Executive Summary

There comes a moment in every organization when financial pressure feels like geological force. A company that once stood tall begins to creak under the weight of debt obligations. Cash flows tighten, credit lines shrink, and the boardroom conversation turns urgent. In that crucible, a leader must ask a profound question not only about survival but about identity. When pressure starts to fracture the balance sheet, what choices preserve both fiduciary duty and organizational sovereignty? Having led treasury operations, managed credit facilities including an eight million dollar credit line, negotiated complex financing arrangements, and guided organizations through liquidity challenges across sectors from manufacturing to software as a service to nonprofit, I learned that the firms that emerge stronger treat pressure not as a crisis but as a crucible from which clarity, resilience, and sometimes transformation emerge. Just as geological pressure over time fashions coal into diamonds, financial strain, when managed well, can forge stronger foundations. This essay explores refinancing under pressure through three strategic options: stretching existing obligations, extending or converting debt through structured instruments, or breaking open new capital alliances via equity or asset sales. Each choice carries implications for control, autonomy, cost, and organizational identity.

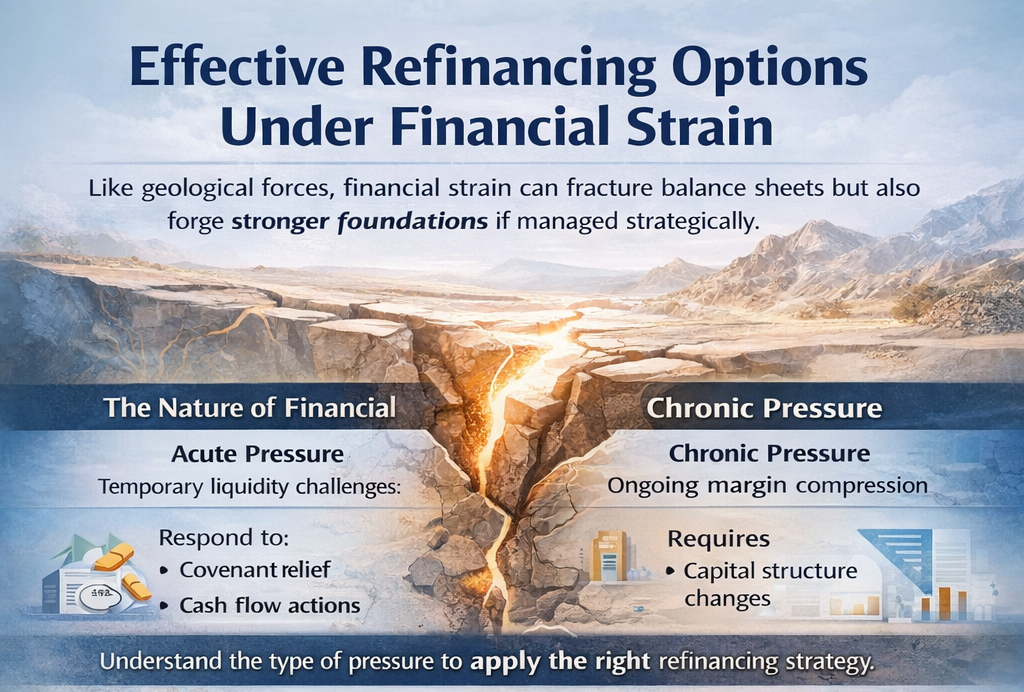

The Nature of Financial Pressure

Financial strain manifests differently depending on its source and duration. Short-term liquidity crunches differ fundamentally from structural margin compression. A seasonal working capital squeeze requires different solutions than sustained cash flow deterioration from competitive pressure. During my time managing treasury and working capital for a one hundred twenty million dollar logistics and wholesale enterprise, we faced both types. Seasonal inventory builds created temporary liquidity needs that resolved through extended payment terms and short-term borrowing. But when freight costs increased structurally due to capacity constraints, we needed fundamental business model adjustments, not just financing flexibility.

Understanding the nature of pressure determines appropriate responses. Acute, temporary strain often responds to covenant relief and maturity extensions. Chronic, structural pressure requires capital structure changes including equity infusion or asset monetization. The mistake many leaders make is treating chronic problems with acute solutions, repeatedly extending maturities without addressing underlying performance issues. This delays inevitable reckoning while accumulating costs.

