Executive Summary

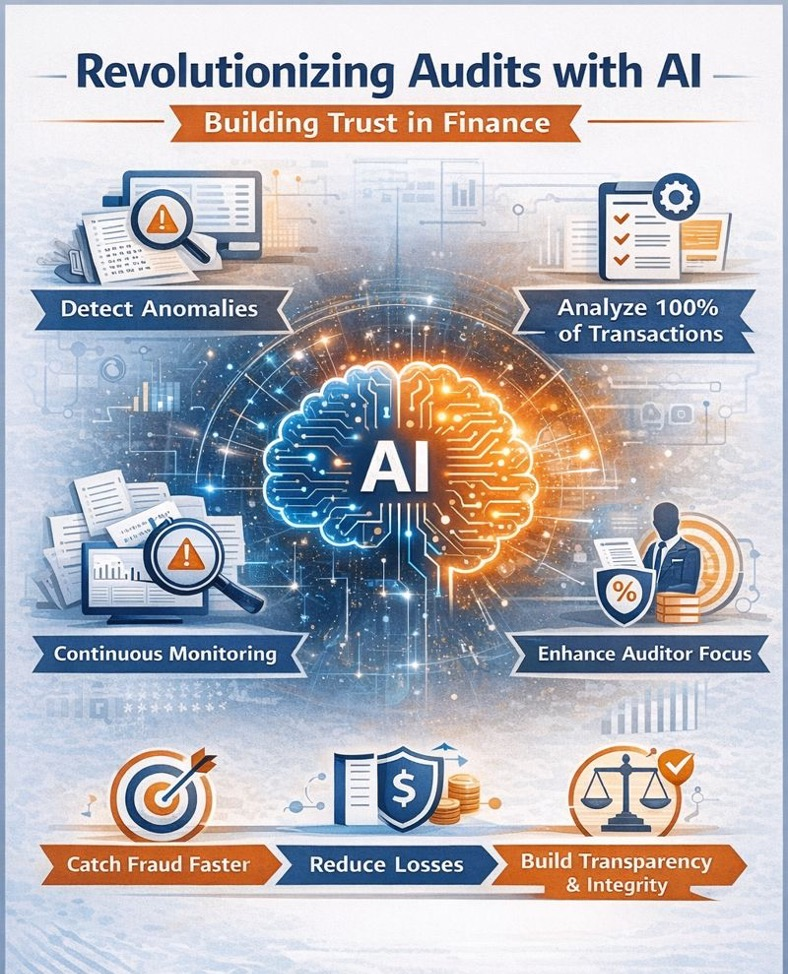

In business, trust is everything. It underpins the capital markets and gives customers, investors, and regulators the confidence to engage in the long game. But trust is earned slowly and lost swiftly. Nowhere is that erosion more insidious than in financial fraud, which rarely announces itself loudly. It begins quietly, in spreadsheets and overrides, in unchecked entries and ignored anomalies. The tragedy is not just in the act but in the fact that most of it could have been prevented. Today, we sit at the intersection of a digital transformation and a credibility revolution. Artificial intelligence is reshaping how businesses account, not merely in reporting results but in detecting deviations. Using pattern recognition, anomaly detection, and self-learning models, AI can flag where things do not add up long before a human auditor would ever see a red flag. Having served as a Certified Internal Auditor and having led internal controls, Sarbanes-Oxley compliance, and audit functions across organizations from public gaming companies to fast-growing software as a service firms to nonprofit entities, I have witnessed how traditional audit approaches leave gaps that fraud exploits. This article explores how artificial intelligence transforms audit from a periodic, retrospective exercise into a continuous, proactive system that not only detects fraud faster but builds a culture of transparency and financial integrity that becomes a competitive advantage.

