Executive Summary

In thirty years of working across finance, operations, and strategy, I have seen companies obsess over assets they can touch, measure, or depreciate. Tangibles have always dominated the language of balance sheets. Buildings, equipment, inventory fit neatly within accounting frameworks. But in an age where intelligence compounds faster than capital, we must ask: what happens when the most valuable asset in your business is not physical but cognitive? Having implemented enterprise resource planning systems, designed business intelligence architectures, and led financial planning and analysis across organizations that scaled from nine million to one hundred eighty million dollars in revenue, I have witnessed how companies invest millions in artificial intelligence systems yet treat them as operating expenses rather than strategic assets. The rise of artificial intelligence, particularly generative models and autonomous agents, has changed the nature of how companies operate, decide, and create value. Yet our financial statements remain stubbornly anchored in an industrial worldview. This article argues for artificial intelligence models to be considered akin to amortizable research and development or long-term intangible assets, and explores valuation frameworks that CFOs can use to communicate the strategic value of cognitive capital to boards and investors.

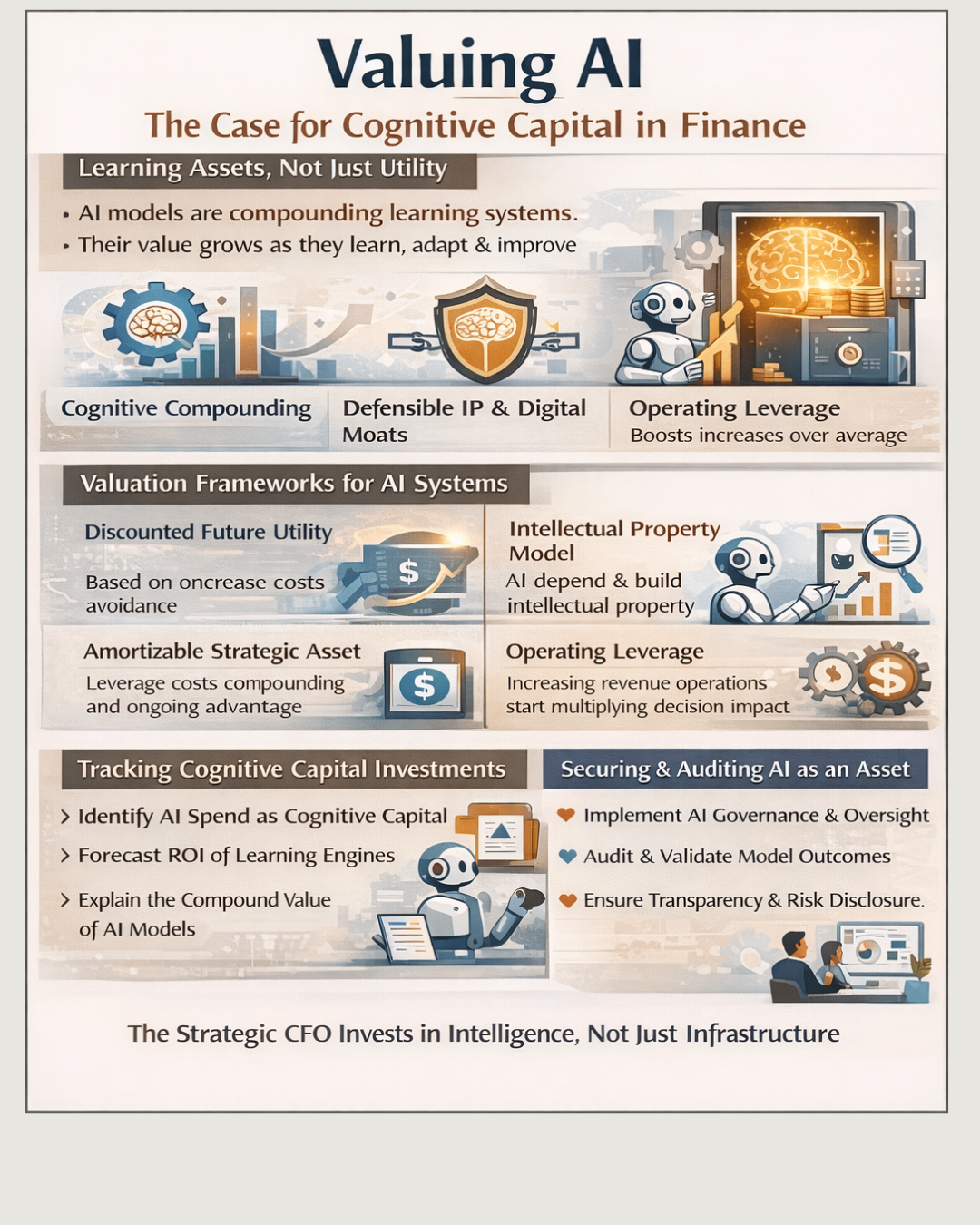

AI as Learning Asset, Not Just Utility

The traditional finance lens classifies technology expenses as either capitalizable software or expensed research and development. But artificial intelligence breaks this binary. When a company invests two million dollars training a domain-specific large language model to handle pricing optimization, revenue forecasting, or risk classification, what exactly is being built? This is not a tool with fixed functionality. It is an evolving system. Every dataset improves it. Every user interaction tunes it. Every decision it supports enhances its contextual accuracy. In essence, artificial intelligence systems learn. And in learning, they compound.

This is what I call cognitive compounding. Unlike depreciating machines, these assets grow more effective with time, provided they are fed, governed, and integrated responsibly. The more you use them, the better they become. This reverses the traditional economics of capital investment. Having managed capital allocation across organizations and secured over one hundred twenty million dollars in capital through multiple fundraising processes, I learned that investors increasingly ask not just about technology spend but about technology capability and competitive advantage.

In a software as a service company, we trained a generative artificial intelligence agent on three years of sales, product, and support interactions. By the third quarter, the agent’s forecasts outperformed our manual forecasts in accuracy and response time. That model, with each passing month, became more valuable. It absorbed company-specific behavior, product knowledge, and seasonal variance in ways no new hire could replicate. This is not software. This is a memory system. A learning engine. And that has intrinsic value.

Valuation Frameworks for Intelligent Systems

