Introduction

Add-On Acquisitions and the Buy-and-Build Strategy: Synergy or Risk?

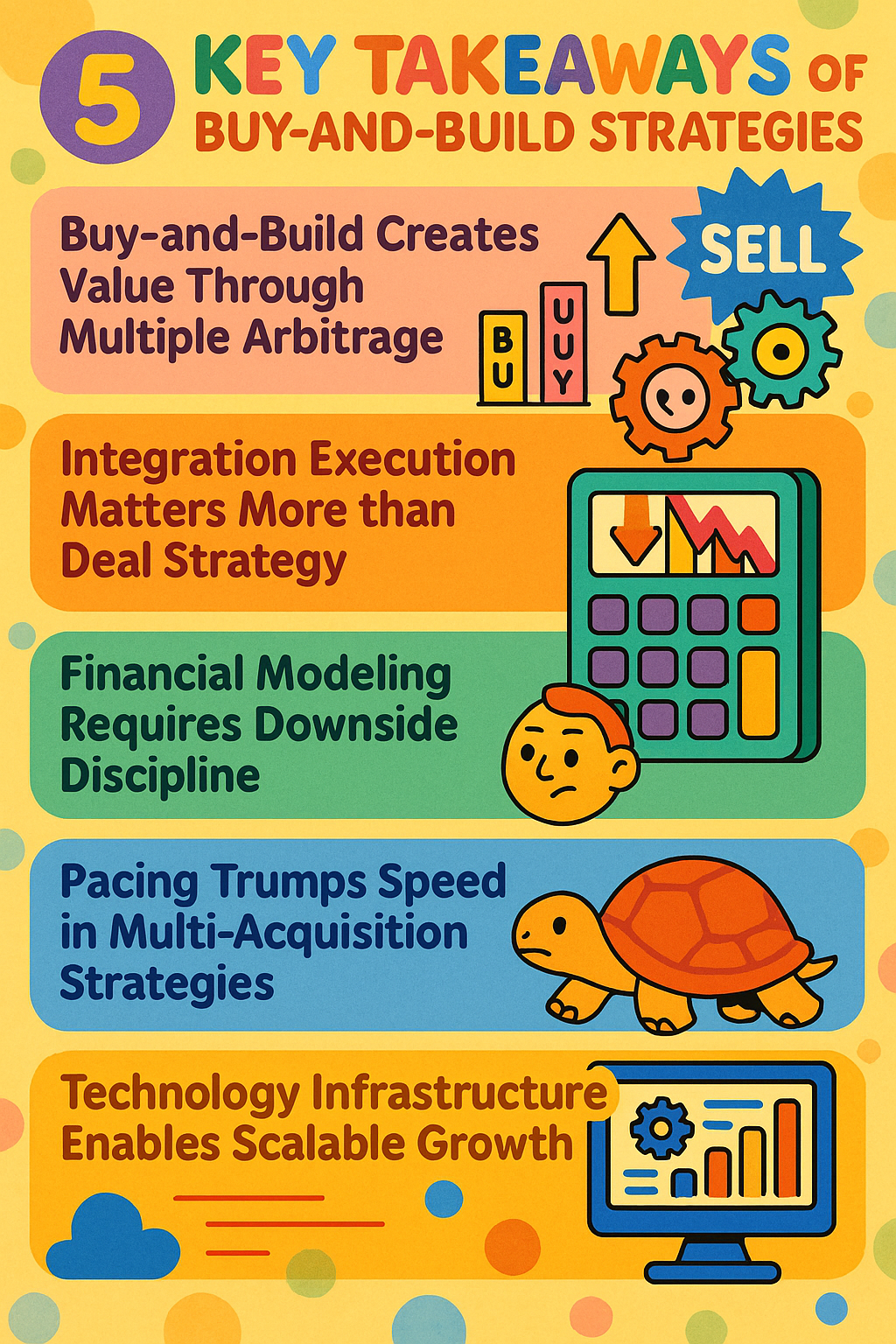

Private equity firms and strategic acquirers have increasingly turned to the buy-and-build strategy as a cornerstone of value creation. Rather than relying solely on a single platform acquisition, these investors pursue multiple add-on acquisitions to consolidate fragmented markets, achieve operational efficiencies, and drive exponential growth. The promise is compelling: acquire a solid platform company, then systematically bolt on complementary businesses to create a market leader worth far more than the sum of its parts. Yet this approach carries significant risks that can undermine value creation if not executed with discipline and strategic clarity.

Having led over $150 million in M&A transactions across cybersecurity, digital marketing, gaming, and manufacturing sectors, I have witnessed both the transformative potential and the costly pitfalls of buy-and-build strategies. The difference between synergy and disaster often comes down to integration execution, cultural alignment, and the finance leader’s ability to model risk accurately while maintaining operational visibility throughout the consolidation process.