The Traditional Audit Gap

The traditional audit process has always been retrospective. We gather the transactions, test the samples, perform reconciliations, verify controls. If something appears off, we probe further. The weakness is not in the diligence. Auditors are skilled professionals with a serious mandate. The weakness is in the approach. While the systems being audited have become real-time and always-on, the audits themselves remain periodic and backward-looking. That gap is where fraud thrives.

Throughout my career leading audit functions, implementing internal controls, and managing Committee of Sponsoring Organizations of the Treadway Commission frameworks across organizations including a multi-studio gaming enterprise and various software as a service companies, I experienced these limitations firsthand. Sample-based testing means most transactions never get reviewed. Period-end reviews mean issues go undetected for weeks or months. Control testing is annual while operations are continuous. This temporal mismatch creates exposure.

Artificial intelligence, when properly applied, begins to close that gap. Imagine a system that does not just look at fifty journal entries per month, but fifty thousand. One that does not sample, but consumes the full ledger. One that does not wait for quarter-end, but flags a misclassification the moment it happens. A system that understands historical behavior across departments, vendors, time zones and detects when something falls outside the pattern. This is not science fiction. This is available today.

Contextual Intelligence: How AI Transforms Detection

At its core, AI in audit is about contextual intelligence. Traditional rule-based systems require explicit thresholds. Flag all transactions over ten thousand dollars without approval. Highlight payments to new vendors. These are useful, but brittle. Fraudsters know the rules and work around them. AI works differently. It learns what normal looks like in your company. It sees that an employee in procurement typically initiates purchase orders under five thousand dollars on Wednesdays, and that a new purchase order for forty-eight thousand dollars on a Saturday evening from a new IP address should be looked at, regardless of whether it clears existing approval flows.

That context is everything. Because most fraud does not scream. It whispers. It lives in the margin. A vendor slightly overbilled, a journal entry backdated, an override approved by the same person who requested it. These are not always malicious. Errors happen. But they compound. And without the ability to see across systems, roles, and time, they slip through. AI offers the promise of connecting those dots.

During my time implementing enterprise resource planning systems including NetSuite and Oracle Financials, and designing internal control frameworks, I learned that most control weaknesses are not in the rules themselves but in the exceptions. The approved overrides. The after-the-fact adjustments. The transactions that technically comply but look suspicious in context. Traditional audits struggle to catch these because they lack the bandwidth to examine every exception. AI does not have that limitation.

Enhancing Auditors, Not Replacing Them

To be clear, AI does not replace auditors. It enhances them. It takes the ocean of data and distills it down to where human judgment matters most. It surfaces not just red flags but grey areas: the judgment calls, the borderline cases, the transactions that do not quite fit. It allows auditors and finance leaders to spend less time checking boxes and more time asking questions. It makes them proactive, not reactive.

Take journal entries, one of the most fertile grounds for manipulation yet often reviewed only in sample. AI can analyze every journal entry, tag them by risk profile, and flag entries that bypass controls, are booked near period-end, or exhibit round-number patterns common in manipulation. More importantly, it can benchmark across entities, departments, even peer companies when anonymized, to understand what should raise an eyebrow.

Having managed multi-entity consolidations spanning operations across the United States, India, Nepal, and Europe, I know that journal entry patterns vary by entity and context. What looks normal in one subsidiary might be suspicious in another. What looks reasonable in month seven might be concerning in month twelve. AI can learn these contextual patterns at scale in ways that human auditors simply cannot.

Cross-System Pattern Recognition

Consider third-party payments. AI can track not just the amounts and approvals, but patterns. Are multiple vendors routing to the same bank account? Are new vendors being created during off-hours? Are employees receiving reimbursements that correlate with purchasing card usage spikes? These signals do not live in one system. They live across systems. And AI is the bridge.

One of the most compelling use cases is behavioral analytics. AI does not just analyze what was done but by whom. It can build profiles of user behavior. It learns that a certain employee rarely logs in after hours, or never changes master data. If that behavior shifts suddenly, it flags it. It can identify privilege creep, dormant users suddenly activated, shared credentials. It makes the invisible visible.

