Executive Summary

In business, as in physics, the systems that endure are not the ones that resist force but the ones that bend, adapt, and recover. Resilience is not toughness in the traditional sense. It is agility with a margin of safety. The most effective companies are not necessarily those with the boldest strategies or flashiest growth curves but the ones that can take a punch, reset quickly, and continue moving forward with clarity. More often than not, this resilience is designed, not discovered. And the blueprint starts in the office of the Chief Financial Officer. The strategic CFO, particularly in high-change environments, serves as architect of the system’s ability to absorb volatility and emerge stronger. This is not about sandbagging forecasts or hoarding cash. This is about building an operating model that responds dynamically to stress, maintains coherence under duress, and allocates resources in ways that protect both the core and the option to evolve. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the CFO who embraces this mindset does not ask what do we expect next year but rather what happens when what we expect does not happen. That is the hallmark of resilience, recognizing that the future is not a probability distribution but a series of surprises. You cannot predict your way to stability. You can only design your way to adaptability.

Modularity and Structural Clarity

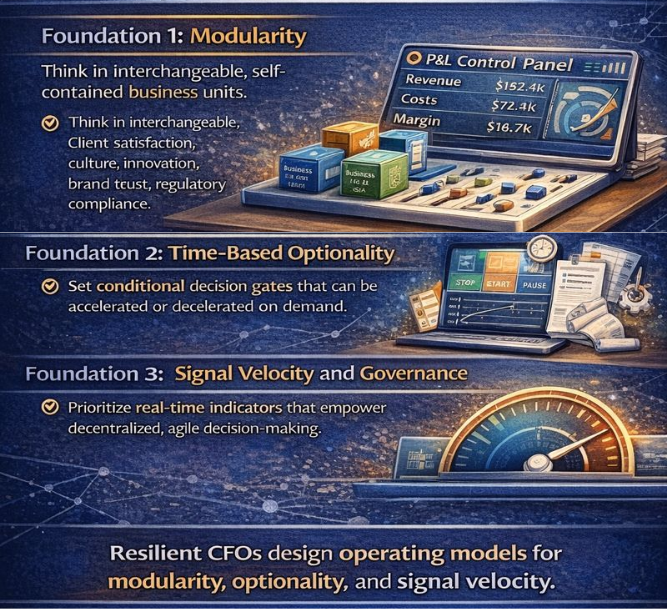

The first foundation of a resilient operating model is modularity. Businesses are often built in layers including new systems added to old ones, departments customized for projects that never got retired, and pricing strategies with logic long lost to institutional memory. Over time, what was once coherent becomes brittle. Modular design changes this by thinking in terms of interchangeable, self-contained units including business lines, territories, cost centers, and revenue motions that can be throttled up or down, split or merged, suspended or scaled independently.

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, the challenge was creating a structure that allowed each entity to operate semi-autonomously while maintaining consolidated visibility and control. A well-structured profit and loss statement aligned with modular accountability becomes a control panel. This is not just accounting hygiene. It is the foundation for decision velocity. When I managed global finance for a $120 million logistics organization, we created modular cost centers for freight, warehousing, and last-mile delivery. This allowed us to respond to regional demand shifts without disrupting the entire operation. A CFO designing for modularity does not insist on uniformity but on traceability.

Time-Based Optionality

The second ingredient is time-based optionality, decision flexibility under uncertainty. Most annual plans assume static capital allocation, but when the environment shifts including supply chains locking up, competitors dropping prices, or financing drying up, fixed plans become liabilities. The resilient CFO builds this flexibility structurally through hiring roadmaps with conditional gates, marketing budget tranches tied to pipeline quality, payment terms that create positive working capital on demand, vendor contracts with variable components, and cloud infrastructure scaled to usage.

When I led finance at a digital marketing company where we scaled revenue from $9 million to $180 million, we built conditional growth models that allowed us to accelerate or decelerate hiring and marketing spend based on real-time customer acquisition cost and pipeline velocity. Optionality costs something including speed, discounts, and predictability, but it is worth its weight in gold when volatility strikes. The best way to measure your optionality is to ask if our revenue fell 30 percent next quarter, how quickly could we respond without destroying value. If the answer is anything longer than a month, your system is fragile.

Signal Velocity and Governance

The third cornerstone of resilience is signal velocity, the speed at which insight travels from reality to decision. Most organizations are long on data but short on signal. A resilient operating model prioritizes real-time or near-real-time visibility into leading indicators including customer sentiment before churn, sales cycle slippage before revenue miss, net promoter score and engagement drop before renewals soften, and vendor shipping delays before cost of goods sold rises.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the purpose was creating feedback loops that allowed us to see problems emerging before they hit the income statement. When I improved month-end close from 17 days to under six days at a cybersecurity firm, the value was not just efficiency but the ability to act on current information. A resilient CFO ensures that decision rights are decentralized but within an aligned framework. General managers should have autonomy to pause or accelerate their levers within agreed bounds.

Resource Elasticity and Cultural Resilience

Resilience requires that resource deployment including people, capital, and tools can flex without systemic disruption. A CFO thinking in terms of elasticity avoids over-optimizing for efficiency at the expense of durability. Lean is good. Brittle is not. The resilient organization has some slack by design. When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, the key was not cutting to the bone but cutting to a sustainable level that preserved core capabilities while eliminating waste.

Cultural resilience matters because no operating model exists without people. The CFO’s job is to anchor clarity in communication. In times of uncertainty, organizations look for signal from the top. A resilient organization does not just have a crisis plan. It has a communication rhythm. Bad news is not buried. Plans are not sugarcoated. Trade-offs are explained, not hidden.

Capital structure serves as a strategic buffer. The strategic CFO knows how to build a structure that withstands variance in cash flow, asset pricing, and access to funding. That does not always mean hoarding cash. It might mean covenant-light debt, a flexible revolver, building working capital flexibility, or investing in a treasury function that models risk. When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, the structure was designed not just to fund growth but to provide flexibility if market conditions changed. Resilience is knowing the difference between a stretch and a cliff.

What resilience looks like in practice is surprisingly unsexy. It is clear processes, clean data, flexible contracts, modular organizational design, and disciplined communication. When designed properly, resilience shows up in the form of reversibility. Can you make a bold decision and reverse it with minimal pain if the world changes? If not, you have built a system that only works under perfect conditions.

Conclusion

What resilience looks like in practice is surprisingly unsexy. It is not an artificial intelligence dashboard or a crisis command center. It is clear processes, clean data, flexible contracts, modular organizational design, and disciplined communication. It is a culture where change is expected and modeled, not feared or fought. When designed properly, resilience shows up in the form of reversibility. That is the real test. Can you make a bold decision and reverse it with minimal pain if the world changes? If not, you have built a system that only works under perfect conditions, and those are in short supply. There is a moment in every company’s life when the music stops. Funding dries up. A product stumbles. A key executive leaves. The market shifts. In those moments, your resilience is not a theory. It is the only thing that matters. The CFO who designed for resilience is not caught off guard. They have modeled downside, rehearsed trade-offs, aligned the board, and earned the team’s trust. They do not need heroics because the system works even under strain. That is not luck. That is design. Resilience is not a characteristic of the market. It is a decision made in advance, a structure built with foresight, and a leadership posture that prioritizes survival with purpose. The CFO who masters this art does more than preserve the company. They position it to win the moment the winds shift, not because they predicted the storm but because they built a ship designed to sail through it.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.