Executive Summary

Accounting is the language of business. That famous Buffett quote does not just apply to earnings per share or free cash flow. It applies equally to the fine print most executives do not like to read. One of those chapters in the modern business dialect is lease accounting, and in the post-ASC 842 world, it is no longer just a footnote. It is front and center. What used to be buried in the back of the 10-K is now lighting up the balance sheet. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that how we treat lease accounting says more about our financial discipline and strategy than most realize. ASC 842, the updated lease accounting standard, may sound like a problem for the back office. But that would be a mistake. It is actually an opportunity for CFOs to think about how they allocate capital, manage risk, negotiate contracts, and communicate with stakeholders. And like all worthwhile opportunities in business, it is wrapped in complexity.

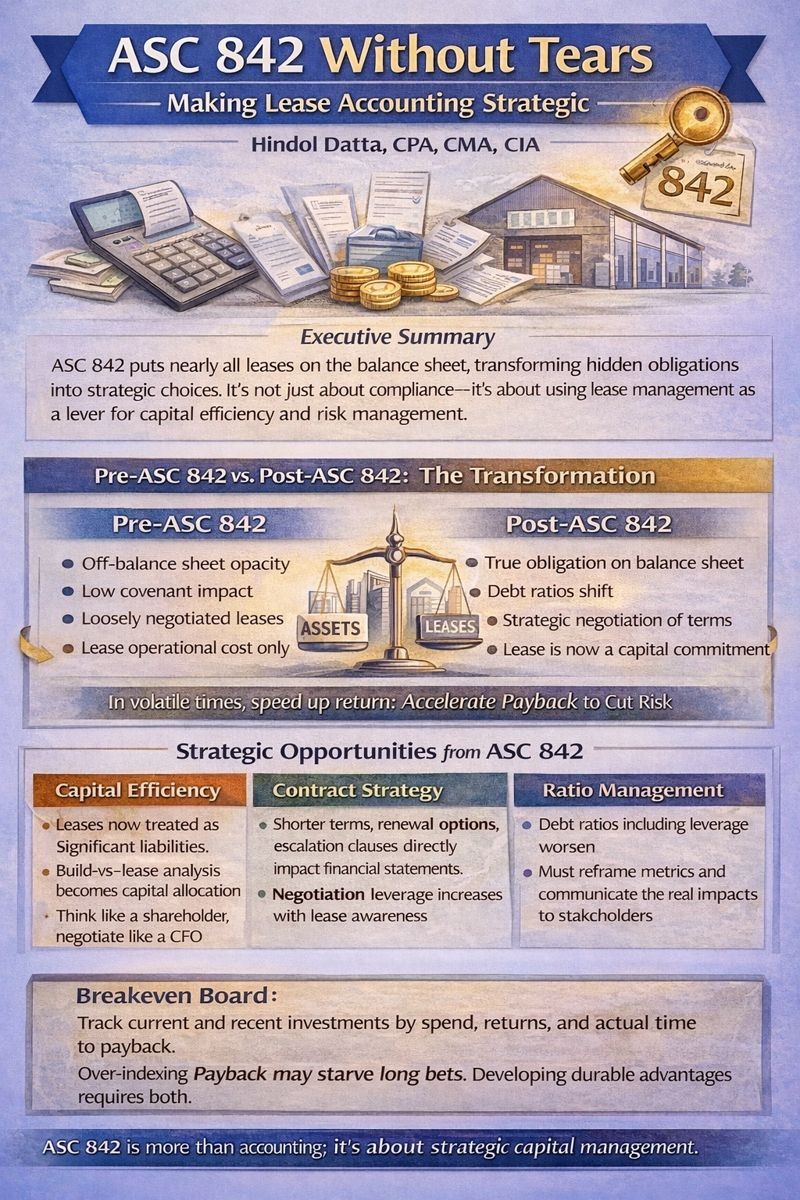

The ASC 842 Transformation

ASC 842 requires companies to recognize virtually all leases including operating and finance on the balance sheet. That means every copier, server rack, distribution center, or office floor under lease is not just a monthly line item anymore. It is a right-of-use asset with a corresponding lease liability. The balance sheet grows, the optics change, and if you are not careful, so does the narrative.

Before ASC 842, many operating leases were off-balance sheet, meaning companies could enjoy the benefits of using assets without formally disclosing the full economic obligation. This made financial ratios like return on assets, debt-to-equity, and EBITDA coverage look cleaner than they really were. Investors, lenders, and boards often had to piece together the lease commitments buried in the footnotes. That opacity is gone now. Regulators insisted on transparency, and the rules caught up.