The Strategic Logic Behind Buy-and-Build

The buy-and-build approach typically begins with a platform acquisition: a well-managed company with strong fundamentals, scalable infrastructure, and capable leadership. This platform serves as the foundation for subsequent add-on acquisitions, which are generally smaller targets that bring complementary capabilities, geographic reach, customer relationships, or specialized expertise.

The strategic rationale is straightforward. Fragmented industries offer opportunities to consolidate market share rapidly. In digital marketing, for instance, dozens of specialized agencies operate in distinct niches, from programmatic advertising to email marketing to social media management. A platform company can acquire these specialists, cross-sell services across an expanded client base, eliminate redundant overhead, and present a comprehensive solution portfolio that commands premium pricing.

Similarly, in professional services sectors like cybersecurity and identity access management, consolidation creates opportunities to offer end-to-end solutions that individual boutique firms cannot match. When I worked with companies scaling from nine million to over 180 million in revenue, the pattern was consistent: strategic add-ons that brought either new capabilities or new customer segments accelerated growth far beyond organic trajectories.

The math is seductive. Acquire a platform company at 8x EBITDA. Add three bolt-on acquisitions at 5x to 6x EBITDA because they are smaller and less strategic. Realize operational synergies that expand combined EBITDA by 20 to 30 percent through overhead reduction, shared infrastructure, and cross-selling. Exit at 10x to 12x EBITDA because the combined entity now commands market leadership premium. The multiple arbitrage alone can generate substantial returns before accounting for operational improvements.

The Synergy Thesis: Where Value Creation Happens

Successful buy-and-build strategies create value through several mechanisms. Revenue synergies emerge when complementary product lines allow cross-selling to existing customer bases. A cybersecurity firm specializing in identity and access management can partner with a company focused on threat detection, then offer integrated solutions that neither could provide independently. Customers benefit from simplified vendor relationships, and the combined entity captures a larger wallet share.

Cost synergies typically offer more reliable value. Consolidating back-office functions, eliminating duplicate technology systems, and rationalizing real estate can drive immediate margin expansion. When scaling a logistics and wholesale organization managing global supply chains, I found that systematically reducing logistics costs per unit by 22 percent required not just better freight negotiation but fundamental redesign of warehouse management and distribution networks. Similar principles apply in acquisitions: true cost synergies demand operational transformation, not merely headcount reduction.

Operational leverage provides another value driver. A platform company with robust ERP systems, business intelligence architecture, and financial controls can onboard acquired entities more efficiently with each successive transaction. The first add-on requires significant integration effort to align systems and processes. The second and third become progressively easier as playbooks mature and integration teams develop expertise.

Market positioning creates intangible but significant value. Consolidating fragmented industries changes competitive dynamics. A larger combined entity can invest more in technology, attract better talent, and negotiate more favorable terms with suppliers and partners. In manufacturing sectors, scale enables component sourcing advantages that smaller competitors cannot match. In SaaS and digital services, scale supports greater investment in product development and customer success capabilities.

The Risk Reality: Where Strategies Fail

Despite compelling strategic logic, buy-and-build strategies frequently destroy value. Integration complexity represents the most common failure mode. Each acquired company brings distinct cultures, systems, processes, and ways of working. Forcing rapid standardization can drive talent attrition and customer defection. Moving too slowly leaves unrealized synergies and maintains costly redundancies.

I have observed integration failures across multiple industries. In gaming and digital entertainment, acquiring multiple development studios seemed strategically sound: more franchises, more talent, more distribution leverage. Yet creative cultures resisted corporate standardization. Autonomous studios that thrived independently struggled under centralized financial controls and product approval processes. Key talent departed. Product quality suffered. The consolidated entity underperformed its acquisition model by significant margins.

Cultural misalignment extends beyond creative industries. In professional services, compensation structures, client relationship ownership, and decision-making authority vary widely. Integrating firms where partners historically operated autonomously into a corporate structure with standardized compensation and centralized business development creates friction. Client relationships, the primary asset in services businesses, often belong to individuals who may not remain through integration turbulence.

Financial modeling optimism compounds these operational challenges. Deal teams under pressure to deploy capital make aggressive assumptions about synergy realization timelines, customer retention, and cost reduction. A model projecting 30 percent EBITDA expansion through overhead reduction may assume no disruption to revenue. Reality proves messier. Key customers defect during ownership transitions. Sales cycles lengthen as prospects adopt a wait-and-see approach. Integration costs exceed projections. Synergy realization takes 18 to 24 months, rather than the modeled 6 to 9 months.

Debt leverage magnifies downside risks. Buy-and-build strategies typically involve significant borrowing to rapidly fund multiple acquisitions. When integration proceeds smoothly and synergies materialize on schedule, leverage accelerates returns. When integration stumbles, debt service constraints limit operational flexibility precisely when companies need resources to address problems. Cash flow pressure forces difficult decisions between debt covenant compliance and necessary operational investments.

Hidden liabilities emerge post-acquisition with disturbing frequency. Inadequate due diligence, particularly in lower-middle-market transactions where targets lack sophisticated financial infrastructure, can miss customer concentration risks, pending litigation, regulatory compliance gaps, or employee-related liabilities. One professional services acquisition revealed post-close that three of the five most significant client relationships were personally tied to the selling founder, who departed immediately after earnout completion.

