Executive Summary

There is a kind of magic trick in SaaS accounting. One that makes a business look like it is sprinting toward the horizon, throwing off healthy top-line growth and long-term customer value. Investors cheer, boards nod approvingly, and founders high-five each other over celebratory forecasts. But beneath the surface of that hockey stick, a quieter and more stubborn reality lives, a reality shaped not by promises or bookings or even cash, but by something far more arcane: how revenue is actually recognized. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that for anyone operating, leading, or investing in a software company, the distinction between booked revenue, cash collected, and revenue recognized is not just semantics. It is the foundation upon which decisions are made, bonuses are paid, covenants are met, and valuations are set. In SaaS, more than in perhaps any other industry, revenue is a mirage until it is properly tamed. And that taming, governed by ASC 606 and the five-step framework it mandates, is anything but trivial.

Part I: The Illusion of Momentum

We live in a world where most SaaS companies front-load their sales effort, backload their delivery, and recognize revenue somewhere in between. A sales rep closes a three-year deal and celebrates a $2.4 million win. But the company cannot call it revenue, not yet. Because under GAAP, revenue must not only be earned but delivered, and delivery in the SaaS world is a continuous performance obligation stretched over time.

This creates tension. Sales operates in bookings. Finance operates in revenue. Cash operates in collections. And between the three, confusion thrives. It is not unusual to see a SaaS startup with meteoric bookings growth and flat revenue. Or worse, strong collections and weak margin, all because of misalignment in how deals are structured and how those structures get accounted for.

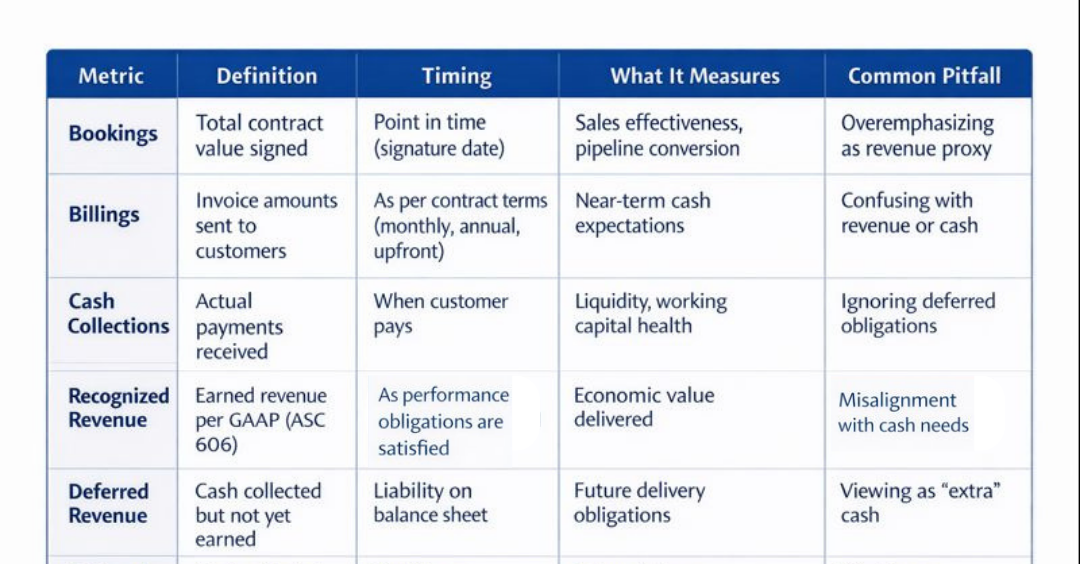

Revenue Metrics Comparison Framework

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, one of the most critical challenges was establishing clear definitions and tracking mechanisms for each of these metrics. Sales leadership celebrated bookings. The board wanted to understand revenue recognition patterns. Investors focused on billings as a leading indicator. And operations needed cash flow projections. Without disciplined tracking and communication of how these metrics relate, strategic decisions become misaligned with economic reality.

The essence of the SaaS RevRec puzzle lies in three truths:

First, software is not a single-point product. It is an ongoing service, a bundle of rights and obligations that must be unbundled and measured over time.

Second, most SaaS contracts do not neatly fit the textbook model. They contain discounts, renewals, variable usage, professional services, onboarding credits, and performance triggers, each of which adds layers to the recognition policy.

Third, compliance is not optional. With ASC 606 now firmly in place, and public market scrutiny higher than ever, RevRec errors are not just restatable. They are reputation-killers. More than a few companies have watched their IPO ambitions stall because revenue was misrecognized by a quarter or two or twelve.

