Executive Summary

If finance were a theater, the treasury function would be the quiet orchestra pit. Essential to the performance, but rarely in the spotlight. It hums in the background, tuning instruments like cash flow, foreign exchange exposure, liquidity buffers, and working capital cycles, while the main cast plays out revenue, EBITDA, and valuation on center stage. But in today’s global, volatile, and fast-moving world, that model is not just outdated, it is dangerous. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the modern CFO must no longer treat treasury as a compliance function or a place to park excess cash. Treasury must become strategic, an engine of foresight, resilience, and value creation. The smartest companies are not just managing cash. They are architecting the flows of capital in ways that support speed, scalability, and risk-adjusted return. They are reinventing treasury as a control tower, not a ledger.

From Compliance to Strategic Control

To understand this shift, it helps to start with the classic view of treasury. Traditionally, treasury teams focused on four pillars: managing cash balances, projecting short-term liquidity, executing payments, and hedging foreign exchange and interest rate risk. These were and remain essential responsibilities. But they operated largely in a vacuum, often detached from the rhythm of commercial operations. They ensured solvency but rarely shaped strategy. That is no longer enough. In markets defined by supply chain shocks, interest rate swings, geopolitical uncertainty, and rising capital costs, the companies that thrive are those that make money move faster, cheaper, and smarter.

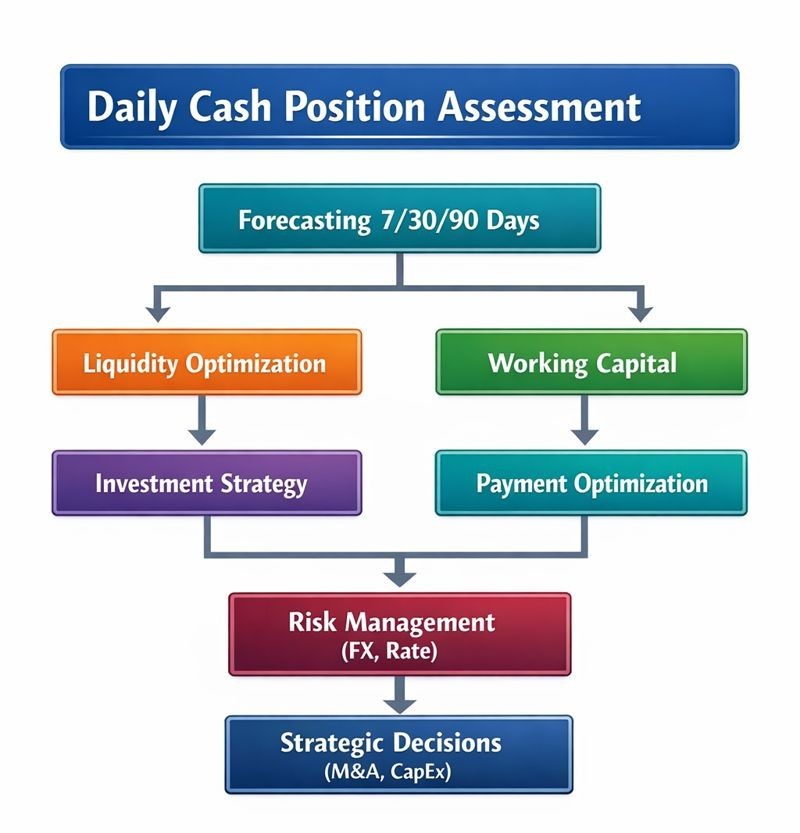

Strategic Treasury Decision Flow

Time Arbitrage and Yield Optimization

Let us start with the first, and perhaps most underappreciated, role of treasury in a modern company: time arbitrage. Cash is not just a store of value. It is a resource with time sensitivity. When you collect faster than you spend, you generate working capital leverage. When you defer payments without damaging relationships, you build runway. When you forecast with precision and automate sweeps, you earn basis points that compound into real margin. In volatile rate environments, treasury becomes not just a custodian but a yield manager.