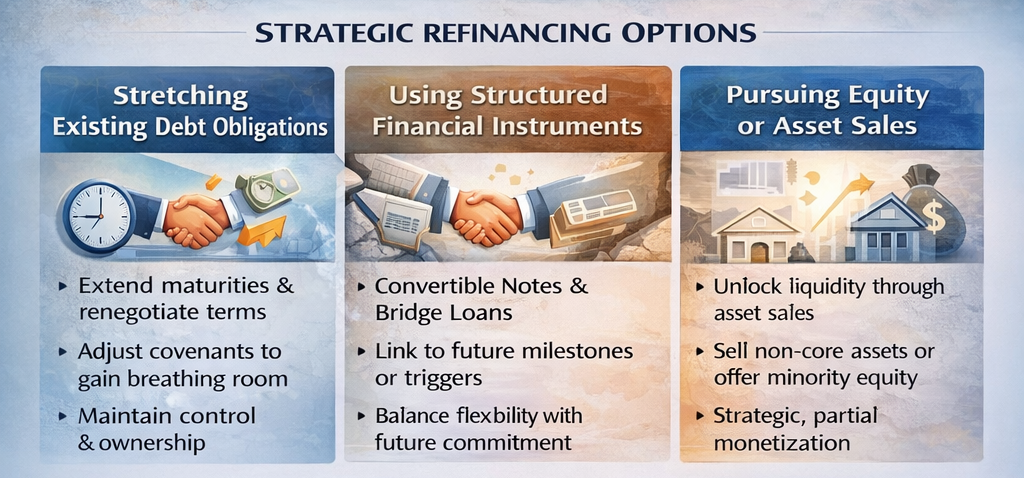

Stretching Obligations Without Diluting Control

The first and least disruptive approach involves restructuring current debt obligations. Lenders may agree to extend maturities or adjust covenants when they believe in the underlying business. Banks often prefer to avoid forcing a company into technical default that might work against their own recovery prospects. Renegotiation is not surrender. It is mutual survival. If you preserve operations and reassure stakeholders, you may simply gain breathing space.

I witnessed this dynamic when leading finance for organizations that experienced covenant pressure. In one case, new accounting standards changed how we calculated leverage ratios, creating technical violations despite stable operations. Rather than declare default, lenders agreed to covenant modifications that reflected economic reality. The conversation focused on cash flow forecasts and oversight rather than dilution. Both sides recognized that the firm had intrinsic value but was temporarily squeezed. In that moment, the lender and borrower stood together rather than apart.

Stretching obligations buys time and retains control. The business avoids an equity rewrite or new governance layers. That time can be used to stabilize operations, refine strategy, and rebuild cash flow. The downside exists too. Creditors remain creditors. Late payments accrue cost. Maturity may still come with risk. Not everyone has the margin to stretch. But when executed with discipline, stretching becomes a reset rather than retreat.

Having negotiated complex licensing agreements, managed compliance audits, and established financial reporting during my time standing up a cannabis manufacturing finance function, I learned that lender negotiations require transparency, realistic projections, and credible action plans. Lenders do not expect perfection. They expect honesty and competence. A CFO who presents a clear-eyed assessment of challenges, articulates specific remediation steps, and demonstrates progress toward milestones will often find lenders willing to provide flexibility.

Structured Instruments as Bridges

When strain runs deeper, simple extensions fall short. Structured instruments such as convertible notes or promissory financing offer lifelines that combine flexibility and commitment. These tools allow firms to refinance liability while deferring the valuation or equity impact until a future milestone or fundraising event. In software as a service or fintech companies, these instruments may hinge on performance triggers such as revenue run rate or product launch.

Bridging capital tied to regulatory approval, customer milestones, or product launches allows firms to secure financing without giving away equity prematurely. Investors remain silent observers until the firm crosses a threshold, then convert at a fair valuation. The firm avoids immediate dilution and gains governance stability through clarity of timeline. During my time leading finance for high-growth companies including software as a service and digital marketing firms, I participated in multiple convertible note rounds. The best structured instruments had explicit triggers, reasonable conversion mechanics, and aligned incentives between founders and investors.

Bridging instruments require skill. They require aligned incentives and explicit triggers. But they reinforce trust when both parties agree that time and performance matter more than immediate valuation. Under pressure, these structures allow control to remain in the hands of management. They combine financial flexibility with behavioral discipline. When securing forty million dollars in Series B financing and an eight million dollar credit line for a nonprofit organization, the negotiation balanced investor protection with operational flexibility. The key was transparent communication about milestones, risks, and value creation pathways.

Equity and Asset Sales: Strategic Monetization

When pressure intensifies, convertible or stretch options may no longer suffice. At that point, organizations must look more fundamentally at ownership and assets. With proper execution, some asset sales or partial equity offers can stabilize the balance sheet while maintaining core autonomy. In one scenario I encountered, a company owned significant but non-core real estate and distribution assets. Rather than sell the entire enterprise, they chose to monetize those assets. They brought in a minority investor to underwrite operations and paid down debt. They signed a lease that allowed them to continue operations unimpeded. The structure kept control while creating liquidity.

If equity dilution cannot be avoided, then structured minority investment offers an alternative to full takeover. You retain board influence and operational leadership. You gain the funds to rebuild. The key in both asset sales and minority equity is alignment. You must remain in control of direction. The transaction should resource your strategy, not redirect it. Having overseen over one hundred fifty million dollars in acquisition transactions and led post-merger integration work, I learned that transaction structure matters as much as valuation. Control provisions, board composition, protective rights, and governance frameworks determine whether a transaction enhances or constrains strategic flexibility.