Part II: The ASC 606 Five-Step Framework

ASC 606 was designed with admirable intentions. It was meant to create consistency across industries, simplify revenue recognition principles, and eliminate the patchwork of industry-specific rules that had developed over decades. But in doing so, it introduced a five-step framework that, while elegant in theory, becomes murky the moment it intersects with the real-world contract structures of high-growth SaaS companies.

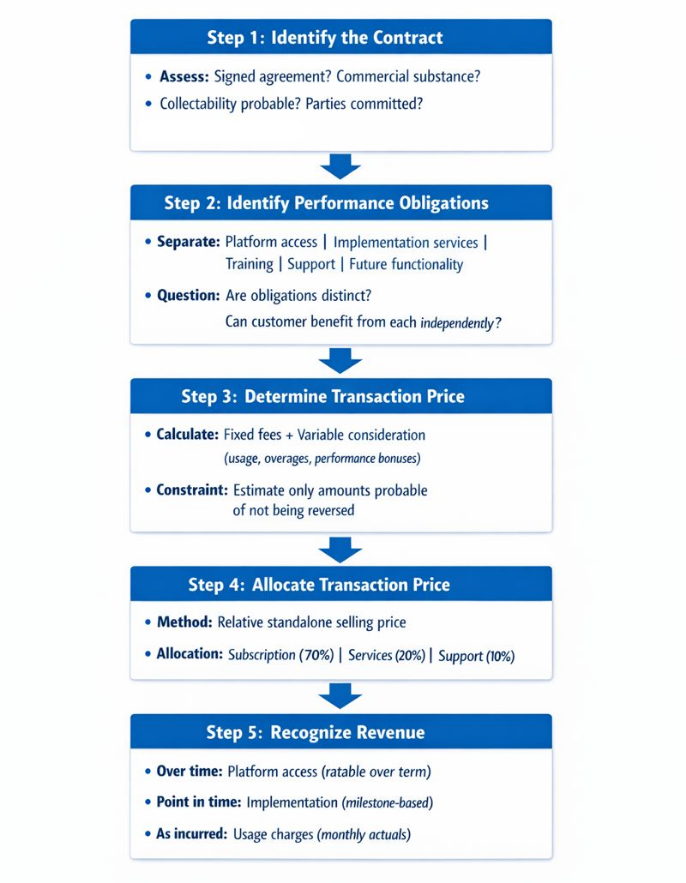

ASC 606 Five-Step Revenue Recognition Process

This flowchart illustrates the systematic process SaaS companies must follow under ASC 606. Each step involves critical judgment and cross-functional coordination. The flowchart demonstrates how a single contract flows through identification, obligation separation, pricing determination, allocation, and finally recognition with different timing patterns for different elements.

Step 1: Identify the Contract with the Customer

The first step seems straightforward but this is where many companies already begin to wobble. In software, the contract can take many forms including a signed agreement, a purchase order, a master services agreement bundled with scopes of work, or even an online clickthrough. Sometimes the customer is a direct buyer, other times a reseller or channel partner, and occasionally the final user is not even named at the time of sale.

Step 2: Identify Performance Obligations

More treacherous still is identifying performance obligations. In other words, what exactly has the company promised to deliver, and in what form is that promise distinct? In a straightforward SaaS arrangement, there may be a clean-cut subscription to a platform with delivery of access over a twelve-month term. But what happens when implementation services are included? Or when the customer receives free onboarding support, training modules, or integration assistance?

These questions are not idle. Each answer carries consequences for timing. If implementation is necessary for the customer to receive any value from the platform, and no other vendor could reasonably provide the same service, the two may need to be bundled into a single performance obligation. That means revenue cannot be recognized for either until the entire unit is fulfilled.

When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, revenue recognition configuration was critical. We had to map each product and service offering to appropriate recognition rules, establish standalone selling prices, and build automated allocation logic. Without proper system configuration, manual intervention becomes unsustainable at scale.

Step 3: Determine the Transaction Price

Rarely is the transaction price as simple as a flat annual fee. The modern SaaS contract often includes a fixed base fee, usage-based charges, overage tiers, discounts, promotional credits, and sometimes noncash consideration such as free months or extended trials. Some agreements contain performance incentives or penalties tied to uptime, migration deadlines, or business outcomes.

All of this must be rolled up into an estimated price that reflects the company’s best judgment about what will ultimately be earned. Variable consideration, a topic of increasing regulatory attention, must be estimated with rigor and constrained conservatively. It is not enough to model a best-case scenario and hope for realization. Instead, finance teams must ask what amount is probable of not being reversed, applying techniques such as expected value or the most likely amount.

