Executive Summary

In difficult times, it is easy for a company to react by slashing costs indiscriminately, raising eyebrows among employees, unsettling investors, and dimming the light of innovation. Decisions born from panic rarely result in sustainable improvements. True leadership demands something rarer: the wisdom to balance prudence and principle, to remove excess without damaging the spirit, to honor the human side of business even as we strengthen its financial spine. Cost reduction is a necessary tool for long-term value creation. It is not an admission of defeat but a commitment to discipline. Yet when wielded carelessly, cost cuts can fracture trust, erode morale, and stunt growth. The fundamental challenge for any CFO or CEO is to distinguish between costs that are dilutive drains and those that are strategic investments, then remove the former while preserving the latter. This is not just a finance exercise. It is a values exercise. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that intelligent cost reduction is neither simplistic nor cruel. It requires clarity of purpose, rigor in process, and above all, respect for the people who bring the strategy to life.

The Foundation: Why Culture Matters in Cost Planning

Every business is a collection of human stories, systems, and aspirations. Profit is not just a number. It is oxygen for investment, growth, and entrepreneurship. When profits erode, organizations must act. The temptation, then, is to turn cost cutting into a game of targeting headcount, travel, and perks indiscriminately. But if you target the wrong categories, you chip away at equity including equity of trust, equity of identity, and equity of shared ambition.

Imagine two companies. One reduces travel budgets by half, cuts employee development, and slashes perks with no context. The other clearly states we are tightening our belt, but this is how much each function can reduce, what we value most, and here is how we will spend what remains. One gets hostility, one gets cooperation. The difference lies not in the dollars but in the dialogue. Leaders must remember that culture is built through action, not memos. Everyone notices decisions, not slogans. If leaders model intentionality by sharing the why, seeking feedback, and acknowledging impact, then cost discipline becomes stewardship, not austerity.

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, we faced pressure to reduce administrative overhead. Rather than making uniform cuts across all entities, we analyzed which functions created strategic value and which were duplicative. We consolidated back-office operations while preserving customer-facing capabilities. The result was 25 percent cost reduction without impacting service delivery or employee morale in core teams.

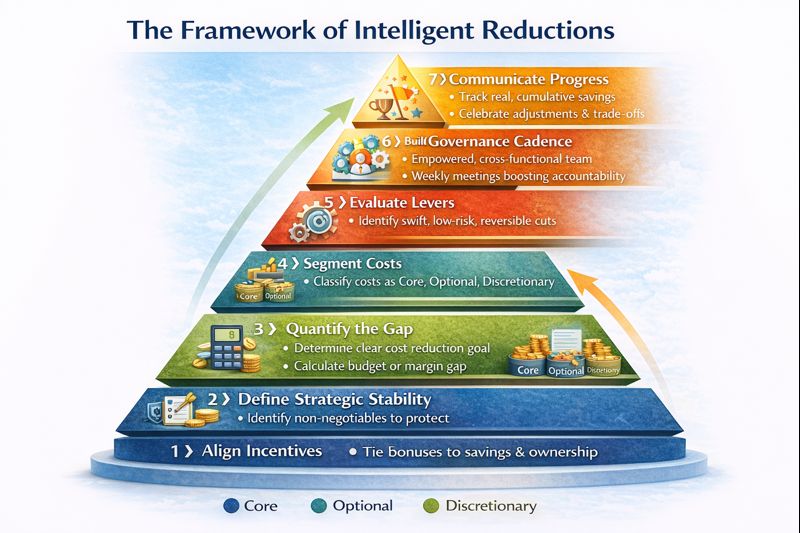

The Framework of Intelligent Reductions

To cut intelligently, you need a structured framework. First, define strategic stability by identifying what the company must maintain including client satisfaction, culture, innovation, brand trust, and regulatory compliance. These are non-negotiables. Second, quantify the gap by determining the budget shortfall or margin target with precision. If revenue is falling or margins are compressing, set a clear cost reduction goal.

Third, segment costs into buckets. Core costs are essential to running the business or achieving the strategy. Optional costs are enhancing but not mission-critical. Discretionary costs are nice-to-have items employees have come to expect. Fourth, evaluate levers by identifying reduction opportunities within each bucket that are swift, low-risk, and reversible. Fifth, build the governance cadence by creating a cross-functional team that meets weekly, empowered with data and decision threshold clarity. Cost removal is a process, not a one-off event.

