain the present but forecast the arc. Forecasts, when narrative-aligned, are not guesses. They are commitments, bounded by assumption and stress-tested by scenario.

Conviction grows when the CFO explains tradeoffs. What was not done. What was deprioritized. Where the capital was withheld. What growth was sacrificed to build control. These decisions signal maturity. They show that the team understands cost of capital, not just in dollars but in time, in focus, and in dilution.

Designing the Narrative Framework

Numbers do not speak for themselves. They whisper possibilities. They hint at momentum. But they need voice, structure, and interpretation. The CFO’s role is not to merely report performance. It is to curate understanding. And understanding begins with narrative framework. Without it, even the best metrics fall flat, unmoored, uncontextualized, and unconvincing.

Transforming KPIs into Storylines

CAC becomes a signal of sales efficiency. Payback period becomes a vote on model health. Retention becomes proof of value delivery.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI, we did not present dashboards. We presented stories. Bookings showed demand validation. Utilization demonstrated delivery efficiency. Backlog signaled revenue visibility. ARR proved recurrence. Retention confirmed customer value.

Each metric advanced the argument. Too many metrics dilute belief. Too few invite suspicion. The CFO’s craft lies in curating signal, not displaying volume.

Internal Coherence

This entire structure rests on one principle: internal coherence. Every number must support the story. Every story must survive the numbers. If the growth narrative depends on expanding sales headcount, then the P&L must reflect that. If margin improvement is cited, then cost structure must show it. Disconnection between narrative and financials is the quickest path to investor skepticism.

Presentation matters too. Narrative frameworks are visual as well as verbal. Investors process pattern. CFOs who design clean dashboards, consistent charts, and focused decks reinforce signal. Too much data is noise. Too little is evasion. The art is in curating, elevating the metrics that matter and de-emphasizing what distracts.

CFO Narrative Framework Components

| Framework Element | Purpose | Key Components | Common Pitfalls |

| Market Context | Ground the opportunity | Market size, growth drivers, competitive dynamics, regulatory landscape | Too broad (unfocused), too narrow (ignores threats) |

| Company Position | Establish credibility | Market share, customer validation, competitive advantages, track record | Claiming leadership without proof, ignoring weaknesses |

| Growth Engine | Prove the model | Unit economics, customer acquisition, retention cohorts, sales efficiency | Conflating growth with profitability, hiding churn |

| Risk Acknowledgment | Build trust through transparency | Dependencies, concentration, execution risks, market uncertainties | Burying volatility, defensive framing, over-optimization |

| Forward Motion | Provide conviction | Investment thesis, capital deployment, milestones, scenario planning | Hockey-stick projections, vague plans, unrealistic assumptions |

| Financial Proof Points | Validate with data | CAC/LTV, gross margin, burn multiple, payback period, cash efficiency | Metric soup (too many), cherry-picking, inconsistency over time |

Delivery: Why CFO Presence Matters More Than Slides

Investors do not just hear narratives. They read CFOs. Voice, tone, pacing, and composure matter because they signal control. A CFO who can name weaknesses without apology and articulate strengths without bravado builds trust.

When fuel costs spiked twenty-two percent in one quarter at a logistics company I supported, I led the investor update by acknowledging the impact, quantifying exposure, outlining hedging actions, and detailing pricing adjustments already in motion. Confidence held because the tone signaled command, not crisis.

CEO-CFO Orchestration

Narratives fail when leadership overlaps or contradicts. The CEO and CFO must align on flow, not just facts. Who sets context. Who delivers evidence. Who handles risk. Investors notice hesitation, interruption, and misalignment instantly.

Sequencing matters. Context before numbers. Engine before risk. Strategy before forecast. Narrative flow determines interpretation.

Channel Adaptation

Channels amplify or diminish this effect. Investor days, earnings calls, fireside chats, webinars, and board updates each have their own rhythm. A quarterly earnings call requires tight pacing. An investor day allows for depth. A virtual pitch demands more visual clarity. The CFO must tailor tone and content to the medium. Reading slides verbatim in a live setting kills momentum. Overloading numbers in a short window causes fatigue. The delivery must adapt.