How should CFOs and boards approach the valuation of these artificial intelligence models? We can borrow logic from research and development accounting and apply a discounted future utility model. The value of the artificial intelligence system is tied to the incremental decisions it improves, the time it saves, and the risk it reduces. For example, if your generative artificial intelligence forecast model shortens your quarterly forecast cycle by ninety percent and improves your hiring plan accuracy by ten percent, those are cost and opportunity benefits that are model-driven.

My background as a Certified Management Accountant emphasizes this value-based perspective. Management accounting focuses not just on historical cost but on decision value, contribution margin, and strategic positioning. When evaluating artificial intelligence investments, we must ask what decisions improve, what opportunities unlock, and what risks reduce. Having built financial models and created investor-grade forecasts for organizations across multiple sectors, I learned that the most compelling valuations connect investment to measurable business outcomes.

Another approach is to think of artificial intelligence models like intellectual property. Much like a patented algorithm or proprietary dataset, a well-trained artificial intelligence model becomes a barrier to entry. The uniqueness of your dataset and the specificity of your fine-tuning create defensibility. In one gaming company where I led financial planning and analysis for a multi-studio enterprise, we trained a recommendation agent on player behavior that led to a ten percent increase in in-app monetization. That model cannot be replicated without the same data. It becomes a digital moat.

In such cases, valuation can draw on replacement cost, marginal contribution to revenue, or a cost-avoidance model where risk mitigation has monetary value. These frameworks may not fit neatly into generally accepted accounting principles, but that is no excuse to ignore them in investor narratives or capital allocation logic. Having managed board reporting for organizations that executed over one hundred fifty million dollars in acquisition transactions, I learned that investors care about competitive advantage and strategic positioning as much as accounting precision.

AI as Amortizable Strategic Asset

In many ways, thinking of artificial intelligence models as amortizable research and development aligns with how we treat other long-term capabilities. Just as an enterprise resource planning investment gets depreciated over time, so too should the cost of building and refining artificial intelligence systems. This amortization concept is particularly powerful when boards ask the CFO whether artificial intelligence investments are one-time or recurring. The honest answer is both. The initial training cost may be capital-like, while the ongoing fine-tuning and monitoring is operational. But the key is that the asset created delivers multi-period benefit. That is the very definition of amortizable value.

In my advisory roles, I now recommend tagging artificial intelligence-related expenses under a new line: Cognitive Capital Investments. This allows the finance function to track return on artificial intelligence more transparently and to explain to the board why these costs are not just technology overhead but strategic enablers. My certifications spanning accounting, management accounting, and internal audit provide the technical foundation for designing these classification frameworks within existing accounting standards while pushing for evolution where standards lag reality.