Sixth, track and communicate progress. Each reduction must be monitored including projected, achieved, and evaluated. Celebrate savings and recognize trade-offs. Seventh, align incentives by tying bonuses or rewards to both savings execution and organizational sentiment. Ensure leaders take ownership. When I managed global finance for a $120 million logistics organization and overhauled freight, warehouse management, and last-mile logistics processes, we used this framework to reduce logistics cost per unit by 22 percent while maintaining service levels. The key was segmenting costs and engaging operational teams in identifying friction points.

Common Reduction Opportunities

Travel and entertainment present immediate opportunities. Virtual work disrupted travel prematurely, but travel budgets rebounded quickly. A granular review of trips, their return on investment, and alternatives can deliver 20 to 40 percent savings with little impact on culture or client relations. When I led finance at a digital marketing company where we scaled revenue from $9 million to $180 million, we implemented trip approval workflows tied to revenue opportunity size. Sales trips for deals over $100,000 were approved immediately. Trips for smaller opportunities required manager justification. This reduced travel spend by 30 percent while maintaining coverage of strategic accounts.

Third-party spend offers substantial savings. Many organizations cultivate vendor relationships over years, allowing subtle creep especially in information technology, consulting, or software as a service contracts. A targeted vendor rationalization program can free up 5 to 10 percent of procurement spend. This requires examining accumulated spending and replacing it with smarter use. When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, we discovered significant overlap in functionality. Consolidating to a single platform reduced software licensing costs by 40 percent while improving data consistency.

Expense policy updates provide quick wins. Sharp policy definitions supported by automation prevent abuse and waste while maintaining employee dignity. It is about clarity, not restriction. Undisclosed privileges often exist where employees benefit from unstructured perks including lunches, memberships, and subscriptions that were once appropriate during good times but are now outdated. Use analysis of transaction data to identify them. Ask leaders to surface discretionary privileges transparently.

Meetings and time waste cost money. People cost money. Time is the only finite resource. Conduct a meeting audit. Discontinue low-value recurring meetings. Train teams to adopt structured decision protocols. When I improved month-end close from 17 days to under six days at a cybersecurity firm, we eliminated half of the recurring close meetings by automating variance analysis and exception reporting. Teams only met to discuss material variances, not to review clean reconciliations.

Inefficient processes become more expensive per unit when volumes change. Data reveals if your cost-to-serve ratio is sustainable. In many cases, streamlining requires little investment, just cross-functional work and discipline. Information technology and SaaS stack rationalization can reduce software spend by 15 to 30 percent. The enterprise is full of overlapping tools including duplicate features, ignored modules, and unused licenses. Make each business unit justify why each license exists. When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI, we discovered that 40 percent of licenses were unused or underutilized. Rightsizing licenses and consolidating tools generated immediate savings.

Marketing spend requires disciplined optimization. Not all marketing needs to be cut, especially if conversion metrics exist. But rigorous analysis of unit economics, focus on high return on investment channels, elimination of vanity metrics, and analysis of customer acquisition cost payback times can optimize spending. When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we tracked marketing spend by channel and cohort performance. This revealed that certain channels had three times longer payback periods than others, allowing us to reallocate budget to higher-performing channels.

Headcount is the most sensitive area. Everyone worries about layoffs, and for good reason. People are both expense and the engine. If cuts are necessary, prioritize elimination of administrative roles, duplicated positions, or open roles. Avoid cutting roles where redundancy is minimized. Offer redeployment options. Provide clear explanation, and support exiting employees with dignity. Even in layoffs, treatment matters greatly. Executing with empathy including transparent communication, fair severance, and positive assistance is essential. A culture cannot be fixed after trauma. It must be treated as though it matters, because it does.

Cutting for Speed, Not Just Savings

The best cost initiatives do more than reduce expenses. They accelerate the business. When cost cutting is paired with acceleration, it is not a signal of decline but a beacon of boldness. Think of cost not as a line to trim but as a lever to pull. That lever must be calibrated against speed. The task is not to cut everything. It is to cut the friction from everything. Friction that hides in complexity, duplication, manual handoffs, or outdated systems. Remove that friction, and everything flows faster. And when that happens, cost cutting becomes a growth enabler.