Step 4: Allocate the Transaction Price

From here, the company must allocate the total transaction price across its performance obligations. This requires determining the relative standalone selling price of each component. The process is not always scientific. If the company sells subscriptions for $100,000 and services for $25,000 but bundles them for $110,000, the allocation must respect the ratio implied by the standalone prices, not the nominal contracted amounts.

Step 5: Recognize Revenue

Finally, we arrive at the moment of recognition, the precise point when revenue is booked to the income statement. In SaaS, the default model is ratable recognition over the contract term, assuming access to the software is even and continuous. But not all elements fit this mold:

- Professional services: May be recognized over time if delivery is progress-based, or at a point in time if tied to specific milestones

- Usage-based charges: Typically recognized as incurred

- Support services: May align with the subscription term or may need separate tracking

- Embedded options: Such as rights to future discounts or renewals, may alter the recognition profile

This is the puzzle. It is never quite finished. Every new product feature, pricing experiment, go-to-market shift, or contractual incentive adds a layer.

Part III: Systems, Scale, and Operational Backbone

By the time a SaaS company reaches its second or third year of growth, the revenue engine is no longer just an idea on a pitch deck. It is a living system. Bookings accumulate, contracts proliferate, renewals kick in, churn lurks, upsells spike unpredictably, and discounting becomes both art and necessity. If revenue recognition in the early stage feels like fitting puzzle pieces by hand, scaling that function across hundreds or thousands of customers is more like assembling a plane mid-flight.

Common RevRec System Failure Points

System Fragmentation:

- Sales uses CRM platform to generate quotes

- Legal tracks contracts in shared drives

- Billing is handled through payment processor or ERP module not designed for SaaS

- Finance runs revenue recognition on Excel spreadsheets maintained by single analyst

Consequences:

- Visibility is fractured

- Data integrity is inconsistent

- Compliance is precarious

- Audit readiness is compromised

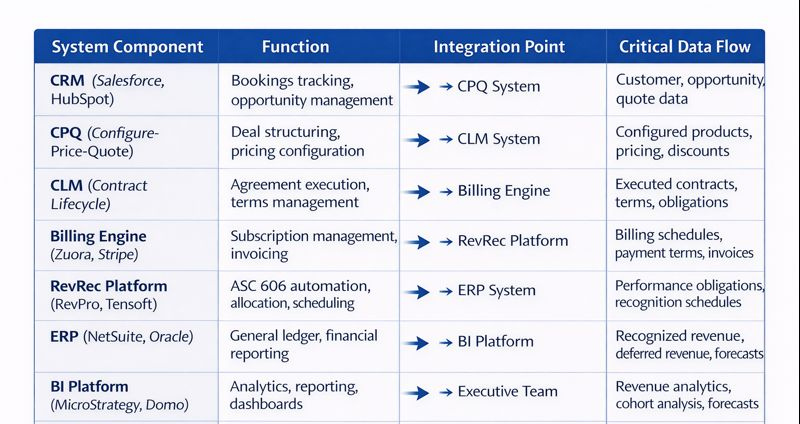

Integrated Revenue Stack Architecture

A well-integrated revenue stack typically includes a CRM for bookings, a CPQ system for pricing configuration, a contract lifecycle management tool for agreement execution, a billing engine for subscription management, and a RevRec automation platform that sits on top of the ERP. These systems must not only speak to each other but share a single source of economic truth, one that is GAAP-compliant, audit-ready, and updated in real time.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the integration between revenue recognition systems and business intelligence platforms was critical. Leadership needed to understand not just how much revenue was being recognized but how it mapped to customer cohorts, product lines, geographies, and channels.

Building RevRec Discipline at Scale

Change Control: Finance must be at the table not after the deal is signed but before it is finalized. Great finance leaders help design commercial structures that drive flexibility for the customer while preserving accounting clarity for the business.

Documentation: As revenue policies evolve, they must be codified in a RevRec manual that internal and external auditors can reference. A well-maintained revenue policy is not just a compliance asset. It is a competitive one. It reduces audit friction, accelerates diligence, and signals maturity to investors.

