Executive Summary

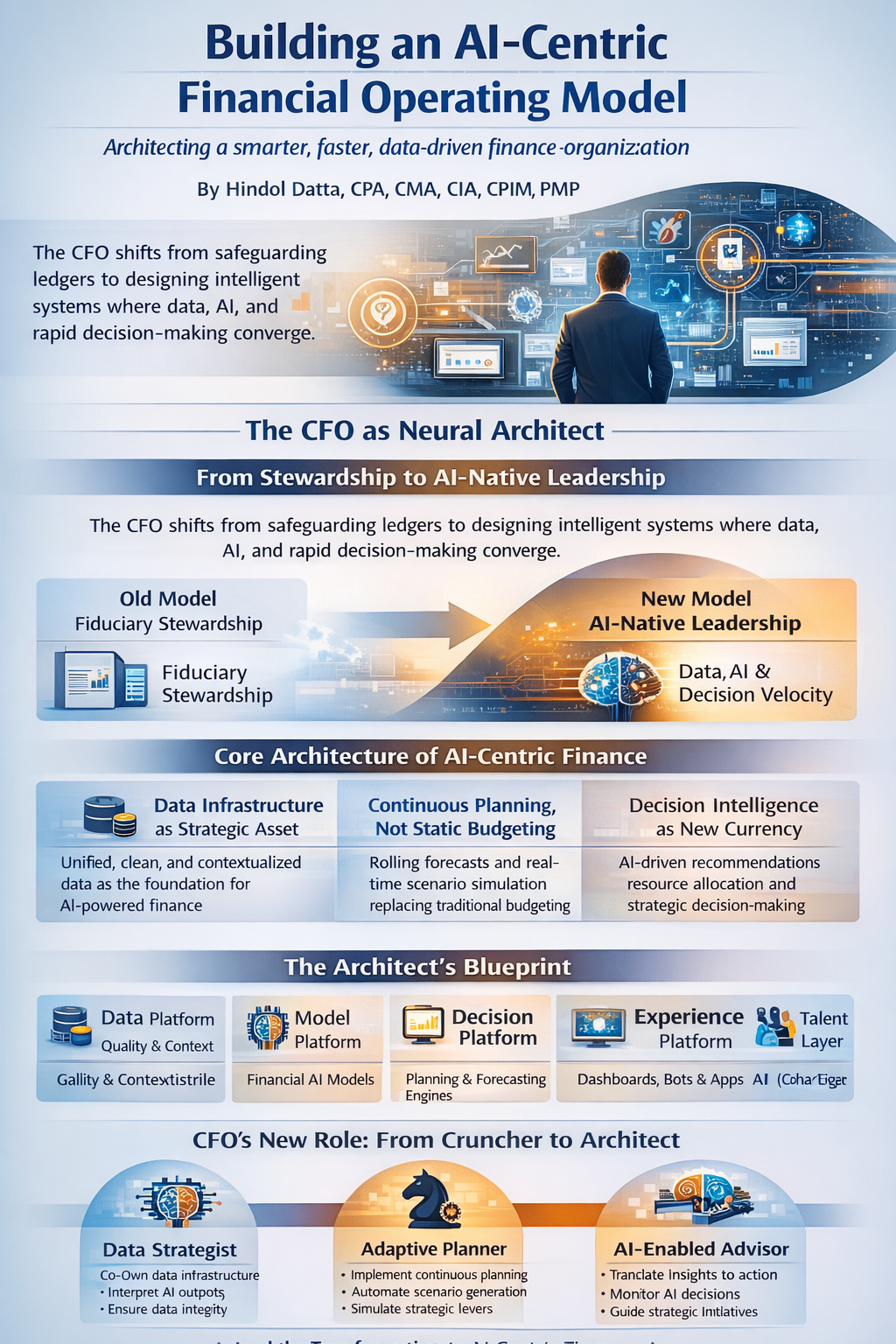

There was a time when the role of the CFO was defined by stewardship: safeguarding the books, closing the quarter, and forecasting with prudent conservatism. Today, that definition is wholly inadequate. In a world tilting inexorably toward algorithmic intelligence, the CFO is no longer just a fiduciary. We are architects of a financial operating system where data, artificial intelligence, and decision velocity converge. Having built and redesigned finance organizations across cybersecurity, software as a service, digital marketing, gaming, logistics, and professional services sectors, implementing enterprise resource planning systems, business intelligence architectures, and operational analytics platforms, I have witnessed the evolution from traditional finance to data-driven finance. Now we face the next transformation: from data-driven to artificial intelligence-native. This article is both proposition and prescription: that AI-centric finance is not a technology strategy but an operating model, and that model must be designed, led, and owned by the CFO. Anything less cedes the future.

AI Is a Platform Shift, Not a Toolkit

Let us be clear: artificial intelligence is not merely another lever in the CFO’s arsenal, like spreadsheet macros or business intelligence dashboards. It is a platform shift on par with cloud computing or the internet itself. It alters how decisions are made, who makes them, and how capital is allocated. This shift demands we move from a system of record mindset to a system of prediction mindset.