The CFO’s Critical Role in Buy-and-Build Success

Finance leaders serve as the crucial counterbalance to deal momentum. While development teams focus on strategic fit and revenue opportunities, the CFO must model downside scenarios rigorously, stress-test integration assumptions, and build financial infrastructure that maintains visibility across growing complexity.

Robust due diligence processes separate successful acquirers from value destroyers. Beyond standard financial statement analysis, effective due diligence examines customer concentration and retention trends, key person dependencies, technology debt, contract terms that may limit operational flexibility, and cultural assessment through employee interviews. I advocate for operational due diligence that goes beyond the data room, including site visits, customer reference calls, and detailed process mapping to identify integration challenges before closing.

Financial modeling discipline requires explicit documentation of synergy assumptions with clear ownership, timelines, and dependencies. Instead of a single optimistic case, comprehensive models include base, upside, and downside scenarios with sensitivity analysis around key variables: customer retention, synergy realization timing, integration costs, and organic growth rates. These models should assume delayed synergy realization and higher integration costs by default, requiring explicit justification for aggressive timelines.

Integration planning must begin during due diligence, not after closing. The first 90 days post-acquisition determine success or failure. Companies need detailed integration playbooks covering systems consolidation, organizational design, customer communication, and key talent retention. Finance teams should establish integrated reporting from day one, even if manual processes bridge system gaps temporarily. Visibility into actual performance against acquisition model assumptions enables rapid course correction.

Post-acquisition monitoring distinguishes competent from exceptional finance organizations. Track actual synergy realization monthly against model assumptions. Monitor customer retention, employee turnover, and operational metrics rigorously. Build integrated dashboards that provide visibility across the entire platform and all add-ons, enabling pattern recognition and early warning of integration challenges.

Working capital management becomes critically important in buy-and-build scenarios. Multiple acquisitions strain cash resources through transaction costs, integration expenses, and working capital needs of growing operations. CFOs must model the cash flow implications of multiple acquisitions carefully, ensuring adequate liquidity buffers for operational flexibility. I have seen acquisition programs stall not from lack of targets or strategic fit but from cash constraints that inadequate treasury management failed to anticipate.

Building for Success: Principles for Disciplined Execution

Successful buy-and-build strategies share common characteristics. They maintain strategic discipline, resisting the temptation to pursue tangential acquisitions to deploy capital. Each add-on should strengthen the core value proposition in clearly defined ways: new geographic markets, complementary capabilities that enable cross-selling, or operational expertise that improves platform performance.

Pacing matters enormously. Aggressive acquirers pursuing multiple simultaneous integrations overwhelm organizational capacity. Even sophisticated corporate development and integration teams struggle to manage more than two significant integrations concurrently. The pressure to deploy capital rapidly conflicts with operational reality. Better to sequence acquisitions with adequate time for integration and synergy realization before pursuing the next target.

Cultural assessment deserves equal weight with financial analysis. Companies should develop explicit frameworks for evaluating cultural fit during due diligence, including leadership assessment, employee interviews, and evaluation of decision-making processes. Some cultural differences can be managed through thoughtful integration approaches. Others represent fundamental incompatibilities that no amount of change management will resolve.

Technology infrastructure provides the backbone for scalable integration. Platform companies need modern ERP systems, business intelligence architecture, and data integration capabilities before pursuing add-ons aggressively. Attempting to integrate acquisitions onto inadequate technology foundations creates compounding problems. When implementing NetSuite and OpenAir PSA systems while managing multi-entity finance architectures, I learned that technology standardization, while painful initially, dramatically simplifies subsequent integrations and enables the operational visibility necessary for managing complexity.

Conclusion: Navigating the Synergy-Risk Balance

Add-on acquisitions and buy-and-build strategies are powerful value-creation tools when executed with discipline and realistic expectations. The strategic logic is sound: consolidate fragmented markets, realize operational efficiencies, and build market-leading platforms that command premium valuations. Yet the execution challenges are substantial, requiring sophisticated integration capabilities, rigorous financial modeling, and organizational capacity to manage complexity.

The finance leader’s role is crucial. We must balance optimism with skepticism, model downside scenarios rigorously, build infrastructure for visibility and control, and maintain discipline around pacing and strategic fit. Success requires not just analytical capabilities but also operational expertise to identify integration challenges, organizational leadership to drive change, and communication skills to align stakeholders around realistic expectations.

The question is not whether buy-and-build strategies create value. In the right circumstances with disciplined execution, they clearly do. The question is whether your organization has the capabilities, infrastructure, and discipline to execute successfully. That assessment requires honest evaluation of past integration performance, current organizational capacity, and financial resources available to absorb inevitable challenges. Companies that answer these questions honestly before pursuing aggressive buy-and-build strategies position themselves for success. Those who do not discover that synergy and risk are not alternatives but two sides of the same strategic coin.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.