Executive Summary

If the twentieth-century CFO was the steward of capital, and the early twenty-first-century CFO became the strategic partner to the chief executive officer, today’s CFO is undergoing yet another transformation, augmented by a new kind of teammate. Enter the artificial intelligence co-pilot: a digital assistant not confined to spreadsheets or dashboards but capable of contextual understanding, pattern recognition, and real-time recommendation. Having led finance organizations across three decades, implementing enterprise resource planning systems, business intelligence platforms, and financial planning automation that improved month-end close from seventeen days to under six days and increased revenue recognition accuracy by twenty-eight percent, I have witnessed multiple waves of technology transformation. But artificial intelligence assistants represent something fundamentally different. They are not replacing finance leaders. They are rewiring how we make decisions, where we focus time, and how quickly we convert data into action. This article explores how artificial intelligence co-pilots are becoming indispensable to finance teams that must navigate increasingly volatile, complex, and compressed business cycles.

From Passive Tools to Active Thinking Partners

Traditional finance tools, enterprise resource planning systems, planning software, business intelligence dashboards, are reactive. They wait for queries. They rely on users to know what to ask. But today’s artificial intelligence assistants are proactive, adaptive, and conversational. They operate not as static repositories but as embedded collaborators.

A finance artificial intelligence co-pilot can now summarize variances in a board-ready format within seconds, surface anomalies in cash flow projections before month-end, run scenario models across dozens of assumptions in real-time, suggest budget reallocations based on real-time signals from operations, draft investor updates, earnings talking points, or strategy memos using live data, and act as a digital memory bank recalling the rationale behind last quarter’s forecast variance.

This capability closes the gap between insight and action. It reduces the friction of decision-making and puts the full weight of historical data, contextual understanding, and real-time computation behind every choice the CFO makes. Having managed board reporting for organizations that raised over one hundred twenty million dollars in capital and executed over one hundred fifty million dollars in acquisition transactions, I learned that decision velocity increasingly separates winning companies from struggling ones. Artificial intelligence co-pilots accelerate that velocity dramatically.

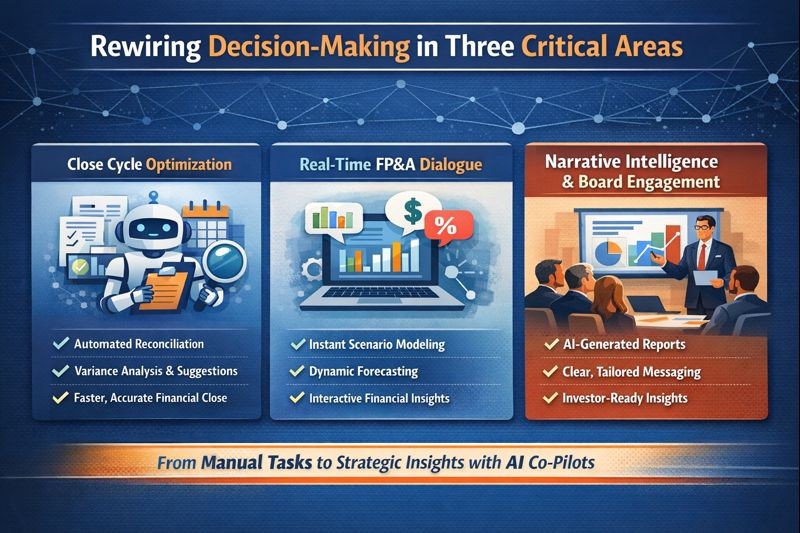

Rewiring Decision-Making in Three Critical Areas

Close Cycle Optimization

The traditional close cycle is labor-intensive. Reconciling accounts, explaining variances, consolidating inputs are high-friction, low-leverage activities. With a co-pilot embedded, much of this burden shifts. The assistant flags journal entries that deviate from pattern, pre-drafts variance commentary based on transactional analysis, tracks recurring adjustments and suggests automation, and learns how your team annotates entries and mimics that style for continuity.

The result: faster close, higher accuracy, and more time for strategic analysis. Your team is no longer scrambling to reconcile. They are thinking about next quarter’s trajectory. When I improved month-end close from seventeen days to under six days through process redesign and system automation, the breakthrough came from eliminating unnecessary manual work. Artificial intelligence co-pilots take this further by not just automating but intelligently interpreting what the numbers mean and why they changed.

