Executive Summary

In large, multi-entity organizations, there exists a quiet madness living just beneath the surface, an ecosystem of intercompany transactions so convoluted that nobody dare admit its depth. It is not fraud. It is not malfeasance. It is more insidious, the product of disconnected intent, misaligned processes, and a gradual erosion of clarity over time. The operating philosophy is simple: we will settle that later, they will figure it out, or it is only a small adjustment. Yet this benign neglect piles up into something far heavier, far more dangerous. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that most global finance executives will tell you our intercompany reconciliation is a two-week annual exercise ahead of the board meeting. Finance waves a magic wand and quietly posts a journal to clean it up. No one asks questions because the reconciliation process assumes it is always broken. That is the moment when the hidden mess becomes visible and frighteningly expensive. Adjustments skyrocket. Restatements become necessary. Cash flow forecasts are misaligned with operational reality.

Part I: Recognizing the Invisible Chaos

Imagine two subsidiaries of a global parent. Subsidiary A sells a software license to Subsidiary B based on usage, passes an invoice, records the revenue, and waits for the internal payment. But Subsidiary B is using a shared services team, and the invoice lands in a queue handled by a different shared services hub entirely. The invoice gets coded to a temporary general ledger account, awaiting analysis. Months later, in the midst of an audit or consolidation, the charge resurfaces, missing context, missing approvals, missing clarity. Meanwhile, the shared services team is attributing costs to the wrong project, leading to variance in profitability and cost allocation.

This is not hypothetical. The treasure trove of misclassification, unreported liabilities, and hidden cash flows lives in the parent’s balance sheet. Yet the conversation never changes until external auditors, regulators, or tax authorities mandate clarity. What triggered this failure? In most cases, it was not malice. It was scale and complexity without design.

Common Symptoms of Broken Intercompany Processes

- Unreconciled balances: Intercompany payables and receivables stacked month over month

- Cash flow surprises: Unexpected cash balances and delayed sign-offs

- Currency mismatches: Foreign exchange gain or loss surprises due to mismatched aging and inconsistent policies

- Reporting variances: Consolidated numbers do not align with entity profit and loss performance

- Close delays: Reconciliation becomes a two-week annual exercise rather than a real-time confirmation

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, intercompany reconciliation was one of the most challenging aspects. Each entity operated on different systems with varying close calendars, chart of account structures, and approval workflows. Without centralized governance and standardized processes, intercompany transactions became a monthly cleanup exercise rather than a controlled workflow.

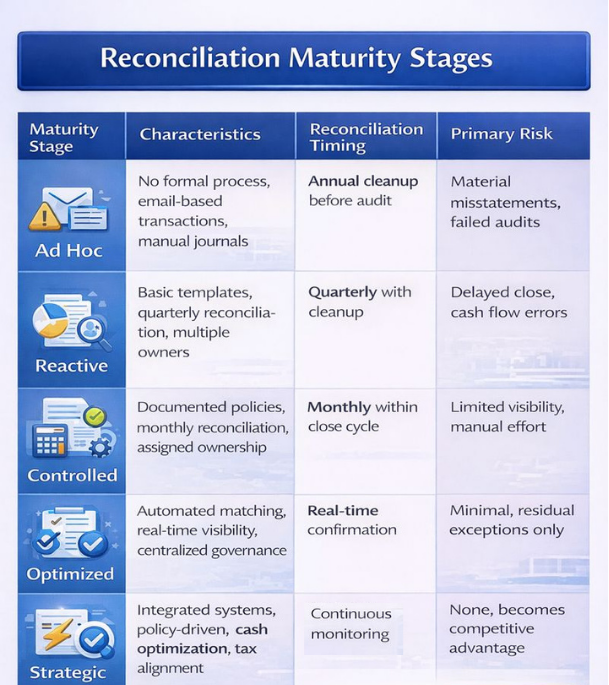

Intercompany Process Maturity Model

But the diagnosis is worse: these symptoms become normalized. They become just how we close. And that normalization spreads until the financial narrative is built on shifting sand. To begin fixing this, the first step is acknowledgment. No team wanted intercompany reconciliation days. No CFO would design an expense into November for reconciliation journals. But when everyone accepts the inefficiency, the system perpetuates itself.

Which means understanding scale: how many entities, jurisdictions, currencies, products, and customers drive intercompany flows? How many different chart of accounts exist? Are there shared services centers that are both internal vendors and cost centers? Are intercompany rates and margins documented and visible? What master data errors recur? What controls are in place and how often are they bypassed?