The Art of Q&A

This adaptability extends to follow-up. The Q&A is the most revealing part of any investor conversation. It is unscripted. Investors look for intellectual honesty. A CFO who hears a tough question and pauses, not out of confusion but to reflect, signals maturity. Rushing to answer often betrays fragility. The best answers are not defensive. They are framing devices: here is how we think about that question, followed by structured reasoning.

Body language is not trivial. Confidence is read in posture, in eye contact, in breath. A CFO who leans forward in hard questions, who keeps their composure under interruption, signals command. These signals matter more in volatile markets where investors crave not just upside but safety. The CFO becomes that signal.

Preparedness is the engine behind delivery. A CFO who rehearses, who runs mock Q&A, who internalizes key pivots in the story, who has tiered responses based on audience depth, this CFO arrives with presence. Presence is not charisma. It is control. It is the ability to steer a conversation without domination.

Sustaining Belief Over Time

Telling a good story is not the hard part. Sustaining belief in that story over time is. For a CFO, the narrative does not end when the raise closes or the earnings call concludes. That is when the real work begins. The market is not interested in one-time conviction. It looks for consistency. It watches how the story evolves. And most importantly, it notices when the story begins to break.

Continuity as Heartbeat

Continuity is the heartbeat of narrative credibility. Investors do not expect static performance. They expect strategic integrity. The CFO must become the custodian of this integrity, ensuring that what was said last quarter still frames what is said today, even if the metrics shift. The art lies in continuity, not repetition. Numbers change. Strategy adapts. But logic, tone, and discipline must stay.

One of the most common credibility traps is overcorrecting in response to volatility. When revenue dips or customer behavior shifts, some CFOs reframe aggressively. They pivot the narrative to new segments, new strategies, new KPIs. But constant repositioning signals drift. The best CFOs resist that impulse. They evolve the narrative without abandoning its core. They recontextualize. They acknowledge headwinds. But they link every change back to prior strategy.

Handling Underperformance

This is especially vital in moments of underperformance. How a CFO handles a miss defines their credibility. Avoidance kills trust. Spin breeds suspicion. The most respected CFOs name the miss clearly. They explain the causality. And they outline a path forward grounded in action, not excuse. They own the shortfall without overstating the recovery. Investors do not expect perfection. They expect accountability.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, we missed our initial six-month target by three weeks. Rather than obscure the delay, I presented the board with a detailed variance analysis showing where complexity exceeded estimates, what additional controls we added to protect quality, and the revised timeline with weekly milestones. Three months later we hit the target. The board’s confidence held because we had demonstrated accountability through transparency, not optimism through spin.

Internal-External Coherence

Narratives told externally must be lived internally. If a strategic pillar is emphasized with investors, it must appear in operating cadence. If a metric is highlighted externally, it must be visible internally. Narrative decay begins with internal inconsistency.

CFOs who reinforce narratives through letters, roundtables, and disciplined earnings calls build familiarity. Familiarity builds belief.

Crisis Reframing

Every narrative is eventually tested. In crisis, the CFO becomes the stabilizer. Not by minimizing disruption, but by contextualizing it. What remains true. What fundamentals still hold. Where discipline persists.

In volatility, investors look for leading indicators, not excuses. Cash burn. Pipeline conversion. Retention cohorts. Liquidity runway. These metrics must be elevated and framed as direction, not absolution.

If credibility is built in calm, the CFO is believed in crisis.

Conclusion

Over the long term, narrative stewardship means investing in the story itself. That means keeping the framework current, rehearsing delivery, and refining messages. But it also means building systems that produce truth on demand. Data quality, forecasting accuracy, and team alignment are not tactical. They are strategic. They enable belief. In the end, investors do not reward the best story. They reward the truest one. And the truest stories are not perfect. They are transparent, disciplined, and resilient. The CFO who tells that kind of story does more than secure capital. They earn the one thing markets value above all: enduring trust.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.