When a process works, the best leaders do not ask can we justify this expense. They ask can we accelerate this process, can we drive down cycle time. Fast cycle time is a double benefit. It reduces cost by freeing up resources and it unlocks capacity to go faster. That makes velocity your partner in cost. Imagine a world where every invoice is matched and paid automatically, where license renewals trigger review and not autopay, where teams measure time-to-market and not headcount. The result is a system that frees up funding and capacity while making decisions faster.

True cost transformation begins with curiosity, not fear. Curiosity to ask what would happen if we removed this step, or this system, or this meeting. It is about understanding the full chain of value. Every extraneous approval, every redundant report, every unused license, is a signal you can get faster. And when you are faster, you are better positioned to serve customers and respond to change.

I once worked with a logistics operations team where forecasts took two full weeks. The reason was that each region adjusted numbers, combined them into a master file, adjusted again, and then packaged into a deck. Reimagining that with automation, standardized assumptions, and a single source of truth cut two weeks out of the cycle. That is not just cost-saving. That is time-saving. That is strategy. This is not about indiscriminate cuts. It is about disciplined reduction where one improvement leads to twenty improvements, until you have cut enough to actually amplify speed.

Inventory, vendor contracts, travel, support functions, and marketing campaigns all get reviewed. But the focus is not trimming fat. It is blowing away drag. When cost initiatives result in zero-based budgets, they should also result in zero-latency processes where accounting closes faster, approvals flow without bottlenecks, and reporting is flexible and real-time. When done right, the cost envelope shrinks while response time contracts. The business feels lighter and more nimble.

This requires confident autonomy, not command and control. When team leaders have the mandate to cut infrastructure spend by 20 percent and reduce approval cycle time by 30 percent, they stop hoarding systems. They refuse repetitive meetings. They automate recurring expenses. The result is efficiency becomes a muscle. Leaders worried about culture often fear cost tightening. But culture is not about opulence. Culture is about intent. If employees hear we are trimming expense to invest in speed, innovation, and customer experience, they lean in. If they hear we are cutting to save money period, they disengage.

Communication matters. This is not a sprint. It is a continuous pursuit. Business leaders should hold periodic efficiency reviews where teams identify waste, test a fix, and measure time improvement. This embeds cost-speed thinking directly into execution cycles, not as a side project. And every cut must be tied to an outcome. A meeting ends only when someone updates cycle time. A cut in software spend coincides with alerts when a license is idle. A reduction in travel aligns with faster decision cycles. The link between savings and speed must be explicit, visible, and reinforced.

That does not mean heroics. Change burns energy. Good leaders buffer for that. They do not cut training or hiring in value streams. They allow experimentation in parallel. They fund speed bets with cost gains. That way, people see payoff. And people double down. A mistake many organizations make is thinking cost-saving is a one-time deal. It is not. It is never done. Systems, processes, and technology drift. You must build cost-speed reviews into governance. Not as a negative filter, but as an optimizer.

Think of your business as a racecar. Cost trimming is reducing drag. But speed comes from engine power including talent, technology, and insight. You sharpen by tuning both. One without the other is imbalance. When done well, the results multiply. You deliver cheaper and faster. Customers notice. Investors notice. You make decisions, not wait for them. Your strategy becomes agile and responsive, not stuck.

The People Imperative

Cost cutting meets its greatest friction in the human element. How can we preserve culture while removing cost? First, respect the story. Every cost item was chosen at some time for a reason. Understand the history. Empathy does not delay discipline. It allows smarter reductions. Second, enable agency. When leaders invite suggestions and allocate bandwidth for staff to identify efficiencies, they earn greater alignment. Grassroots cost-saving can uncover hidden potential.

Third, provide context. Do not frame cost cutting as narrow belt tightening. Present it as part of ensuring longevity, preserving culture, and enabling future investment. People want their work to matter. Help them see the connection. Fourth, celebrate the wins. Even small savings, when contextualized, can be morale boosters. Recognize process improvements that preserve value and culture. Fifth, continue investment. Culture thrives on small bets. Do not cut your learning and development budget in half if training is your employer brand. Do not cut recognition budgets if culture thrives on rituals. Cutting in one area is acceptable. Cutting your ability to invest in your future, especially in people, is not.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we faced pressure to demonstrate fiscal discipline to justify the capital raise. Rather than making across-the-board cuts, we engaged program teams in identifying efficiencies. They proposed consolidating vendor relationships, renegotiating facility leases, and automating administrative processes. Because the cuts came from the teams themselves, implementation was smooth and morale remained high. Employees felt ownership over the outcome rather than victimized by it.

