Executive Summary

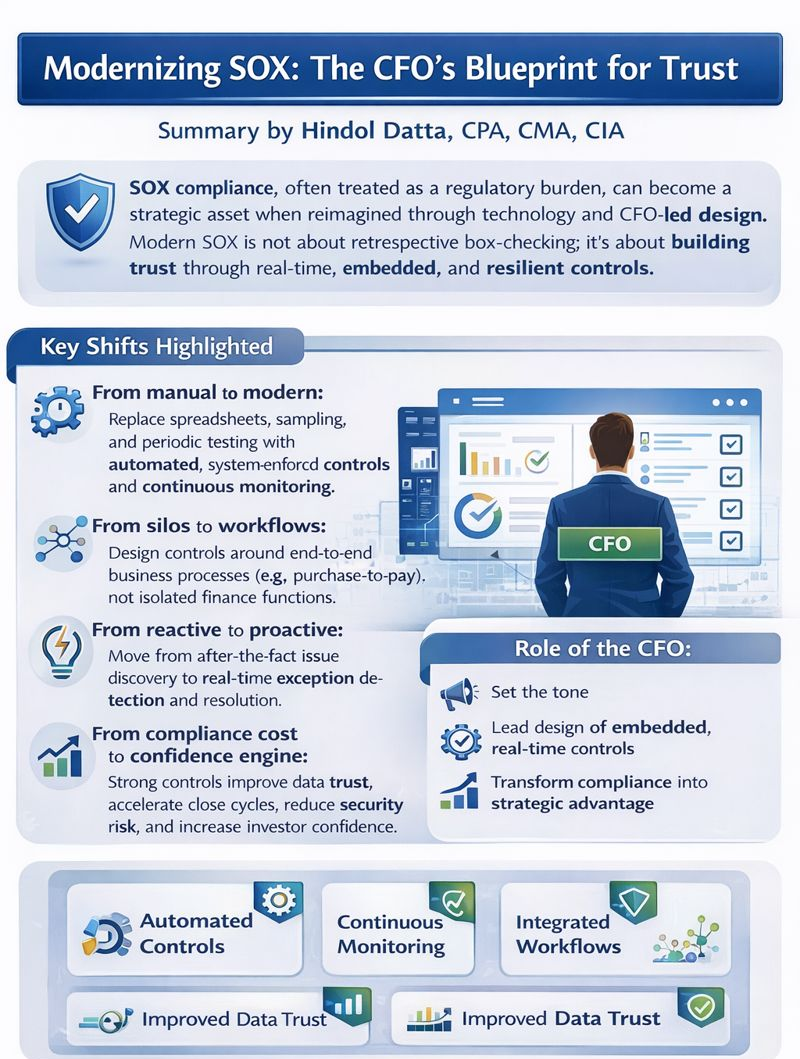

If you were to assemble a list of the least glamorous aspects of the CFO’s remit, Sarbanes-Oxley compliance would likely rank near the top. It evokes images of checklists, control matrices, quarterly certifications, and audit fatigue. For many finance leaders, it is a necessary burden, an expense to be endured for the privilege of remaining publicly traded. Yet beneath the surface of this regulatory obligation lies a quiet opportunity. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that when SOX is approached not as a defensive perimeter but as an operational asset, it becomes something far more powerful: a blueprint for trust. The smartest CFOs do not view SOX as a cage. They see it as a chassis. A structure upon which to build durable controls, scale responsibly, and most critically, turn compliance into confidence. And the lever to unlock that potential is technology. Not just automation for the sake of efficiency, but thoughtful integration of tools that raise visibility, reduce risk, and enable faster, smarter decisions.

From Manual to Modern

Let us start with a reminder of why SOX exists. Born from the ashes of Enron and WorldCom, the Sarbanes-Oxley Act was designed to restore faith in financial reporting. It demanded that executives personally attest to the accuracy of their filings and instituted a framework, specifically Section 404, to ensure that internal controls over financial reporting were not only documented but tested and auditable. But that was 2002. In the years since, business has changed dramatically. Transactions are now digital. Revenue streams are more complex. Organizations are more distributed. Finance teams rely on a mosaic of cloud systems, each generating its own data and risks. And yet, many SOX programs still run on the same manual spreadsheets, tick-and-tie procedures, and backward-looking testing cycles of two decades ago.