Part II: Designing a Strategic Intercompany Operating Model

Fixing broken intercompany processes starts not with accounting entries but with architecture. To design a strategic intercompany operating model, CFOs must think like system architects. Every financial movement between entities is not just an entry. It is a contract, a workflow, and an agreement on value. When those agreements lack formal governance, the rest of the finance function is left to mop up the ambiguity.

Governance: Assign Clear Ownership

The first component of the fix is governance. That starts with assigning clear ownership. In most companies, no one truly owns intercompany. Accounting books the entries, but operations initiate them. Treasury manages cash but does not always know which cash is owed where. Tax is focused on transfer pricing but not on transactional timing. Legal is concerned with compliance but not necessarily with systems design.

World-class companies appoint an Intercompany Controller or a Global Intercompany Process Owner. This person does not book entries. They govern process. They work with legal, tax, treasury, and operations to establish a consistent policy framework: what gets billed, how it is priced, who approves it, when it settles, and how it is tracked. They define acceptable timing windows, documentation standards, and escalation protocols. Most importantly, they create visibility across the lifecycle of an intercompany transaction.

Process Mapping: Standardize End-to-End

From governance flows process mapping. A mature intercompany process is one that is mapped from end to end. It starts at transaction initiation, when an entity provides engineering services or intellectual property to another, and flows through documentation, invoicing, entry, and reconciliation. Every touchpoint must be standardized. If Entity A is booking an intercompany receivable on Day 3 of close, Entity B must book the corresponding payable with matching attributes: general ledger code, counterparty reference, date, and foreign exchange rate.

Mature companies standardize these flows across all entities, regardless of geography. That means building process templates including what a software recharge looks like, what a logistics pass-through looks like, how a license agreement is booked. These templates reduce variability, train new hires faster, and allow automation to scale.

When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, intercompany configuration was critical. We established standard intercompany transaction types including service recharges, product transfers, royalty payments, and shared services allocations. Each type had defined approval workflows, pricing methodologies, and matching requirements. This standardization reduced reconciliation time by approximately 70 percent.

System Enablement: Build Interoperable Automation

Which brings us to system enablement. No amount of governance or process mapping will work if the systems infrastructure cannot support it. Many companies use different ERPs across their entities. Some use SAP and NetSuite in parallel. Others have legacy ERPs acquired through mergers and acquisitions that cannot speak to each other. In these environments, intercompany transactions are exported, emailed, and manually reconciled. Errors compound. Rework increases. And the cost of close rises.

To address this, the CFO must lead a cross-functional system assessment. The goal is not necessarily a single ERP but interoperable automation. Can systems pass intercompany entries between ledgers automatically? Are there common master data standards including vendor IDs, product SKUs, and currency codes? Is foreign exchange conversion happening at the right point in the workflow? Do journal entries include enough metadata for downstream audit traceability? Are eliminations during consolidation predictable and complete?

In high-performing organizations, intercompany systems are configured to mirror one another. A receivable booked in one entity automatically triggers a payable in the other, with identical reference fields. Timing mismatches are flagged. Exceptions are tracked in dashboards. This reduces month-end pressure and allows the close to move from investigation to confirmation.

Policy Enforcement: Document and Digitize Agreements

Alongside automation comes policy enforcement. Intercompany agreements must be digitized and stored in accessible repositories. Pricing must be based on transfer pricing documentation, not internal negotiation. Services should be cataloged and standardized. If you charge 3 percent on a treasury support fee, that rate should be documented, justified, and consistently applied. Tax authorities scrutinize intercompany recharges more than ever, and inconsistency is a red flag. The finance function must treat intercompany charges not as informal housekeeping but as contractually governed transactions.

Intercompany Performance Metrics

Leading organizations establish intercompany KPIs:

- Percentage of matched intercompany transactions at close

- Number of days to intercompany reconciliation

- Value of open intercompany balances over 30, 60, or 90 days

- Frequency of manual overrides or adjustments

- Percentage of transactions supported by documented intercompany agreements

These metrics are shared, tracked, and tied to performance. Teams that lag are supported, not blamed, but the visibility ensures accountability. Dashboards show trendlines. Leaders understand where breakdowns occur. Escalations are data-driven.

My certifications as a CPA, CMA, and CIA emphasize the internal control and audit discipline required for intercompany processes. But what separates mature finance organizations from reactive ones is treating intercompany not as an afterthought but as essential infrastructure, like cash management or tax compliance.