Pre-ASC 842 versus Post-ASC 842

| Dimension | Pre-ASC 842 | Post-ASC 842 |

| Balance Sheet Treatment | Operating leases off-balance sheet | All leases on-balance sheet as ROU assets and liabilities |

| Transparency | Commitments in footnotes only | Full lease obligations visible |

| Financial Ratios | Artificially favorable (lower leverage, higher ROA) | Reflect true economic obligations |

| Capital Allocation | Build-buy-rent analysis often arbitrary | Lease vs. buy decisions require discounted cash flow rigor |

| Covenant Impact | Minimal | May trigger debt covenant recalibration |

| Strategic Focus | Lease as operational expense | Lease as capital allocation decision |

| Negotiation Priority | Price and flexibility | Terms, options, escalations (accounting impact) |

When I managed global finance for a $120 million logistics organization, we maintained significant warehouse and vehicle leases across multiple geographies. Under ASC 842, these leases materialized on the balance sheet as substantial right-of-use assets and liabilities. This required proactive communication with lenders to adjust debt covenant calculations and with the board to explain the impact on leverage ratios despite no change in underlying economics.

Strategic Opportunities from ASC 842

Capital Efficiency and Better Decision-Making

The real challenge is not compliance. It is making lease decisions strategic. Because once leases show up on the books, they affect how we think about capital allocation. That warehouse lease you inked for ten years at $100,000 a year? Under ASC 842, that is now a right-of-use asset and a lease liability of close to $850,000 sitting on your balance sheet, depending on discount rate. If your weighted average cost of capital is 9 percent and your lease implicit rate is 6 percent, the math alone tells you that strategic lease negotiations should become part of the CFO’s playbook, not delegated to procurement or facilities.

Negotiation Leverage and Contract Terms

Understanding how a lease will appear under ASC 842 allows companies to negotiate smarter. Shorter terms, renewal options, termination clauses, and escalation rates now have direct accounting and economic consequences. For example, embedded renewal options that are reasonably certain to be exercised must be included in the liability. This means clarity in lease language and flexibility in terms is not just operationally smart. It is financially strategic.

Ratio Management and Stakeholder Communication

When leases hit the balance sheet, they inflate liabilities. This means key ratios including debt-to-equity, leverage coverage, and asset turnover shift. For some companies, these changes trigger debt covenants, rating agency reviews, or shareholder questions. A thoughtful CFO gets ahead of this. They work with lenders, boards, and analysts to explain the impact, adjust metrics where needed, and craft a transparent narrative.

When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, ASC 842 compliance required configuring lease modules to track right-of-use assets, calculate lease liabilities using appropriate discount rates, and generate required disclosures. The system implementation forced discipline around lease data collection, contract centralization, and ongoing monitoring that improved overall lease portfolio management beyond just accounting compliance.

Portfolio Planning and Cross-Functional Collaboration

What is often missed is the planning value. When lease obligations were off-book, it was easy to sign a long-term lease and forget about it. ASC 842 forces a rethink. It demands that lease costs be included in capital plans, cash flow forecasts, and scenario models. This encourages CFOs and finance teams to review their real estate and equipment portfolio as a portfolio, not a patchwork.

The discipline of ASC 842 also improves collaboration. Facilities, legal, procurement, accounting, and financial planning and analysis now must coordinate. Lease decisions affect multiple dimensions: cash, tax, optics, compliance, and operations. A company that gets this right uses the rule as a bridge, connecting functions that might otherwise stay siloed.

Technology and Analytics Advantages

Implementing ASC 842 properly almost always requires systems investment, whether in ERP modules, lease administration software, or data architecture. Once the infrastructure is in place, it opens the door to deeper analytics: lease benchmarking, utilization metrics, cost per square foot, contract duration trends. These are not just compliance outputs. They are decision inputs. CFOs can use them to evaluate location strategy, vendor performance, and cost takeout plans.

My certifications as a CPA, CMA, and CIA emphasize the technical accounting rigor required for ASC 842 implementation. But what separates strategic finance leaders from reactive ones is the ability to see beyond compliance. The best CFOs use ASC 842 as a forcing function to improve lease portfolio management, negotiate better terms, align cross-functional teams, and make capital allocation decisions with greater discipline.

Conclusion

ASC 842 has turned leasing into capital allocation by another name. That is not a burden. It is an upgrade. It means the CFO now has a broader canvas, one that includes not just how capital is raised or deployed but how it is contracted and committed. And in volatile markets, that ability to design flexibility into commitments is pure gold. Lease accounting is no longer a sleepy appendix in the annual report. It is a financial policy signal. It is a systems test. It is a cultural pulse check. And for the CFOs who treat it not just as accounting but as strategy, it becomes something even more powerful: a source of clarity in a complex capital environment.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.