During my time managing global finance operations spanning manufacturing, logistics, and supply chain functions, I saw companies successfully monetize non-core assets including real estate, intellectual property, and distribution networks. The critical success factor was ensuring that asset sales did not impair core operations. Selling a warehouse makes sense if you can lease it back on favorable terms. Selling intellectual property makes sense if you retain licenses to use it. The transaction should unlock capital without sacrificing capability.

Six Guiding Questions for Decision-Making

How does leadership decide between stretching, structured instruments, or asset and equity solutions? I offer six guiding questions informed by experience managing treasury, capital allocation, and financing across diverse organizations and stages.

First, define the nature of pressure. If it is short-term, do you anticipate seasonal or compliance obligations? If the strain arrives gradually from margin compression due to industry change, then a long-term structural solution is required. Short-term pressure often responds to covenant relief. Longer-term pressure may require capital structure change. My experience managing working capital for organizations with seasonal patterns, from retail to wholesale to professional services, taught me to distinguish cyclical from structural issues.

Second, clarify runway and objectives. Create realistic cash flow models under different scenarios. If relaxing obligations buys sixty days and that buffer returns you to cash positive status, then stretching may suffice. If you need twelve months to hit a milestone, a convertible note may fit. If public markets or regulated status change, then equity or asset restructuring may be necessary. Having built financial models and created investor-grade forecasts for organizations raising over one hundred twenty million dollars in capital, I learned that credible projections are foundational to financing discussions.

Third, match instrument to organizational appetite. If leadership seeks to preserve decision-making, delay dilution. If leadership values simplicity and speed, issue equity. If they prefer explicit trade partners, consider selling part of real estate or intellectual property. During my time serving on boards and managing board reporting for organizations across multiple sectors, I learned that boards have different risk tolerances and governance preferences that should inform financing strategy.

Fourth, consider governance and reporting. If lenders need more oversight, will you add board committees or audit metrics? Is that acceptable? If equity arrives, will you tolerate board representation or protective provisions? How will that shape your operating rhythm? My experience implementing Sarbanes-Oxley controls and managing audit relationships across organizations including a public gaming company taught me that governance requirements carry costs in time, complexity, and constraints on decision-making.

Fifth, articulate narrative. This moment calls for communication. Stretching obligations requires telling employees, partners, and suppliers that you retain stamina and agency. Pulling in convertible financing requires storytelling about performance and execution. Selling assets for runway frames discipline, not distress. The communication is strategic medicine. It matters. Throughout my career managing global distributed teams and communicating with diverse stakeholders from boards to banks to business partners, I learned that how you frame challenges influences outcomes. Transparency builds trust. Clear plans inspire confidence.

Sixth, align reinvestment. Every dollar restructured must find its way to impact. Investments must connect to the story of return and resilience. Having managed capital allocation across organizations scaling from nine million to one hundred eighty million dollars in revenue, I learned that disciplined capital deployment determines whether refinancing creates value or merely delays reckoning.

The Geological Metaphor: Pressure and Transformation

Let us imagine geological strata. Deep oceans deposit sediment, older layers compress younger layers, pressure builds until coal becomes graphite, then diamond crystallizes. That time horizon spans millions of years. In business, time compresses geological time. Pressure can build in weeks, not eons. A firm that bends rather than breaks can crystallize new properties. It gains reflective surface and refracts light. But if it cracks under stress, it fractures. Then control evaporates. All options change. Equity falls into takeover. Leadership becomes subordinate.

That is why structured responses matter. They allow metamorphosis, not collapse. They preserve identity amid transition. My certifications spanning accounting, management accounting, internal audit, production and inventory management, and project management reflect the multidisciplinary perspective required to manage financial strain effectively. You need the analytical rigor of an accountant, the strategic thinking of a management accountant, the control mindset of an auditor, the operational understanding of an inventory planner, and the execution discipline of a project manager.

Conclusion

Financial strain tests leadership. It reveals whether organizations have the discipline to make hard choices, the creativity to structure flexible solutions, and the resilience to emerge stronger. The firms that navigate refinancing successfully do so by understanding the nature of their pressure, matching solutions to their specific circumstances, maintaining transparency with stakeholders, and preserving strategic control while accessing necessary capital.

Based on twenty-five years of financial leadership across diverse sectors and situations, from startups to growth companies to established enterprises, from high-growth to turnaround scenarios, I can attest that the choices made under financial pressure define organizational trajectory for years to come. Choose well, and strain becomes the catalyst for transformation. Choose poorly, and it becomes the prelude to loss of control. The time to prepare is before pressure arrives, building relationships with lenders, maintaining financial flexibility, and developing contingency plans. But when pressure does arrive, as it inevitably does, structured thinking and disciplined execution separate those who emerge stronger from those who simply survive.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.