Legacy finance was backward-looking reporting. AI-centric finance is forward-looking simulation. Legacy finance relied on human-curated key performance indicators reviewed on monthly cadences. AI-centric finance generates machine-identified signal flows in real-time, event-triggered operations. Legacy finance treated budgeting as ritual and maintained centralized authority. AI-centric finance treats resource allocation as a feedback loop and enables distributed, data-informed autonomy.

Throughout my career implementing NetSuite, Oracle Financials, OpenAir professional services automation, and integrating them with Salesforce and business intelligence platforms, I learned that each technology generation required rethinking not just tools but workflows. Moving from manual journals to enterprise resource planning systems changed how we closed. Implementing business intelligence changed how we analyzed. Artificial intelligence will change how we decide. In essence, we move from a factory model to a flight control tower: sensing, predicting, and guiding.

The New Operating Model: From Ledgers to Learning Loops

To build an AI-centric finance function, we must redesign the operating architecture around learning loops rather than linear workflows. The core building blocks include data infrastructure as a strategic asset, continuous planning instead of static budgeting, and decision intelligence as the new currency.

Data Infrastructure as Strategic Asset

CFOs must co-own the data strategy. The model is clear: raw data flows into feature stores, which produce model-ready data. Semantic layers provide finance language models, essentially large language models trained on general ledger, enterprise resource planning, customer relationship management, and financial planning and analysis data. An AI-powered finance team relies on data infrastructure that is clean, contextualized, and composable. This is not information technology’s job anymore. It is ours.

During my time designing multi-entity global finance architecture spanning the United States, India, and Nepal, and implementing business intelligence systems including MicroStrategy and Domo, I learned that data architecture determines what is possible in analytics and planning. Poor data architecture means perpetual manual reconciliation and limited insight. Strong data architecture enables automation, prediction, and intelligence. With artificial intelligence, this becomes even more critical because models require vast amounts of clean, connected data to learn effectively.

My technical skills including SQL and R are not just tactical capabilities. They enable me to understand data architecture decisions, evaluate vendor claims about artificial intelligence capabilities, and identify gaps between what systems promise and what they can deliver. Modern CFOs need not be data engineers, but we must be fluent enough to lead data strategy conversations and make informed architectural decisions.

Continuous Planning, Not Static Budgeting

Traditional annual budgets are like shipping maps drawn before a hurricane. In contrast, artificial intelligence enables rolling forecasts, scenario generation, and probabilistic planning. Tools like Anaplan, Pigment, or proprietary systems integrated with generative artificial intelligence now allow for real-time reforecasting with changing assumptions, automated budget-to-actual variance alerts, and simulations of strategic levers including pricing, customer acquisition cost, and retention.

The role of financial planning and analysis evolves into financial strategy engineering: a fusion of economics, machine learning, and systems design. Having led financial planning and analysis functions across organizations from startups to growth-stage companies to established enterprises, I experienced the limitations of traditional planning cycles. We would spend weeks building annual budgets that became obsolete within months. We would create quarterly rolling forecasts that required substantial manual effort to update. Artificial intelligence changes this fundamentally by enabling continuous planning that updates automatically as new data arrives.

When I improved month-end close processes from seventeen days to under six days through process redesign and system automation, the breakthrough was eliminating unnecessary complexity and establishing automated workflows. The same principle applies to planning. Artificial intelligence eliminates manual consolidation, variance calculation, and commentary generation, allowing planners to focus on strategic analysis and scenario evaluation.

Decision Intelligence as New Currency

Finance becomes a recommendation engine for the business. Artificial intelligence can generate not just insights but actions. Which customers are at risk? Which marketing campaigns should we throttle or double down on? Where is working capital trapped? CFOs must build closed-loop systems where insights lead to decisions that feed back into the models, continuously improving prediction accuracy.

During my time leading deal desk and revenue operations for a cybersecurity company, I saw how real-time decision support could transform business outcomes. When sales teams received immediate margin guidance, pricing recommendations, and contract term optimization during deal negotiations rather than after the fact, they closed better deals faster. This was decision intelligence in action, and artificial intelligence amplifies this capability exponentially.

The Organizational Shift: Finance as Product Team

Operating in an AI-centric model demands new organizational design. Instead of siloed roles, we pivot to cross-functional pods structured like product teams. The financial planning and analysis analyst becomes a financial systems engineer. The data analyst becomes a finance machine learning model trainer. The business partner becomes an embedded finance product owner. Information technology systems support becomes finance platform architect.

The finance team must build and iterate on internal tools and products, not just reports. We design experiences: from dashboards that anticipate user needs to bots that answer ad-hoc questions in natural language. The CFO becomes the chief product officer of financial intelligence. Having built finance organizations across multiple sectors and implemented business intelligence systems that served hundreds of users, I learned that user experience determines adoption. The most sophisticated analytics are worthless if users find them difficult to access or understand. Product thinking forces us to prioritize user needs, iterate based on feedback, and measure success by business outcomes rather than technical implementation.

