Executive Summary

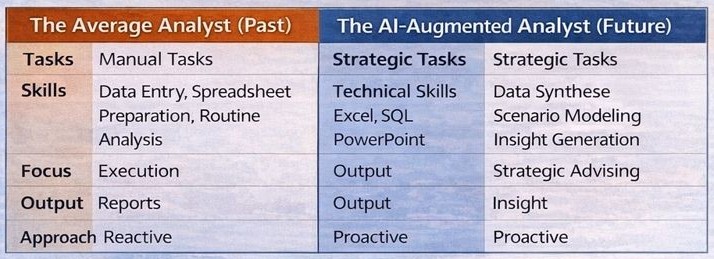

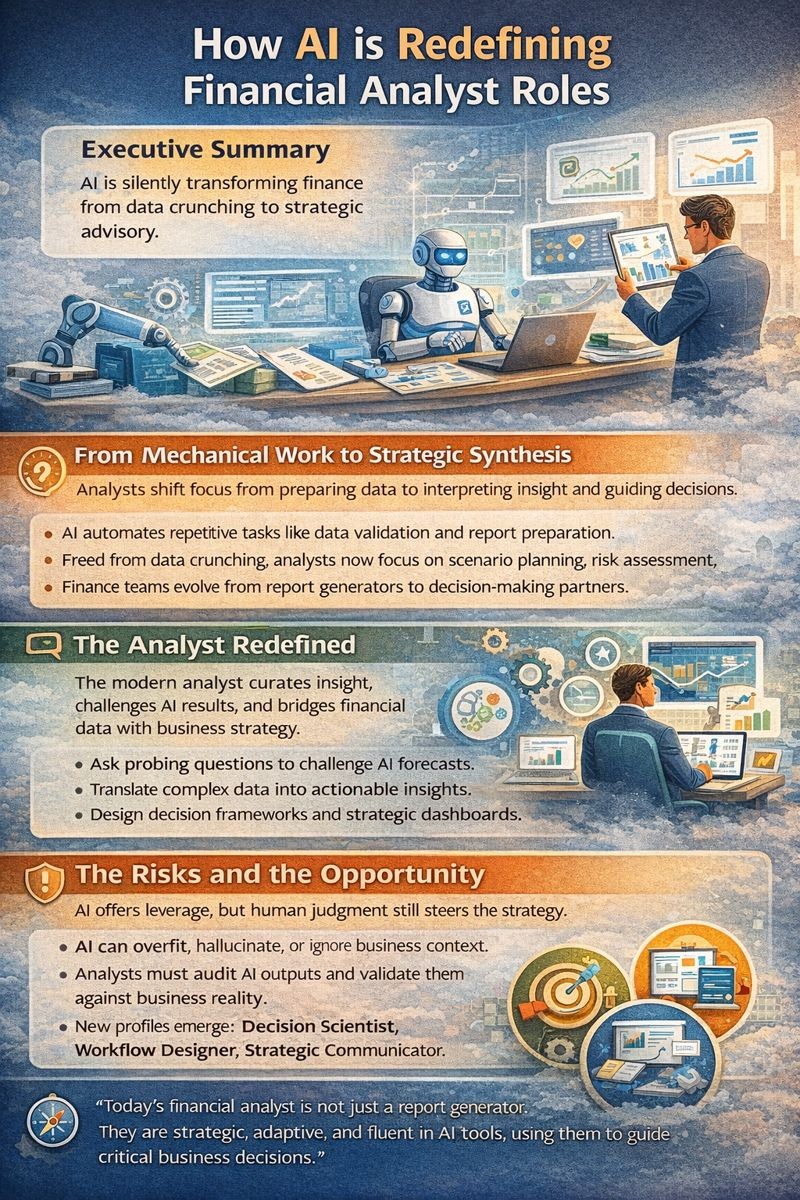

The modern finance function is undergoing a quiet revolution. Not a loud disruption but a silent shift in how work gets done, how insight is created, and how value is defined. After three decades working across the spectrum of finance from high-growth SaaS to freight logistics, from edtech to adtech, I have watched this shift build over time. I have led financial planning and analysis teams through market crashes, product pivots, and boardroom resets. But what is happening now, catalyzed by intelligent AI agents, is something fundamentally new. This is not just automation. It is the slow but certain extinction of what we once called the average analyst. The role we built around downloading data, checking formulas, preparing variance tables, and formatting decks is vanishing. And it should. AI agents now do all of that, and they do it faster, more accurately, and without ever asking for time off. Throughout my career implementing enterprise systems from NetSuite to Oracle Financials, building KPI frameworks using MicroStrategy, Domo, and Power BI, and reducing month-end close from 17 days to under six days, I have observed how technology transforms finance operations. But AI represents something fundamentally different. It flips the equation from execution to judgment, from preparation to synthesis, from output volume to decision velocity.

From Mechanical Work to Strategic Synthesis

I still remember building models in Excel twenty years ago, watching systems struggle under the weight of nested lookups and complex formulas. At the time, it felt like mastery. But in hindsight, much of that work, while critical, was mechanical. Finance teams were in many ways an extension of the reporting machine. We found discrepancies. We explained them. We tracked down data from five different systems that never talked to each other. That manual burden shaped an entire generation of analysts and finance leaders. We prized diligence, accuracy, and endurance. But in doing so, we over-invested in execution and under-invested in judgment.

AI agents flip this equation. In one SaaS organization, a generative forecasting assistant reduced the time spent on monthly forecasting from sixteen hours to less than ninety minutes. It automatically ingested bookings, usage, retention, billing adjustments, and product launches, then surfaced five plausible forecasts with confidence intervals, anomalies flagged, and driver sensitivity mapped out. What used to be a monthly grind became a Monday morning conversation.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, the time-consuming part was always data preparation and validation, not the strategic analysis that followed. We spent days reconciling revenue across multiple systems, validating customer counts, and ensuring that churn calculations matched billing records. AI eliminates this bottleneck. The work that once consumed 70 percent of analyst time now happens automatically, freeing the team to focus on what the numbers mean rather than whether they are correct.