Leadership and Governance

This is a leadership moment, not a finance moment. The CFO, COO, and CIO should lead together, unbundling cost-impact teams from future-mindset teams. Finance provides the mandate, operations drive the cycle, and information technology builds enabling systems. The executive team protects the future investment while removing the dead weight. That step is not simple. It demands courage. Removing friction often reveals oversight we ignored. The bias to do is powerful. But the ability to subtract complexity is the mark of discipline.

Once, a product team doubled down on dual-service tiers even though one was rarely used. The leader turned it off quietly. He also phased out legacy support tools. He rebalanced the cost, reinvested savings into feature velocity, released faster, and the team shipped twice as many sprints in six months. That is not heroics. It is intentional engineering aligned with value, financed with freed capital, and powered by speed.

This is the imperative of modern leadership: not austerity for austerity’s sake, but cost as catalyst. Cost innovation requires three things including visibility, autonomy, and iteration. See the friction. Allow judgment. Measure the result. Repeat. Cutting for speed is upstream thinking. Building for cost is downstream. The best leaders connect them. Every cost choice is measured against its impact on cycle time, quality, and optionality.

Measuring Success Beyond the Numbers

A cost reduction plan looks easy on paper. But real success lies in sustaining values while delivering results. First, turnover rate. Is it rising, especially among high-performers? That is a warning sign. Second, employee net promoter score. Did it drop steeply during the cuts? Did it recover? Third, engagement scores. Are staff continuing to volunteer effort or doing the bare minimum?

Fourth, quality signals. Are customer complaints rising? Is research and development slowing? Fifth, return to growth. Is the organization returning to investment with purpose? If margins are up but culture metrics are down, you have not merely saved costs. You hollowed out the engine. When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we tracked culture metrics alongside financial metrics. This dual accountability ensured that cost initiatives did not destroy the organizational capabilities we had acquired.

Conclusion

In bringing financial intelligence to cost reduction, leaders must be clear about drawing the lines between costs that destroy value and those that build it, executing with transparency by sharing rationale, choices, and benefits, engaging the entire organization by inviting them into the process, and measuring not just financial results but cultural feedback. When done well, cost discipline is not painful. It is clarifying. When done poorly, it is disorienting. And culture is not a feel-good term. It is a real asset with real return on investment.

So if you find yourself cutting budgets, tightening belts, or pruning your cost structure, ask yourself is this decision preserving the heart of our business including the confidence, creativity, and capabilities we rely on, or are we raising numbers at the expense of the engine itself. Because in the end, the only cost you cannot cut without creating lasting damage is the cost that destroys belief. And a company that has lost belief is bankrupt, even if its profit and loss statement looks healthy.

In today’s fast-moving world, it is not enough to simply cut costs to survive. The companies that thrive do not just save money. They use those savings to get faster, smarter, and stronger. That is how you cut intelligently: by removing drag, not blood. Not slowing, but sharpening. Not shrinking, but evolving. And when the CEO asks where can we be cheaper without slowing down, the answer is not in spreadsheets. It is in the systems including approvals, meetings, tools, and data flows. Which ones create drag? Which can we remove, combine, or replace?

When you cut intelligently, you are not doing less. You are enabling more. More focus. More clarity. More capacity. More velocity. That catapults strategy forward. That is not conservative. It is aggressive. It is the discipline to remove friction and make the ride faster regardless of headwind. It is how you build an organization that can scale for years without becoming sluggish. And that is why you do not just cut. You cut to speed. Because in this day and age, acceleration is the currency of survival, and thrift is the foundation of momentum. Leaders who believe cost kills ambition will shrink. Those who believe cost can fuel speed will soar. This is cost discipline tuned to velocity. This is how you use cost as your ally, not your adversary. And this is the path to building something fast, frugal, focused, and built to last.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.