When I led the implementation of Sarbanes-Oxley controls and segregation of duties frameworks, one of the hardest challenges was monitoring user access and behavior over time. We would conduct annual user access reviews, but changes happened continuously. Former employees retained access. Users accumulated privileges over time. Temporary access became permanent. AI can monitor these patterns continuously, flagging deviations in real time rather than discovering them months later during the annual review.

The Fraud Detection Advantage

The payoff is immense. Studies from the Association of Certified Fraud Examiners show that the median duration of occupational fraud is fourteen months before detection and that proactive data monitoring and analysis cuts that time in half. Companies that use AI-powered analytics detect more fraud, faster, and with smaller losses. This is not a luxury. It is a competitive moat.

But AI in audit is not just about fraud. It is about integrity. A company that can detect and remediate issues in real-time does not just reduce losses. It builds a culture of transparency. It makes every employee, from accounts payable to financial planning and analysis, aware that the system sees. Not in a punitive way, but in a principled one. It reinforces that financial stewardship is not an annual audit. It is a daily discipline.

Having built finance organizations across industries from cybersecurity to manufacturing to education, I have learned that culture matters as much as controls. When employees know that transactions are monitored intelligently, they exercise more care. When they understand that anomalies will be investigated, they think twice before taking shortcuts. This is not about surveillance. It is about creating an environment where integrity is the default.

The CFO’s Pivotal Role

The CFO’s role here is pivotal. AI tools do not implement themselves. They require thoughtful integration, training, oversight. CFOs must lead the charge, not just by writing the check but by rethinking the audit process itself. What are we trying to protect? Where are we exposed? What can machines see that humans miss? How do we combine both into something better?

My background spanning accounting, internal audit, and project management certifications provides the multidisciplinary perspective needed for this work. Implementing AI in audit is not just a technology project. It is an accounting project requiring deep understanding of controls and risks. It is an audit project requiring expertise in what constitutes suspicious activity. And it is a project management challenge requiring coordination across finance, information technology, internal audit, and business operations.

CFOs must also lead in trust. AI, by its nature, is a black box to many. It is critical that CFOs work with internal audit and risk teams to validate models, ensure explainability, and maintain governance. False positives can create noise. False negatives can create blind spots. The CFO must ensure that the system enhances, not replaces, accountability. When I implemented business intelligence systems including MicroStrategy and Domo for operational analytics, one of the key lessons was that users must understand and trust the data. The same principle applies to AI-powered audit tools. If finance teams do not trust the flagged anomalies, they will ignore them. If they trust them blindly without exercising judgment, they will chase false leads.

Cultural Transformation

There are cultural hurdles, too. Some teams may see AI as a threat. But the most enlightened finance leaders present it as an enabler. You are not being watched. You are being supported. You are not being replaced. You are being empowered. The goal is not surveillance. The goal is resilience.

Throughout my career managing global distributed teams across multiple time zones and cultures, I learned that technology adoption depends on how you frame it. When we implemented automated revenue recognition at a cybersecurity company, increasing accuracy by twenty-eight percent, some team members initially worried about job security. But we positioned it as freeing them from manual data entry so they could focus on analysis and strategy. The same applies to AI in audit. It frees finance professionals from tedious reconciliation work so they can focus on understanding why anomalies occur and how to prevent them.

AI also redefines how we think about materiality. In the old world, we accepted a certain level of error as inevitable. Sample-based testing meant small frauds often went undetected if they fell below the sample threshold. In the new world, if we can monitor one hundred percent of transactions continuously, our threshold for tolerance can change. We can be both precise and fast. We can catch issues before they snowball. We can turn exception reporting into insight.