Cross-Functional Alignment: The companies that get RevRec right do not treat it as a quarterly ritual or a last-mile accounting process. They treat it as a core function of commercial architecture:

- Legal and sales align on standardized templates that reflect clean obligation structures

- Systems are implemented to tag, track, and allocate revenue automatically

- Reporting tools distinguish between bookings, billings, cash, and recognized revenue

- The broader organization is educated on how revenue flows

Part IV: From Numbers to Narrative

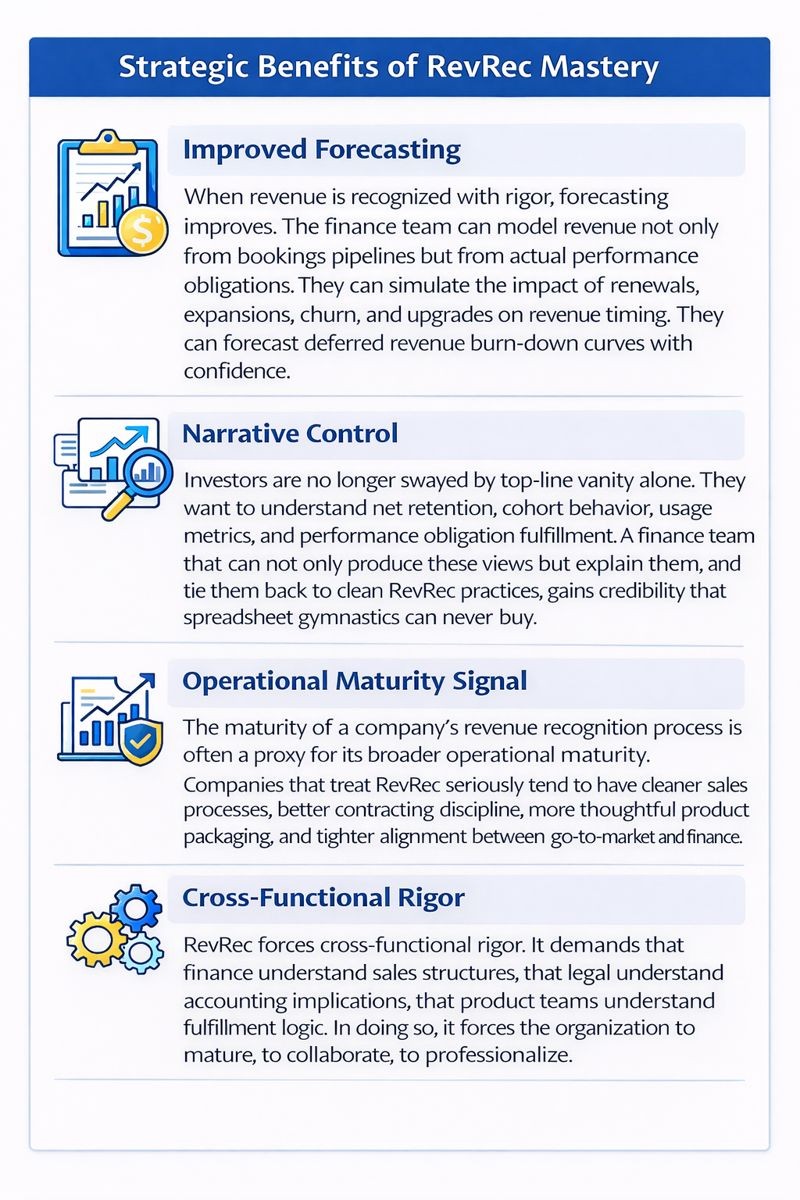

At some point in the life of every SaaS company, the conversation around revenue shifts. It stops being a back-office exercise or a quarterly scramble and becomes something bigger, a narrative. The revenue line is no longer just a number on the profit and loss statement. It is the single most scrutinized proxy for the company’s health, momentum, and credibility.

When revenue is recognized correctly, aligned to delivery, governed by policy, and supported by systems, it tells a story that is both optimistic and grounded. It builds trust. It gives investors a clear view of the company’s ability to fulfill its promises. It enables leadership to communicate growth not as an aspiration but as a trajectory with evidence.

My certifications as a CPA, CMA, and CIA emphasize the technical rigor required for revenue recognition. But what separates successful SaaS companies is not just technical compliance. It is the ability to build systems that scale, policies that adapt, and narratives that resonate with stakeholders while maintaining absolute fidelity to economic substance over legal form.

Conclusion

Revenue is not cash. It is not bookings. It is not momentum. But in its most rigorous form, revenue is something even more powerful. It is truth. And in an industry driven by scale, growth, and ambition, truth is the most valuable currency of all. The SaaS RevRec puzzle is not merely an accounting challenge, nor a systems implementation, nor a compliance hurdle. It is a mirror. It shows a company who it really is, how it sells, how it fulfills, how it promises, and how it performs. And if that reflection is clear, disciplined, and consistent, then the company does not just have a strong revenue model. It has a strong business.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.