When I managed global finance for a $120 million logistics organization, we faced similar challenges. Freight cost analysis required pulling data from warehouse management systems, transportation management platforms, and accounting ledgers. Analysts spent the first week of each month just assembling the data. By the time analysis began, the information was already stale. An AI-augmented approach would have compressed that timeline from weeks to hours, allowing us to respond to cost trends while they were still emerging rather than after they had already impacted the quarter.

The Analyst Redefined

The value of the modern finance analyst is no longer in spreadsheet fluency. It is in synthesis. The analyst of the future does not just prepare data. They curate insight. They ask the right questions of their AI counterpart. They know how to challenge a forecast, when to adjust a scenario, and how to connect financial signals to business behavior. This shift is as much cultural as it is technical. I now screen hires less for technical wizardry and more for business intuition. Do they understand customer behavior? Can they translate product engagement into churn risk? Do they see how customer acquisition cost and retention form a loop rather than a ratio?

At a digital marketing company where we scaled revenue from $9 million to $180 million, we introduced a concept called Finance as Product. Analysts became designers of decision systems. They owned not just the models but the workflows, the interfaces between finance and go-to-market, between product and pricing. Their job was to make decisions easier, not just numbers cleaner. We built self-service dashboards that allowed sales leaders to model commission scenarios, product managers to evaluate feature profitability, and marketing teams to assess campaign return on investment without waiting for monthly reports.

The most valuable analysts I have worked with in recent years are the ones who use AI as a co-pilot. They start with a prompt instead of a blank page. They let the agent draft a variance analysis, then they refine it, adding business context. They allow the AI to run five simulations, then they identify which scenarios deserve attention. In a growth-stage company I advised, we deployed an AI agent that monitored real-time cost drivers and generated alerts when key cost thresholds breached tolerance bands. Our analysts did not waste time combing through reports. They acted on signal, not noise. This freed them to investigate why costs were rising, not just document that they had risen.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, part of that acceleration came from automation. But the larger impact came from redesigning the close process to separate mechanical tasks from analytical ones. AI can now perform those mechanical tasks completely, allowing the entire close process to focus on analysis, reconciliation of exceptions, and strategic insight generation. The future close will not measure success by speed alone but by how quickly insight reaches decision makers.