Capital Allocation in a World of Learning Systems

With artificial intelligence models taking on core responsibilities including forecasting, pricing analysis, and compliance risk detection, the CFO’s role must evolve from manager of dollars to allocator of intelligence. Every investment decision must now ask: how does this affect our learning advantage? If a company spends heavily on artificial intelligence agents that automate revenue operations, should that spend be evaluated the same way we evaluate sales enablement tools? I would argue not. Because artificial intelligence agents do not just automate, they evolve. They replace organizational memory loss. They synthesize across functions. They generate insights that transcend the original problem statement.

During my time leading revenue operations and deal desk functions for a cybersecurity company, we implemented artificial intelligence-powered pricing optimization that analyzed customer profiles, competitive positioning, and margin requirements to recommend optimal contract terms. This was not just automation. It was institutional knowledge capture. When experienced salespeople left the company, the model retained their pricing intuition. When market conditions changed, the model adapted based on new win-loss data. This persistent learning capability has strategic value that traditional capital budgeting frameworks struggle to capture.

In one education technology company, an artificial intelligence compliance agent trained on federal grant documentation reduced audit risk dramatically while also identifying areas for funding eligibility we had missed. That one system paid for itself within two quarters through risk mitigation and opportunity unlock. Try modeling that kind of return on investment with a traditional payback period. Having managed treasury operations, working capital optimization, and capital allocation across organizations, I learned that the most valuable investments are often those with option value and compound benefits that extend beyond initial projections.

Governance, Auditability, and Risk Disclosure

As artificial intelligence systems mature, they will require the same governance and auditability as other corporate assets. Just as boards review treasury strategy or investment policies, they must now ask: what models have been trained? What data governs them? What biases could they carry? What controls exist around their outputs? Intellectual capital carries risk: reputational, regulatory, and operational. The finance function must partner with legal, security, and data teams to build robust audit trails for artificial intelligence models.

My background as a Certified Internal Auditor informs this governance perspective. Just as we audit financial processes for control effectiveness, we must audit artificial intelligence systems for data quality, model accuracy, bias detection, and output validation. During my time implementing Sarbanes-Oxley controls and managing internal audit functions across organizations including a public gaming company, I learned that governance frameworks must evolve with business complexity. Artificial intelligence introduces new complexity that requires new controls.

In my experience, the best-managed artificial intelligence systems are those with layered controls. Analysts interpret outputs before action. Models are retrained only with validated datasets. Legal reviews ensure that no decision system operates without context or override. Boards must insist that every artificial intelligence investment comes with explainability mechanisms, confidence thresholds, and override protocols. This is not just risk management. It is fiduciary responsibility.

AI as Signal of Operating Leverage

One of the cleanest financial arguments for treating artificial intelligence as an asset is its ability to generate operating leverage. Every time a model makes a better decision faster, it extends your margin, improves your scalability, and reduces your reliance on headcount. In this sense, artificial intelligence is not just a cost center. It is an asset that drives productivity. In a logistics business, we used an artificial intelligence-powered optimization agent that reduced per-mile fuel costs by mapping real-time congestion patterns. That model scaled across regions without requiring additional analysts. That is leverage. That is capital efficiency. That is a story your balance sheet must tell.

Having managed supply chain analytics for a one hundred twenty million dollar logistics and wholesale enterprise, where we reduced logistics cost per unit by twenty-two percent, I witnessed how data-driven optimization creates sustainable competitive advantage. The artificial intelligence models we deployed did not just save money once. They continuously improved operations as they learned from new data, creating compounding value over time.

Conclusion: Strategic Communication and Evolution

To reflect this shift, I now advise clients to stop treating artificial intelligence as a footnote in information technology spend. Instead, include a section in board materials titled AI Assets and Cognitive Leverage. In it, articulate what artificial intelligence models are in use, how they evolve, what value they create, and how they align to strategy. This memo should live alongside the financials. Not in the appendix, but at the front. Because it does not describe a tool. It describes a capability. A living, learning capability that gives your business compound advantage.

Capital markets reward narrative as much as numbers. The ability to explain how your company uses artificial intelligence not just to save costs but to make better decisions is what differentiates good CFOs from great ones. Your artificial intelligence systems are intellectual capital. They deserve a seat on the balance sheet. Maybe not in a literal generally accepted accounting principles-compliant sense just yet. But certainly in how you manage them, invest in them, govern them, and communicate their impact.

Based on thirty years of financial leadership across diverse sectors and situations, from startups to public companies, from high growth to operational optimization, I can attest that we are entering a new era of finance. Not just forecasting revenue or optimizing margin, but managing cognition, investing in learning, designing systems that evolve, and extracting value from intelligence itself. The CFOs who lead this transformation, who create frameworks for valuing cognitive capital, who communicate the strategic importance of learning systems to boards and investors, will create disproportionate advantage for their organizations. The time to begin is now.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.