Real-Time Financial Planning and Analysis Dialogue

Rather than waiting for a planning cycle to rerun scenarios, the artificial intelligence assistant enables rolling dialogue between business drivers and financial outlook. What happens to free cash flow if customer churn increases three percent in third quarter? How does a fifty basis point rise in interest rates affect our debt coverage in fiscal year 2026? What is the weighted impact on gross margin if input costs rise across three suppliers?

These questions are answered in seconds. No more building spreadsheets from scratch. No more lag between curiosity and clarity. The CFO is no longer just reviewing forecasts. They are conversing with them. Having led financial planning and analysis across organizations from startups to growth-stage companies to established enterprises, I spent countless hours building scenario models manually. The ability to generate scenarios conversationally transforms how finance supports strategic decision-making.

Narrative Intelligence and Board Engagement

CFOs must communicate complex financial realities in ways that boards, investors, and executives understand. Artificial intelligence co-pilots trained on prior earnings calls, investor decks, and board reports can now draft key performance indicator summaries in investor-ready prose, segment commentary with linked visuals, and talking points that anticipate questions based on historical queries.

And because these assistants learn from context, they can adapt tone, structure, and level of detail for different audiences. This brings consistency, saves time, and amplifies the CFO’s narrative control across every channel. My experience managing board reporting taught me that clear communication is as important as accurate numbers. Artificial intelligence assistants that can draft consistent, audience-appropriate narratives enhance both efficiency and effectiveness.

What the Co-Pilot Is Not

Let us be clear: an artificial intelligence assistant is not a decision-maker. It is not a source of truth independent of judgment. It cannot understand unquantifiable nuance yet. The CFO remains the pilot in command. But just as autopilot handles altitude while the captain navigates weather and airspace, the artificial intelligence assistant handles data wrangling, summarization, comparison, and suggestion while the finance leader makes the strategic calls.

The CFO’s role expands, not shrinks, with this new partnership. The assistant removes friction, not responsibility. My background as a Certified Internal Auditor emphasizes this principle. Controls do not eliminate judgment. They support it. Artificial intelligence co-pilots serve the same function, providing guardrails and guidance while humans retain accountability.

Designing a High-Trust Framework

To deploy artificial intelligence co-pilots responsibly and effectively, CFOs must focus on four enablers. First, data quality and governance: the co-pilot is only as good as the data it reads. Finance must lead data standardization, lineage mapping, and quality assurance across core systems. Second, clear guardrails and oversight: all artificial intelligence-generated outputs should be transparent, auditable, and subject to override. The assistant must explain its logic and provide traceability for every recommendation.

Third, role-based personalization: the co-pilot must be trained to serve different stakeholders including the CFO, the controller, the financial planning and analysis analyst, and the investor relations lead. Context is everything. Fourth, upskilling and trust building: finance teams must learn how to work with the co-pilot, when to trust, when to validate, and how to interpret suggestions. Human-machine collaboration is a learned skill.

Having built finance teams across cybersecurity, software as a service, digital marketing, gaming, logistics, manufacturing, and education sectors, I learned that technology adoption depends on training, trust, and demonstrated value. These principles apply equally to artificial intelligence co-pilots.

Conclusion: Decision Velocity as Competitive Advantage

The age of the artificial intelligence co-pilot is not about replacing finance acumen. It is about amplifying it. The CFO who embraces this partnership will move faster, see clearer, and lead with greater confidence. The real benefit is not just productivity. It is decision velocity, the ability to respond to change with clarity, precision, and narrative control. And in a world of volatile inputs and high investor scrutiny, that is a differentiator boards will value.

Based on thirty years of financial leadership across diverse sectors and situations, from startups to public companies, I can attest that we are at an inflection point. The finance functions that embrace artificial intelligence co-pilots strategically, that train their teams to collaborate effectively with intelligent systems, that build governance frameworks ensuring transparency and accountability, will create disproportionate value. Those that resist will find themselves managing with increasingly obsolete tools in an increasingly fast-moving world. The choice is clear. The opportunity is now.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.