Hiring for Judgment and Systems Thinking

As finance organizations retool for an AI-augmented future, the hiring rubric must evolve. Technical knowledge remains table stakes, but it is no longer differentiating. What separates top talent now is systems thinking, communication, and the ability to design with ambiguity. We need translators, people who understand how product strategy influences unit economics, people who can challenge assumptions baked into AI outputs, people who know that no model, however sophisticated, is a substitute for business context.

I have started using a different interview technique. Instead of asking candidates to walk me through a model, I ask them to review an AI-generated memo and critique it. I want to see how they interpret confidence bands, how they question embedded assumptions, how they link insights to decisions. This is where the modern analyst shines. Can they spot when an AI forecast looks reasonable on the surface but fails to account for a policy change or market shift? Can they identify which variables matter most and which are noise? Can they translate technical output into business language that drives action?

When I built enterprise KPI frameworks tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the analysts who excelled were not the ones who could build the most complex formulas but the ones who could explain what the metrics meant and what actions they should trigger. They understood that a decline in pipeline velocity might signal sales process friction, that rising customer acquisition cost without corresponding lifetime value growth indicated efficiency deterioration, and that utilization patterns revealed capacity constraints before they became delivery problems.

The finance function I am building today looks fundamentally different from the one I built a decade ago. Then, I needed analysts who could master pivot tables, write macros, and reconcile complex ledgers. Now, I need analysts who can design decision frameworks, challenge AI outputs with business context, and communicate financial insights in ways that shape strategy. The former skill set is becoming commoditized. The latter is becoming invaluable.

The Risks and the Opportunity

With great power comes great distortion. AI can hallucinate. It can overfit. It can miss the nuance behind a number. The average analyst is not just disappearing because AI is efficient. It is because finance leaders must demand more than execution. I remember a case where an AI forecast significantly overestimated growth because it failed to factor in a sales compensation plan that capped variable earnings. It had the data. It had the model. But it lacked the policy context. A human analyst caught it and saved the quarter’s forecast from embarrassment.

This is where judgment comes in. AI agents can suggest. But humans must decide. We must remain vigilant in auditing AI outputs, in understanding when to trust the signal and when to flag it. When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, the financial projections that supported that raise were built on models. But they were validated by human judgment about program scalability, donor behavior, and market dynamics that no algorithm could fully capture.

The finance organizational chart of the future will look very different. I see three core profiles emerging. First, the decision scientist, someone who blends forecasting, scenario design, and behavioral finance. They understand probability distributions, can model uncertainty, and know how to frame decisions under ambiguity. Second, the workflow designer, someone who builds and refines how agents interface with business systems. They are part finance professional, part systems architect, designing the infrastructure that allows AI to augment human decision making. And third, the strategic communicator, someone who translates analytics into boardroom-ready narratives. They know how to take complex model outputs and distill them into clear, actionable insights.

All three roles require fluency with AI agents. But none of them involve manually creating charts. The AI will do that. What matters is what we do with those charts. When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, the value was never in the presentation aesthetics. It was in the clarity of the narrative, the honesty about risks, and the precision of the recommendations. AI can generate the slides. But it cannot provide the strategic judgment that determines which story to tell.

Conclusion

For CFOs, this shift demands courage. Letting go of the old world where we equated hours spent with value created requires belief in leverage. GenAI gives us that leverage. But it is the human analyst who defines where to apply it. I no longer ask my teams to be efficient. I ask them to be impactful. I want to know which insights changed a decision, which forecasts shaped a roadmap, which signals preempted a risk. The average analyst, defined by repetitive work, long hours, and minimal insight, is going extinct. And that is a good thing. In its place, a new kind of analyst is emerging. Curious. Adaptive. Narrative-driven. System-literate. This analyst uses AI not to replace their job but to redefine it. They ask better questions. They act faster. They design better decisions. To every CFO, I offer this call to action: stop defending the old analyst. Start investing in the new one. Build teams that think like founders, not just operators. Let AI agents take the drudgery. Let your people own the insight. Because in the end, financial success is not built on reports. It is built on judgment. And judgment, powered by intelligent tools, is what will define the next generation of finance leaders.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.