My project management certification and experience leading implementations across organizations informs this perspective. Building artificial intelligence-native finance functions is not just a technology project. It is organizational transformation requiring change management, training, communication, and continuous improvement. The skills that made someone an excellent financial analyst do not automatically make them an excellent financial systems engineer. We must hire for new capabilities, train existing teams, and create career paths that reward both financial expertise and technical fluency.

Governance at Machine Speed

Artificial intelligence does not eliminate the need for controls. It amplifies the need. The pace of autonomous decisions must be matched by machine-readable guardrails. This includes policy as code, embedding compliance logic directly into finance bots and workflows. It requires artificial intelligence explainability, ensuring every model decision, whether forecast or anomaly detection, comes with interpretable output and an audit trail. And it demands risk thresholds where systems flag decisions that cross financial or operational boundaries, triggering human review or automated throttling.

This is programmable governance, where financial controls are embedded in code, not documents. My background as a Certified Internal Auditor and experience implementing Sarbanes-Oxley controls across organizations including a public gaming company informs this perspective. Traditional controls rely on segregation of duties, approval hierarchies, and periodic testing. These remain important, but artificial intelligence-native organizations need additional controls that operate at machine speed.

When I implemented automated revenue recognition at a cybersecurity company, increasing accuracy by twenty-eight percent, one of the critical success factors was building validation logic directly into the automation. The system would flag exceptions in real-time rather than discovering them during month-end review. This principle scales to artificial intelligence-powered finance: controls must be embedded in systems, operating continuously rather than periodically.

The Cultural Imperative: From Gatekeepers to Guides

As we re-architect the model, we must also rewire the mindset. Finance traditionally acted as gatekeeper: approving spend, enforcing discipline, setting limits. In the artificial intelligence model, our role shifts to enabling empowered decision-making through context and clarity. We go from saying no to asking why not, and what is the return on investment? We no longer build walls. We build rails that allow the business to move faster without falling off track.

And we must become evangelists for this shift, training teams on tools, interpreting model outputs, and building trust in autonomous systems. Throughout my career managing global distributed teams across multiple time zones and cultures, I learned that cultural transformation is harder than technical implementation. When we implemented new enterprise resource planning systems or business intelligence platforms, user adoption determined success more than technical functionality. The same applies to artificial intelligence-powered finance. If finance teams do not embrace new tools and workflows, if business partners do not trust model recommendations, the investment will not deliver value regardless of technical sophistication.

Capital Allocation in the AI Era

The ultimate lever of the CFO, capital allocation, becomes more dynamic and precise in an artificial intelligence-driven world. Dynamic return on investment modeling for investments updates in real-time as new data arrives. Predictive cash flow management uses artificial intelligence to forecast accounts receivable and accounts payable cycles by customer cohort behavior. Workforce planning leverages scenario-based modeling of productivity, automation, and compensation structures.

Capital now flows not based on politics or precedent but based on learning, signal, and impact. Having managed treasury operations, working capital optimization, and capital allocation across organizations spanning from nine million to one hundred eighty million dollars in revenue, and having secured over one hundred twenty million dollars in capital across multiple fundraising processes, I understand that capital allocation is where strategy becomes reality. The best strategies fail if capital is misallocated. Artificial intelligence improves allocation by providing better predictions, faster feedback, and more comprehensive scenario analysis.

The Architect’s Blueprint

To operationalize AI-centric finance, the CFO must design and oversee six critical layers. The data platform layer owns data quality, context, and taxonomy. The model layer selects, governs, and trains financial artificial intelligence. The decision layer builds planning and forecasting engines. The experience layer creates interfaces including dashboards, bots, and applications. The governance layer encodes compliance, explainability, and audit. The talent layer upskills teams into artificial intelligence-native operators.

Every year, each layer must be re-evaluated, stress-tested, and updated, just as an architect revisits a building’s load-bearing assumptions after an earthquake. This continuous evolution distinguishes artificial intelligence-native organizations from those treating artificial intelligence as a point solution. Having led financial planning through multiple economic cycles and business disruptions, I learned that operating models must adapt continuously. What works in stable growth periods fails during volatility. What works at ten million in revenue breaks at one hundred million. Artificial intelligence-native finance must be designed for continuous evolution.

Conclusion: From Number Cruncher to Neural Architect

To thrive in the decade ahead, the CFO must step fully into this new mantle, not as a finance operator but as a neural architect of the enterprise. We must weave together data, design, governance, and intelligence into an operating model that is fast, flexible, and self-improving. Artificial intelligence will not replace finance teams. But finance leaders who fail to build artificial intelligence-native models will be replaced by those who do.

The question is not whether your organization will adopt artificial intelligence in finance. It is whether you will lead that transformation or be compelled to follow. Based on my experience building and transforming finance organizations across industries, stages, and geographies, I can tell you that the CFOs who lead this transformation will deliver disproportionate value to their stakeholders. Those who resist will find themselves managing increasingly obsolete functions in an increasingly intelligent world. Let us build accordingly.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.