Consider what happens when interest rates rise from near-zero to five percent. Suddenly, idle cash has a cost of opportunity. A well-run treasury can generate millions in interest income simply by laddering deposits, using money market instruments, or leveraging short-term government bonds. But more importantly, treasury can avoid the hidden cost of float, money tied up in disconnected accounts, cross-border friction, or settlement delays. When I managed global finance for a $120 million logistics organization, we implemented a treasury management system that automatically swept excess cash from operating accounts into higher-yielding instruments overnight. This generated over $500,000 in additional annual interest income, money that had previously sat idle in checking accounts.

Global Operations and Currency Risk

That leads us to treasury’s role in operational agility. In global businesses, currency risk and liquidity mismatches are real threats to growth. A contract signed in euros, a supplier paid in rupees, a customer billed in yen, each introduces risk and complexity. A strategic treasury team does not just hedge exposures after the fact. It builds natural hedges into operations. It matches costs and revenues in local currencies. It creates offshore liquidity pools. It monitors central bank policies. It turns foreign exchange from a speculative guess into a managed variable.

The same logic applies to capital deployment. Many companies suffer from capital mismatch. They fund long-term assets with short-term cash, or hold excess reserves in regions where cash is trapped. Strategic treasury maps capital structure to strategy. It considers whether that new facility should be leased or owned, whether that acquisition should be debt-funded or equity-dilutive, whether local lines of credit offer better tax treatment than upstreaming cash. These are not abstract trade-offs. They are decisions that shape return on invested capital and enterprise value.

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, treasury management became critical. We established local currency accounts in each region, matched revenue and expenses within currency zones where possible, and used forward contracts only for exposures that could not be naturally hedged. This approach reduced our foreign exchange hedging costs by 40 percent while providing better protection against currency volatility.

Data Intelligence and Predictive Analytics

But to make these decisions, treasury must become data fluent. Gone are the days when treasury relied solely on static reports and manual spreadsheets. Today’s treasury needs real-time dashboards, predictive analytics, and scenario modeling. Treasury should know, at any given moment, not just what the cash position is but what it will be in a week, a month, a quarter, under multiple scenarios. This is not just forecasting. It is operational intelligence.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we integrated treasury metrics including daily cash position, forecast accuracy, days sales outstanding, days payable outstanding, and cash conversion cycle. This visibility allowed proactive decision-making rather than reactive crisis management. And the CFO must lead here. That means investing in treasury technology, treasury management system platforms, API integrations with banking partners, and machine learning models for cash flow patterns.

Customer and Supplier Optimization

One of the greatest missed opportunities in treasury is its role in customer experience. Take payments. Every friction in the payment flow, be it onboarding, invoicing, settlement, or reconciliation, affects customer satisfaction. A strategic treasury function works hand-in-hand with sales operations, product, and customer success to optimize payment terms, methods, and timing. It helps reduce churn. It frees up capital for both parties. It becomes a tool for retention, not just recovery.

On the other side of the equation is supplier management. Treasury should be deeply involved in vendor terms, payment cycles, and early payment discounts. In many companies, millions are left on the table simply because finance and procurement do not coordinate payment strategies. A strategic treasury function turns accounts payable into a profit center, not by delaying payments irresponsibly but by optimizing for cash flow health, supplier resilience, and strategic partnerships. When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, treasury played a critical role. We renegotiated payment terms with key vendors, took advantage of early payment discounts where they exceeded our cost of capital, and optimized the timing of cash outflows to match inflows more precisely.

Conclusion

The future of treasury is autonomous, integrated, predictive, and strategic. Treasury is no longer just the engine room. It is becoming the radar. And in uncertain seas, it is the difference between steering with confidence and drifting with hope. The CFO who understands this does not just upgrade treasury systems. They rethink the role entirely. They turn it from a back-office function into a front-line force. Because in business, as in life, it is not just how much cash you have. It is how you use it. And the companies that use it best are those where treasury does not follow the business. It fuels it.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.