Part III: From Structural Liability to Strategic Asset

When an intercompany process works properly, no one notices. Transactions flow cleanly between legal entities. Month-end reconciliation becomes a confirmation step, not a detective mission. Cash movements between subsidiaries are scheduled and tracked. Eliminations during consolidation occur with no variance. But when that system breaks down, the damage is exponential. Broken intercompany processes corrode more than the books. They destabilize internal confidence, dilute decision-making quality, and introduce risk vectors that ripple from accounting to treasury to tax.

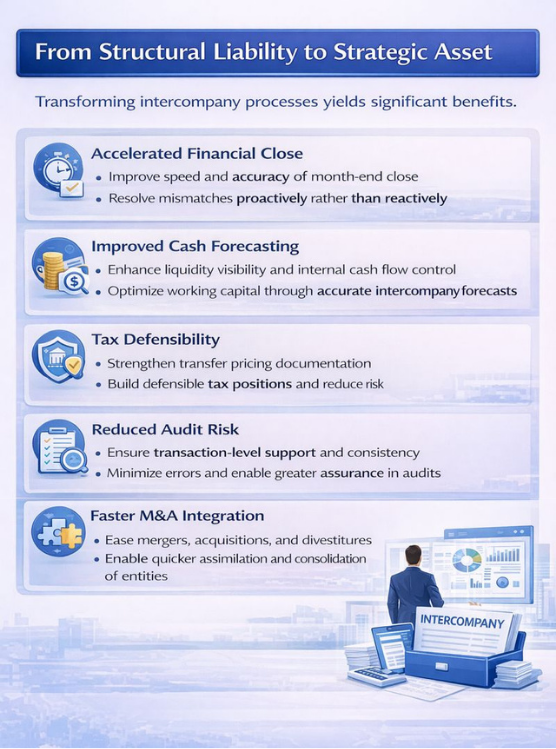

Fortunately, intercompany reform does not just fix problems. Done right, it becomes a strategic unlock. It improves operational integrity, enhances financial agility, and lays the foundation for more sophisticated enterprise decisions.

Accelerated Financial Close

For most companies with fragmented intercompany architecture, intercompany reconciliation is one of the biggest drivers of close delays. Month-end becomes a scramble of email chains, last-minute journal entries, and buried mismatches. Accounting teams book plug entries just to get the ledgers to tie. By contrast, companies that institutionalize clean intercompany processes find that the close accelerates. Transaction-level data is matched and verified before close begins. Teams spend their time confirming, not correcting.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, intercompany reconciliation was a major focus area. We implemented automated matching rules, established cutoff policies, and required transaction-level support documentation. The result was that intercompany became a real-time confirmation process rather than a month-end surprise.

Improved Cash Forecasting

Many companies treat intercompany cash flows as noise, either netted at the corporate level or ignored in subsidiary-level forecasts. But that neglect hides critical liquidity dynamics. A delayed intercompany settlement can shift a subsidiary’s cash runway by weeks. When intercompany processes are digitized and controlled, cash visibility improves dramatically. Treasury can see upcoming settlements, netting positions, and foreign exchange exposure. Forecasts incorporate internal flows with confidence. And the organization can optimize working capital by managing itself.

Tax Defensibility

Intercompany transactions are the heart of transfer pricing. If the documentation is weak, inconsistent, or nonexistent, the tax position becomes indefensible. Regulators across the globe are increasingly aggressive in challenging intercompany charges, particularly for services, intellectual property use, and royalty payments. By establishing policy-based intercompany charges tied to transfer pricing documentation and matched in both entities’ ledgers, companies build a defensible posture.

Reduced Audit Risk

Auditors scrutinize intercompany transactions precisely because they are prone to error and inconsistency. When a material mismatch is found, it triggers deeper testing, more samples, and more time spent. Clean intercompany processes reduce these risks. With transaction-level support, automated matching, and clear documentation, auditors can test with confidence. This improves relationships and reduces costs.

Faster M&A Integration

Perhaps the most strategic benefit comes during mergers and acquisitions integration. Acquiring or divesting entities is complex enough without broken intercompany mechanics. If the acquiring company has a mature intercompany architecture including defined policies, automated reconciliation, and centralized oversight, it can absorb or spin off entities with far less friction. A company with strong intercompany design can stand up or wind down legal entities quickly, repatriate cash with precision, and provide a clean financial story to stakeholders.

Conclusion

The CFO who leads intercompany transformation becomes more than a controller. They become a system designer, an architect of enterprise performance. They understand that financial clarity is not just a reporting requirement. It is a competitive advantage. Clean intercompany flows enable faster closes, better tax positioning, improved cash flow, and higher investor confidence. Fixing intercompany processes may never make headlines. But it is one of the quietest, most profound ways a CFO can upgrade the operating system of the enterprise.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.