Beyond Fraud: Performance Enhancement

And that insight goes beyond fraud. AI-powered audit systems can help finance leaders identify process inefficiencies, policy violations, vendor concentration risk, and even revenue leakage. It is not just about loss prevention. It is about performance enhancement. When I led operations for organizations spanning from nine million to one hundred eighty million dollars in revenue, I learned that the same controls that prevent fraud also improve operational efficiency. Duplicate payments caught by AI save money. Invoice discrepancies identified early preserve vendor relationships. Revenue recognition errors detected immediately prevent restatements.

During my time managing supply chain analytics and logistics operations for a one hundred twenty million dollar wholesale and logistics enterprise, we discovered that many of the anomalies flagged by our analytics systems were not fraud but inefficiency. Duplicate shipments. Incorrect pricing. Misclassified inventory. Fixing these issues not only reduced losses but improved margins and customer satisfaction.

The New Standard

Of course, technology is not a silver bullet. Bad actors will evolve. Schemes will adapt. But the game has changed. Fraud thrives in opacity. AI brings light. It creates a new standard where every transaction can be reviewed, every anomaly investigated, every deviation understood. And that standard raises the bar for everyone. Boards will expect it. Regulators will respect it. Investors will reward it.

Having managed board reporting and investor relations for organizations that raised over one hundred twenty million dollars in capital, I can attest that investors increasingly expect operational maturity in finance functions. During due diligence, they ask about internal controls, fraud prevention, and audit capabilities. A CFO who can demonstrate AI-powered continuous monitoring signals sophistication and reduces perceived risk. This translates directly into valuation.

Similarly, audit committees are beginning to expect continuous monitoring capabilities. During my time managing Sarbanes-Oxley compliance and working with external auditors, I saw the audit landscape evolving. Auditors increasingly expect companies to have robust data analytics capabilities. Companies that can provide comprehensive transaction data with AI-flagged anomalies make the audit process more efficient and effective, reducing audit fees while improving audit quality.

Building the System of Financial Integrity

Because in a digital era, financial integrity is not a given. It is a system. And the companies that build that system, intelligently and ethically, will not only avoid disaster. They will earn trust. And trust compounds faster than any margin.

The implementation roadmap starts with assessment. Where are your highest risk areas? What transactions are currently sample-tested that could be fully analyzed? What cross-system patterns are invisible today? Then pilot. Choose one high-value use case, implement AI analytics, measure results, and learn. Journal entry testing is often a good starting point because it is high risk, well-defined, and fully contained within your general ledger.

Next, expand systematically. Add vendor payment analytics. Layer in behavioral monitoring. Integrate procurement and expense data. Build the capability incrementally, ensuring each layer adds value before moving to the next. Throughout the process, invest in training. Finance teams need to understand how AI works, what it can and cannot do, and how to investigate flagged items effectively.

Finally, institutionalize. Make AI-powered audit part of your regular control framework. Include it in your risk assessment. Report on it to the audit committee. Communicate the capability across the organization. When employees know the system exists and understand its purpose, the deterrent effect amplifies.

Conclusion

The revolution in audit powered by artificial intelligence represents one of the most significant advances in financial integrity since the development of modern internal controls frameworks. It transforms audit from a periodic, sample-based exercise into a continuous, comprehensive system that detects issues faster, prevents losses more effectively, and builds a culture of transparency and accountability.

For CFOs, this is not optional. It is strategic. The companies that embrace AI-powered audit will operate with greater confidence, lower risk, and higher trust. They will catch fraud faster, prevent losses more effectively, and build reputations for financial integrity that become competitive advantages. Those that resist will find themselves at increasing disadvantage, both operationally and in the eyes of investors, regulators, and boards.

The tools are available. The business case is proven. The question is whether finance leaders will step up to build the audit function of the future or continue managing with the tools of the past. Based on my experience across industries and having witnessed the evolution of audit practices over twenty-five years, I can tell you that this transformation is inevitable. The only question is whether you will lead it or be compelled to follow. Trust is everything in business. And AI gives us the tools to build that trust systematically, continuously, and at scale. The time to act is now.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.