Traditional versus Modern SOX Approach

| Aspect | Traditional SOX | Modern SOX |

| User Access Reviews | Quarterly manual reviews via CSV exports and email | Real-time IAM integration with automated exception alerts |

| Transaction Monitoring | After-the-fact sampling of small transaction subsets | Continuous monitoring of 100% of transactions with algorithmic flagging |

| Documentation | Manual compilation of screen captures and approval logs | Automated immutable audit logs linked to control frameworks |

| Controls Architecture | Functional silos (AP, AR, Payroll separate) | Workflow-based end-to-end process controls |

| Testing Cycle | Annual or quarterly retrospective testing | Continuous real-time control validation |

| Risk Response | Reactive issue remediation | Proactive exception management |

This is where modern technology enters the picture, and why the CFO must take the lead. Because while the Chief Audit Executive may own the controls library and the external auditor may opine on design and effectiveness, it is the CFO who sets the tone. The CFO determines whether compliance is reactive or proactive, whether it is a cost center or a source of assurance, whether controls are bolted on or built in.

When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, SOX compliance was a critical consideration. We designed system configurations with built-in segregation of duties, automated approval workflows, and comprehensive audit trails. Role-based access controls were enforced at the system level, not through manual oversight. This reduced our control testing burden by approximately 60 percent while actually improving control effectiveness.

Automation and Continuous Monitoring

Modernizing SOX starts with automation. Controls that rely on manual approvals, ad hoc emails, or paper-based sign-offs are not only inefficient, they are brittle. They break under pressure, fail to scale, and introduce human error at the worst moments. By contrast, automated controls such as system-enforced segregation of duties, real-time exception alerts, and integrated approval workflows are faster, more consistent, and more auditable.

Take user access reviews, for instance. In a traditional SOX environment, these are performed quarterly, often manually, through exported CSV files and email chains. In a modern environment, identity and access management tools integrated with ERP systems can flag anomalous access in real time, log all changes, and trigger certifications through automated workflows. The result is not only better compliance but better security.

Another ripe area is transaction monitoring. In a traditional model, control testing happens after the fact, often by sampling a small subset of transactions. But with modern data platforms and analytics, companies can move to continuous controls monitoring. This means applying algorithms to 100 percent of journal entries, vendor payments, or revenue recognitions, flagging exceptions based on defined thresholds and patterns. Not only does this catch issues earlier, but it allows finance leaders to focus on root causes, not just symptoms.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, we implemented automated variance analysis and exception reporting. Material variances triggered workflow alerts to responsible managers. This created a continuous control environment where issues were identified and resolved during the month, not discovered during close. The same principles apply to SOX controls, where continuous monitoring prevents issues rather than just detecting them after the fact.

Rethinking Controls Architecture

But perhaps the most transformative shift comes from rethinking controls architecture itself. Traditionally, controls are built functionally, one for accounts payable, another for accounts receivable, another for payroll. But modern finance systems enable controls to be designed around workflows. For instance, a purchase-to-pay process can have embedded controls at initiation, approval, invoice matching, and payment release, all tracked end-to-end in a single system. This reduces handoffs, improves traceability, and aligns controls with how the business actually operates.

This is critical because the greatest risk to compliance is not bad actors, it is broken processes. Controls fail when workflows are fragmented, when systems do not talk to each other, or when responsibilities are unclear. Technology allows CFOs to close those gaps, to integrate finance, procurement, HR, and IT into a cohesive control environment, to see the full picture, not just isolated snapshots.

Of course, modernization is not just about tools. It is about mindset. A modern SOX program is not owned by audit, it is embedded across the enterprise. It is not an annual fire drill, it is a continuous discipline. And it is not about saying no, it is about enabling the business to move fast without breaking trust. That is the opportunity for the CFO. To lead a culture where controls are seen not as constraints but as commitments, where compliance is not the floor but the foundation.

Strategic Benefits Beyond Compliance

And the payoff? It goes beyond clean audits. A modern SOX program improves decision-making. When controls are real-time, finance teams can trust the data they use. When workflows are instrumented, issues can be resolved before they escalate. When access is governed, security incidents drop. And when compliance becomes part of the product build, risk is managed upstream. It also enhances investor confidence. Boards, auditors, and capital providers increasingly expect internal controls to be not only effective but resilient. A CFO who can articulate how technology supports control assurance demonstrates maturity. And maturity attracts capital.

My certifications as a CPA, CMA, and CIA emphasize the importance of internal controls and governance. But what transforms compliance from burden to asset is leadership that views controls as enablers rather than constraints, that invests in systems that make compliance continuous rather than periodic, and that embeds control discipline into organizational culture.

Conclusion

The future of SOX is real-time, integrated, and data-driven. The companies that get there first will not only reduce risk. They will run faster. They will empower teams. And they will build trust with every transaction. Because in the end, compliance is not just about avoiding failure. It is about enabling freedom, the freedom to grow, to scale, to innovate, knowing that the foundation is strong. And that is a responsibility, and opportunity, only the CFO can lead.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.